Originally published by the ECB working papers series No 2711, August 2022. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

What is the impact of stress tests on bank stock prices? To answer this question we study the impact of the publication of the EU-wide stress tests in 2014, 2016, 2018, and 2021 on the first and second moment of equity returns. First, the effect of the disclosure of stress tests on (cumulative) excess/abnormal returns is studied through a one-factor market model. Second, both returns and volatility of bank stock prices changes upon the disclosure of stress tests are investigated through a structural GARCH model. Results suggest that the publication of stress tests provides new information to markets. Banks performing poorly in stress tests experience, on average, a reduction in returns and an increase in volatility, while the reverse holds true for banks performing well. Banks performing moderately have rather a small effect on both mean and variance process. These results indicate that the publication of stress tests improves price discrimination between ’good’ and ’bad’ banks, which can be interpreted as a certification role of the stress tests in the stock market.

After the global financial crisis, stress tests became an important assessment tool to ensure that the European banking system is robust and resilient to adverse macro-financial shocks. The main objective of stress tests is to identify tail risks in banks’ balance sheets, build confidence in the banking system and enhance transparency among market participants. Due to the opaque nature of banks, informational asymmetry may undermine the ability of market participants to take informed decisions, i.e., distinguish between “good” and “bad” banks. The disclosure of stress test results expands the information available to investors, thus improving the ability of markets to discriminate between banks.

This study investigates the presence of a certification role of the EU-wide stress tests in market behaviour. It is assessed whether the publication of stress test results provides new information to market participants by increasing transparency on the resilience of individual banks. For this, the bank stress test performance is related with the mean and volatility dynamics of bank equity returns.

The empirical literature on the informational content of stress test publications is relatively limited, in particular for the European context. So far, only few empirical studies estimate the short-term effects of stress testing exercises and most of them are related with exercises led by the Federal Reserve System in the United States (U.S.). While the literature has shed considerable light on the relationship between stress test publications and stock price returns, little attention has been devoted to higher-return moments.2 For this reason, this study contributes to the literature by not only exploring the dynamics in mean returns, but also including the volatility aspect in the analysis. Thus, a relevant contribution of this paper is the impact of stress tests disclosure on the second moment of equity returns (or volatility).

The literature is consensual in inferring that the disclosure of stress test results generally reveals new information to markets (e.g., Peristian et al. (2010), Hirtle et al. (2011), Tarullo (2010, 2016), Bernanke (2013), Petrella and Resti (2013), Goldstein and Sapra (2014), Alves et al. (2015), Flannery et al. (2017), Georgescu et al. (2017) and Sahin et al. (2020)). However, some authors argue that while promoting market discipline, such disclosures may exacerbate bank-specific inefficiencies (e.g. Goldstein and Sapra (2014)). Also, there is a consensus in the literature that the stress tests are effective in reducing bank incentives to take risks and therefore in enhancing financial stability (Borio et al., 2014; Gick and Pausch, 2012; Goldstein and Sapra, 2014; Pierret and Steri, 2019; Cortés et al., 2020; Kok et al., 2021; Konietschke et al., 2022; among others).

The results presented in this article depicts that the disclosure of stress tests expand the information available to investors, thus improving the ability of markets to discriminate between banks. More specifically, the results show that banks that do badly in stress tests face a reduction in returns and an increase in volatility after the publication of stress test results, while the reverse holds true for banks performing well. These results support the hypothesis that the publication of the EU-wide stress tests improves price discrimination between ’good’ and ’bad’ banks, which can be interpreted as a certification role of the stress tests in the stock market.

The remainder of this article is structured as follows. Section 2 describes the empirical setup used for the analysis. Section 3 presents the results for the impact of the publication of stress tests on bank stock prices. Section 4 concludes the analysis.

This study relies on daily and five-minute intraday frequencies of equity prices for banks that participated in the EU-wide stress tests of 2014, 2016, 2018 and 2021 and contains on average 37 banks for each exercise.3 In terms of empirical setup, two distinctive but complimentary methods are applied to measure whether the publication of stress test results is priced in stock markets, namely:

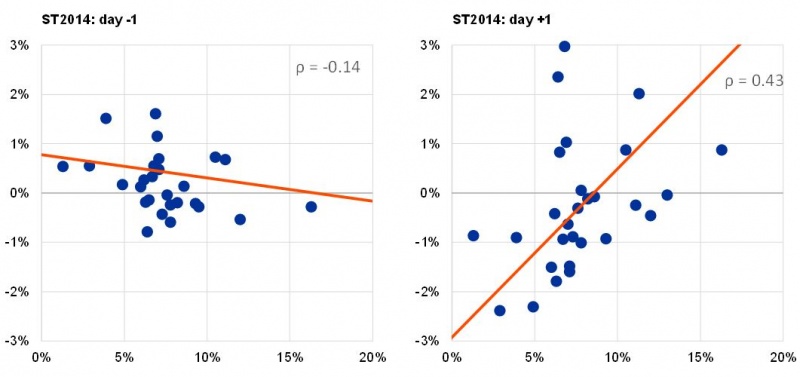

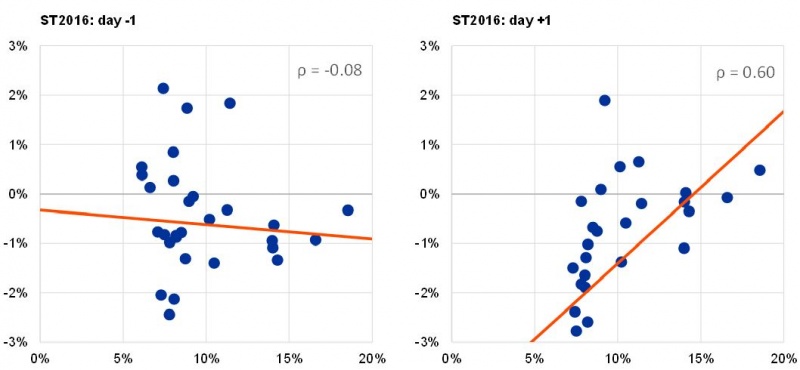

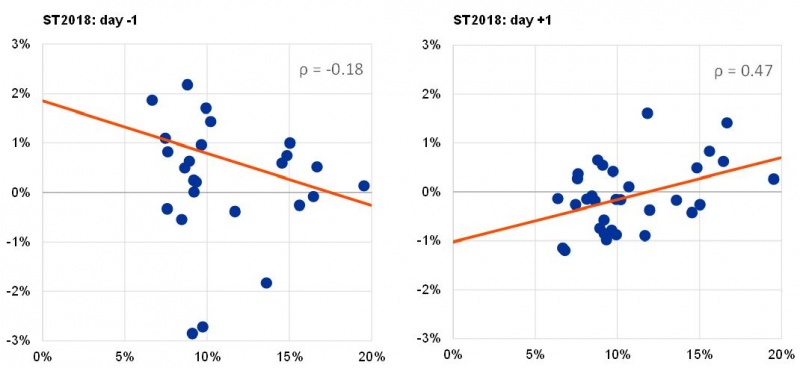

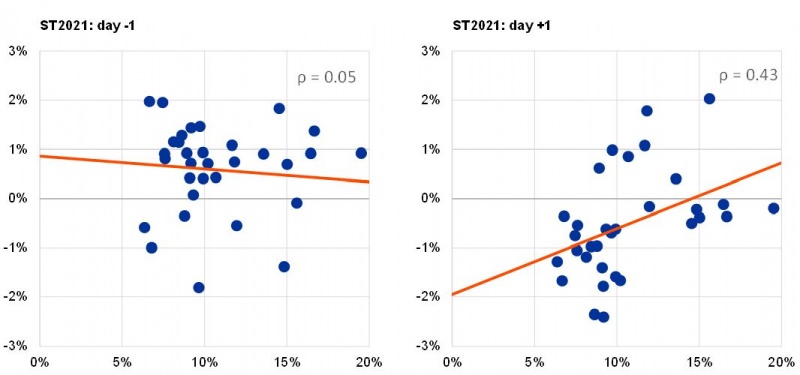

The stock market response to the disclosure of stress test results provides insights to whether stress tests provide new information to market participants. Figure 1 depicts scatter plots on the relation between bank abnormal returns and bank projected end-CET1 ratio on the day before and day after the stress test publication. Banks that perform better during stress tests tend to report higher excess returns than banks that perform worse (i.e., banks with larger capital gaps in the stress tests experienced higher negative abnormal returns). Ordinary least squares (OLS)-fitted trend lines and correlation coefficients indicate that on the day before stress test publication events, the relationship is relatively weak and statistically insignificant. Conversely, the correlation coefficient on the day after the publication reveals a much stronger relationship and is statistically significant across all stress test events. To formally test this relationship, a panel regression is estimated (see Table 3 of the ECB working paper No 2711) revealing that the publication of the end-horizon stress test CET1 ratio has a significant effect on the cumulative abnormal returns. Results indicate that a 1 percentage point increase in the bank projected end-CET1 ratio generates, on average, 0.34 percentage points higher cumulative abnormal returns. This suggests that the published end-horizon stress test CET1 ratio is used as new information by the markets as a measure of bank resilience to an adverse shock, and therefore decreases the risk of holding the bank stocks.

Figure 1: Relationship between abnormal returns and stress test performance (in terms of end-CET1 ratio)

(x-axis: projected end-CET1 ratios; y-axis: abnormal returns expressed as percentages)

Sources: Bloomberg and authors’ calculations. Notes: This chart plots the relationship between bank abnormal returns and bank projected end-CET1 ratios (from the stress tests) on the day before (left) and after (right) the publication of the 2014, 2016, 2018 and 2021 stress test results. The OLS-fitted trend line (red) has been added for reference.

As already mentioned, a relevant contribution of this study is the impact of stress tests disclosure on the second moment of equity returns (or volatility). The results based on a structural GARCH model to investigate whether the disclosure of stress tests had a significant effect on the first (λ, returns) and second moment (δ, volatility) of equity returns are available in Table 5 of the ECB working paper No 2711. The results depict that, when controlling for the dynamics in the market index, the median bank experiences, on average, a change of -0.25 percentage points in returns during the event window. Regarding the second moment of returns, the results show that the median bank experiences, on average, a 6% reduction in the variance process of its equity return series. However, as suggested by the interquartile range of both variables, there is a high degree of heterogeneity in the estimated values of λ and δ among banks.

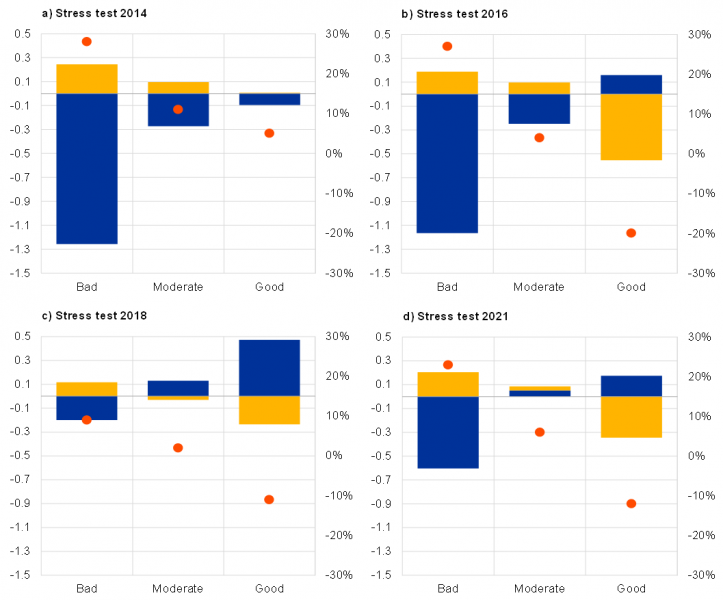

To further explore whether the variation in the mean and volatility of equity returns is tied to the performance of banks in stress tests, the average estimated change in the first (returns) and second (volatility) moments of equity returns is calculated for banks that are categorised in three groups, in terms of projected end-CET1 ratio: good, bad and moderate performers.7 Our findings are displayed in Figure 2, which indicates that banks that perform poorly in stress test exercises experience, on average, a reduction in returns and an increase in volatility, while the reverse holds true for banks that perform well (blue and yellow bars respectively). By aggregating the estimates across the four stress test exercises, results show that banks that perform well during stress test exercises experience, on average, an increase in equity returns of 0.18 percentage points and a reduction in the variance process of 28%. While banks that perform poorly experience, on average, a decrease in equity returns of 0.80 percentage points and an increase in the variance process of 19%.

To ensure that the findings from the GARCH specification are robust, consideration is also given to whether realised volatility is significantly higher or lower during the event window.8 The results depicted in Figure 2 (red dot) show that the realised variance increases (decreases) for bad (good) performing banks after the publication of stress tests. This confirms our earlier results with respect to the second moments of equity returns obtained from the GARCH specification.

A possible explanation for our results may lie in the fact that stress test results are of special interest to shareholders. Bad (good) performance during the stress test exercises may increase (decrease) the probability of mandatory equity issuance, which sets shareholders at a disadvantage if stock dilution takes place (Georgescu et al., 2017). Another related explanation may be that the fundamentals of bad (good) performing banks were better (worse) than anticipated by shareholders, which was therefore priced in by markets during the days after the disclosure of the stress test results (Ellahie, 2012). Therefore, even if the bank risk profile is already reflected in the behaviour of stock markets, these results suggest that the new information provided by the publication of the stress test exercises have changed the informational environment in a tangible way such that both the returns and volatility of bank equity return series were impacted.

Figure 2: Average change in the first (blue, returns) and second (yellow, volatility) moments and in realised variance (red)

(x-axis: stress test performance per bank category (in terms of projected end-CET1 ratios), y-axis left-hand scale: average values for estimated coefficients (blue) and (yellow) in percentage point changes; right-hand scale: average percentage changes in realised variance (red dot))

Sources: Bloomberg, Refinitiv and authors’ calculations. Note: This chart presents the average change in the first (blue, returns) and second (yellow, volatility) moment as estimated by the structural GARCH model for each category of banks (good, moderate, bad) after the 2014, 2016, 2018 and 2021 stress test publication. The red dot represents the average change in realised variance computed through five-minute intraday quoted data for each category of banks (good, moderate, bad) after the 2014, 2016, 2018 and 2021 stress test publications. Banks are categorised as good if they complete the stress tests with a projected end-CET1 ratio above the 67th percentile of the distribution of banks, and as bad if banks complete the stress tests with a projected end-CET1 ratio below the 33rd percentile of the distribution.

The global financial crisis revealed strong limitations of the supervisory framework in safeguarding the resilience of the banking system to adverse shocks. To restore market confidence, the EU banking system moved to a centralised Banking Union, with the establishment of the Single Supervisory Mechanism (SSM). This centralisation was primarily set up to ensure financial stability, reduce systemic risk build-up and to make financial institutions equipped to withstand adverse shocks. Therefore, the centralised stress testing exercises have become an important assessment tool for identifying potential vulnerabilities in the banking system, thereby informing supervisory evaluations and contributing to macroprudential policy discussions.

Overall, this analysis shows that stock markets react to the information disclosed following the stress test exercises and confirm the certification role of stress tests, enabling investors to assess more effectively the resilience of banks. The results of this study show that banks performing poorly in stress tests face a reduction in the first moment of equity returns but an increase in volatility, while the reverse holds true for banks that perform well. Stock returns of banks that perform moderately in stress tests have a rather small effect on both the mean and variance process.

The publication of the stress test results expands the information available to market participants and enhances price discrimination given that abnormal price behaviour in bank stocks is highly correlated with stress test performance in the days following the disclosure of results, indicating that individual bank resilience is priced by the market. This suggests that the stress tests play an important role in improving financial stability and restoring confidence in the banking system by mitigating bank opaqueness among market participants and, at the same time, building up confidence in the banking system.

Alves, C., Victor, M. and Silva, P. (2015), “Do stress tests matter? A study on the impact of the disclosure of stress test results on European financial stocks and CDS markets”, Applied Economics, Vol. 47, Issue 12, pp. 1213-1229.

Andersen, T.G., Bollerslev, T., Diebold, F.X., and Labys, P. (2003), “Modeling and forecasting realized volatility”. Econometrica, Vol. 71, Issue 2, pp. 579-625.

Andersen, T.G. and Benzoni, L. (2008), “Realized volatility“, Working Paper Series, No 14, Federal Reserve Bank of Chicago.

Bernanke, B. (2013), “Stress testing banks: what have we learned?”, speech at the “Maintaining financial stability: holding a tiger by the tail” financial markets conference sponsored by the Federal Reserve B, Speech 624, Board of Governors of the Federal Reserve System, 8 April.

Borio, C., Drehmann, M., and Tsatsaronis, K. (2014), “Stress-testing macro stress testing: Does it live up to expectations?”, Journal of Financial Stability, Vol. 12, Issue C, pp. 3-15.

Cortés, K., Demyanyk, Y., Li, L., Loutskina, E. and Strahan, P. (2020), “Stress Tests and Small Business Lending”, Journal of Financial Economics, Vol. 136, Issue 1, pp. 260-279.

Durrani, A., Marques, P. A. and Ongena, S. (2022), “The certification role of the EU-wide stress testing exercises in the stock market: What can we learn from the stress tests (2014-2021)?”, Working Paper Series, No 2711, ECB, Frankfurt am Main, August.

Ellahie, A. (2012), “Capital market consequences of EU Bank Stress Tests”, Conference Discussion Paper, New York Federal Reserve Bank.

Engle, R.F. and Siriwardane, E. (2018), “Structural GARCH: the volatility-leverage connection”, The Review of Financial Studies, Vol. 31, Issue 2, pp. 449-492.

Flannery, M., Hirtle, B. and Kovner, A. (2017), “Evaluating the information in the federal reserve stress tests”, Journal of Financial Intermediation, Vol. 29, January, pp. 1-18.

Georgescu, O. M., Gross, M., Kapp, D. and Kok, C. (2017), “Do stress tests matter? Evidence from the 2014 and 2016 stress tests”, Working Paper Series, No 2054, ECB, Frankfurt am Main, May.

Gick, W., and Pausch, T. (2012), “Persuasion by stress testing – optimal disclosure of supervisory information in the banking sector”, Discussion Paper, No 32, Deutsche Bundesbank.

Goldstein, I. and Sapra, H. (2014), “Should banks’ stress test results be disclosed? An analysis of the costs and benefits”, Foundations and Trends in Finance, Vol. 8, Issue 1, pp. 1-54.

Hirtle, B., Kovner, A., Vickery, J. I. and Bhanot, M. (2011), “Assessing financial stability: the capital and loss assessment under stress scenarios (CLASS) Model”, Journal of Banking and Finance, Vol. 69(1), pp. 535-555.

Kok, C., Müller, C., Ongena, S. and Pancaro, C. (2021), “The disciplining effect of supervisory scrutiny in the EU-wide stress test”, Working Paper Series, No 2551, ECB, Frankfurt am Main, May.

Konietschke, P., Ongena, S. and Ponte Marques, A. (2022), “Stress tests and capital requirement disclosures: do they impact banks’ lending and risk-taking decisions?”, Working Paper Series, No 2679, ECB, Frankfurt am Main, July.

MacKinlay, A.C. (1997), “Event studies in economics and finance”, Journal of Economic Literature, Vol. 35, Issue 1, pp. 13-39.

Peristian, S., Donald, P. and Savino, V. (2010), “The information value of the stress test and bank opacity”, Staff Report, New York Federal Reserve Bank, No 460.

Petrella, G. and Resti, A. (2013), “Supervisors as information producers: Do stress tests reduce bank opaqueness?”, Journal of Banking and Finance, Vol. 37, Issue 12, pp. 5406-5420.

Pierret, D. and Steri, R. (2019), “Stressed Banks”, Research Paper Series, No. 17-58, Swiss Finance Institute.

Sahin, C., de Haan, J. and Neretina, E. (2020), “Banking stress test effects on returns and risks”, Journal of Banking and Finance, Vol. 117, August.

Tarullo, D.K. (2010), “Lessons from the crisis stress tests”, Remarks made to the International Research Forum on Monetary Policy, Federal Reserve Board, Washington D.C.

Tarullo, D. K. (2016), “Next steps in the evolution of stress testing”, Remarks at the Yale University School of Management Leaders Forum, Board of Governors of the Federal Reserve System, Washington, 26 September.

Agha Durrani: European Central Bank; agha_hur_ali.durrani@ecb.europa.eu. Aurea Ponte Marques: European Central Bank; aurea.marques@ecb.europa.eu. Steven Ongena: University of Zurich, Zurich, Switzerland; Swiss Finance Institute, Zurich, Switzerland; KU Leuven, Leuven, Belgium; Norwegian University of Science and Technology, Trondheim, Norway; Centre for Economic Policy Research, London, United Kingdom; steven.ongena@bf.uzh.ch.

This is surprising since the concept of volatility pervades almost every facet in finance. Volatility is a frequently used risk measure that has numerous applications in risk management, option pricing models, asset pricing models, portfolio optimization, etc.

Due to the fact that stock prices are not available for all banks participating in the stress tests.

More formally, this can be expressed as: ARi,t = ri,t – E (ri,t | Xt) (1), where ARi,t, ri,t and E(ri,t | Xt) are abnormal, actual and estimated normal returns, respectively, for time step t.

Stock market returns are modelled through a one-factor market model: ri,t = ai + birm,t + ei,t (2), where ri,t , rm,t denote stock returns for bank i and the market portfolio m, respectively, ai and bi the parameters of the market model and ei,t the zero mean disturbance term. To proxy the market portfolio, Petrella and Resti (2013) is followed by using national stock market indices to ensure that residuals only include idiosyncratic effects. Coefficients a and b are estimated via an iteratively re-weighted least squares method to reduce the effect of extreme data points. The panel regression applied to the cumulative abnormal returns (CAR) is: CAR j,t = α + β1Yj,t + β2Xj,t + ηj,t (3), where Yj,t denotes the projected end-capital ratio under the adverse scenario, and Xj,t a vector of control variables containing the logarithm of banks’ total assets and the leverage ratio.

For the mean specification, our study expands the specification used in (1) by introducing a dummy variable St to control for abnormal stock return behaviour during the event window: ri,t = ai + birm,t + λ St + ei,t . For the volatility process hE,t it is assumed that bank stock prices can be modelled as the product between (latent) asset volatility and a leverage multiplier. To directly measure the effect of stress test announcements on stock price volatility, an extended version of the structural GARCH model is applied, through an interaction variable kt. The final equation used can be described as follows: E (ȓ2E,t | Ft-1) = kthE,t where kt = 1 + δSt, ȓE,t the demeaned return process and Ft the information set at t.

The sample of banks for each stress test is divided into: banks with a projected end-CET1 ratio above the 67th percentile of the distribution of banks as good performers; banks with a projected end-CET1 ratio below the 33rd percentile as bad performers; and banks with a projected end-CET1 ratio between the 33th and 67th percentiles as moderate performers.

A complex aspect when modelling return volatility is that actual realizations are not directly observable (Andersen and Benzoni, 2008). A common strategy to overcome this is to conduct inference through complex econometric procedures. A breakaway from this approach is to instead rely on realised variance.