Abstract

Household consumption recovery in Europe has not met expectations, despite falling interest rates and rising real wages. Instead, European households have increased their savings. This cautious behaviour may be due to factors like persistent uncertainty about the macroeconomic outlook and the lingering impact of recent high inflation on consumer sentiment. Additionally, the housing and financial wealth that European households accumulated during the pandemic has been largely eroded by high inflation and interest rates, dampening their consumption. Looking ahead, while falling rates may bolster the housing market, only a moderate increase in consumption can be expected, as headwinds from anticipated fiscal consolidation, slower employment and wage growth, and a decline in non-wage disposable income growth will weigh on household spending.

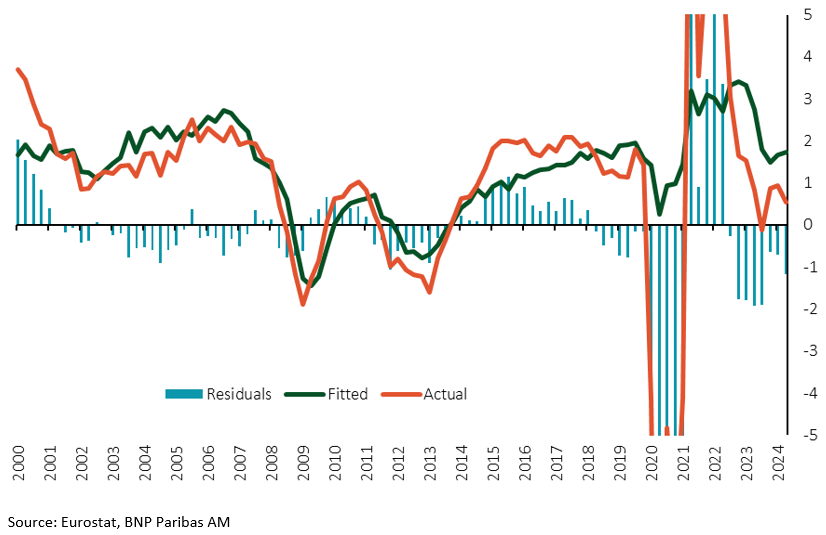

Despite declining inflation and a gradually improving macroeconomic outlook in Europe since 2023, the anticipated consumption rebound has not occurred. Since Q1 2022, real private consumption has grown modestly by 2.4%, while households have saved more, with the saving rate rising from 13.1% in Q2 2022 to 15.6% in Q2 2024. Although monetary policy easing and disinflation suggest a favourable environment for consumption, actual spending growth has lagged behind expectations. And indeed, if we try and predict consumption growth using a simple model that links consumption to gross disposable income, housing and financial wealth, and mortgage rates (based on data from 2000 to 2019), we get much stronger consumption dynamics than the ones we have observed over the last couple of years (Figure 1). As we discuss below, we think the saving rate may start inflecting again next year, gradually returning to its historical trend. We foresee a consumption recovery as well, although this will only take place at a gentle pace.

Figure 1. Euro area consumption growth (%y/y)

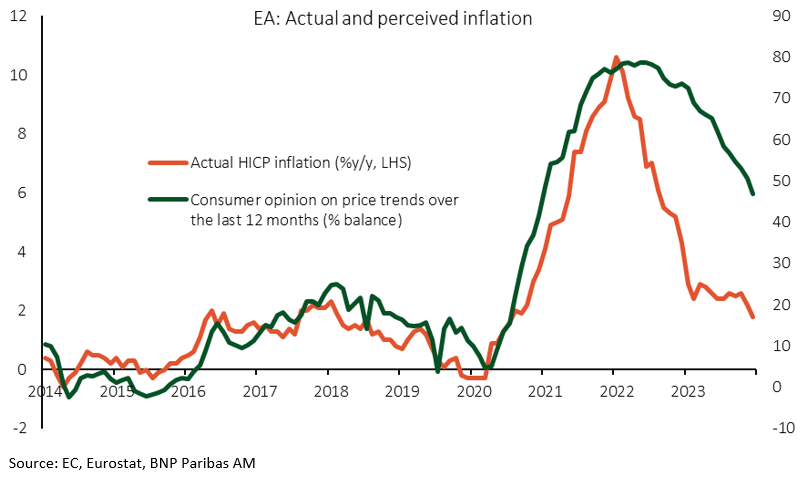

The sluggish outlook for consumption also aligns with consumer sentiment, which has improved since late 2022 but has not fully recovered from the adverse effects of the Russian invasion of Ukraine. A significant drag on consumer confidence, in particular, seems to be related to the assessment of the general economic outlook. This in turn could be driven by a variety of factors, such as: i) a negative view of the housing market, linked to the still restrictive level of interest rates, ii) elevated uncertainty over the macroeconomic and fiscal outlook and iii) a lingering negative perception of inflation. The latter factor can be clearly seen from a comparison of the consumers’ subjective assessment of past price trends against actual inflation, which suggests consumers still perceive inflation as being significantly higher than it actually is (Figure 2).

Figure 2. Euro area: Actual and perceived inflation

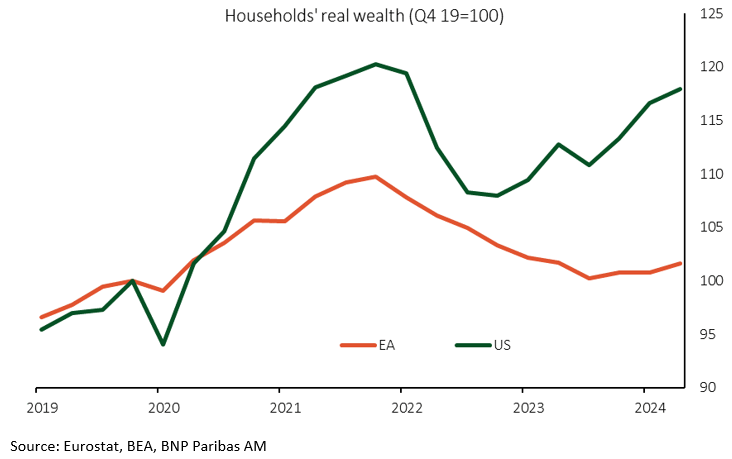

A further drag on consumption, especially compared to the US, is the erosion of European household wealth due to high inflation and restrictive monetary policy. As Figure 3 indicates, real wealth among European households has fallen back to pre-pandemic levels, reducing their propensity to spend compared to US households, whose wealth has once again increased recently due to the rise in home prices and the surge in value of their equity holdings. Although distributional data on wealth are not easily available, we suspect wealth erosion has been more pronounced among households in the lower half of the wealth distribution, which tend to be more indebted and hold more liquid assets than the median household.

Figure 3. Household wealth in real terms (Q4 2019=100)

While the sharp rise in interest rates since 2022 has caused a decline in housing prices and investment, a recovery in the housing market over the next few quarters seems likely. Historically, there is a negative correlation between housing market prospects and interest rates, and the current cycle seems to make no exception. And indeed, indicators like mortgage demand and house price inflation suggest an improved housing outlook.

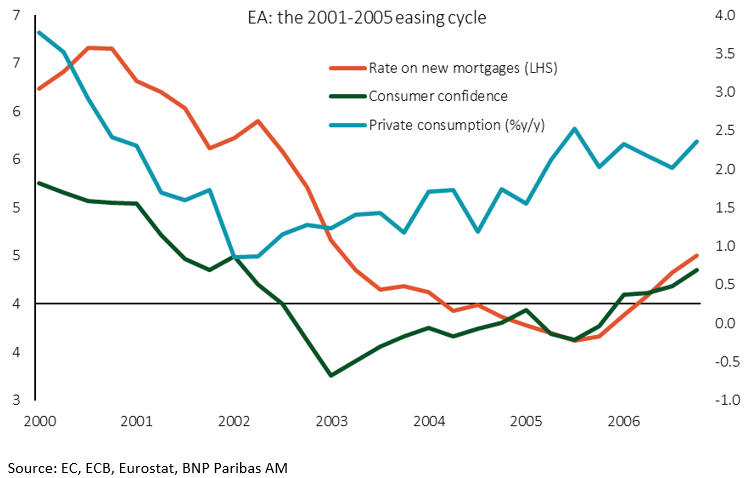

While a better outlook for the housing market is certainly positive for the whole economy, the implications for private consumption growth are not straightforward. On the one hand, one may argue that housing investment may crowd out private consumption with households saving more to invest in the housing market. On the other hand, the fall in interest rates may “lift all boats alike” via a positive income effect, pushing up both housing investment and private consumption in other goods and services. At the current juncture we tend to view the latter scenario as more plausible. This is also confirmed by historical experience. And indeed we think there may be similarities with the only soft landing episode we have available for the euro area, ie. the phase of policy easing that occurred in the early 2000s, when policy rates were gradually reduced from 4.25% to 2% over approximately two years. During that easing phase, both private consumption growth and consumer confidence gradually improved, although with a significant delay of 1-2 years (Figure 4). We think part of the reason for the slow pace of recovery in consumption should be attributed to the slowdown in disposable income growth that occurred at the same time. This was due to both a deceleration in wage compensation (largely through a fall in employment growth between 2000 and 2003) and a drag from net property income growth, which turned negative for four consecutive quarters, largely due to the stock market crash that occurred in Q4 2001.

Figure 4. The 2001-05 easing cycle

Looking ahead, we believe that consumption growth may resume but at a slow pace due to several headwinds. To start, most euro area economies are entering a phase of fiscal consolidation, with higher taxes and reduced subsidies, which generally leads to higher savings and slower disposable income growth. Studies (eg. Viren, 2024) indicate a negative propensity to consume out of higher taxes and lower fiscal transfers in Europe, suggesting tighter fiscal policies may hinder consumption. Additionally, nominal wages are expected to moderate due to declining inflation and flat labour productivity, while softening employment trends may further slow growth in the wage component of income. Finally, a further easing in monetary policy should reduce the non-wage component of household income, as interest income from deposits should drop, while mortgage costs may adjust to the lower rate environment only gradually.

Viren, Matti (2024). “Household saving and consumption in Europe continue to follow traditional patterns”, SUERF Policy Brief No 1000, October 2024