Abstract

This policy brief analyzes the macroeconomic consequences of a potential increase in US import tariffs under the Trump presidency, using the Oxford Economic Model. The scenarios considered include a 60% tariff on Chinese imports to the US, a 10% tariff on all other trading partners, alongside retaliatory measures from affected countries.1 Moreover, we simulate a 25% tariff on imports from Canada and Mexico (and retaliation) in a separate scenario. The findings suggest that broad-based tariffs would significantly dampen US and euro area (EA) GDP growth, with US growth contracting by up to 1.2 percentage points (ppt) in 2025 and EA growth declining by 0.3 ppt by 2026. Inflationary effects are mixed, with US inflation rising by nearly 0.8 ppt due to higher import costs, while EA inflation could remain subdued due to weaker demand. Additional tariffs on Canada and Mexico would further exacerbate the downturn, as well as retaliatory tariffs, compounding negative effects on trade and economic growth. Our analysis underscores the risks of escalating trade barriers and highlights the need for careful policy consideration to mitigate economic disruption.

US-president Trump has articulated many economic policy proposals with a significant emphasis on trade protectionism and the implementation of tariffs. His proposal included the introduction of tariffs, ranging from 10% on all imports to 100% for countries that no longer want to use the US-dollar as their trading currency. This policy aims at putting pressure on trade partners and to protect domestic industries by making foreign goods more expensive, thereby encouraging consumers to buy American products, reduce trade deficits, and bring manufacturing jobs back to the US. Aside from the fact that it is questionable whether such trade policy would have the desired effect on the US domestic industry and trade balance, it would also have far-reaching implications for global trade, potentially disrupting international supply chains and provoking retaliatory tariffs from other nations.

In this policy brief, we use a large macro model of the global economy developed by Oxford Economics to assess the implications of these import tariffs for US and EA growth and inflation developments. In particular, we stick to the most prominent proposal of a straight 10% tariff on all trading partners, with the exception of China on which a 60% tariff is levied. We also assume that all countries affected by the tariffs in turn raise retaliatory tariffs to the same extent. So, e.g., a 10% tariff is levied on all imports form the EU which retaliates by raising a tariff of 10% on US-imports. In addition, we separately illustrate the results of Trump’s proposal to raise a 25% tariff on imports from Canada and Mexico.

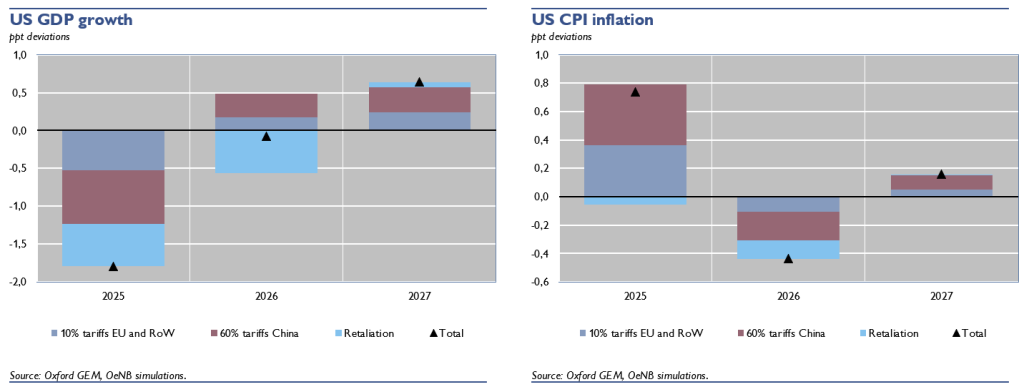

Figure 1 shows the effects of 10% tariffs on imports from all US trading partners and 60% tariffs on imports from China for the US-economy over the next three years (in deviation from a baseline scenario in which tariffs remain unchanged as they were at the end of 2024). The imposition of US-tariffs has an immediate negative effect for the US-economy, even without retaliation. The model predicts that in 2025 the imposition of US-tariffs lowers GDP growth by more than one percentage point (ppt) in 2025 and raises CPI inflation by almost 0.8ppt.

Raising tariffs makes imports more expensive which directly affects inflation. However, part of this effect could be compensated by foreign exporters charging lower prices. To what extent this happens depends on competitive conditions in export markets, but a full absorption is very unlikely. At the same time, demand is shifted from imports to domestic products, which allows US-firms to charge higher prices.

Figure 1. Effects of broad-based tariffs on the US

US GDP is lowered due to weaker sentiment and lower exports, following an appreciation of the US-dollar that makes US-exports more expensive.2 The effects are relatively short-lived allowing growth to rebound in 2026 and 2027. Note, however, that the rebound in 2026 and 2027 does not fully compensate for the drop in 2025, so that the level of GDP in 2027 is still below the baseline.

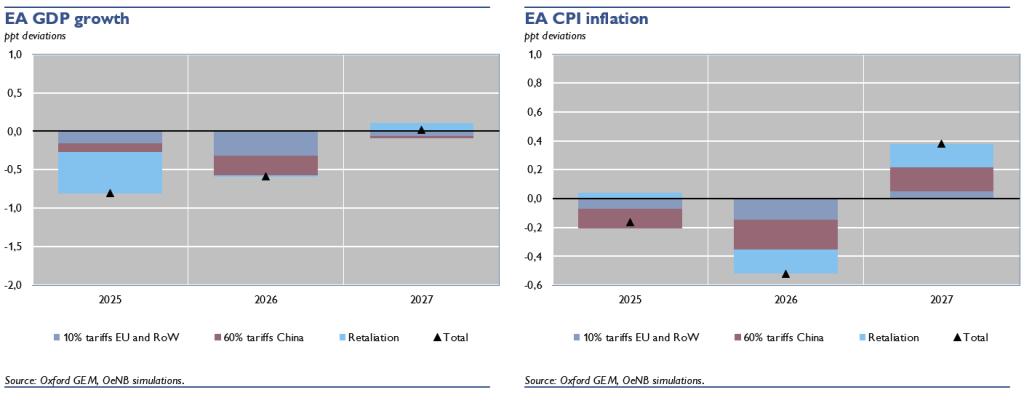

Assumed retaliation by trading partners makes the effects only worse. It knocks off a further 0.5 ppt of US growth in both 2025 and 2026. In this case the exchange rate is reacting less,3 but demand for US-exports is directly hit by tariffs from all its trading partners. Due to the further decrease in economic activity, inflation is lowered a bit in this scenario.4 Figure 2 illustrates the implications of the same scenarios for the EA. The US-tariff lowers GDP growth also for the EA economy. However, the effect is much weaker initially, but more persistent, with an even bigger downturn in 2026 following the one in 2025, since the European economy is more open than the US economy, and also affected indirectly via the negative effects of US-tariffs on its trading partners. E.g., the 60% US-tariff on China leads to a strong reduction in GDP growth there which also implies lower demand for European exports to China.

The global downturn in GDP growth reduces the demand for crude oil leading to a short-lived reduction in the oil price of more than 10%. This, along with the reduction in European GDP growth, has a small dampening effect on EA-inflation both in 2025 and 2026.

Retaliation from the EA makes the downturn in GDP growth only worse reducing it by an additional 0.5 ppt. This also has a slight positive effect on EA-inflation in 2025 through higher import prices.

Figure 2. Effects of broad-based tariffs on the EA

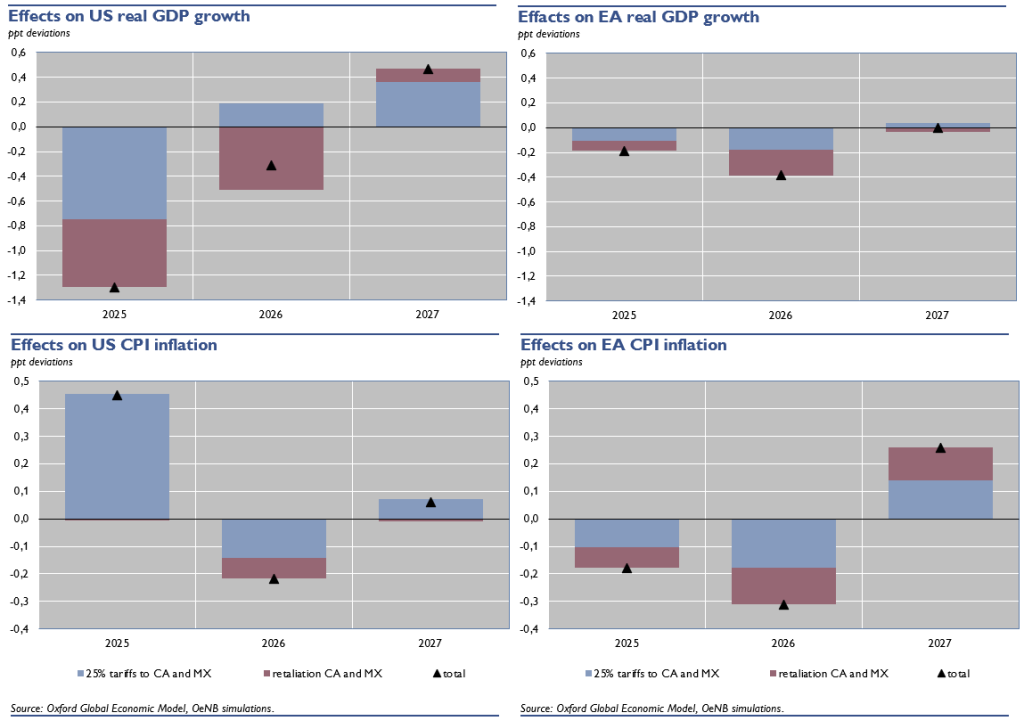

Illustrating another proposal of Trump that was reiterated recently we present the results of a scenario where 25% tariffs on imports from Canada and Mexico are raised. We also assume that Canada and Mexico retaliate with tariffs of the same amount. The chart below shows the effect of 25% tariffs on Canada and Mexico’s imports in light blue and the effects including their full retaliation in red. US GDP growth in this scenario would decrease by almost 0.8ppt in 2025 in case of no-retaliation and by additional 0.5ppt with retaliation, summing to a total 1.3ppt loss on growth compared to the baseline. US inflation would increase by about 0.5ppt in 2025 compared to the baseline and decrease in 2026 by 0.2 ppt. While the effect of retaliation on inflation in 2025 would be negligible, in 2026 it would contribute to dampening inflation compared to a scenario without tariffs.

The effects of US tariffs on Canadian and Mexican imports (and respective retaliation) on EA growth amount to approximately half of the effect of the scenario in which the US applied 10% tariffs to all trading partners’ imports (including Europe) and 60% on imports from China including retaliation. Nevertheless, the effect on inflation in 2025 is similar to the previous scenario. The fact that tariffs affect more strongly two of the largest oil and gas producers (US and Canada), is possibly contributing to this effect on inflation in 2025. In 2026 and 2027, the effects on inflation are by 0.2 ppt smaller than in the previous scenario.

Figure 3. Effects of tariffs on Canada and Mexico on the US and EA

While it is unclear which trade policies will be effectively implemented, our analysis highlights the significant economic risks associated with the imposition of broad-based import tariffs and targeted tariffs on key trading partners. The ensuing contraction in GDP growth for both the US and the EA, coupled with inflationary pressures in the US, underscores the potential for substantial economic disruption. The retaliatory measures from affected countries would further amplify these negative impacts.

At the time of writing, this was the most likely scenario.

The real effective exchange rate appreciates initially by 1.5ppt and by 2.5ppt by the beginning of 2027.

The real effective exchange rate appreciates initially by 0.9ppt, followed by a short depreciation and is generally more volatile in this scenario.

There is a risk of an escalating trade war, in which both parties keep on raising tariffs in a tit-for-that manner. How this would play out is impossible to predict and thus not part of this analysis.