This policy brief explains the main findings of a recent paper that identifies two channels through which international diversification impacts global bank leverage. It includes the well-known risk channel and a new channel that focuses on exchange rate adjustments, namely the currency channel. By altering the distribution of returns on global bank portfolios, both channels affect banks’ tail risk, their fund-raising capacity and their leverage. Overall, the risk channel accentuates leverage procyclicality when international assets are most volatile, while the currency channel lowers the tail risk and boosts banks’ fund-raising capacity. Theoretical predictions are confirmed using French granular data during the GFC. Especially, the currency channel helped reduce banks’ leverage procyclicality during the GFC. Given the recent rise in U.S. rates and the dollar, the model may offer an interesting story in predicting the leverage adjustments of Eurozone banks.

The procyclicality of bank leverage has been the subject of keen interest, especially in the wake of the Global Financial Crisis (GFC). Following Geanakoplos (2009), Shin (2012) and Adrian and Shin (2014), leverage procyclicality refers to the cyclical variations of leverage according to the financial cycle. By extending their leverage during booms, banks strengthen the value of assets and create an endogenous mechanism similar to the financial accelerator (Danielson et al. (2012)). Through the presence of global banks, this implies an amplification of global financial booms and busts which is associated with a low and high level of risk, respectively (Adrian and Shin (2010,2014)). Overall, this common and procyclical behavior of global bank leverage is a major source of risk for both the financial and the real economy (Geanakoplos (2009)).

Although the procyclical pattern of leverage is well-known, the channels through which banks’ diversified and international exposures affect leverage procyclicality were not yet documented. If we focus on the international exposures of banks in the four largest countries in the Eurozone, 27% of cross-border assets are denominated in US dollars between 2019 and 2020 (source: Locational Banking Statistics from the BIS). This international exposure is not without consequences for the leverage procyclicality of global banks.

This policy brief explains the main findings of a recent paper of Pedrono (2022) that identifies two channels through which international diversification impacts global bank leverage. It includes the well-known risk channel and a new channel that focuses on exchange rate adjustments, namely the currency channel.

Based on a contract model à la Holmström and Tirole (1997) between the bank and its creditor with international assets and liabilities, Pedrono (2022) defines a Value-at-Risk (VaR) rule by considering the international portfolio of banks. The VaR rule implies that the probability of default of the bank – defined through the global portfolio return distribution – is constant over all states of the nature. To satisfy this rule, the bank and its creditor set the level of payoff and debt according to the state of nature. Assuming that the state of nature is reflected in the distribution of the portfolio return via a location parameter (i.e. the better the state of nature, the higher the location and the mean of the distribution), payoff, debt and leverage adjust to changes in this parameter and the associated risk environment. As returns increase with the improvement of the state of nature, the distribution of portfolio return shifts to the right and banks see their tail risk decrease. In order to maintain a stable probability of default, they exploit all their debt capacity and increase their leverage. On the other hand, during a downturn, asset yields and the value of collateral are compressed. Banks’ tail risk increases and banks reduce their leverage to keep their probability of default constant. Leverage is then procyclical through what is called the “risk channel”.

When banks have a diversified portfolio of assets, the bank’s portfolio returns will be defined by both domestic and international conditions: the distribution of portfolio returns is mixed and the procyclicality of leverage depends on the relative performance of assets. The higher (lower) the risk introduced by diversification, the lower (higher) the leverage to satisfy the VaR rule. It follows that the risk channel accentuates leverage procyclicality when the foreign economic condition is more volatile than the domestic one, that is when it outperforms the domestic economic condition during booms but falls behind it during busts.

International diversification introduces a second channel, namely the currency channel. The currency channel comes from the effect of exchange rate changes on the composition of the bank portfolio return (i.e. the valuation effect). Since international assets denominated in foreign currency are converted into domestic currency on the banks’ balance sheets, exchange rate adjustments affect the weight of domestic and international assets in the distribution of the banks’ portfolio returns. The impact of the currency channel on the tail risk of the portfolio return depends on the behavior of the foreign exchange rate.

Consistent with the stylized facts in the literature, the exchange rate is defined such that the currency with the higher interest rate typically appreciates. Therefore, the currency channel always promotes the asset that offers a better return in the portfolio. It directly changes the shape of the global portfolio return distribution by reducing its tail risk. For a given probability of default, banks see their fund-raising capacity boosted by the currency channel of international diversification.

Focusing on the Global Financial Crisis (GFC) that is associated to a negative foreign shock and a depreciation of the US dollar between end 2008 and end 2009, the model predicts that leverage procyclicality increases with diversification due to the risk channel but decreases with dollar depreciation due to the currency channel.

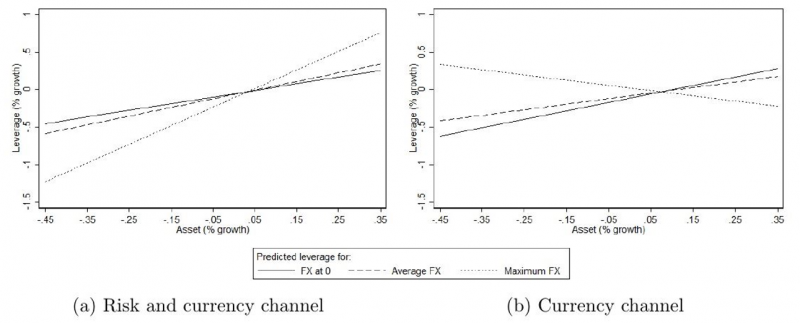

Using granular French banking data on this period, results confirm theoretical predictions. Figure 1) depicts the predicted leverage procyclicality conditional on international diversification levels. Panel (a) shows procyclicality for different levels of diversification considering simultaneously the risk and the currency channel. Procyclicality increases significantly with international diversification, suggesting that the risk channel dominates the currency channel. Panel (b) focuses on the currency channel of diversification and shows that procyclicality decreases with diversification, possibly leading to a counter-cyclical leverage for the highest level of diversification.

Figure 1: Predicted leverage procyclicality and international diversification

The slope of each line measures the procyclicality of leverage focusing on banks located in France during the GFC. Each line expresses leverage procyclicality for different levels of international diversification. Three levels of diversification are considered: a minimum diversification equal to 0 (continuous line); an average diversification equal to the average level of diversification observed in the data (dashed line); a maximum diversification equal to the highest level of diversification observed in the data (dotted line). Panel (a) considers simultaneously the risk and the currency channel while panel (b) focuses on the currency channel.

Additional findings point out that international diversification is relevant to the procyclicality of leverage, even if banks use hedging strategies, such as financial instruments related to foreign currency exposure or a perfect match between foreign currency assets and liabilities.

Given recent developments in U.S.-euro area interest rate differentials and exchange rates, the results of Pedrono (2022) can help draw some potential implications for euro area global bank leverage.

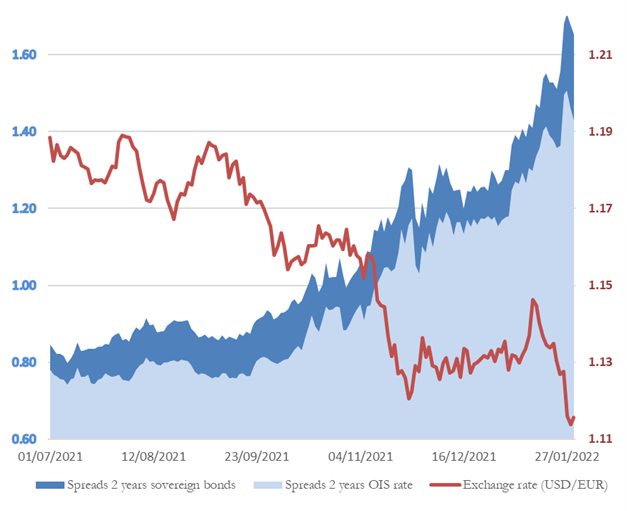

Between the summer of 2021 and the beginning of 2022, rates widened between the United States and the euro zone, whether for sovereign bonds (+0.81 points between 01/07/2021 and 31/01/2022) or risk-free rates (+0.65 points for OIS rates, see figure 2). This increase in spreads is explained by a generalized rise in short-term rates (less than two years) in the United States, while rates for the same period in the euro zone remain stable. At the same time, we have seen the dollar appreciate against the euro by 6% over the same period. The dollar is thus back to its pre-Covid-19 crisis level and the exchange rate behavior is, once again, consistent with the stylized facts in the literature.

Figure 2: US-Eurozone interest rate spreads and exchange rate developments

Sovereign spreads express the difference in rates between US bonds and the composite bond of the euro zone (calculated according to the relative size (GDP) of member countries). Source: Bloomberg, Banque de France calculations.

According to the theoretical predictions of the model, the rise in US rates – via the risk channel – shifts the distribution of portfolio returns to the right: the expected return increases and the tail risk of banks decreases. With a constant probability of default, banks see their debt capacity increase. Exploiting this leverage capacity would mean that the increase in US rates would be associated with an increase in bank leverage via the risk channel.

In the present case, where the rise in US rates is accompanied by an appreciation of the dollar, the weight of dollar-denominated assets increases at the expense of domestic assets: the currency channel favors the most profitable assets. The distribution of portfolio returns shifts further to the right and the tail risk decreases again. For a given probability of default, banks also see their debt capacity increase through the currency channel as well.

Consequently, the increase in spreads observed since the summer of 2021, combined with the appreciation of the dollar, could lead to a significant leverage effect for banks with a portfolio diversified between the United States and the euro zone, i.e. all the euro area banks identified as systemic financial institutions. These procyclical adjustments, reinforced by the currency channel, could be a source of financial instability, particularly in the event of an economic downturn.

The international dimension of banking activities associated with the Value-at-Risk rule offers a new framework for explaining the procyclicality of global bank leverage. The international diversification of balance sheets plays a key role by introducing both a currency and risk channel for banks. It underlines the specific role of international diversification in financial stability risk and economic stability. As not all foreign currencies and foreign economies are alike, Pedrono (2022) shows that the impact of international diversification differs according to which currency denomination is included. Therefore, policy recommendations need to be identified for international banking regarding the characteristics of foreign exchange rates and relative economic and financial performances.

Adrian and Shin (2010), Liquidity and leverage, Journal of Financial Intermediation, 19, 418-437.

Adrian and Shin (2014), Procyclical leverage and Value-at-Risk. Review of Financial Studies, 27, 373-403.

Geanakoplos (2009), The leverage cycle, NBER Macroeconomics Annual, 24, 1-66.

Holmström and Tirole (1997), Financial intermediation, loanable funds, and the real sector. Quarterly Journal of Economics, 112, 663-691.

Pedrono (2022), The currency channel of the global bank leverage cycle, Journal of International Money and Finance, forthcoming.

Shin (2012), Global banking glut and loan risk premium. IMF Economic Review, 60, 155-192.

|

About the author Justine Pedrono is a senior research economist at the Banque de France. Her research covers banking and international macroeconomics. She holds a Ph.D in economics from the Aix-Marseille School of Economics (AMSE). justine.pedrono@banque-france.fr |

The views expressed here are those of the author and do not represent those of the Banque de France.