The recent collapse of banks in the United States and the subsequent ripple effects felt around the world once again underscore the critical need for proactive measures to detect and assess banking risks. In a recent paper, we propose an early-warning method for identifying bank risks based on the average syndicate size of loans they participate in. At the bank level, it predicts, for at least three years ahead, greater risks (i.e., loan loss provisions, idiosyncratic return volatility, default probability, and frequency of lawsuits) and lower profitability, especially for opaque and complex banks. Furthermore, when banks fail the Federal Reserve’s forward-looking stress tests, they subsequently reduce their syndicate concentration. At the aggregate level, higher syndicate concentration within the financial system predicts greater financial sector risks and economic slowdowns measured by both inputs and outputs, such as private-sector investment, business activity, total factor productivity, industrial production, and gross domestic product.

It is common in today’s financial market for multiple banks to join forces, forming a syndicate to collectively lend to borrowers. Several ways to measure the concentration of a loan syndicate are available, but most of which relies on the knowledge of each bank’s allocation in the syndicate. However, the information of such lenders’ shares in each loan syndicate is extremely limited. For example, only 23% of all 171,036 U.S. loans from 1990 to 2020 recorded by DealScan, a leading data vendor of global syndicated loans, have non-missing lender shares data. Therefore, a syndicate concentration measure based on lender shares would inevitably miss over three quarters of loans.

The beauty of our syndicate concentration measure is its simplicity: we use the reciprocal of the number of lenders in a loan syndicate as the loan-level syndicate concentration measure (Gao et al., 2023). We mathematically show that the number of lenders provides enough information to capture the majority of variation in syndicate concentration via a decomposition of Herfindahl–Hirschman Index (HHI), a well-established concentration measure. As a result, our measure can be particularly valuable by ensuring a large sample coverage when the availability of lender shares data is known to be sporadic.

For each bank-quarter, we then average our loan-level syndicate concentration measure by the dollar amount of loans that the bank participates in over the past year, which we use to measure the bank’s quarterly syndicate concentration. The bank-level syndication concentration is somewhat persistent over time. A bank’s syndicate concentration has a probability of 85% to stay within +/-1 decile rank in the next quarter, but significant changes over a longer period can and do occur.

Our baseline results suggest that the decile rank of bank-level syndicate concentration strongly predicts higher future bank risks and lower bank profitability. Specifically, we estimate multi-quarter-ahead predictive regressions using a quarterly panel of bank risk and profitability measures and the decile rank of bank syndicate concentration. We use decile ranks to mitigate the concern of measurement error. We control for an array of bank characteristics, including the natural logarithm of the book value of total assets, equity capital ratio, returns on assets, market-to-book equity ratio, size of loan portfolio, growth rate of loan portfolio, loan loss allowance, quarterly buy-and-hold stock return and liquidity ratio, as well as year-quarter fixed effects.

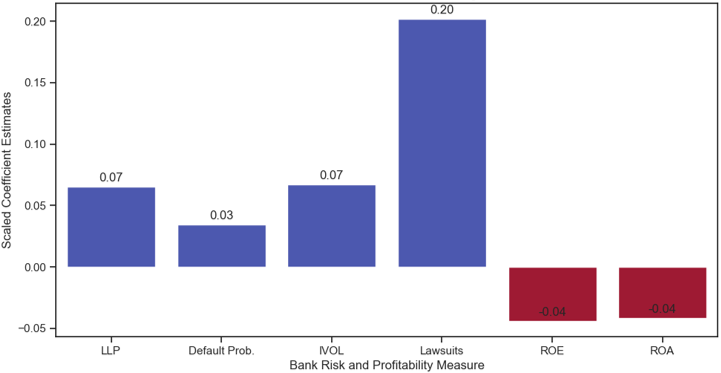

We find statistically and economically significant estimated coefficients of the bank-level syndicate concentration rank for almost all prediction horizons from one-quarter-ahead to three-year-ahead. For example, Figure 1 below shows the coefficient estimates of bank syndicate concentration rank in the three-year-ahead predictive regression, where the estimates are scaled by the sample mean of the corresponding bank risk or profitability measure. It is also evident that the predicted effects are sizeable. An increase in the decile rank of bank syndicate concentration is associated with about 7% increase, relative to the sample mean, in the ratio of loan loss provisions to total loans. In fact, an increase from the bottom decile rank to the top rank predicts, for three years ahead, a 59% increase relative to the sample mean loan loss provisions (scaled by total loans), which implies an additional expected loan loss of over $138 million per year in our sample.

Figure 1: Estimated Coefficients of Predictive Regression

* Coefficient estimates are scaled by the respective sample mean of the variable.

** LLP is loan loss provision; IVOL is idiosyncratic volatility.

Our results remain qualitatively unchanged in a battery of robustness tests, such as additionally controlling for bank specializations in syndicated lending and in industry, bank reputation, and using alternative estimation methods.

Because lead banks have the incentive to retain large loan shares to signal good loan quality, resulting in a greater syndicate concentration, the predictive power of bank-level syndicate concentration should derive primarily from loans joined by the bank rather than from loans lead-arranged.

We validate this conjecture by decomposing the bank-level syndicate concentration measure into two components, one based on the loans where the bank is one of lead arrangers and the other based on the loans where the bank is a non-lead participant. We re-estimate the baseline using the decile ranks of these two measures. Results show that the above documented predictive power comes only from the loans joined by the bank, consistent with our conjecture.

While bank-level syndicate concentration predicts higher future bank risks and lower profitability, we do not find that it negatively predicts bank stock market performance. A possible explanation is that the stock market has recognized the riskiness of banks often lending alone or joining small and concentrated loan syndicates. Consistent with such expectation, we find that a bank with greater bank-level syndicate concentration measure has lower contemporaneous valuation measured by either market-to-book equity ratio or Tobin’s Q.

We further find that the predictive power of bank-level syndicate concentration on bank risks and profitability is stronger for more opaque and/or complex banks. Such banks might lack the ability to timely manage the risks arising from syndicate concentration due to their high opacity and/or complexity.

From 2011, the Federal Reserve began conducting the annual Comprehensive Capital Analysis and Review (CCAR) stress test to determine the capital adequacy of large bank holding companies. Banks that failed a stress test are required to improve risk management, raise new capital, and/or change their capital distribution plans. Thus, a stress test failure is a bad public signal and significantly damages the bank’s reputation.

Given that bank-level syndicate concentration serves as an early-warning bank risk measure and increases future bank risks, we expect the banks failing stress tests would take actions to decrease its bank-level syndicate concentration. e.g., by participating in syndicated loans with more lenders, and/or by reducing participation in loans with less lenders.

Using a difference-in-differences estimation, we confirm that banks that have failed a stress test subsequently reduce their bank-level syndicate concentration in the next two years, relative to banks that have passed the stress test. More importantly, the reduction in the failing banks’ bank-level syndicate concentration comes only from loans joined, not from loans arranged, consistent with our earlier results that the predictive power of bank-level syndicate concentration derives only from loans joined, not loans arranged. This finding again assures the validity of the bank-level syndicate concentration measure. The negative shock to bank reputation and restriction on capital distribution after failing stress tests divert banks from risky lending in small syndicates.

At each month’s end, we construct an aggregate syndicate concentration based on the loan-amount-weighted average of loan-level syndicate concentration, using all loans originated in the past six months. We shorten the rolling window from twelve months to six months to allow more rapid changes in the aggregate syndicate concentration.

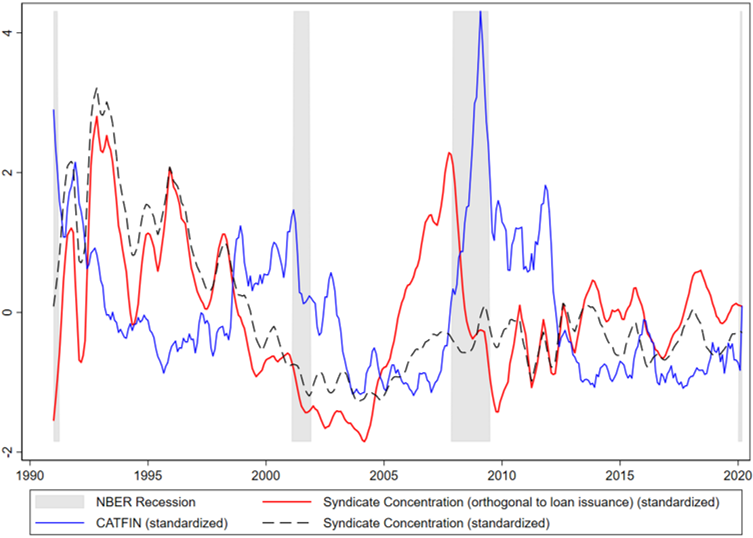

A visual examination of Figure 2 reveals that the aggregate syndicate concentration (red line) leads the financial sector risk (blue line). The financial sector risk is measured by CATFIN as in Allen, Bali and Tang (2012), which is an arithmetic average of three different Value-at-Risk measures for financial firms.

In a multi-period-ahead predictive regression setup, we empirically confirm that the aggregate syndicate concentration positively predicts financial sector risk, as well as growth in the mean ratio of loan loss provisions to loan size. Our regression model controls for a large set of macroeconomic and financial variables, as well as twelve lags of the predictand. Our results are robust to the inclusion of investor sentiment measure in Baker and Wurgler (2006) because Ivashina and Scharfstein (2010) suggest that the time-series variation in the number of syndicate loan participants may be driven by investor sentiment.

Figure 2: Aggregate Syndicate Concentration and Financial Sector Risk

Finally, and importantly, the aggregate syndicate concentration not only predicts greater financial sector risk, but also foreshadows real economic slowdowns.

In a similar multi-period-ahead predictive regression, we find that increases in aggregate syndicate concentration are followed by worsening credit supply conditions as measured by rising excess bond premium (Gilchrist and Zakrajšek, 2012), thereby likely causing reduced investment and macroeconomic slowdowns.

We then use a variety of measures to examine whether aggregate syndicate concentration predicts future macroeconomic activities. First, we find that aggregate syndicate concentration significantly and negatively predicts growth rate of gross private domestic investment for at least six months in the future. Hence, an increase in aggregate syndicate concentration (and the associated increase in financial-sector risks) may hinder future domestic investment growth.

We next turn to a set of macroeconomic variables reflecting the state of macroeconomic conditions and find that an increase in aggregate syndicate concentration predicts reduction in growth rates of total factor productivity (TFP), gross domestic product (GDP), and industrial production. Taken together, we find that higher aggregate syndicate concentration not only curbs future aggregate investment growth, but also reduces future growth in economic outputs and productivity.

We continue to find some negative predictive ability of aggregate syndicate concentration on future Chicago Fed National Activity Index and the Aruoba-Diebold-Scotti Business Conditions Index compiled by the Federal Reserve Bank of Philadelphia, consistent with the other macroeconomic measures and our expectations. There is also some evidence that aggregate syndicate concentration positively predicts the likelihood of an upcoming economic recession.

Moreover, all above results are robust if we additionally control for the financial sector risks and investor sentiment. These finding confirm that aggregate syndicate concentration can serve as an early-warning indicator for the slowdowns in real economic activities.

We use U.S. bank syndicated loan data over three decades (1990-2020) to understand how a bank’s involvement in syndicated lending relates to its future risks and profitability. We show that the average syndicate concentration of loans that a bank recently participates in can serve as an early-warning device, for at least three years ahead, of its future risks and profitability. Such predictive power comes from the loans joined by the bank, not from the ones lead-arranged, and is stronger for opaque and complex banks. Further, greater aggregate syndicate concentration foreshadows greater future financial-sector risks, reduced credit supply, lower future private-sector investment growth, and thus slower future economic activities. Therefore, in order to better maintain financial stability, regulators should be vigilant on the levels of syndicate concentration of individual banks and the financial sector as a whole. Pre-emptive monitoring by bank supervisors may be warranted in the syndicated lending market when syndicate concentration is high.

Allen, L., Bali, T. G., Tang, Y., 2012. Does Systemic Risk in the Financial Sector Predict Future Economic Downturns? The Review of Financial Studies, 25, 3000–3036.

Baker, M., Wurgler, J., 2006. Investor Sentiment and the Cross-Section of Stock Returns. The Journal of Finance, 61, 1645–1680.

Gao, Mingze and Hasan, Iftekhar and Qiu, Buhui and Wu, Eliza, Lone (Loan) Wolf Pack Risk (March 17, 2023). Bank of Finland Research Discussion Paper No. 4/2023, Available at SSRN: https://ssrn.com/abstract=4391791.

Gilchrist, S., Zakrajšek, E., 2012. Credit Spreads and Business Cycle Fluctuations. The American Economic Review, 102, 1692–1720.

Ivashina, V., Scharfstein, D., 2010. Loan Syndication and Credit Cycles. The American Economic Review, 100, 57–61.