This text is a summary of the speech that had to be delivered in the CLAB/CLACE Conference organized by FELABAN and ABA in Punta Cana, Dominican Republic, 19 Sep 2022. The hurricane Fiona mada landfall 10 km from the Conference site the previous night, provoking the closing of the venue and the postponement of the event.

During the last decade banks have been subject to severe shocks: the new regulatory paradigm resulting from the GFC, the digital revolution, the fight against climate change initiatives, a low interest rate environment that eroded profitability and, finally, two external shocks (Covid 19 lockdowns and the Russian invasion of Ukraine). Among these, the digital revolution in isolation poses an existential threat for the banks. Although technology has been at the core of the banking industry since the 1950s, and banks know how to incorporate it in their business, the contours of the financial system are changing, with new competitors and products. Among these changes, those related to the competition posed by bigtechs, the emerging cyber risks and the challenge CBDCs represent for deposits seem to display a greater potential for disruption.

The last decade has been quite unique for the banking industry, hit by a series of shockwaves: the finalization and roll out of a new regulatory paradigm (much tougher than the pre-GFC one), the acceleration of the digital revolution, the ESG revolution, a low/negative interest rate environment (now finally coming to an end), and two exogenous shocks of a colossal magnitude, the Covid 19 pandemic and lockdowns, and the invasion by Russia of Ukraine. In the next pages we will concentrate on just one of these shocks, namely the digital revolution.

It may well be viewed as naïve to devote a few lines to reflect upon the nature of banks´ business: after all, banks have been present for centuries. But the very precise nature of banks´ business is overlooked by the informed media and in political circles. If society has a benign neglect towards a future financial system without banks, it is advisable to understand what role do banks play before they are written off.

A bank is a deposit taking institution and this justifies most of the tough regulations that banks are subject to: banks are being financed by a special type of creditors, the depositors, that deserve a special protection. A bank also embarks in maturity transformation. Banks can embark in maturity transformation thanks to their risk management capacities. Well before the advent of risk modelling through quantitative methods, banks have been able to close the gap of asymmetrical information from depositors to creditors (between deposits and loan demand).1

But the most relevant social function of banks relates to their role in financing SMEs. Due to their small size and relative lack of sophistication in terms of accountancy (lack of audited accounts, etc.), SMEs cannot be financed through financial markets and their sole option is bank finance. Given that SMEs constitute the backbone of any economy (due to their role in employment creation), banks are a key, an indispensable financial institution due to their role in financing SMEs.

Banks are also technological companies. Since the start of the IT revolution in the 1950s, banks have been at the forefront, as avid consumers of a new technology that allows them to deepen their business (increase the client base) in a cheaper and safer way. In other words, you cannot run a bank today without a very strong technological base. Banks do know how to deal with technology, how to embed new technologies into old business in a successful way.

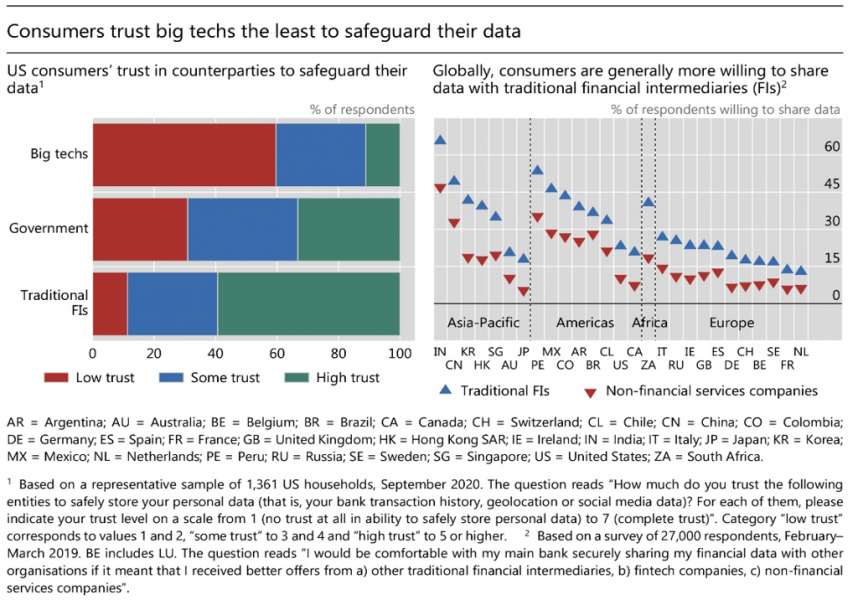

But the crucial, key element of any bank is trust: without the trust of its clients, any bank would only last a fortnight (and maybe just a night!). Sometimes people confuse trust with reputation, but they are independent. Clients, or society as a whole, may not love or like banks, but they trust them as smooth operators. The next graph, taken from a BIS publication, summarizes this. It refers to trust in preserving data of clients, but it may well be extended to other fields.

The technical transformation of society has been present not just since the industrial revolution, but simply since the start of humankind. Technology, as much as language and cultural traits, sets apart humans and the rest of species. But we cannot deny that in the last decades we have seen an acceleration of the transformation not only of economic systems, but also of societies, provoked by the Information Technology revolution and the emergence of the world wide web.

The IT revolution brings about a world of zero marginal cost for onboarding a new client. This represents not just a very powerful tool of transformation of sectors, but also some darker issues such as the emergence of a world of increasing returns to scale and the prevalence of concentration and consolidation forces.

The disruption created also provokes the blurring of frontiers among countries, among sectors and among products. It enables a universal provision of services, but at the same time makes the traditional control of economic activities, based on physical presence in each jurisdiction, extremely hard.2 For national competent authorities (competition, consumer protection or financial stability authorities), the provision of services without a physical presence limits their enforcement capacities.

The IT revolution is also eliminating the differences across sectors in the field of services: financial companies are now technological companies, and non-financial companies are becoming financial companies (bigtechs, telecoms, etc).

The role of technology in banks is shifting from a mere enabler of business to being at the core. The emergence of the smartphone enables deepening financial inclusion at zero marginal and constitutes today the predominant channel to provide basic retail banking services, both due to demand (clients have a cheap, immediate, and safer access to basic services in a 24/7 environment) and supply considerations (banks can automate retail banking processes, which is cheaper and safer).

Technology also supports better risk management thanks to the exploitation of data. Ex ante, risk selection through data lakes using multiple (thousands in fact) parameters limits the risk of adverse selection of clients. Ex post, risk aggregation and risk controls also allow for a sounder management in aspects such as pricing of risks and capital management (i.e., where to deploy scarce capital resources).

For banks, given the fierce competition they face, improving efficiency and profitability (banks can maintain margins but with a lower cost base) is of the essence. The sole caveat comes from the challenges of running hybrid systems, part analog and part digital. Mixing online banking and retail banking through branches and personnel may well be both more expensive and more dangerous from a risk perspective. Once you become digital, branches and employees should play a different, more subsidiary role.

The new technological paradigm creates enormous incentives for the creation of new players and new financial instruments.

Despite the early interest in the potential disruption fintechs would bring, they may have been “the dog that barks but does not bite”. In the space a few years, fintechs have gone from craving to replace banks to desiring to be bought by a bank. If a bank acquires a fintech, the viability of the business is instantly guaranteed (the “volume of clients” challenge disappears instantly). Fintechs display a very high mortality rate due to the fierce competition, and banks have discovered that the cheapest and better way to escape from rigid legacy IT platforms is buying fintechs apps. Regarding 100% digital neobanks, the challenges are similar to those of fintechs, with an added element: they have to comply with costly regulations affecting banks (all the challenges of being a fintech, combined with the challenges of being a chartered bank).

Bigtechs are a totally different “animal”3 and they are increasingly active in the field of finance. According to Agustin Carstens and the BIS, in 2018 already 15% of the revenues of bigtechs came from the provision of financial services. Their global scale and their cross sectoral presence means their monitoring and supervision (including the regulation of some of its activities) is extremely difficult, in particular (but not exclusively) for emerging markets.

The main problem for banks is not just the potential technical superiority of fintechs and bigtechs, but also the asymmetry of regulation. Incumbents do face a stricter regulation and confront a more intrusive and effective supervision than challengers, being this the result of the prevalence of entity-based regulation and supervision versus activity-based regulation and supervision.

Despite authorities and supervisors being far more sensitive to this issue, the practical solution remains elusive:

Another element that is usually ignored but that contributes greatly to that unlevel playing field caused by regulation and supervision is that of compliance. Rules and regulations per se do not create any impact: the effects come from its supervision, from compliance mechanisms that guarantee that the rules are effectively enforced. Here the black box business model of most bigtechs, the universal provision of services that any fintech delivers combined with a very narrow activity, and the weakness of consumer protection enforcement outside the financial sector imply that even well intended and soundly designed regulations become wastepaper in the absence of sufficient means to ensure their compliance. In short, effective compliance mechanism is what makes the difference, and not just regulations.

The digital revolution (the blockchain technology) has also sparked innovations on the forms that money may take. For sure, the concept of digital money is not new: banks´ clients have been able to mobilize their money in a digital format since decades ago, by means of credit cards.4 But the deposit base is critical for any bank, and any menace there is potentially life threatening.

Of the three new forms of money, cryptocurrencies, stablecoins and CBDCs, only the last ones may threat the deposit base5. In the case of stable coins, only the sounder versions may be tricky: when they are backed one by one by safe and liquid assets, and they are based on a strong currency (like the dollar), they could become a formidable competitor for the deposit base in emerging countries. The demise of Libra/Diem has given a temporary respite, but probably not a definitive one.

But it is the CBDC the most critical innovation for banks. In Spanish there is a saying that goes like this: ”the road to hell is tiled with good intentions” (“el camino al infierno está pavimentado con buenas intenciones”). The development of CBDCs may well fit into this area: CBDCs are a natural response of central banks to developments in the new digital realm. At the same time, CBDCs, if ill designed or if they evolve in unexpected ways, represent an existential menace for banks. They may constitute a too strong competitor for banks deposits (the core of banks´ business).

To sum up, the true challenge for banks is the competition with bank deposits that the CBDC represents. For emerging markets, the combination of stablecoins in a hard currency (dollar based) and local CBDCs may become an enormous threat to their deposit base.

Bank clients never have had access to wider, cheaper, better, faster services: digital banking allows for a truly 24/7 provision of services. But the intolerance to failure is growing fast as well. This paradox, quality of service being the highest in history whilst frustration of clients being also on historical maximum, must be taken into account by banks in this new digital environment. If banks do not react fast to problems in the digital realm, things can spiral out of control very fast and create devastating reputational damages.

Another dark side of this new digital realm is called cyber risk. How long may a bank survive if the clients cannot access, due to a cyberattack, to their accounts? One day? One week? One month? Or in a more extreme and unlikely scenario, what would happen if a bank loses all the data of their clients?

Cyber risk has a dual nature. On the one hand, it is a daily risk with limited impact, with daily cyberattacks and repeal of these through firewalls and countermeasures. On the other hand, extreme cyberattacks of serious consequences are a low probability, high impact event. Banks must have sound defenses and they should never fall in the trap of cutting back investment in this area: in the short run nothing happens, until an accident occurs and then it is too late. A final consideration on cyber is its system wide impact: any banking sector will only be as resilient as its weakest link. Here, supervisors should push banks to ensure that the system as a whole is resilient.

An economic sector that displays increasing returns to scale is one where marginal cost are below average cost and costs go down as volume of production increases. The digital world displays this characteristic in an extreme way: not only marginal cost is below average cost, it is zero.

This creates a strong incentive to size and concentration. Bigger banks will have a competitive advantage towards smaller banks, bigtechs will have a competitive advantage versus big banks. This generates enormous challenges in areas such as competition and financial stability.

Whilst technology is making the world more global (making it flat, mainly through internet accessibility), the world is also becoming more unpredictable and parochial by the minute.

We live in a world of “unknown unknowns”, of exogenous shocks orthogonal to the functioning of the economy or the financial system (for instance, Covid 19 and the invasion of Ukraine by Russia) that are impossible to predict. And measuring their impact once they occur is also difficult. Finally, these shocks may well be pretty asymmetric across countries, increasing the tension of reaching a consensus of what to do in the face of these challenges. The international cooperation system we have put in place in the last 30 years6 is being challenged and becoming less relevant in this polarized world. Just when the challenges we face are truly global7 and international cooperation is more needed to solve the trials faced by human kind, it is becoming elusive by the minute.

For banks, the trend towards parochialism represents an additional challenge. In the end, parochialism leads to populism, and the history of populism is closely linked to political attacks towards the banking sector.

The digital revolution is transforming the world, blurring frontiers across countries, across sectors and across products. In particular, the revolution in the financial system has profound implications and represents a threat to incumbents, in particular to banks. But it also offers formidable opportunities for banks, especially in the retail area and in emerging markets. Despite the caricatures of the Mass media, banks enjoy a huge advantage: banks may not be loved, or admired, but they are trusted by clients. Banks need to use that lever of trust to transform the challenges into opportunities. In the end, technology has always helped banks to improve. This time does not need to be different.

In the old days of banking the characteristics of the client asking for financing (the soundness of the business proposals, but also, as John Pierpont Morgan used to stress, his/her character) were ascertained through personal knowledge coming from long term business relationships between banks and their clients. Later on, the emergence of large-scale data processing has allowed for an automatization of processes for most small clients.

From the extraterritorial impact of public policies of some countries, we have gone to the extraterritorial impact of private activities.

The size (measured by their market cap as of first August 2022) of the so-called GAFAM is just jaw-dropping: Apple 2.5 trillion dollars, Microsoft 2 trillion dollars, Alphabet-Google 1.5 trillion dollars (close to Spanish GDP in 21, 1.4 trillion dollars), Amazon 1.3 trillion dollars and Facebook-Meta “only” 435 billion dollars versus 333 billion dollars for the most valuable bank in the world, JP Morgan, and 57 billion dollars of BNP Paribas (the bank with the highest market cap of the eurozone).

We may wonder whether the new forms of digital money are a solution in search of a problem!

Considering the three characteristics of money, unit of account, deposit of value and means of payment, only the stablecoins and CBDCs have the three of them.

The IMF and the World Bank are much older, but they have been invigorated and supported by the Financial Stability Board, by the G20, etc.

The fight against climate change but also the consequences of and challenges posed by the digital revolution.