This policy brief is based on “The ECB’s monetary policy strategy: from the 2021 review to the 2025 assessment”, published in Banco de Portugal Economic Studies, Vol. XI, No. 1, Jan. 2025. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

How should the ECB decide monetary policy? The ECB is currently reassessing its monetary policy strategy and there are important aspects to discuss given that the macroeconomic environment changed significantly since the 2021 strategy review. Drawing on the lessons learned from the recent experience, in Carvalho et al. (2025) we highlight four considerations that should be raised: (i) When is a forceful or persistent monetary policy action needed? (ii) Is forward guidance a useful instrument? (iii) Should the long-run nominal anchor play a more explicit role? (iv) Should the strategy better reflect that economic activity and employment considerations may be taken into account in monetary policy decisions, provided that price stability is fulfilled? This policy brief provides an overview of these considerations.

The primary objective of the European Central Bank (ECB) is to maintain price stability, as enshrined in the Treaty on the Functioning of the European Union (TFEU). The ECB does not have the power to change its mandate but is able to choose and update the monetary policy strategy used to fulfil it. The strategy establishes a numerical definition of the price stability objective and provides a coherent analytical framework for monetary policy decisions, describing the elements considered in the analysis and the instruments available to achieve the mandate.

The current monetary policy strategy was announced in July 2021, after a thorough review that covered all aspects of the decision-making process. Following the commitment established at the time, the ECB announced that it would reassess the strategy in 2025. This is an opportunity to evaluate the changes introduced in 2021, considering the lessons learned in the recent inflationary period and our evolving understanding of how monetary policy works under different macroeconomic environments.

In Carvalho et al. (2025) we contribute to the debate by raising four considerations (Figure 1). There is no ambition to provide a definitive answer to these questions, nor to propose specific changes to the monetary policy strategy. Instead, the article underlines the need for an open and thorough discussion of these four topics.

Figure 1. Four key considerations for the 2025 assessment of the ECB monetary policy strategy

Source: AI-produced figure based on the four considerations.

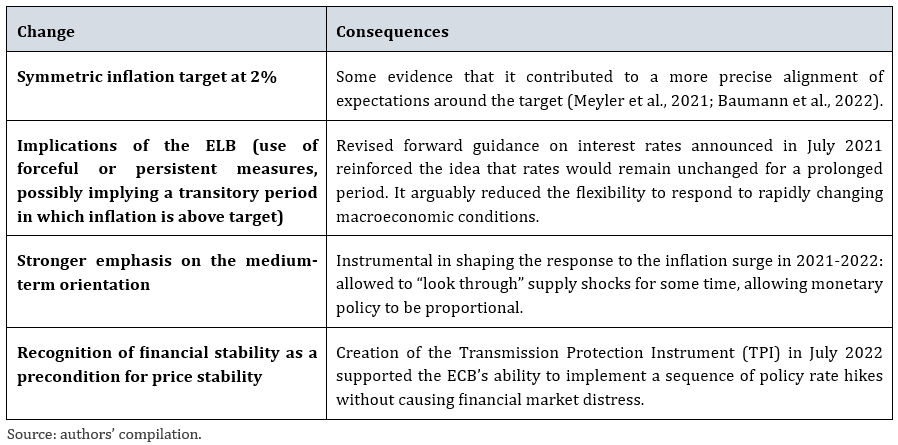

The preparatory work for the 2021 review of the monetary policy strategy was influenced by the context of low inflation and low interest rates, and by the use of unconventional policy measures in view of the proximity to the effective lower bound (ELB), that characterised most of the period after the financial and sovereign debt crises. These concerns were behind some of the key changes introduced in the monetary policy strategy (Table 1).

Table 1. Key changes in the 2021 monetary policy strategy review

The economic landscape changed markedly after the review announcement. Inflation increased to unprecedented levels, reaching more than 10% in end-2022. Against that background, the ECB ended net asset purchases and increased its policy interest rates at a quick pace. Some of the changes introduced in 2021 were instrumental in shaping the response to this extraordinary shift and the strategy seems to have provided a solid framework for policy action. Inflation has since then receded to close to the 2% target and longer-term inflation expectations remained broadly stable through the inflationary process. The experience of recent years and the advances in economic research provide valuable insights that should be considered as the ECB reassesses its monetary policy strategy this year.

Bearing in mind the recent experience, strengthening the robustness of the monetary policy strategy to a rapidly changing and uncertain macroeconomic environment is a critical endeavour of the ongoing assessment.

Moreover, in order to fulfil its purpose, the monetary policy strategy must be grounded in the best understanding of how monetary policy operates, which evolves over time. In this respect, most central banks believe that when inflation deviates, or is at risk of deviating, to the downside from the target, they should temporarily lower nominal interest rates to keep inflation at target. This shall decrease real interest rates, temporarily stimulating aggregate demand and ultimately increasing inflation (and vice versa when inflation rises). However, the effects of monetary policy may differ when interest rate changes are permanent, as advocated in a recently revived body of research (Valle e Azevedo et al., 2022; Uribe, 2022). For example, if a central bank cuts interest rates permanently, agents may adjust their expectations to a “new normal” with lower interest rates, and inflation will eventually fall in proportion to the decline in interest rates. Thus, a very persistent decline in the policy rate may lead to a lower inflation, in contrast with the positive impact of a temporary decline in interest rates.

In Carvalho et al. (2025) we propose four considerations for the debate that we see as key to guarantee that the strategy is robust under different economic conditions and are based on this evolving understanding on how monetary policy works.

Consideration 1: When is a forceful or persistent monetary policy action needed?

The 2021 strategy introduced explicit references to how monetary policy should be conducted in the vicinity of the ELB, expressing the need to be particularly forceful or persistent to prevent negative deviations from the inflation target from becoming entrenched.

The prescription of forceful measures when inflation deviates downwards from target is important, as this may contribute to maintain inflation expectations well anchored and reduce the probability of staying close to the ELB. However, a forceful response when inflation deviates upwards from target may be equally important to maintain inflation expectations well anchored.

The prescription of persistent monetary policy measures near the ELB raises additional concerns. If policy measures are understood as a permanent shift to a “new normal” of low interest rates and thus low inflation, then under the current strategy and in the absence of the significant shocks that occurred since 2020, the euro area could potentially have remained in a regime of low interest rates and below-target inflation. Correspondingly, persistent measures in a high inflation environment, if maintained for too long, could also end up contributing to destabilise longer-term inflation expectations on the upside.

Against this backdrop, it may be important to discuss whether prescribing forceful measures only for downward deviations from the target, without an equivalent prescription for upward deviations, may work against the symmetry of the target. The usefulness of particularly persistent measures at the ELB to bring inflation back to target should also be discussed, given the possibility of destabilising longer-term inflation expectations.

Consideration 2: Is forward guidance a useful instrument?

During the period of low inflation and low interest rates, the ECB made extensive use of forward guidance, committing itself to keeping interest rates low for an extended period, with the goal of providing additional accommodation when the policy rate was approaching the ELB. The aim was to influence agents’ interest rate expectations at long horizons, and thus spending and investment decisions and ultimately inflation.

However, the use of forward guidance carries risks, especially under formulations that reduce the room to react to rapidly changing economic conditions. These risks are present across various formulations of forward guidance, albeit to differing extents. Date-based forward guidance may be clearer to communicate to a wider audience but reduces flexibility to respond to changing economic conditions and if announced for a long period may convey the perception of a “new normal” of low interest rates and thus low inflation. State-based formulations may allow for the flexibility that is needed to adjust the stance of policy in case circumstances change rapidly, but if set against very specific inflation objectives they may still imply a commitment to keep interest rates unchanged for a very long time, again potentially de-anchoring longer-term inflation expectations.

The ECB’s experience with the use of forward guidance in recent years suggests that a thorough discussion of its usefulness as an independent policy instrument is needed, namely given its heavy reliance on the management of expectations at long horizons. In case it is seen as useful, its design needs to be carefully pondered to avoid destabilising inflation expectations and allow the necessary flexibility to deal with changing economic conditions.

Consideration 3: Should the long-run nominal anchor play a more explicit role?

As discussed above, when inflation deviates from the target, central banks typically adjust the policy rate to help bring inflation to target and, importantly, to avoid destabilising longer-term inflation expectations. At the same time, central banks need to ensure consistency with their long-term nominal anchor, the inflation target. In the long run, the nominal policy rate should converge to a neutral level, which is given by the natural real interest rate plus the central bank’s inflation objective, 2% in the case of the ECB. To be consistent with the central bank’s objective, policy rates should follow the fundamental forces driving the economy in the long run.

As the policy rate should converge to its neutral level in the long run, the possibility of communicating more explicitly an estimate of the neutral policy rate, or a range of estimates, may be important to discuss. While there is substantial uncertainty around these estimates, explicit guidance on its level could support well-anchored inflation expectations by providing a long-term anchor for the policy rate consistent with the inflation target. It could also facilitate the explanation of the expected effects of policy decisions, as it would help to clarify the monetary policy stance.

Consideration 4: Should the strategy better reflect that economic activity and employment considerations may be taken into account in monetary policy decisions, provided price stability is fulfilled?

The 2021 strategy specifies that, without prejudice to price stability, in its monetary policy decisions the Governing Council caters for other considerations relevant to the conduct of monetary policy. The overview note elaborates: “Taking such considerations into account will often be necessary to maintain price stability over the medium term. At the same time, monetary policy measures have an impact on the economy and on economic policies.”1

The formulation in the strategy seems to imply that economic activity and employment considerations will be taken into account only to the extent necessary to maintain price stability. However, the TFEU states that, without prejudice to the objective of price stability, the ECB shall support the general economic policies in the Union with a view to contributing to the achievement of its objectives, including balanced economic growth and full employment. In fact, when different policy options exist that are compatible with fulfilling the mandate, the fact that different policy choices have different economic costs is necessarily considered.

Monetary policy has a significant impact on economic activity and employment. A better reflection of this fact in the strategy should be discussed. This recognition would need to be done cautiously to ensure that it is not interpreted in any way as a shift towards a dual mandate. However, it could provide scope for more coherent monetary policy decisions and for simpler communication of decisions to the public.

The formulation in the strategy seems to imply that economic activity and employment considerations will be taken into account only to the extent necessary to maintain price stability. However, the TFEU states that, without prejudice to the objective of price stability, the ECB shall support the general economic policies in the Union with a view to contributing to the achievement of its objectives, including balanced economic growth and full employment. In fact, when different policy options exist that are compatible with fulfilling the mandate, the fact that different policy choices have different economic costs is necessarily considered.

Monetary policy has a significant impact on economic activity and employment. A better reflection of this fact in the strategy should be discussed. This recognition would need to be done cautiously to ensure that it is not interpreted in any way as a shift towards a dual mandate. However, it could provide scope for more coherent monetary policy decisions and for simpler communication of decisions to the public.

In a dynamic and evolving environment, it is crucial to continuously draw on past experiences and advances in economic knowledge to ensure an effective conduct of monetary policy. Regularly refining the ECB’s strategy on the basis of these insights is key to navigating future challenges and maintaining price stability in the euro area. While the 2021 strategy has generally provided valuable guidance to the ECB, it is important to take stock of the lessons learned over the past few years in order to further strengthen its effectiveness.

In Carvalho et al. (2025), we propose four key considerations for the 2025 assessment of the ECB monetary policy strategy, touching on the need to discuss the intensity of the monetary policy response in different circumstances, the usefulness of forward guidance, the role of the long-run nominal anchor and the consideration of economic activity and employment in monetary policy decisions. An open discussion of these aspects would be beneficial, as it could contribute to a better understanding of what the ECB can and cannot achieve.

Baumann, U., Kamps, C. and Kremer, M. (2022). The ECB’s new inflation target one year on. The ECB Blog, 10 August 2022.Carvalho, A., Costa, J. M. C., Garcia, J., Gomes, S., and Ribeiro, P. P. (2025). The ECB’s monetary policy strategy: from the 2021 review to the 2025 assessment. Banco de Portugal Economic Studies, Vol. XI, No. 1, Jan. 2025.

Meyler, A., Moreno, M. S., Arioli, R., and Fischer, F. (2021). Results of a special survey of professional forecasters on the ECB’s new monetary policy strategy. ECB Economic Bulletin, Issue 7/2021.

Uribe, M. (2022). “The neo-Fisher effect: Econometric evidence from empirical and optimizing models”, American Economic Journal: Macroeconomics, 14, 133-162.

Valle e Azevedo, J., Ritto, J. and Teles, P. (2022). “The neutrality of nominal rates: How long is the long run?”, International Economic Review, 63, 1745-1777.

See the overview note of the ECB’s monetary policy strategy at http://www.ecb.europa.eu/home/ search/review/html/ecb.strategyreview_monpol_strategy_overview.en.html.