The value of a stock is the present value of its expected future dividends. Hence, the changes in stock prices must be explained by either changes in expected dividends or in discount rates. The changes in discount rates can be caused either by changes in risk-free rates or in risk premia. The effect of monetary policy on the risk premia is not clear. The conventional wisdom says that expansionary monetary policy makes the valuation of stocks high, i.e., lowers the risk premia. In the article “Monetary Policy and Stock Market Valuation” that is forthcoming in the International Journal of Central Banking, I show that though the expansionary monetary policy lowers short-horizon premia, it tends to raise long-horizon premia. The effect of expansionary monetary policy on the implied long-term average premium is positive. Thus, accommodative monetary policy seems to make the prices of stocks “cheap” in comparison to the expected dividend stream and risk-free rates.

Different valuation measures like price-to-earnings ratios have climbed to historically high levels during the past years. At the same time central banks have lowered their policy rates close to or even below zero and applied many unconventional monetary policy tools. Some policy makers and financial analysts have been worried that central banks blow stock market bubbles and overheat the market. However, it is not clear how monetary policy affects required rates of returns that are used to discount the future expected dividends.

There are reasons to believe that expansionary monetary policy lowers the risk premia as many papers provide empirical evidence that expansionary monetary policy generates an immediate rise in equity prices followed by a period of lower-than-normal excess returns (e.g. Bernanke and Kuttner, 2005). On the other hand, there are many reasons to believe that expansionary monetary policy does not necessarily lower the risk premia. For example, Caballero and Farhi (2013, 2018) argue that asset purchases may raise stock market risk premia by decreasing the supply of negative-beta assets. In addition, expansionary monetary policy may increase risk premia by affecting inflation (e.g. Modigliani and Cohn, 1979; Schotman and Schweitzer, 2000). Assuming that stock market bubbles exist, Galí (2014) shows that monetary policy easing may decrease the size of stock market bubble. Monetary policy may also affect differently on different parts of the equity risk premium curve that is used to discount the future dividends. For example, Binsbergen, Hueskes, Koijen and Vrugt (2013) show that empirically the slope of the curve changes over the business cycle.

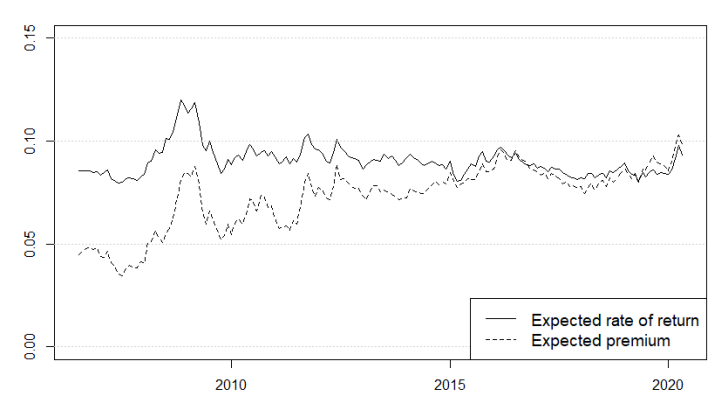

Figure 1 shows the implied average long-term required rate of return and equity premium that are solved using analysts’ dividend forecasts and Eurostoxx 50 index.1 Notably, the expected rate of return for equities has remained rather stable since the 2008 financial crisis, even as risk-free rates have declined substantially. This means that the implied average premium over the risk-free rates has increased considerably since the crisis.

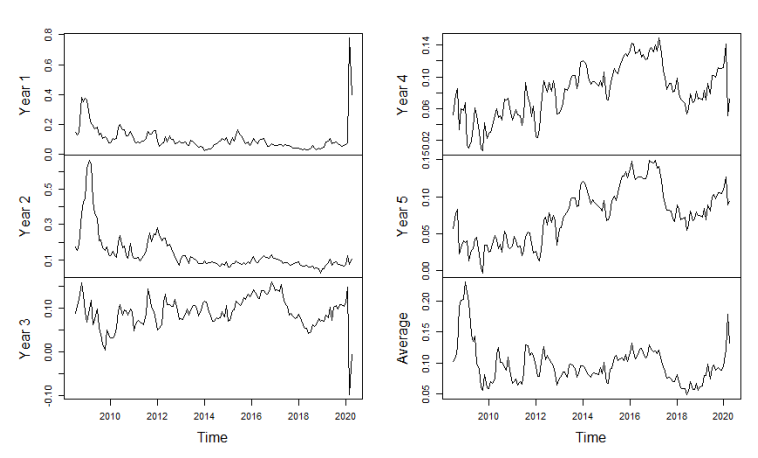

It is widely acknowledged that expected returns vary over time. Consistently, discount rates may vary over discounting horizons. Figure 2 shows the horizon-specific risk premia for the first five years that are implied by analysts’ dividend forecasts and dividend future prices. The term structure of risk premia, obtained utilizing dividend forecasts, behaves very similarly as in Binsbergen et al. (2013), where “equity yields” are based on predictive regressions. The variation in the expected premia is related mostly to the near future. The slope of the implied premium curve seems to be pro-cyclical as well.

Figure 1. Implied expected rate of return and risk premium. The variables are solved applying equation (2) of Laine (forthcoming) to Eurostoxx 50 stock market index and analysts’ consensus forecasts in the period from 06/2006 to 04/2020.

Figure 2. Year-specific risk premia implied by Eurostoxx 50 dividend futures and analysts’ dividend forecast from 7/2008 to 4/2020 based on equation (3) of Laine (forthcoming).

Using local projections and VAR models, I show that monetary policy affects differently on the different parts of the implied equity premium curve. According to the local projection results, the responses of short-horizon and long-horizon premia have the opposite signs. Contractionary monetary policy raises the year 1 implied premium, while the response of implied long-term average premium is negative. The negative effect on the average premium implies that a rate hike seems to make stocks “expensive” in comparison to the expected stream of dividends and risk-free rates. The VAR results are in line with these conclusions.

Recent discussion paper by Kapp and Kristiansen (2021) argues that these type of result might be explained by information surprises: accommodative (contractionary) monetary policy decision may be accompanied by revelation of new negative (positive) information concerning the economic outlook.2 However, my results do not support this explanation, because the results remain the same even though one uses sign restrictions and forces the responses of stock return and inflation expectation to have the “correct signs”.3

The results show that the conventional wisdom that monetary policy easing makes stock market valuation high is likely to be false. They also suggest that “leaning against the wind” policies are ineffective when it comes to the stock market. They underline the fact that the effect of monetary policy on stock market valuation is a puzzle that has not been solved yet.

Bernanke, B.S. and Kuttner, K.N. (2005). What explains the stock market’s reaction to Federal Reserve policy? Journal of Finance, 60(3), 1221-1257.

Caballero, R. J. and Farhi, E. (2013). A model of the safe asset mechanism (SAM): Safety traps and economic policy. National Bureau of Economic Research, No. w18737.

Caballero, R. J. and Farhi, E. (2018). The safety trap. The Review of Economic Studies, 85(1), 223-274.

Binsbergen, J., Hueskes, W., Koijen, R. and Vrugt, E. (2013). Equity yields. Journal of Financial Economics, 110(3), 503-519.

Galí , J. (2014). Monetary policy and rational asset price bubbles. American Economic Review, 104(3), 721-52.

Kapp, D. and Kristiansen, K. (2021). Euro Area Equity Risk Premia and Monetary Policy: A Longer-Term Perspective. ECB Working Paper, No. 2535.

Laine, O.-M. (forthcoming). Monetary Policy and Stock Market Valuation. International Journal of Central Banking. Available at SSRN: https://ssrn.com/abstract=3950239.

Modigliani, F. and Cohn, R.A. (1979). Inflation, rational valuation and the market. Financial Analysts Journal, 35(2), 24-44.

Schotman, P.C. and Schweitzer, M. (2000). Horizon sensitivity of the inflation hedge of stocks. Journal of Empirical Finance, 7(3-4), 301-315.

All the figures of this policy brief are from Laine (forthcoming).

See also the policy brief by Kapp and Kristiansen: Euro Area Equity Risk Premia And Monetary Policy

See Figure F1 in Appendix of Laine (forthcoming).