Exchange-traded funds (ETFs) allow a wide range of investors to gain exposure to a variety of asset classes. They rely on authorised participants (APs) to perform arbitrage, ie align ETFs’ share prices with the value of the underlying asset holdings. For bond ETFs, prominent albeit understudied features of the arbitrage mechanism are systematic differences between the baskets of bonds used to create and redeem ETF shares, and a low overlap between these baskets and actual asset holdings. These features could reflect the illiquid nature of bond trading, ETFs’ portfolio management and APs’ incentives. The decoupling of baskets from holdings weakens arbitrage forces but allows ETFs to absorb shocks on the bond market.

Exchange-traded funds (ETFs) are investment vehicles that allow retail and institutional investors to obtain exposure to a wide range of assets or asset strategies. To perform this function, ETF sponsors – typically, large asset managers – minimise tracking error, or the difference between the return on the ETF and that on its respective benchmark index. The first ETF was introduced in 1993 and tracked the performance of S&P 500. As of 2020, ETFs managed about $7 trillion of assets globally and invested in equity, bonds, commodities, currencies and volatility.

Recent trends and market developments call for a closer analysis of bond ETFs. First, bond ETFs have been growing steadily over the past few years and now manage more than $1.2 trillion of assets across the globe, compared with less than $10 billion in 2009. Second, the Federal Reserve’s corporate bond purchase programme launched in 2020 involves interventions in the bond market through ETFs.2 Third, the difference between ETF share prices and the net asset value (NAV) of the underlying holdings (ie premium or discount) fluctuated more strongly for bond than for equity ETFs during March–April 2020. In addition, the tracking error of bond ETFs increased to above 200 basis points for some funds in March–April 2020, much higher than the historical average of 0.7 bp in the sector. These facts highlighted that features specific to the bond market can have an impact on the pricing of bond ETFs.

In general, ETFs rely on an arbitrage mechanism to keep their share prices aligned with NAV. This mechanism relies on a special type of investors – usually, large market-makers and broker-dealers – collectively known as authorised participants (APs), which can create or redeem ETF shares. Whenever ETF prices rise above NAV, APs have an incentive to step in and exchange a subset of the asset holdings (a “creation” basket) for ETF shares. This helps close the arbitrage gap. Likewise, when ETF prices fall below NAV, APs exchange a “redemption” basket for ETF shares. The following example illustrates the ETF arbitrage mechanism in its simplest form, as well as its relationship with tracking error.

Stylised example

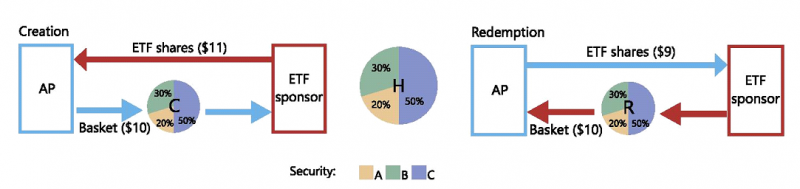

Suppose that a hypothetical ETF called ABC tracks a benchmark of three securities: A, B, and C worth $2, $3 and $5, respectively (Figure 1). The benchmark weights are: 20% (A), 30% (B) and 50% (C). The ETF has one unit of each security, implying that NAV is equal to: $10 = $2 + $3 + $5. Assume that the ETF is trading at a premium: concretely, the ETF share price is $11 > $10. This premium creates an arbitrage opportunity but also reflects a tracking error – the ETF return is higher than that on the benchmark index.

An AP profits from the arbitrage opportunity as follows. It buys a creation basket consisting of one unit of each security for $10 on the secondary market, creates one ETF share by transferring the basket to the ETF sponsor in the primary market (Figure 1, left-hand panel) and sells that share for $11 on the secondary market. This generates an arbitrage profit of $11 – $10 = $1. These transactions put downward pressure on the ETF price and upward pressure on the NAV. For future reference, suppose that closing the gap between the two requires the creation of 10 shares, ie a flow of $100. This flow would also eliminate the tracking error since, in the current stylised example, the creation basket is identical to ETF holdings.

The implications would be symmetric, if the ETF was trading at a discount at $9 < $10. In this case, the AP would buy one ETF share, redeem it for the basket of securities worth $10 in total (Figure 1, right-hand panel) and make a profit of $10 – $9 = $1. This would eliminate the discount by putting upward pressure on the ETF price and downward pressure on NAV.

Figure 1. ABC ETF: a stylised example. AP = authorised participant; C = creation basket; H = ETF holdings; R = redemption basket.

While the above discussion captures well the nature of the arbitrage mechanism in the case of equity ETFs, it misses key features of bond ETFs. These features stem from the specifics of the underlying assets. First, bond ETFs need to transact in a less liquid and more concentrated market, with fewer potential buyers and sellers than in the equity market. Second, the minimum trading size of bonds is much larger than that of equities. Third, bonds have a finite maturity, whereas equities do not.

The illiquid nature of the asset class implies that, compared with equity ETFs, there is a more severe liquidity mismatch between the assets and liabilities (shares) of bond ETFs. To a large extent, bonds are illiquid because they usually trade over the counter (OTC) in a dealer-intermediated market, where not all desired securities are readily available (Hendershott and Madhavan (2015), CGFS (2014), CGFS (2016)). This is not an issue for equities, as they are predominantly traded on exchanges, which are open directly to a wide range of investors.

The minimum trading amount of bonds is several orders of magnitude larger than that of equities. Typically, bonds trade in minimum amounts above $100,000. By contrast, for equities, these amounts can be as small as a fraction of a share, ie less than $5. Thus, bond ETF sponsors would need a much larger basket size than equity ETF sponsors in order to transact in the same number of instruments.

Lastly, bonds’ finite maturity also necessitates portfolio rebalancing. In practice, most bond ETFs have a target maturity defined by their benchmark index.3 Thus, bonds falling below the target maturity need to be replaced by bonds with longer maturity. Such rebalancing is irrelevant for equity ETFs.

Stylised example, revisited

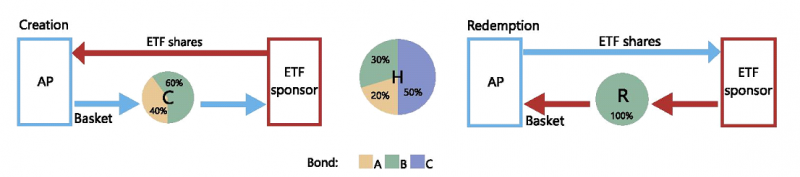

These three specificities of the bond market call for modifications to the above stylised example of the ABC ETF when A, B and C stand for bonds. First, in line with the illiquidity of the market, let bond A be hard to locate. Second, to capture the large minimum trade size, let A, B and C be traded in 20 units or more. Third, to incorporate maturity considerations, assume that bond B is maturing soon.

These modifications weaken the arbitrage mechanism for the ABC ETF. The first modification implies that the ETF may choose to exclude bond A from the creation basket. The second modification means that, even though an inflow of $100 is needed to close the price gap (see above), such an inflow does not allow the ETF to buy all the underlying bonds. One feasible option is to buy 20 units of bond A, 20 units of bond B and none of bond C ($100 = 20 * 2 + 20 * 3; Figure 2, left-hand panel). The third modification suggests that the ETF could overweight bond B in a redemption basket in anticipation of its imminent maturity (Figure 2, right-hand panel). In each case, the difference between baskets and the underlying holdings prevents APs from putting adequate buying or selling pressure on bonds A, B and C. This weakens APs’ capacity to close the ETF premium or discount.

Figure 2. ABC ETF: a stylised example with bonds. AP = authorised participant; C = creation basket; H = ETF holdings; R = redemption basket.

The three specificities of the bond market illustrated in the stylised example translate into three aspects of the arbitrage process that are unique to bond ETFs. First, creation and redemption baskets would differ from actual holdings. Second, as the relative liquidity and availability of various bonds change over time, so will the composition of baskets. Third, creation baskets would differ from redemption baskets in terms of liquidity and maturity. The three unique aspects of the arbitrage process of bond ETFs surface clearly in the data.

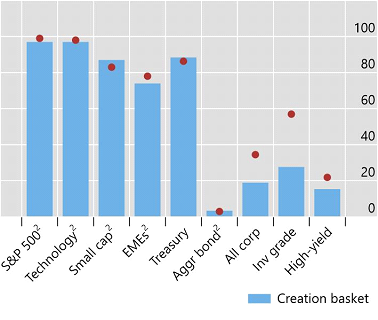

Creation/redemption baskets differ materially from holdings for bond ETFs but not for equity ETFs. This is illustrated by an alignment measure equal to the number of securities common to a basket and holdings, expressed as a share of the holdings. For the largest equity ETFs, the alignment is almost 100% (Figure 3). By contrast, bond ETFs’ baskets are less aligned with holdings. For the largest bond ETF, which tracks the aggregate bond market, baskets represent on average only 3% of holdings.

Figure 3. Baskets are a small share of holdings. The figure shows the share of baskets in holdings, in per cent. Based on changes in ETF holdings on days with creation/redemption. The labels on the horizontal axes indicate ETFs that invest in: the S&P 500 index, US technology stocks, US small-cap stocks, emerging market stocks, US Treasuries, the aggregate US bond market, US corporate bonds, US investment grade corporate bonds, US high-yield corporate bonds, international (ie non-US) government bonds, European investment grade corporate bonds and European high-yield corporate bonds. 2 Based on the largest ETFs.

| US bond ETFs | Non-US sovereign and European corporate bond ETFs |

|

|

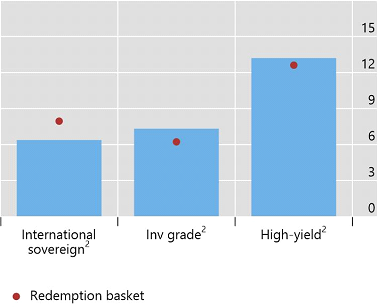

The composition of bond ETF baskets changes frequently over time. The persistence of creation baskets – that is, the fraction of bonds that are in a basket in two consecutive periods – is 45% for ETFs that track Treasuries but only 12% for the largest bond ETF (Figure 4, left-hand panel). Baskets of European bond ETFs and international bond ETFs are even less persistent than those of US ETFs.

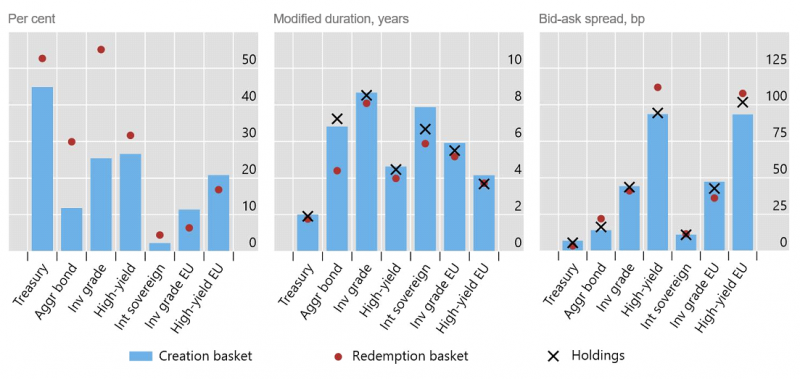

Bonds in the redemption baskets tend to have shorter duration and slightly lower liquidity than holdings and creation baskets (Figure 4, centre and right-hand panels). In terms of duration, the differences are most pronounced for ETFs investing in the aggregate bond index and non-US sovereign debt. Liquidity differences – as measured by the average bid-ask spread – are largest for ETFs investing in the least liquid instruments: high-yield bonds.

Figure 4. Baskets change over time and differ from holdings

The salient features of bond ETFs’ creation and redemption baskets have implications for market functioning. While these features may weaken arbitrage forces, they also enhance the shock-absorbing capacity of ETFs and can help stabilise markets.

Arbitrage versus prevention of runs

Features of bond ETF baskets may weaken arbitrage forces not only directly but also indirectly, by influencing the risk borne by APs. Until the negotiation with ETF sponsors is complete, APs are uncertain about the basket of bonds that they would be able to exchange for an ETF share. They are also unsure how this basket would compare with the one underpinning transactions on the following day. As this uncertainty reduces the risk-adjusted profits that could be extracted from a premium or discount, it weakens arbitrage forces.

That said, the uncertainty’s flip side is flexibility for ETF sponsors to absorb shocks. By selecting the composition of baskets, ETF sponsors could discourage runs by influencing the desirability of redemptions. If there is excessive selling of ETF shares in the secondary market, which puts redemption pressure on APs, the ETF sponsor can include only the riskier or less liquid securities from the pool of holdings in the redemption basket. The lower-quality bonds that APs obtain after redeeming ETF shares would in turn reassure non-running investors that their shares are now backed with holdings of higher average quality. This would discourage further runs and lead to ETF discounts during run episodes.

Such a strategy can backfire in the long run, however, as it can hurt ETFs’ reputation. If investors perceive an ETF as redeeming only low-quality bonds in stress times, they may withdraw from the ETF altogether. This, in turn, could lead to lower inflows to the ETF and, as a result, decrease ETF profits from management fees, which are based on the size of AUM.

Basket flexibility and bond market liquidity

The flexible composition of baskets allows for a more efficient primary market activity and may improve the liquidity of the bond market. Since baskets can differ across APs even on the same day, a large number of diverse APs – with different bond inventories and different client relationships – can participate in creating or redeeming ETF shares. Thus, even when there is a shortage of a particular bond for creation, the bond is still likely to be sourced from the inventory of one of the participating APs. And if the bond is impossible to find, it could be excluded from the basket altogether.

Committee on the Global Financial System (CGFS) (2014): “Market-making and proprietary trading: industry trends, drivers and policy implications”, CGFS Papers, no 52, November.

——— (2016): “Fixed income market liquidity”, CGFS Papers, no 55, January.

Hendershott, T and A Madhavan (2015): “Click or call? Auction versus search in the over-the-counter market”, Journal of Finance, vol 70.

Pan, K and Y Zeng (2019): “ETF arbitrage under liquidity mismatch”, working paper, Goldman Sachs and University of Washington.

Todorov, K (2019): “Passive funds affect prices: evidence from the largest ETF markets”, BIS working paper No 952.

This is a summary of the BIS special feature “The anatomy of bond ETF arbitrage” by the same author. The full version is available here: The anatomy of bond ETF arbitrage (bis.org)

The Secondary Market Corporate Credit Facility (SMCCF) was announced by the Federal Reserve on 23 March 2020 and was expanded on 9 April 2020 to include high-yield bond ETFs.

This is similar to calendar rebalancing for commodity ETFs in Todorov (2019). Such rebalancing arises because the funds target a specific future’s maturity and replace expiring short-term futures contracts with longer-term ones over time.