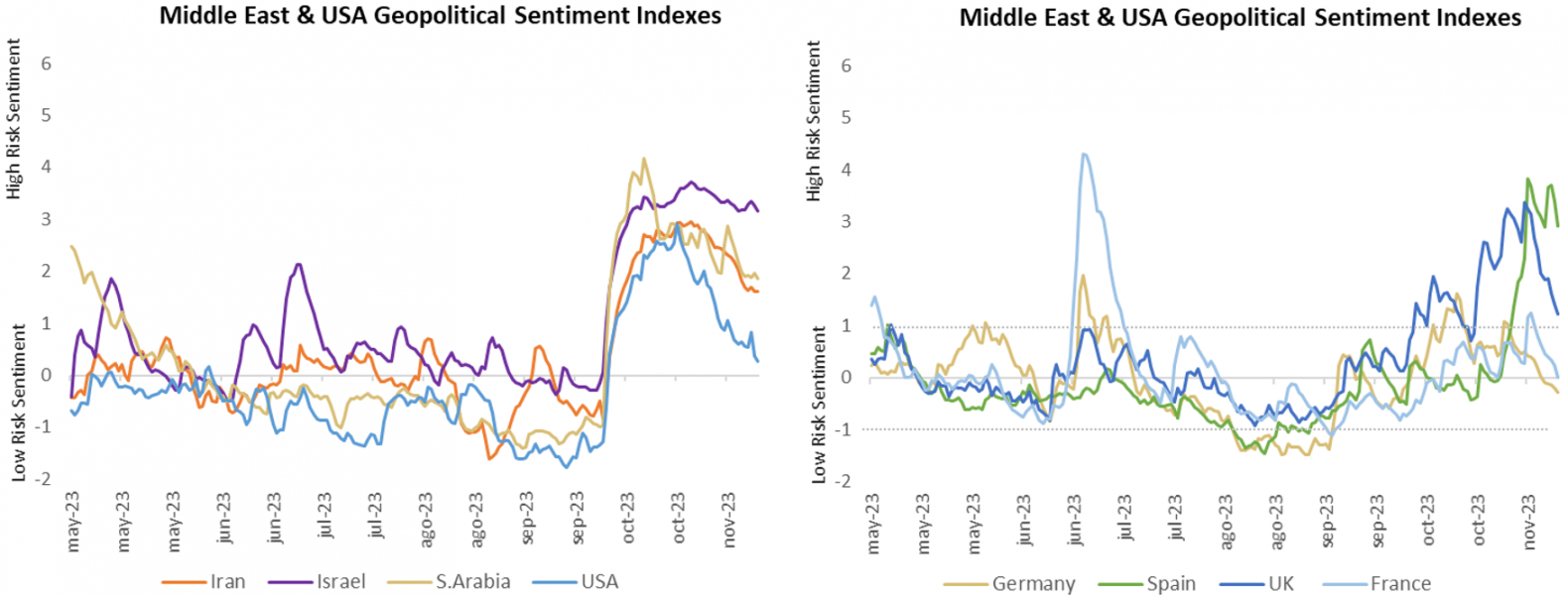

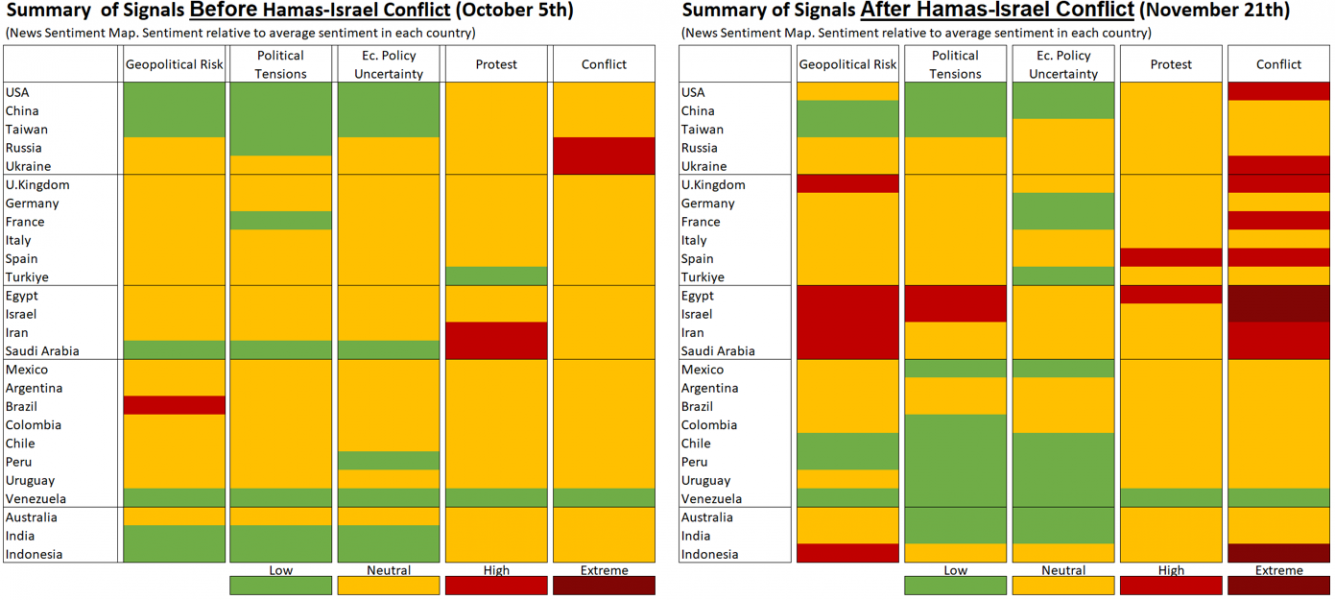

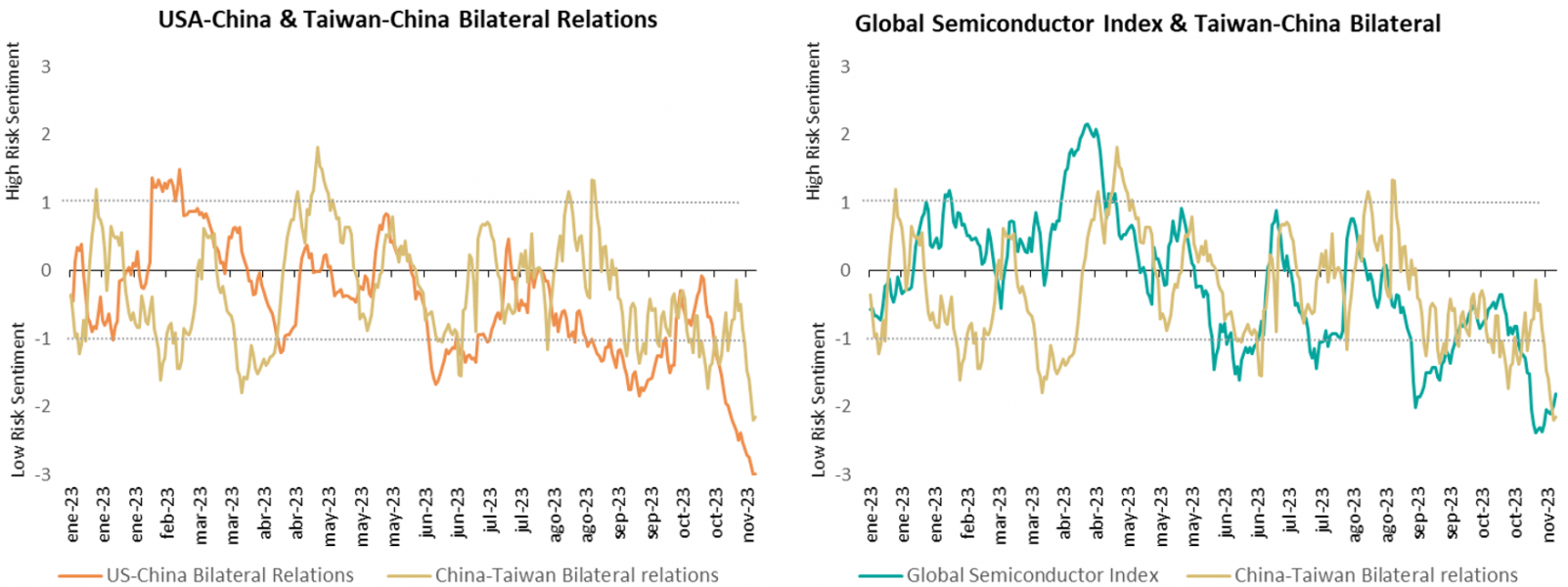

The world has been recently exposed to several geopolitical events which have stressed the World Order. In this section we show how some of our sentiment indexes have captured two different sets of events: the impact of the recent Israel-Hamas Conflict in individual countries and the relationship between China and the US, using bilateral links between the two countries.

(Signals in Geopolitical Risk, Political Tensions, Economic Policy Uncertainty, Protest and Conflict. Signals scaled according to standard deviations of individual series)

ICEWS has recently morphed to POLECAT, a more advanced version. ICEWS uses a mixed methods approach to instability forecasting, combining heterogeneous statistical and agent-based models in an integration framework with an aggregate forecast accuracy of more than 80%. These models are provisioned in near real-time from more than 100 data sources and 250 international and regional news feeds. Millions of news stories are processed by an innovative, shallow-parsing Jabari technology and BBN’s Serif NLP technology.

For detailed information about GDELT, you can consult https://www.suerf.orgwww.gdelt.org.

Focusing on sentiment, once each news piece is translated into English, GDELT applies more than 40 different dictionaries that classify words associated with positive and negative tone to compute the average “tone” of all documents containing one or more mentions to the events we are looking for. The score ranges from -100 (extremely negative) to +100 (extremely positive).

CAMEO is a broadly used coding scheme to systematize the analysis of political and social events and divide them in a scale ranging from material and verbal cooperation to verbal and material conflict.

In the case of the BBVA Geopolitical Risk index, we follow the methodology of Caldara and Iaccovello (2022) to identify the intersection of two sets of keywords related to geopolitical risk.

For political tensions, we collect all news articles that mention politics related topics following the GDELT taxonomy such as elections and campaigns, political parties and politicians, government institutions, policies, political scandals, etc.

The economic policy uncertainty (EPU indicator is based on the Baker, Bloom & Davis (2016) using tone and relative coverage associated with keywords related to Economic Uncertainty and monetary, fiscal and regulatory policy.

Economic policy uncertainty indicators from local media typically anticipate better economic perspectives than those from external media; but the latter are better able to anticipate how the exchange rate evolves.

The index jumped significantly in Spain but for reasons linked to domestic political protests to a large extent unrelated to the Israel Hamas conflict as can be deducted by cleaning the index away from these political protests (not shown in the graph).

Forthcoming in Ortiz, A., Rodrigo, Tsu J and Villarta, P (2023): “A Sentiment analysis of the Semiconductor Crisis”. MIMEO.