In this policy brief, which is based on two papers2 and our further analyses of a pan-European survey of 5,504 respondents that took place in July and August 2020, we show how the COVID-19 pandemic affected consumers’ payment behaviour in Europe. Our study summarizes three key aspects: (i) in what way half of our interviewees changed how they paid during the pandemic and how these responses differed among countries, (ii) factors that contributed to the change, and (iii) how the change impacted intentions of cash and cashless instruments use in the future.

During the initial stages of the COVID-19 pandemic (hereinafter “the pandemic”) unprecedented attention was given to the epidemiological safety of physical money (see, for example, work by Auer et al., 2020). The exact source of the concerns is unknown, but can be seen in a myriad of events, such as the misquoted statement of a WHO spokesperson, news about cash quarantines and burning, or simply the general feel of terror present at that time. Studies commissioned in later stages of the pandemic by the European Central Bank (Tamele et al., 2021) and the Bank of England (Caswell et al., 2020) showed that the overall risk of being infected via banknotes is very low, but the change in the payment behaviour of consumers − as shown in this brief − had already happened by that point. The question is, will it last? No one can answer this question until the pandemic is over, but we share some initial insights into the problem.

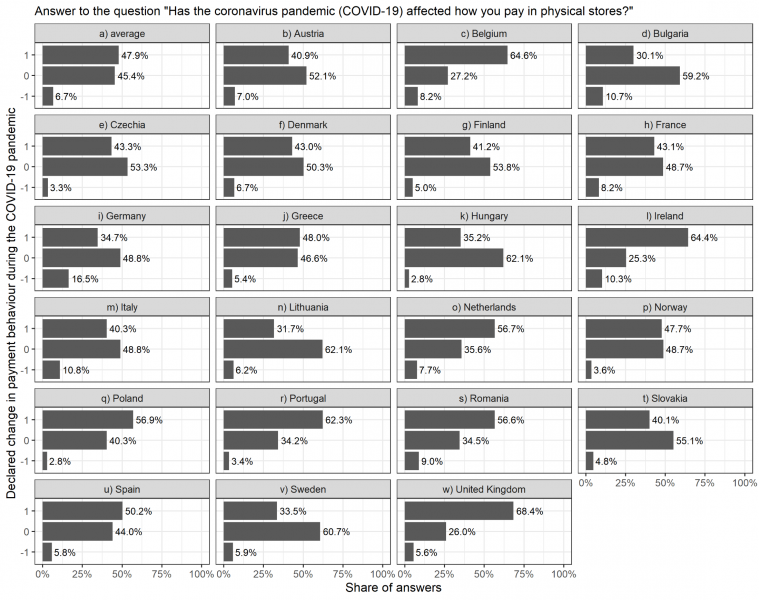

In July and August of 2020, 5504 people from 22 European countries3 were surveyed. Among the questions asked was the following: “Has the coronavirus pandemic (COVID-19) affected how you pay in physical stores?” More than half of responders (56.5%) stated that they had changed their payment behaviour during the pandemic. The majority of people that changed their payment behaviour had turned towards cashless payments (47.9% of all respondents), though it should be noted that some welcomed a different approach and turned towards the more frequent use of cash (6.7% of all respondents).

The change, of course, varied among countries (see Figure 1). In the United Kingdom, Belgium, Ireland and Portugal, more than 60% of surveyed people stated that they had changed their payment behaviour towards cashless payments. On the other hand, the lowest growth towards cashless payments was visible in Bulgaria, Lithuania, Sweden, Germany and Hungary, where less than 40% of respondents reported a change. A more common use of cash was reported most frequently in Germany (with more than 16% of people changing in this direction), Italy, Bulgaria and Ireland. In Hungary and Poland, however, this change was the rarest, with less than 3% of respondents starting to use more cash.

Summing up, citizens of Ireland, the United Kingdom and Belgium were the keenest to change their payment behaviour (no matter in which way) − more than 70% of respondents from those countries reported a change. On the other hand, respondents from Lithuania, Hungary and Sweden were decisively more moderate in their response, less than 40% of people surveyed in those countries reacted to COVID-19 by changing their payment behaviour.

Figure 1. Change of payment behaviour in physical stores during the pandemic

Note: The total number of observations is 5,373; respondents who failed to answer the question or who had not made any purchases during the pandemic were excluded from the sample. 1 denotes a change towards cashless payments, 0 no change declared, and -1 a change towards cash payments.

The analyses performed suggested several insights into factors that affected a change in payment behaviour:

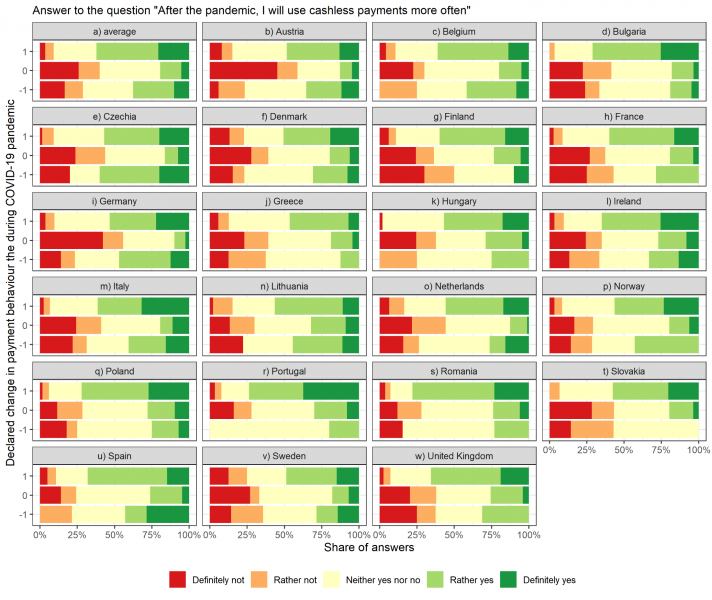

As the section above showed, there has been a clear change in people’s payment behaviour. However, we should also ask whether this change likely to continue after the pandemic recedes. During the survey, the respondents were also asked whether they agreed with the following statement: “After the pandemic, I will use cashless payments more often.” Generally, when analysed further, mostly the same factors tended to influence a change in payment behaviour and intentions concerning the further use of cashless payments after the pandemic. More additional insights can be derived from a comparison of behaviour change and intentions.

Generally, 41.5% of respondents stated that they would ‘rather yes’ or ‘definitely yes’ intend to use more cashless payments; on the contrary 24.2% were ‘definitely no’ or ‘rather no’, with 34.3% undecided. However, there are stark differences when payment behaviour change during the pandemic is taken into account: 62.3% of respondents that had changed their behaviour towards cashless payments (bearing in mind that almost half of respondents acted this way) stated that they were on the ‘yes’ side of our diverging scale, while only 9.2% said ‘no’. People that had not changed their payment behaviour were also unsure about future payment preferences (40.6%) or had a negative attitude towards the idea (39.9%). Surprisingly, people that changed their behaviour towards more cash payments during the pandemic often said that they intended to make more cashless payments in the future (37.6% versus 28.7% who opposed the idea). This may suggest, that the pandemic was causing some consumers to behave against their normal preferences, and in the long term they expected to correct this situation.

Figure 2. Intention to use cashless payments after the pandemic

Note: The total number of observations is 5,373; respondents who failed to answer the question or who had not made any purchases during the pandemic were excluded from the sample. 1 denotes a change towards cashless payments, 0 no change declared, and -1 a change towards cash payments.

In this context as well, sharp differences between countries exist (see Figure 2). For example, the citizens of Portugal, Romania, the United Kingdom, Poland and Ireland were mostly favourable towards the idea (with more than 50% of respondents in favour). On the other hand, the strongest opponents to the idea are citizens of Austria and Germany (states with a generally high usage of cash, see e.g. ECB, 2020) and, somewhat surprisingly − given their status as vanguards of cashless payments − Denmark and Sweden (this may be due to the fact that they have already reached their potential in this area).

Drawing from a large-scale pan-European survey, we were able to: (i) observe how the COVID-19 pandemic has affected consumers’ payment behaviour, (ii) analyse factors that contributed to the change, and (iii) gain some insights into the future use of cash and cashless instruments. Our observations on the increased usage of cashless payments during the pandemic and the factors that have affected that usage are now part of the growing literature on subject, and which is validating our findings. However, it will not be known until after the pandemic whether the changes being observed in 2020 will continue. Our analyses shows that the factors affected the change towards cashless payments also have a significant impact on the intention to use cashless payments in the future. However, observations made in this policy brief suggest that the change of behaviour itself can also be a factor. If so, this could suggest that the role of cashless payments will increase, especially in some countries. In future studies, we intend to explore the country-level factors that have affected the extent of change during the pandemic.

Auer, R., Cornelli, G., & Frost, J. (2020). Covid-19, cash, and the future of payments. BIS Bulletin, 3. https://www.bis.org/publ/bisbull03.pdf

Caswell, E., Smith, M. H., Learmonth, D., & Pearce, G. (2020). Cash in the time of Covid. Bank of England Quarterly Bulletin, Q4. https://www.bankofengland.co.uk/quarterly-bulletin/2020/2020-q4/cash-in-the-time-of-covid

ECB. (2020). Study on the payment attitudes of consumers in the euro area (SPACE).

https://www.ecb.europa.eu/pub/pdf/other/ecb.spacereport202012~bb2038bbb6.en.pdf

Huterska, A., Piotrowska, A. I., & Szalacha-Jarmużek, J. (2021). Fear of the COVID-19 pandemic and social distancing as factors determining the change in consumer payment behavior at retail and service outlets. Energies, 14, 4191. https://doi.org/10.3390/en14144191

Kotkowski, R., & Polasik, M. (2021). COVID-19 pandemic increases the divide between cash and cashless payment users in Europe. Economics Letters, 209, 110139. https://doi.org/10.1016/j.econlet.2021.110139

Tamele, B., Zamora-Pérez, A., Litardi, C., Howes, J., Steinmann, E., & Todt, D. (2021). Catch me (if you can): assessing the risk of SARS-CoV-2 transmission via euro cash (No. 259; ECB Occasional Paper Series).

https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op259~33b180d450.en.pdf

Wisniewski, T. P., Polasik, M., Kotkowski, R., & Moro, A. (2021). Switching from cash to cashless payments during the COVID-19 pandemic and beyond (No. 337; NBP Working Papers).

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of Narodowy Bank Polski.

“Switching from cash to cashless payments during the COVID-19 pandemic and beyond” (2021) by Tomasz Piotr Wisniewski, Michal Polasik, Radoslaw Kotkowski and Andrea Moro, and “COVID-19 pandemic increases the divide between cash and cashless payment users in Europe” (2021) by Radoslaw Kotkowski and Michal Polasik. Both this policy brief, as well as beforementioned works were funded by the National Science Centre, Poland (Grant No. 2017/26/E/HS4/00858).

The respondents were residents of 20 of the 27 European Union Member States, as well as the United Kingdom and Norway.