This Policy Brief is based on Narodna banka Slovenska, Policy Brief 16/2024. We thank for fruitful discussion with and suggestions from Michal Horvath, Jan Beka, Miroslav Gavura, Milan Gylanik, Michal Marenak, Viera Mrazikova , Paverl Gertler, and Slizik Andrej. The views expressed in this brief are those of the authors and do not necessarily represent those of Narodna banka Slovenska, Deutsche Bundesbank or the Eurosystem. All errors and omissions remain the authors’ responsibility.

Using data from household bank transactions spanning 2019 to 2022, we assess the extent to which dynamics of cash in circulation are influenced by traditional shadow economy indicators, as opposed to a preference for cash-based consumption. Our empirical findings strongly confirm the existence of an informal, cash-based economy in Slovakia, driven by production activities not included in the national accounts, as much as by occasional work phenomena.

How much any economy is running on physical cash has always been a concern for policymakers. Traditional monetary policy measures tend to be dampened in their effectiveness whenever a significant portion of economic activity is cash-based. Moreover, the part of an economy that relies entirely on cash transactions is more anonymous in its dynamics and less measurable by conventional methods, hence the term shadow economy.

The shadow economy is hardly a monolithic phenomenon and giving an exact definition has proven to be challenging. The abundant literature (see Schneider and Enste 2000; Lalouette and Esselink 2018) on the topic is somewhat helpful in broadly identifying shadow activities by some of their key features: (a) tax evasion by eluding either general fiscal obligations or specific public services fees; (b) avoidance of regulatory requirements; (c) failure to be captured by statistical reporting and accounting; (d) illegal nature per se. The shadow region of the economy is then composed by legal transactions (small exchanges of goods and services among private individuals) that go un-registered, illegal activities (such as drug and sex trafficking, and trading in stolen goods), and intermediate cases (such as undeclared income from legal activities). Perfectly disentangling these components is usually not feasible due to the inherently obscure nature of the shadow economy.

We use a novel detailed database of cash withdrawals in Slovakia to investigate how much of the cash withdrawals can be attributed to shadow economy activities. We focus on household bank transactions from 2019 to 2022 to assess whether they are driven by a preference for cash payments or by traditional indicators of the shadow economy widely used in the literature (Bartzsch, Schneider, and Uhl 2019; Deutsche Bundesbank 2019; Avouyi-Dovi et al. 2023).

We find that part of the cash demand can indeed be explained by shadow economy metrics, proxying both unmeasured economic activity, and cash paid informal work phenomena.

Our focus is on standard measures of the shadow economy while controlling for other factors that would commonly explain the volume of cash withdrawals. To better understand what drives cash withdrawals in Slovakia, albeit with a limited sample length, we resort to a somewhat naïve approach, and set up a linear regression. When identifying meaningful predictors, we heavily draw from established literature. Our baseline econometric specification incorporates proxies for economic activity, as well as indicators traditionally used to capture the development and dynamics of the shadow economy.

![]()

Where w stands for cash withdrawals aggregated to monthly frequency1, and ts and tr represent the turnover in services and retail, respectively, as proxies of consumer side economic activity. Following (Kaufmann and Kaliberda, 1996; Eilat and Zinnes, 2002), we define as wedge the difference between the growth rates of electricity consumption and industrial production, a long-time known proxy for the unaccounted production activities that are not captured by traditional national accounting. Although it is computed using data on production, the proxy provides an indication of the size and development of (at least some parts of) the shadow economy, based on the understanding that a larger phenomenon simply attracts more money. In the spirit of (Ardizzi et al., 2014; Herwartz, Sardà and Theilen, 2016) we pay special attention to the construction sector, which we capture using both the evolution of the current overall order books, ob, and the labour input in construction, lc, and to the unemployment rate, denoted as u. All the predictors except the wedge are taken in log-differences; due to the use of different units of measure, we standardize all variables. We also extend our specification distinguishing between male and female unemployment and including the growth of self-employed on the labour market. We also include pandemic controls2, given that the most part of our sample spans through pandemic years.

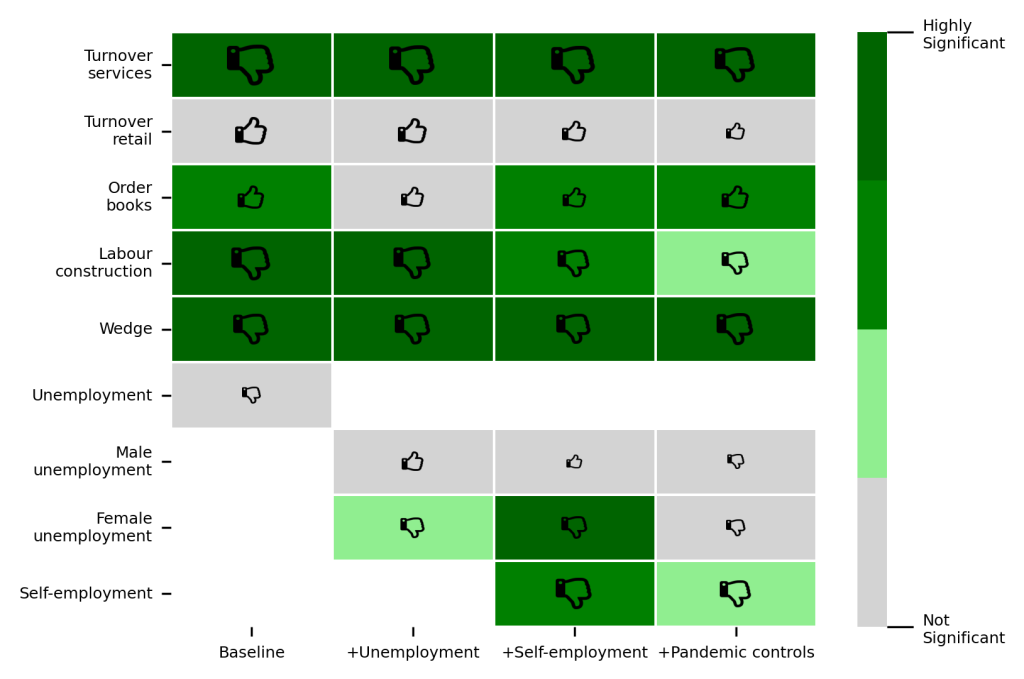

Estimates illustrated in Figure 1 clearly suggest that shadow economy phenomena can help explain cash withdrawals in our sample, albeit with some nuanced dynamics. Unsurprisingly, the regression results clearly indicate that services, rather than goods, are more often paid for in cash. The strongly significant positive coefficient of the wedge signals that a significant contribution to the demand of physical cash stems from undetected economy activities. In line with the literature, the construction sector and the self-employment are particularly prone to cash-based informal work phenomena. Augmenting the specification with male and female unemployment yields valuable insight on how occasional, cash-paid work in response to unemployment spells is distributed between genders. Adding pandemic control leaves the main message unchanged and strengthens the merit of our general conclusions. However, the significance of the labour-related variables becomes slightly less neat. This is not unexpected, given that the shock identification tends to be dominated by the pandemic-induced rise in unemployment, which is then captured by the pandemic controls.

Examining the period between 2019 and 2022, our estimation strongly suggests that metrics traditionally associated to shadow economy activities and exchanges are statistically significant in explaining the value of cash withdrawals. The evidence we provide supports the hypothesis of continued existence of a shadow economy in Slovakia. This is in line with findings for other economies. Although shadow economy phenomena are estimated to be declining across Europe, they remain substantial in size (Kelmanson et al. 2019).

Figure 1 – Determinants of cash withdrawals

Source: Authors calculations

Note: The direction of the thumb indicates the sign of the coefficient, while its size reflects the magnitude.

Ardizzi, Guerino, Carmelo Petraglia, Massimiliano Piacenza, Friedrich Schneider, and Gilberto Turati. 2014. “Money Laundering as a Crime in the Financial Sector: A New Approach to Quantitative Assessment, with an Application to Italy.” Journal of Money, Credit, and Banking 46 (8): 1555–90.

Avouyi-Dovi, Sanvi, Lorraine Chouteau, Lucas Devigne, and Emmanuelle Politronacci. 2023. “Shadow Economy: What Factors Matter in the French Case?” Working Papers.

Bartzsch, Nikolaus, Friedrich Schneider, and Matthias Uhl. 2019. Cash Use in Germany – Macroeconomic Estimates of the Extent of Illicit Cash Use in Germany. Deutsche Bundesbank.

Beckmann, Elisabeth, and Alejandro Zamora-Pérez. 2023. “The Impact of War: Extreme Demand for Euro Cash in the Wake of Russia’s Invasion of Ukraine.” In The International Role of the Euro, edited by European Central Bank, 37–40.

Deutsche Bundesbank. 2019. “Monthly Report – March 2019.” Vol. 71, No 3. Deutsche Bundesbank.

Eilat, Yair, and Clifford Zinnes. 2002. “The Shadow Economy in Transition Countries: Friend or Foe? A Policy Perspective.” World Development 30 (7): 1233–54.

Herwartz, Helmut, Jordi Sardà, and Bernd Theilen. 2016. “Money Demand and the Shadow Economy: Empirical Evidence from OECD Countries.” Empirical Economics 50 (4): 1627–45.

Kaufmann, Daniel, and Aleksander Kaliberda. 1996. “Integrating the Unofficial Economy into the Dynamics of Post-Socialist Economies: A Framework of Analysis and Evidence.” Policy Research Working Paper Series, December.

Kelmanson, Ben, Koralai Kirabaeva, Leandro Medina, Borislava Mircheva, and Jason Weiss. 2019. “Explaining the Shadow Economy in Europe: Size, Causes and Policy Options.” IMF Working Papers, December.

Lalouette, Laure, and Henk Esselink. 2018. “Trends and Developments in the Use of Euro Cash over the Past Ten Years.” Economic Bulletin Articles 6.

Schneider, Friedrich, and Dominik H. Enste. 2000. “Shadow Economies: Size, Causes, and Consequences.” Journal of Economic Literature 38 (1): 77–114.

A reasonable concern regards the influx of Ukrainian refugees following the start of the Russian invasion in February 2022 (Beckmann and Zamora-Pérez 2023). Since our sample include only a portion of bank accounts opened in Slovak banks, we are immune by this potential source of distortion. However, we are unable to distinguish which account holders are foreign citizens or determine their nationality.

We control for the number of new cases and deaths to capture the need of restrictive measures, as well as the potential decline in social interactions due to health concerns and the fear of infection. We are aware that lockdowns and restrictions were deployed on a regional basis; however, we choose to only include a national aggregate, since all our explanatory variables are observed at a country level.