The significant influx of private and public capital into climate tech since 2005 raises questions about the social efficiency and financial performance of these investments. With data for the United States, we find that more private capital is allocated to technologies with a higher emission reduction potential and that investors have prioritised more mature technologies. Moreover, more private capital is directed to innovative companies as the sector matures and grows and financial frictions abate. Higher allocative efficiency of investments is in turn associated with better financial performance. US government subsidies have been allocated more to technologies attracting less private capital. Their crowding-in effect is greater when allocated to nascent technologies that are not yet patented.

Technological advancements are vital for addressing climate change, but substantial investments are needed to fund these breakthroughs. From 2005 to 2011, a period sometimes dubbed ‘climate tech 1.0’, private investors showed interest in technological solutions to facilitate the energy transition, particular in solar and wind technologies. However, the sector experienced a significant downturn when major investors incurred substantial losses. Of the USD 25 bn invested by venture capitalists, only USD 15 bn was recovered by 2014 (Gaddy et al. (2017)).

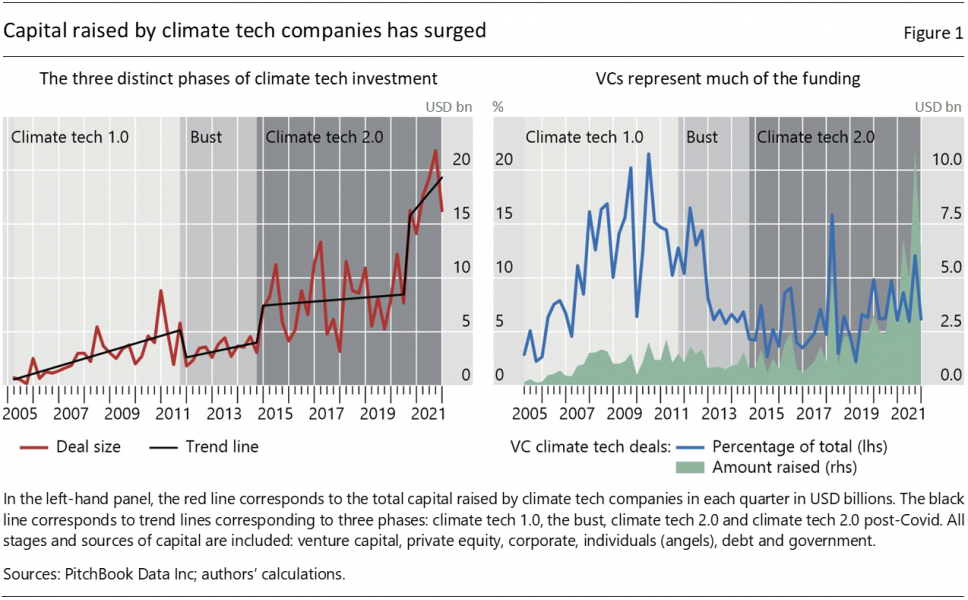

In recent years, climate tech has regained the attention of investors, marking the onset of ‘climate tech 2.0’. This resurgence has been characterised by significant investment inflows. In the United States alone, the sector saw a peak of USD 22 bn in Q3 2021, surpassing previous waves by considerable margin (see the left-hand panel of Figure 1). Furthermore, the investor base has become more diversified; there has been a shift toward “patient capital”, i.e. investors with a long time horizon, such as corporate venture capitalists (VC), wealthy individual investors and specialised investors. Several firms have successfully raised first-time and follow-on funds, accounting for 11% of total US VC funding in 2021 (see the right-hand panel of Figure 1). Investment grew at a rate of over 150% between 2015 and 2021.

These massive inflows into the sector beg the question about the social efficiency and financial return of these investments. This is particularly relevant given the recent enactment of the US Inflation Reduction Act (IRA). The IRA allocates more than USD 400 billion in public sector subsidies and tax incentives towards clean energy, electric vehicles and other related areas over the upcoming decade.

In our study (Cornelli et al., (2023)), we address three key questions. First, we examine the efficiency of capital allocation in the market, specifically whether it targets technologies with high potential for short to medium term CO2 emissions reduction. Second, we investigate whether capital flows to companies engaged in developing new technologies, proxied by patenting activity. And third, we analyse the performance of investments in innovative climate tech companies.

First, we find that private investors channel more capital towards firms with a high emission reduction potential (ERP). Other things equal, we find a positive, statistically and economically significant relationship between the logarithm of capital raised (expressed in real terms) and the logarithm of the ERP. In particular, if ERP increases from its median to its peak level, capital raised increases by 20 percentage points.

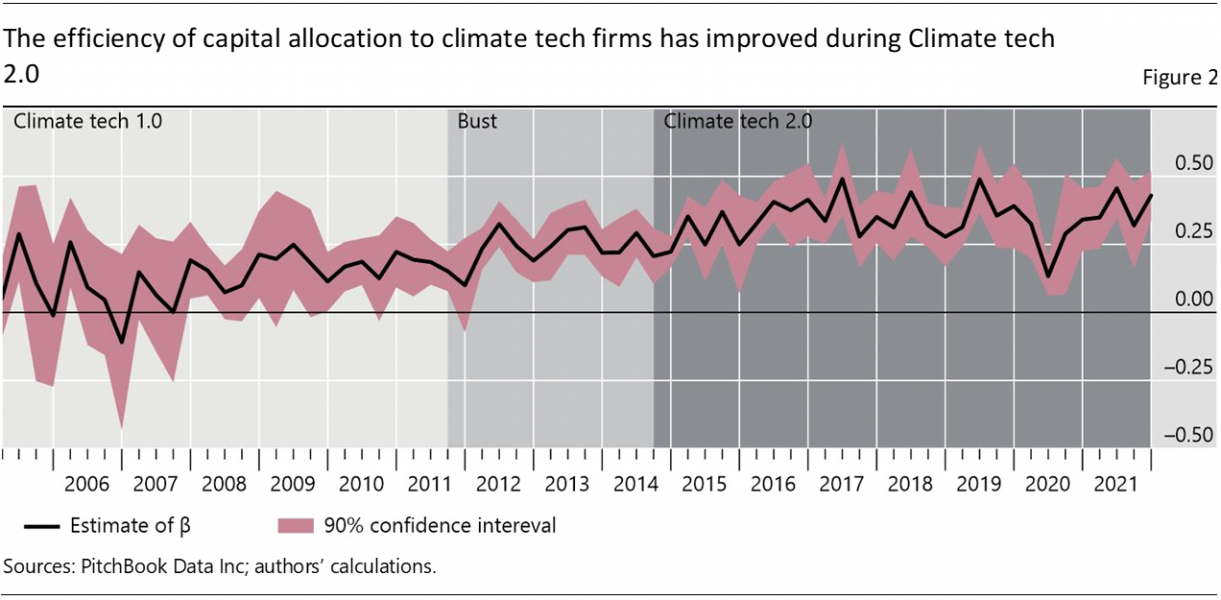

Second, more capital is channelled toward more innovative companies since 2015. This can be measured through the correlation between (citation-weighted) patents and the amount raised in a deal. In particular, we run ordinary least squares (OLS) estimates (for each quarter) for an equation where the dependent variable is the log amount raised in a deal. The key explanatory variable is the log number of citation-weighted patents of a company at the time of the deal.

Figure 2 plots this key elasticity, i.e. β. This represents the percentage increase in capital allocated resulting from a 1 percent increase in innovation activity. The shaded area corresponds to the 90 per cent confidence interval of the β estimates. The allocative efficiency (represented by the elasticity β) grows over time and turns positive and statistically significant during the climate tech 2.0 period. This finding suggests that since 2015, on average, an increase in patenting activity of one standard deviation above the mean is associated with a USD 2.52 million increase in capital raised per deal. This amount is economically significant given an average deal size of about USD 1.67 million.

As a third step in the analysis, we consider two indicators of company performance as outcome variables. These are: (i) the probability of a successful exit through an IPO or an MA deal, and (ii) conditional on the occurrence a successful exit, the probability of achieving an outsized return.

We find that companies that were funded in a more efficient market (measured through β) are also more likely to experience a successful exit, such as an initial public offering (IPO). An increase of β from 0 (as for climate tech 1.0 investments) to 0.35 (as for climate tech 2.0 investments; see Figure 2) is associated with a seven-percentage point increase in the probability of experiencing a successful exit, an 11-percentage point increase in the probability of an IPO, and a four-percentage point increase in the probability of an MA by 2021.

Moreover, successful exits are more likely to yield outsized returns. An increase in β from 0 to 0.35 is associated with a 26-percentage point increase in the probability of an exit over $1 bn, a nine-percentage point increase in the probability of returning 5 times more than the invested amount and a seven-percentage point increase in the probability of returning 10 times more than the invested amounts.

We established that private investors channel more capital towards firms with a high ERP and high patenting activity. But what role does the government play?

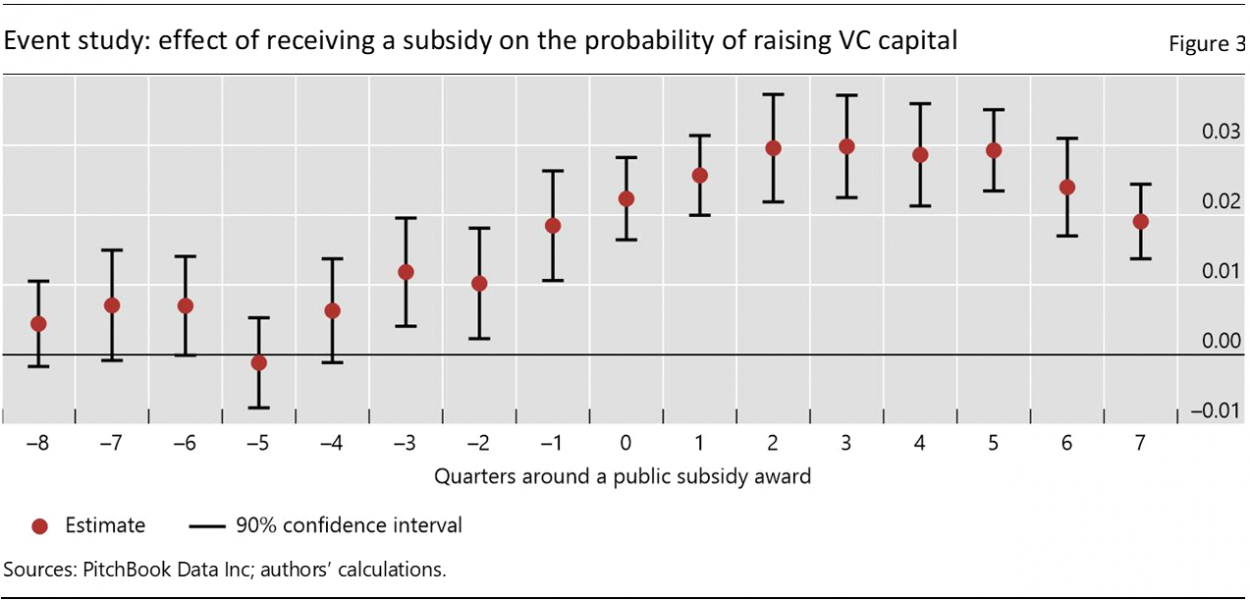

To better understand the effect on private investments of government subsidies – a key instrument to incentivise research on clean technologies (Acemoglu et al. (2012; 2016)) – we run an event study analysis. Specifically, we estimate the effect of a company j being awarded a subsidy on the probability of raising VC capital in subsequent quarters. Figure 3 reports the results. The horizontal axis shows the number of quarters before and after a public subsidy is awarded. The vertical axis shows the estimates from a panel fixed effect model. The dependent variable is a dummy that takes value one if a company has raised VC capital in each quarter. The explanatory variables are dummies that take value one if the company has obtained a public subsidy within an 8 quarter window around each quarter. The unconditional probability of raising VC capital in each quarter is 2.7% (normalised to 0% in Figure 3).

Being awarded a subsidy significantly increases the probability of raising VC capital in the following 8 quarters. At the peak, it increases the unconditional probability of raising VC capital per quarter, by around 3% (therefore from about 2.7% to 5.7%). The effect is statistically significant even three quarters before the award, due to announcements taking place on average two and a half quarters before a transaction. So, this evidence suggests that, on average, public investors crowd in, rather than crowd out, private investors. In other words, when the government supports these sectors and the market expands, they attract more private capital.

In particular, we find that funds invested by the US government are channelled towards nascent, low-ERP sectors that receive initially less private capital. While taken individually, these sectors have a low ERP score, together their impact is potentially significant. Finally, we also find that the government crowding-in effect is greater when subsidies are allocated to nascent technologies that are not yet patented (see also Howell (2017)).

In this policy note, we have documented how private and public capital is allocated to climate tech companies. Our analysis reveals that the market allocates more capital to technologies that have a higher potential to curb CO2 emissions. Further, following the massive losses recorded on climate tech investments in the 2000s and early 2010s, the leading investors in the market – venture capitalists – have significantly reallocated capital toward established companies with already patented ideas. This trend is accelerating as the sector matures and offers investment opportunities that better match the risk, return and time profile of traditional VC capital. We further show that the rebalancing of VC capital toward companies with more mature technologies is associated with a higher rate of successful exits and higher private returns.

We also find that funds invested by the US government are channelled towards nascent, low-ERP sectors that receive less private capital. While taken individually, these sectors have a low ERP score, their combined impact is potentially significant. We also show that, as the government supports these sectors and as the market expands, they attract more private capital.

Acemoglu, D., Aghion, P., Bursztyn, L. and Hemous, D. (2012). “The environment and directed technical change”. American Economic Review, 102(1):131–166.

Acemoglu, D., Akcigit, U., Hanley, D. and Kerr, W. (2016). “Transition to clean technology”. Journal of Political Economy, 124(1):52–104.

Cornelli, G., Frost, J., Gambacorta L. and Merrouche, O. (2023). “Climate tech 2.0: social efficiency versus private returns”. BIS Working Paper Series, 1072.

Gaddy, B. E., Sivaram, V., Jones, T. B. and Wayman, L. (2017). “Venture capital and cleantech: The wrong model for energy innovation”. Energy Policy, 102: 385–395.

Howell, S. T. (2017). “Financing innovation: Evidence from R&D grants”. American Economic Review, 107(4):1136–64.