Disclaimer1

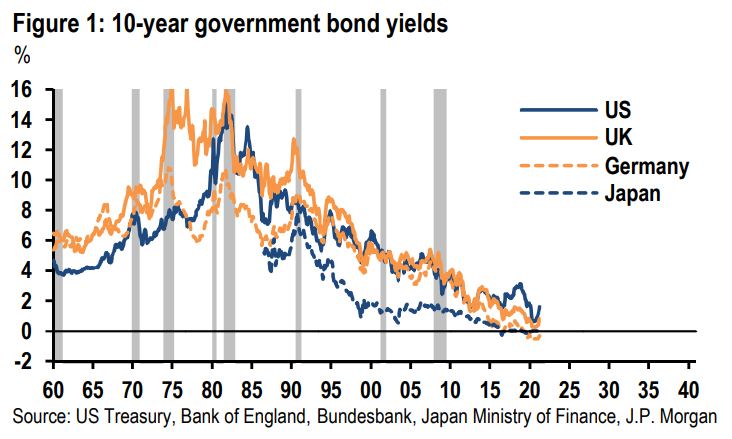

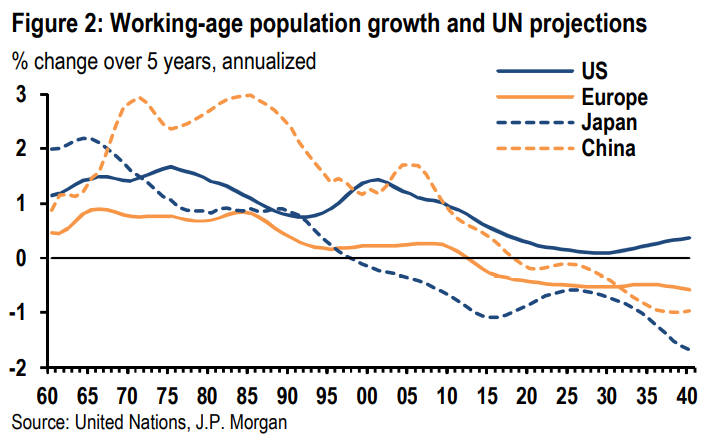

Over the last 40 years, interest rates have fallen from historic highs to historic lows (Figure 1). Declines in global inflation and inflation expectations have contributed to large declines in nominal interest rates, but real interest rates have fallen, too. Although we and others have spilled much ink on this topic, we find that many investors are still skeptical about the drivers of this decline, leading them to question the sustainability of current asset valuations. In our view, the global slowdown in population growth is likely one key driver of lower real interest rates, and it is likely to persist (Figure 2). In this note, we lay out the intuition behind this argument and discuss implications for asset markets.

|

|

Economic theory suggests that the supply of savings and the demand for borrowing combine to determine real interest rates. Many economic models posit that much of the flow of funds from savers to borrowers is effectively a flow from older generations to younger generations. Savings from wealthier older generations fund consumption, education, and home buying by younger generations, as well as the accumulation of business capital for younger generations to work with. If population growth slows permanently, future younger generations will be smaller relative to older generations, and the demand for borrowing will fall relative to the supply of saving, reducing the trend level of interest rates in the long run.

All kinds of rates of return should be lower under slower population growth, including bond yields, stock earnings/price ratios, and real estate cap rates or rent/price ratios; low yields and high price/earnings ratios thus need not indicate a “bubble.” But low yields also need not imply high prices. For example, if new housing can be built at a fixed price, then supply should expand and rents should fall to reduce cap rates.

Economists often model the determination of real interest rates in two different general frameworks—one based on explicit modeling of lending between generations to fund consumption, and the other based on the accumulation of capital like houses, factories, machinery, or software.

In the first framework (so-called “overlapping generations models2”) people are modeled as going through multiple stages of life. In the early stages, they borrow to fund their consumption and education, in the middle stages they work, pay back loans, and save, and in the later stages they retire and spend down their savings. When one generation is in the saving phase, its saving is used to fund the borrowing of the next generation, which is in its borrowing phase at the same time. In this framework, it is not hard to see that a permanent decline in population growth would mean that future borrowing generations will be always be smaller relative to the saving generations, pushing interest rates down.

In the second framework, effects on interest rates are more subtle. In models based on capital accumulation, like the textbook “Solow model,” people consume a fraction of their income and invest the rest in productive capital, which will be combined with labor to produce output in the future. With a constant saving rate, the economy will come to a steady state where the ratio of capital to labor is constant (or growing at a constant rate if there is technological progress). In competitive markets, real interest rates in this model would be determined by the “marginal product of capital” or the amount of extra output produced by a unit of capital—that is, capital would be paid according to its contribution to output (as would labor). Importantly, we would also assume that the productivity of capital is determined by the amount of labor it has to work with (and vice versa). In this model, a permanent decline in population growth produces a new steady state where capital is more abundant relative to labor, meaning that capital earns lower returns and thus that interest rates fall.3

As a brief aside, in the capital accumulation framework, a slowdown in technological progress would have an analogous effect on interest rates. If the rate of new idea production slows, capital will become abundant relative to ideas, and the return earned by capital will fall. We thus see how we arrive at the rule of thumb that interest rates should be related to trend GDP growth rates. Interest rates are not directly determined by GDP growth per se, but both GDP growth and the return on capital are driven by population growth and technological progress (i.e., productivity growth).

Of course, real world financial markets are more complex than either of these simple models, but we think both models still contain an important insight. In essence, in a world with lower population growth, savings by older generations should grow larger relative to the needs of younger generations. There should be ample demand from the old for long-lived investments of all kinds, pushing down the expected returns on these investments. Real interest rates paid on savings accounts, bonds, and other fixed income instruments should be lower than they used to be. Measures of internal rates of return like earnings/price ratios on equities should also be lower, as should rent/price ratios or “cap rates” on real estate.

One might jump to the conclusion that asset prices must rise in order to accommodate demand and reduce these rates of return. But the supply of assets also matters. For example, think of single-family rental housing. If an unlimited supply of equivalent houses can be built for $200,000 each, then the equilibrium price of an existing house should not rise above $200,000, because one could always build a new house for that amount. To equilibrate markets and make sure that every investor does not become a single-family landlord instead of holding stocks or bonds, the supply of houses should rise until rents have fallen enough to bring rent/price ratios into alignment with lower rates of return on other assets. Of course, not every market features elastic supply like this. In markets with fixed or constrained supply and steady demand, the adjustment in rent/price ratios would occur through higher prices.

It is debatable how corporate capital and the price of equities should be seen in this light. Some firms might be thought of like the elastically-supplied house. In theory, the value of a simple construction firm, for example, should be equal to the value of its assets like machinery (unrealistically assuming no value from intangibles like its employee, supplier, or customer relationships). If new construction machinery can be produced at a fixed price, then no construction firm should have an enterprise value above the cost of reproducing its machinery, because one could always buy new machinery for a lower price and start a new firm. In a world of low interest rates, earnings/price ratios for construction firms should fall due to reduced profitability of machinery as it becomes more abundant. On the other end of the spectrum, if a firm can produce a steady stream of income with a set of assets that are better thought of as fixed in supply (perhaps a “platform business” with a strong “moat”), then the value of this firm should rise in a world with low interest rates.

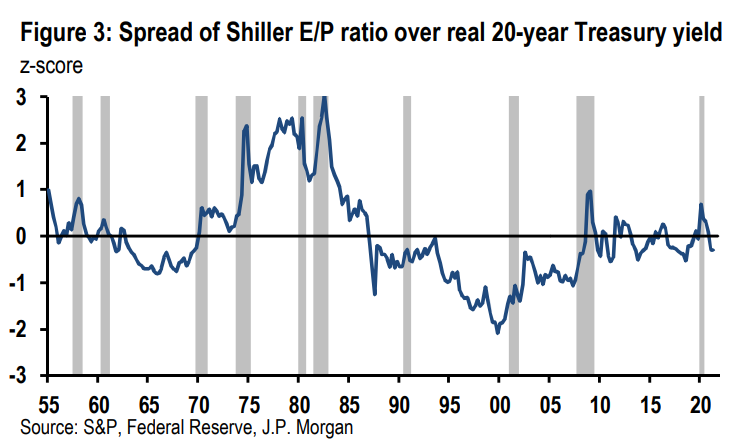

We leave it to our equity analysts to assess the valuations of individual stocks, but we conclude by noting again that higher price/earnings ratios are to be expected in a world of lower population growth and interest rates. We are thus not inclined to view current historically high P/E ratios as a significant macroeconomic vulnerability. In fact, the spread between current E/P ratios and real Treasury bond yields is still near the middle of its historical distribution (Figure 3). To be fair, the economic models described above are not precise enough to determine that current interest rates are the “correct” ones, so there is always a chance of bond yields reverting toward historical norms. But we think that low population growth and other factors provide enough reason to think low real interest rates will persist, and we are not overly concerned that the bursting of an “everything bubble” will threaten the recovery.

See Gagnon, Johannsen, and Lopez-Salido and Eggertson, Mehrotra, and Robbins for recent models like this.

Not all models of capital accumulation have this property, however. In the canonical “neoclassical growth model” where a representative household chooses saving to maximize the present discounted utility of future generations, the savings rate adjusts in response to population growth, leaving the steady state capital/labor ratio unchanged. Interest rates are determined by the discount rate at which households value their future generations’ utility. In this model, if each generation started having fewer kids, then saving would fall to offset the decline in population growth, because the utility of future generations is the only motivation for saving. We think this is not a good description of reality, which likely falls in between the extremes of the neoclassical and Solow models. See Farhi and Gourio for a more detailed recent model of this type.