This policy brief is based on RaboResearch | The economic returns on defense R&D | 15-01-2025.

Abstract

The re-election of President Trump has accelerated Europe’s impulse to rearm as the world returns to a ‘Grand Macro Strategy’ requiring states to possess military strength. We underline the importance of defense R&D expenditure in long-run productivity growth. We estimate that a 1% increase in defense R&D spending increases productivity by 0.06% to 0.1%. This is lower than the effect found for non-defense R&D. However, given the low levels of defense R&D spending compared to civilian R&D activities in most countries, a 1% increase in defense R&D generally encompasses a much smaller investment than a 1% increase in non-defense R&D. If we calculate the additional GDP generated due to the increased productivity and set this off against the investment value, the effective ‘bang for the buck’ on defense R&D is between $8.1 and $9.4. By comparison, for non-defense R&D it is $1.5 to $1.7. This hypothesis has further geopolitical and geoeconomic implications.

“The society that separates its scholars from its warriors will have its thinking done by cowards and its fighting by fools.” Thucydides

War in Ukraine and the Middle East, the de facto closure of the Suez Canal, and alleged grey-zone attacks on EU infrastructure have all pushed defense up Europe’s policy priority list. On 5 March 2024, the European Commission approved a Joint Communication aimed at bolstering the European arms industry; on 16 April, former ECB President and Italian Prime Minister Draghi gave a speech calling for “radical change”, including the development of a hugely scaled-up, integrated European defense system; and on 25 April French President Macron’s Sorbonne speech underlined that Europe can no longer rely solely on US military protection in the face of existential external threats, and that: “…today, our Europe is mortal. It can die. It can die, and it all depends on our choices.”

The re-election of President Trump has accelerated this impulse. Trump’s claim that Canada, the Panama Canal, and Greenland should all come under US control underline that, as we had predicted, the world has returned to ‘Grand Macro Strategy’ of economic statecraft over economic policy, requiring states to possess economic, political, and military strength. Trump is also insisting NATO members commit to spending 5% of GDP on defense at a time when many are failing to even reach the committed 2% level: the implied US threat is that without this burden sharing, it may walk away from its NATO commitments. Suggestions are therefore of trillions of euros being required for defense over the next decade to bring shriveled European militaries back in line with the force levels that prevailed during the last Cold War.

We will address the potential direct economic boost to the European economy from much higher defense spending in a future report. However, this study will focus specifically on the part of such spending which could hypothetically generate long-term positive spillovers to the broader civilian domain: defense R&D.

Despite some naysayers, there is academic recognition that defense spending can have a stimulatory effect on GDP. However, there is less –modern– economic acceptance of the clear historical pattern: that the military is a vital conduit for innovation that flows on to the civilian economy.

Taking a historical view, however, the relationship is clear: war and innovation have always gone hand-in-hand. Thucydides was adamant scholars and warriors need to work together. Arrighi (2007), drawing from McNeill (1982), notes Marx argued ancient armies first developed the wage system, the division of labor, the first use of machinery on a large scale, and that “the commercialization of war and an incessant armament race have characterized the Western path of capitalist development from its earliest beginnings.” He notes the Crimean War (1854-56) as a turning point in transitioning European capital-goods industry from craft methods to automatic or semiautomatic milling machines, which were only profitable if vast quantities of munitions could cover the initial capital outlay. War was also drove Europe’s railway networks (Stevenson, 1999).

Moreover, WW1 introduced surgical dressings, gas masks, sonar, aircraft design, air traffic control, and affordable wrist watches. WW2 saw radar, the shipping container (vastly reducing the cost of trade), the jet engine, rocketry, computer technology), and nuclear power. In later decades, the US Defense Advanced Research Projects Agency (DARPA) launched the microchip; the graphic user interface; the mouse; the internet; cryptography; GPS; touch screens; voice recognition; modern robots; drones; and exoskeleton lifters – all technologies which our economies rely on today. For a non-exhaustive overview of modern innovations emerging from defense R&D over time, please see the table in the Annex our RaboResearch report. Today, there is still a pipeline of paradigm-shifting ideas taking place under defense auspices.

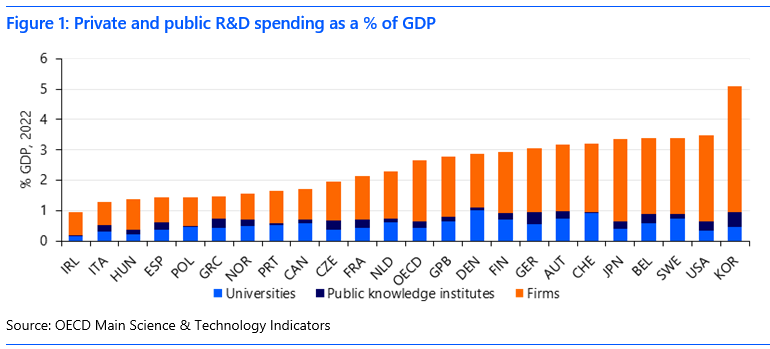

By contrast, Europe today lags in areas such as personal, cloud, and quantum computing, cybersecurity, and AI (see European Commission, 2024), to the detriment of its overall economic performance. Indeed, with the exception of the Netherlands’ ASML, there are few leading global European tech champions. This could be linked with relatively low defense R&D spending. While it can still gain indirectly from others’ research, as we shall show, currently there is little likelihood of the breakthrough technologies that emerge from defense R&D being seen in Europe.

Show me the money!

The military has also gone hand-in-hand with financial innovation. Funding military spending, including defense R&D, was traditionally pivotal to a polity’s prospects, and its single largest expense, often draining public coffers. Today’s EU spends vastly more on welfare than warfare.

Past military build-ups and conflict were responsible for: the origin of modern-day central banking (i.e., the Bank of England); Hamiltonian fiscal unity within previously disparate entities (i.e., the US); long-term bond issuance (i.e., perpetual bonds/Consols in the UK); and war bonds (in many places); financial repression (in many places); the age-old resort of seignorage (i.e., money printing), or Modern Monetary Theory today; the introduction of the global Bretton Woods system post-1945, and arguably its end in 1971. Going forwards, this trend could possibly also include a new hybrid fusion of simultaneously tighter and looser fiscal and monetary policy –“high rates and acronyms”– as noted in our report on EU strategic autonomy; or another shift in the global financial architecture, such as China and Russia’s push for an alternative to the US dollar system, and/or the potential US adoption of a strategic Bitcoin reserve.

Obviously, financial innovation can have a major positive or negative impact on the overall economy. Even though this falls outside our focus on the scientific and knowledge-based benefits of defense R&D spending, it is important to underline this long-run trend.

It is well established that R&D generates significant positive productivity effects for firms and society1. Indeed, Lucking, Bloom, and Van Reenen (2020) conclude that the social return compared to the private return to R&D is about four to one.

The reason for these large societal benefits is that R&D generates large spillover effects due to knowledge being: non-rivalrous and non-excludable (it spreads through all corners of an economy as patents expire or are ignored, and knowledge is vested in people, who are mobile).2 As the IMF (2016) says: “…in advanced economies, private firms should invest 40% more in R&D to account for the positive knowledge spillovers they create to the wider economy.” However, due to knowledge spillovers, firms conducting R&D are unable to fully capture all economic benefits from their activities, which can reduce their propensity to do so.

From a societal perspective, this is suboptimal and implies a strong case for public support of R&D. In some fields, it is perhaps inevitable for the government to step in and organize publicly-financed R&D, especially when the distance to the market is larger, e.g., in fields such as space (where SpaceX has however taken the lead from the groundwork long done by NASA in the US), public health, energy, AI, and defense.

Defense R&D has the same properties as general R&D: indeed, its record at DARPA suggests one more positive for technological progress. However, it also comes with a parallel procurement and/or financial and/or political aspect which might explain why the few empirical studies assessing the impact of defense R&D on productivity find mixed results:

As a result, we have developed our own model which focuses on the long-run relationship3 between defense R&D and productivity (see the technical annex of the RaboResearch report for additional explanation). This allows us to examine whether defense R&D also generates the productivity gains caused by domestic/international knowledge-creation/spillovers and has similar properties as R&D conducted by firms, universities, or public research institutes.

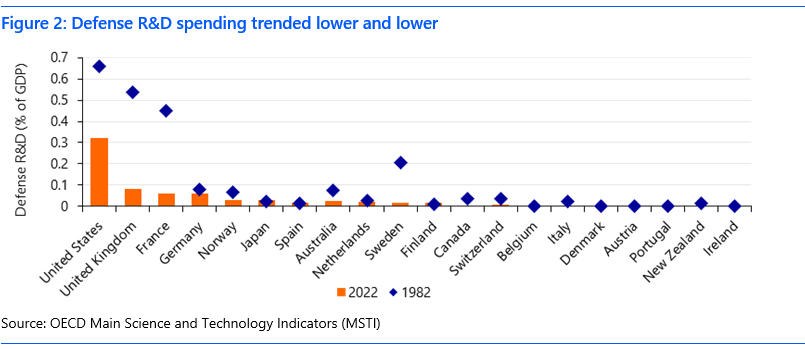

As a first step, we look at the data for defense-related R&D in 19 OECD countries4 from 1981-2021. This is instructive in showing how far such R&D has declined since the Cold War. Not all economies used to spend on this area, but for those who did, the reversal has been marked. In the US, 1982 spending was 0.66% of GDP, but in 2022 just 0.32%; in the UK, it dropped from 0.55% to 0.08%; in France, from 0.45% to 0.06%; and in Sweden, from 0.2% to 0.01% (see Figure 2).

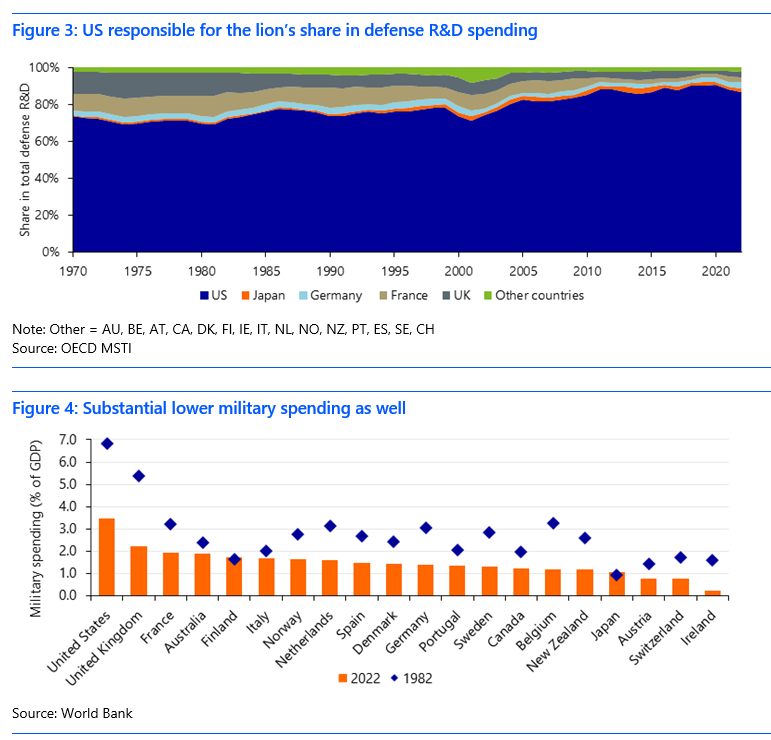

Of course, with US GDP being largest, it is responsible for the lion’s share of total defense R&D, investing $65-70bn (in constant prices) annually over the last five years: to put this figure in perspective, the other 18 OECD countries together invested $7-10bn annually (see Figure 3).

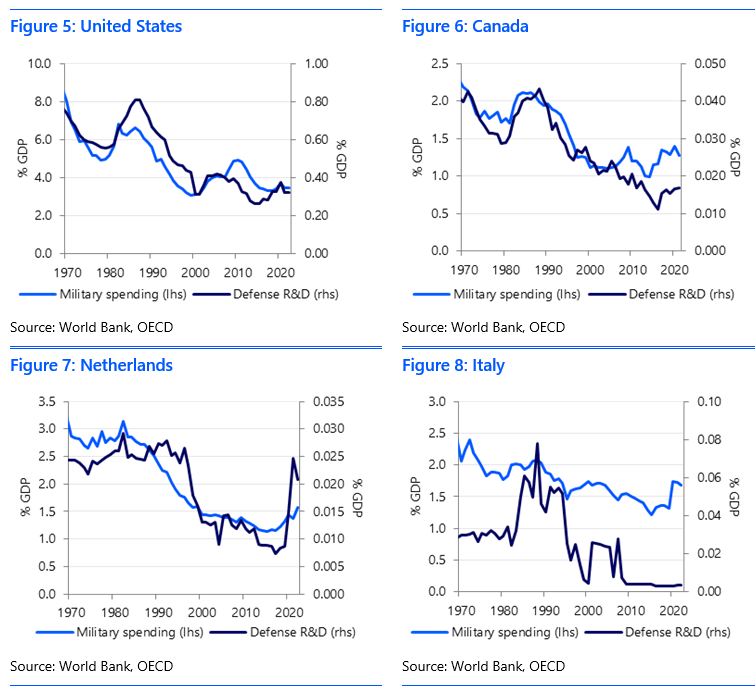

Logically, as military spending has plunged since the end of the Cold War (see Figure 4), so has defense R&D. The US, Canada, the UK, New Zealand, the Netherlands, and France all have a correlation coefficient of 85-90%; Switzerland, Sweden, Norway, Germany, Italy, and Australia 60-75%; and Belgium and Japan 30-40%. Austria, Finland, Denmark, Portugal, and Spain see military and defense R&D spending move in opposite directions. (See Figures 5-8 for some examples.)

Nonetheless, the military-defense R&D correlation in the countries that used to spend the most on R&D, and the prospects of an increase in NATO defense spending from <2% to perhaps 5% of GDP, is still likely to generate a significant defense R&D impulse ahead, the effects of which would flow through to the broader economy with a lag.

“Using cointegration regressions (see the technical annex of the RaboResearch report for additional explanation), we can derive the following long-term relationship:

A 1% increase in domestic defense R&D spending increases domestic productivity by 0.01% to 0.02% in the long run.

However, this is only the partial impact on the productivity level of a country. Countries benefit from each other’s defense R&D spending too. Military innovations like computer chips, mobile phone, and the internet did not just benefit the US economy, but increased productivity globally. These spillovers increase the returns on defense R&D spending as follows:

If all related countries (measured by bilateral trade or technological similarity, NB, and geopolitical alignment in this sample group) increase their defense R&D spending by 1%, spillovers boost productivity by an additional 0.05% to 0.08% percentage point.

The combined 0.06% to 0.10% increased long-term productivity still might not seem like a lot, especially compared to the returns from civilian R&D, which we estimate at 0.04% to 0.07% (domestic) plus 0.10% to 0.16% (from spillovers), so 2 to 3 times higher.

However, given the low levels of defense R&D spending compared to civilian R&D activities in most countries, a 1% increase in defense R&D generally encompasses a much smaller investment than a 1% increase in non-defense R&D. If we calculate the additional GDP generated due to the increased productivity and set this off against the investment value, we arrive at the following, explosive, estimated relationship:

The effective ‘bang for the buck’ on defense R&D is between $8.1 and $9.4; by comparison, for non-defense R&D it is $1.5 to $1.7.

The vastly higher return on defense vs. non-defense R&D is most likely due to the radically different obstacles the former must overcome with trial-and-error approaches compared to more piecemeal and smaller targets in most civilian R&D spending. As DARPA notes of its own mission: “Unlike other agencies, [we are] not satisfied with incremental advances. We push transformational breakthroughs – innovations that not only solve current challenges but also establish the US as the leading driver of strategic technological invention.” When key defense breakthrough innovations spillover to the civilian domain, everyone benefits hugely: think of the Manhattan Project > nuclear power, or a distributed communications system > the internet (see the table in the Annex for more examples).

The bang for the buck that we find for non-defense R&D is lower than some other studies, albeit we are still talking about a societal return of 50 to 70%, which is still very substantial. However, Lucking, Bloom and Van Reenen (2019) find for a bang for the buck of one to four, based on micro-level data for US firms. Erken en Groenewegen (2019, in Dutch) report societal returns for the Dutch economy of 2.6 for private R&D and 4.2 for public R&D.

The difference most likely is methodological in nature. While these studies examine the impact in individual countries, our sample consists of 19 countries, including some that do not have an innovation system in place which is as effective as that of the US or the Netherlands.5 In addition, some of the countries in our sample might lack absorptive capacity to capture the full benefits of international R&D spillovers (see Cohen and Levinthal, 1990). The enormous heterogeneity in R&D returns between individual countries is also illustrated by Soete, Verspagen and Ziesemer (2022).

In short, while defense R&D is an area often overlooked by economic research, and immediately puts many on the defensive, our model estimates that its potential impact is downright explosive: the defense ‘bang for the buck’ is potentially up to 6 times higher than equivalent spending on civilian R&D. As we enter an increasingly volatile geopolitical age, this might also have positive implications for the American, European, and even the global productivity trajectory.

Of course, these high returns do not immediately manifest themselves even if countries decide to step up military and defense R&D investment. It took the US decades to build up a solid research infrastructure resulting in the groundbreaking innovations that have benefited global productivity. Ultimately, perseverance in R&D investment is crucial.

Considering these results more widely, one can even argue that part of the explanation for the notable trend towards lower productivity growth in developed economies since the end of the Cold War is not just: (i) a systemic shift towards cheap labor over capital investment via globalization, and; (ii) to Western financialization over physical production, where productivity gains are easier, but; (iii) also due to a secular shift towards far lower defense and defense R&D expenditure (and in the US case towards more monopolistic, less innovative defense R&D structures, which the Trump administration plans to address).

Since the end of the Cold War, the US has been doing most of the heavy lifting on defense R&D, albeit at far lower levels than during it, while the rest of the world –including US allies like Europe, and US rivals such as Russia and China, etc.– have been able to reap the flow-through benefits to the civilian economy.

From a Grand Strategy perspective, the US is likely going to step up such R&D ahead. It is also insisting that NATO allies greatly increase their own defense, and defense R&D, spending, which could see even higher long-term benefits within the Western alliance. Yet if Europe refuses, the US may opt to go it alone, both geopolitically and technologically, to others’ detriment.

Moreover, from a Grand Macro Strategy perspective, even assuming a pan-NATO boost in defense R&D spending, the US is not likely to be willing to see civilian benefits rapidly transferred to its actual or potential rivals. If the US is unhappy with European ‘freeriding’ on its defense spending in recent decades, it is likely to be vehemently opposed to spillover productivity gains from NATO defense R&D into the Chinese or Russian military or civilian economies: we already see this in the recent US actions to limit exports of its highest level AI chips.

The implication is therefore that a return to Cold War-era defense and defense R&D spending will logically lead to Cold War-era bifurcation of research, technology, and goods markets.

In that respect the global benefits of such an approach may be lower even if the returns within NATO members could remain high. At the same time, however, recall that exactly the same defense-R&D-behind-a-firewall process will naturally be happening in China and Russia, etc. Indeed, exactly this process of military competition, seen as more existential than any national corporate rivalry, is what has always driven the push for rapid, boundary-pushing technological innovation in the first place.

See Coe and Helpman (1995), Coe, Helpman & Hoffmaister (2009), Lucking, Bloom & Van Reenen, (2020), Ciaffi, Deleidi & Mazzucato (2023), Audretsch & Belitski, (2023).

See Romer (1990).

As we use panel cointegration techniques to estimate the long-run relationship between R&D and productivity, potential endogeneity is less of an issue compared to model estimates in first differences. Coe, Helpman and Hoffmaister (2009) argue that panel cointegration estimates are super consistent (see also Stock, 1987), and robust to problems such as omitted variables, simultaneity, and endogeneity.

For some OECD and many non-OECD countries, such as China, there is lack of information on the amount that is spent on defense R&D.

That said, we also do not have sufficient data to include Israel in our sample, where there has clearly been a productivity spillover from sustained high defence R&D into its civilian high-tech sector in areas like cybersecurity.