The views expressed are those of the authors and do not necessarily reflect those of Norges Bank, the Bank of Finland, or the Eurosystem.

Systematic forecast errors can affect the credibility of the central bank and are easily spotted by its watchers and the media. In this note, we show that the ECB’s inflation projections are unbiased on average. However, the ECB tends to underpredict when inflation is high at the time of forecasting, even outside of crisis periods. This state-dependent bias cannot be fully explained by errors in external assumptions or by forecasting models, potentially pointing to strategic forecasting.

Inflation forecasting plays a critical role in monetary policy and in central bank communication. Central banks’ inflation projections provide an outlook on future developments on which monetary policy decisions are based. They also affect the inflation expectations of the economic agents. However, central banks have made large forecasting errors, especially following significant events such as the Global Financial Crisis and the COVID-19 pandemic. Repeated errors may undermine the credibility of monetary authorities and lead to unanchored expectations.

In our recent study (Granziera et al. (2024)), we examine the potential bias in the inflation projections of the European Central Bank and the Eurosystem (henceforth referred to together as the “ECB”), focusing on whether systematic forecast errors are related to the level of the inflation rate observed at the time of forecasting.

Our results indicate that while the ECB’s projections show no bias on average, there is a significant state-dependent bias in forecasts from one to four quarters ahead. Specifically, when inflation is above an estimated threshold of 1.8% at the time of forecasting, the ECB tends to underpredict inflation. This suggests that the ECB projects inflation to revert to the target too quickly. It is notable that this bias is not driven by the large forecast errors observed during crises, as these outliers are excluded from our analysis.

We further explore potential reasons for this state-dependent bias, considering errors in the ECB’s exogenous assumptions and commonly used forecasting models. We find that errors in exogenous assumptions correlate with inflation prediction errors, but they do not fully explain the latter. Additionally, we find that common forecasting models show a bias of opposite sign, over(under)predicting inflation when it is high (low), which indicates that the models’ persistence is higher than that of the ECB’s forecasts.

To test for bias, we examine forecast errors, defined as the difference between the actual inflation rate and the ECB’s forecast. If the forecast errors are zero in expectation, the projections are unbiased. In practice, this is tested by checking whether the sample mean of the forecast errors is statistically significantly different from zero. A positive average indicates systematic underprediction, while a negative one indicates overprediction.

After testing for bias in a linear specification, we further explore whether and how the forecast errors depend on economic conditions at the time of forecasting. Previous studies (e.g., Goodhart and Pradhan (2023), Herbert (2022), Messina et al. (2015)) have shown that forecast errors can be state-dependent, i.e., their average can change depending on whether the economy is in an expansion or a recession. Our approach is different, however. Rather than relating forecast errors to the phases of the business cycle at the time when inflation is realized, we relate the bias to the level of inflation observed at the time of forecasting.

For our statistical testing framework, we use the method developed by Odendahl et al. (2023), which allows the forecast errors to have a different expected value depending on whether the inflation rate observed at the time of forecasting is above or below an unknown threshold. This allows us to see whether the forecast bias occurs and changes when inflation is above or below a certain level.

It should be noted that this methodology estimates the threshold value that determines the state-dependence. This is crucial, given that using a fixed threshold can be limiting, as setting the threshold a priori is somewhat arbitrary. Therefore, our approach is more flexible and potentially more accurate for potential bias in the ECB’s projections.

We analyze the ECB’s quarterly projections for the year-on-year change in the euro area Harmonized Index of Consumer Prices (HICP). This measure of inflation is central to the ECB’s price stability mandate. The projections are crucial for monetary policy decisions, as they are presented to the ECB Governing Council before its deliberations.

Our dataset includes real-time data estimates and projections from the current quarter up to eight quarters ahead, spanning from 1999Q1 to 2023Q4. The ECB staff produces forecasts that are published in March and September and collaborate with national central bank (NCB) experts in forecasts published in June and December. Monthly inflation projections for up to 11 months ahead are provided by the NCB experts during each of the four forecast rounds, through the Narrow Inflation Projection Exercise (NIPE).

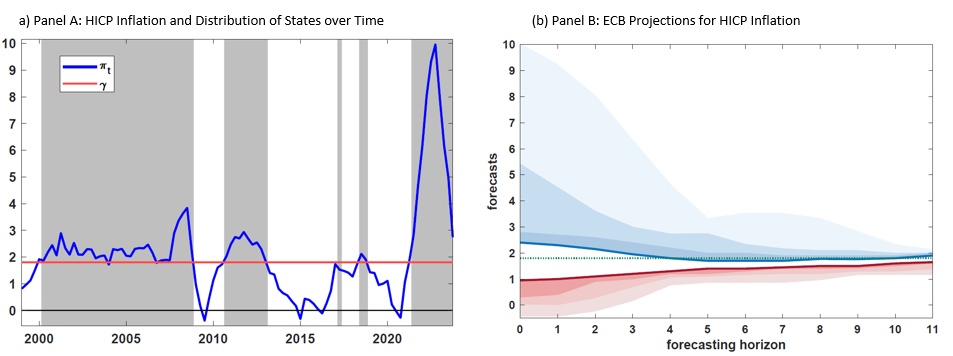

Figure 1A shows the euro area HICP inflation across the sample, with shaded areas marking periods when inflation was above 1.8%, which turns out to be the estimated threshold value for most forecast horizons. Notably, inflation exceeded the 1.8% threshold in 58% of the observations. Figure 1B illustrates projections for different horizons, indicating median forecasts and quantile ranges based on whether observed inflation was above or below 1.8%.

Figure 1B shows that the forecasts revert towards 1.8% by the projection horizon’s end, often within four quarters. The convergence is quick, flattening at longer horizons. When initial inflation is high, projections tend to reach 1.8% after three quarters, indicating a tendency to underestimate the persistence of inflation.

To compute the state-dependent mean of the forecast errors, we must define the inflation rate observed by the ECB at the time of forecasting. Consistent with the cutoff dates of the forecasting process, we assume that when making projections, the ECB knows the average inflation rate from the previous quarter and the first month of the current quarter. We believe that this measure provides a realistic view of the ECB’s available information during forecasting.

The last four years in our sample, marked by the pandemic and subsequent economic disruptions, led to significant forecast errors. To mitigate their impact, we exclude these and other outliers from our analysis. This ensures our results are not distorted by these extraordinary events. Therefore, we test for the presence of bias in ‘normal’ times.

Figure 1. HICP Inflation and Inflation Projections

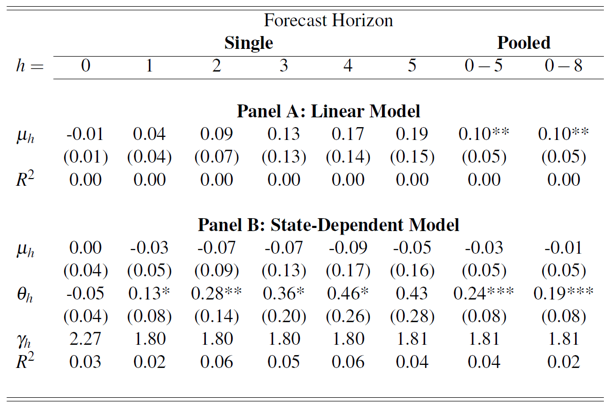

The linear test reveals that the ECB inflation projections are generally unbiased. Table 1, Panel A shows the estimated coefficients for forecast horizons from nowcasting up to five quarters ahead. Most of the coefficients are positive, indicating a tendency to underpredict, but they are not statistically significant. Thus, there is no systematic bias across the different horizons. These findings align with previous studies (e.g., Kontogeorgos and Lam-brias (2022)), suggesting that ECB inflation projections are optimal and rational.

However, our state-dependent bias regression model results, shown in Table 1, Panel B, indicate the presence of a bias that depends on the inflation rate observed at the time of forecasting. The intercept term is negative for all horizons except nowcasting, while the non-linear term is positive and significant for horizons from one to four quarters ahead and for pooled horizons. The estimated threshold parameter is 1.8% for all forecast horizons except for the nowcast. This value is close to the ECB’s de facto inflation target estimated by Hartmann and Smets (2018), Rostagno et al. (2019), and Paloviita et al. (2021)).

The positive bias is more pronounced at horizons from one to four quarters ahead, reaching up to 0.37 percent-age points. We conclude that the ECB tends to overpredict inflation slightly when it is below the estimated thresh-old and especially to underpredict it when above, particularly at intermediate horizons.

The results remain qualitatively unchanged when we repeat the analysis using different assumptions about the information set available to the ECB at the time of forecasting. Additionally, defining the state based on realized inflation at the end of the forecast horizon, rather than at the time of forecasting, actually strengthens the bias magnitude. Finally, the results are robust to lower threshold values, which are set manually.

The size of the state-dependent bias that we uncover might not seem substantial at first glance. However, it is worth noting that the bias we report occurs in ‘normal times’, when inflation does not deviate too much from the de facto target, as forecast errors deemed outliers are excluded from our analysis.

We explore various factors that may contribute to the state-dependent bias in the ECB inflation projections and relate our findings to the existing literature. The ECB projections rely on three main components: assumptions about external variables, forecasting models, and expert judgment. We focus on the first two elements and suggest alternative explanations related to central bank strategic behavior.

The ECB projections are based on technical assumptions about the economic environment, including short-term interest rates, the Euro/US Dollar exchange rate, and Brent crude oil prices. Previous studies (e.g., Kontogeorgos and Lambrias (2022), Glas and Heinisch (2023)) have shown that errors in these assumptions can lead to inaccuracies in inflation projections. We test whether these errors contribute to the state-dependent bias by incorporating them into our regression models. Our analysis reveals that although errors in external assumptions significantly affect inflation forecast errors, they do not fully account for the state-dependent bias.

The ECB forecasts are produced using various models, including simple univariate models, like random walk and autoregressive models, as well as more complex models like the Bayesian Vector Autoregression (BVAR). We test such models for bias and find that they do not replicate the state-dependent bias observed in the ECB projections. Instead, these models tend to underpredict when inflation is low and overpredict when it is high, suggesting that the persistence embedded in the models is inconsistent with how quickly ECB forecasts revert to the target.

While errors in external assumptions and the persistence of forecasting models do not fully explain the state-dependent bias, strategic behavior and management of inflation expectations potentially play significant roles. Our findings align with theoretical and experimental studies (e.g., Ahrens et al. (2023), Herbert (2022), Duffy and Heinemann (2021), Gomez-Barrero and Parra-Polania (2014), Ellison and Sargent (2012), Capistran (2008)), which suggest that central banks may strategically bias their forecasts to achieve broader monetary policy objectives.

Our analysis documents a state-dependent bias in the ECB’s inflation projections, but it does not reveal the causes of the bias. However, as the ECB’s published inflation projections represent an important communication tool, we conjecture that the presence of this bias may be related to strategic motives behind monetary policy communication. The incentive to manage expectations may be higher at intermediate horizons, when the central bank has both relevant knowledge about the effects of economic shocks and the possibility to affect future inflation through its influence on economic agents’ expectations.

The ECB has recently revised its forecasting tools and practices in response to a series of unprecedented crises, increased uncertainty, and large forecasting errors. For example, more detailed assessments of projection errors are now published (Chahad et al. (2022, 2023)). Also, sensitivity analyses and scenarios have been published during the pandemic and after the Russian invasion of Ukraine (Lagarde (2023)). The recent exceptionally large challenges in inflation forecasting have also prompted other central banks to improve their forecasting methods and processes (see, e.g., Bernanke’s review of forecasting at the Bank of England (Bernanke (2024)). Because the credibility of a monetary authority may be related to the forecast accuracy of its projections, further analysis of the determinants of the bias is needed.

Table 1. Bias in ECB Inflation Projecitons

Note: The linear model in Panel A is ε_(t+h|t)=μ_h+u_(t+h|t), where ε_(t+h|t)=y_(t+h)-y_(t+h|t) is the forecast error, μ_h is an intercept, and u_(t+h|t) is an error term. The state-dependent model in Panel B is ε_(t+h|t)=μ_h+θ_h G(S_t;γ_h)+u_(t+h|t), where G(S_t;γ_h)=1(S_t≥γ_h) is an indicator variable which gets the value 1 if the state variable S_t (the average inflation rate from the previous quarter and the first month of the current quarter) is greater than or equal to the unknown threshold γ_h, and zero otherwise. Coefficients have been estimated over the sample 1999Q1−2023Q4. R^2 is the adjusted R^2. Newey-West standard errors are in parenthesis. Stars denote the 10% (*), 5% (**), and 1% (***) significance levels.

Ahrens, S., J. Lustenhouwer and M. Tettamanzi (2023). The Stabilizing Effects of Publishing Strategic Central Bank Projections. Macroeconomic Dynamics 27, 826–868.

Bernanke, B. (2024). Forecasting for monetary policy making and communication at the Bank of England: a review. Published on 12 April 2024.

Capistran, C. (2008). Bias in Federal Reserve Inflation Forecasts: Is the Federal Reserve Irrational of Just Cautious? Journal of Monetary Economics 55, 1415–1427.

Chahad, M., A.-C. Hofmann-Drahonsky, B. Meunier, A. Page and M. Tirpák (2022). What explains recent errors in the inflation projections of Eurosystem and ECB staff? ECB Economic Bulletin, Issue 3/2022.

Chahad, M., A.-C. Hofmann-Drahonsky, A. Page and M. Tirpák (2023). An updated assessment of short-term inflation projections by Eurosystem and ECB staff. ECB Economic Bulletin, Issue 1/2023.

Duffy, J. and F. Heinemann (2021). Central Bank Reputation, Cheap Talk and Transparency as Substitutes for Commitment: Experimental Evidence. Journal of Monetary Economics 117, 887–903.

Ellison, M. and T. J. Sargent (2012). A Defence of the FOMC. International Economic Review 53(34), 1047–1065.

Glas, A. and K. Heinisch (2023). Conditional Macroeconomic Survey Forecasts: Revisions and Errors. Journal of International Money and Finance 138.

Gomez-Barrero, S. and J. A. Parra-Polania (2014). Central Bank Strategic Forecasting. Contemporary Economic Policy 32(4), 802–810.

Goodhart, C. and M. Pradhan (2023). A Snapshot of Central Bank (two year) Forecasting: a Mixed Picture. Working Papers 18043, CEPR.

Granziera, E., P. Jalasjoki and M. Paloviita (2024). The bias of the ECB inflation projections: a State-dependent analysis. (a) Bank of Finland Research Discussion Paper 4/2024. (b) Norges Bank’s Working Paper 11/2024.

Hartmann, P. and F. Smets (2018). The First Twenty Years of the European Central Bank: Monetary Policy. Working Papers 2219, European Central Bank.

Herbert, S. (2022). State-Dependent Central Bank Communication with Heterogeneous Beliefs. Working Papers 875, Banque de France.

Kontogeorgos, G. and K. Lambrias (2022). Evaluating the Eurosystem/ECB staff macroeconomic projections: the first 20 years. Journal of Forecasting 1, 211–404.

Lagarde, C. (2023). Communication and monetary policy. Speech at the Distinguished Speakers Seminar organised by the European Economics & Financial Centre. London, 4 September 2023.

Messina, J., T. M. Sinclair, and H. Stekler (2015). What Can We Learn from Revisions to the Greenbook Forecasts? Journal of Macroeconomics 45, 54–62.

Odendahl, F., B. Rossi, and T. Sekhposyan (2023). Evaluating Forecast Performance with State Dependence. Journal of Econometrics 237(2).

Paloviita, M., M. Haavio, P. Jalasjoki, and J. Kilponen (2021). What Does “Below, but Close to, Two Per Cent” Mean? Assessing the ECB’s Reaction Function with Real Time Data. International Journal of Central Banking 17(2), 125–169.

Rostagno, M., C. Altavilla, G. Carboni, W. Lemke, R. Motto, A. S. Guilhem, and J. Yiangou (2019). A Tale of Two Decades: The ECB’s Monetary Policy at 20. WP N. 2346, European Central Bank.