Euro liquidity lines – in the form of swap and repo lines – have become an integral part of the European Central Bank’s toolkit. During the global financial crisis and the COVID-19 pandemic, the ECB established swap and repo lines with 16 foreign counterparts to provide liquidity in euro to FX markets mainly within Europe, thus playing the role of a Regional Lender of Last Resort. We provide novel evidence that the mere announcement of those lines is effective at reducing the premium paid by recipient country agents to borrow euros (the so called basis), and in providing positive spillback effects to the Euro Area – boosting domestic bank equity prices in euro area countries highly exposed via banking linkages to targeted countries.

Central bank liquidity lines have been used extensively in the last decade to provide liquidity in foreign exchange markets during periods of financial distress, including the COVID-19 pandemic (see for example Aizenman et al. 2021 among others). In those cases, central banks coordination has played a key role in preventing temporarily financial market turmoil to morph into global financial instability (IMF 2020). Their functioning is straightforward: when a line is activated between a source central bank and a recipient one, the latter can access the source central bank’s currency in exchange for its domestic currency at the spot exchange rate and at a fixed interest rate, which is below the market rate. At maturity, the same amount of money is exchanged among the two counterparties at the same fixed spot exchange rate. Thus the recipient central bank can inject liquidity in foreign currency in the domestic market, preventing pressures on the exchange rate or avoiding to exhaust its own International Reserves. On the other hand, by reducing foreign liquidity shortage and the probability that a financial turmoil arises in the recipient country, the source central bank prevents negative spillbacks in the form of financial instability (see McCauley and Schenk 2020, ECB 2020).

In this context, previous contributions have extensively focused on the Fed liquidity lines and its role of international Lender of Last Resort, but what do we know about the ECB’s? What is the scope and effectiveness of these lines? We provide descriptive and empirical evidence on the effectiveness of ECB agreements providing euro liquidity and their positive spillovers and spillbacks (Albrizio et al. 2021).

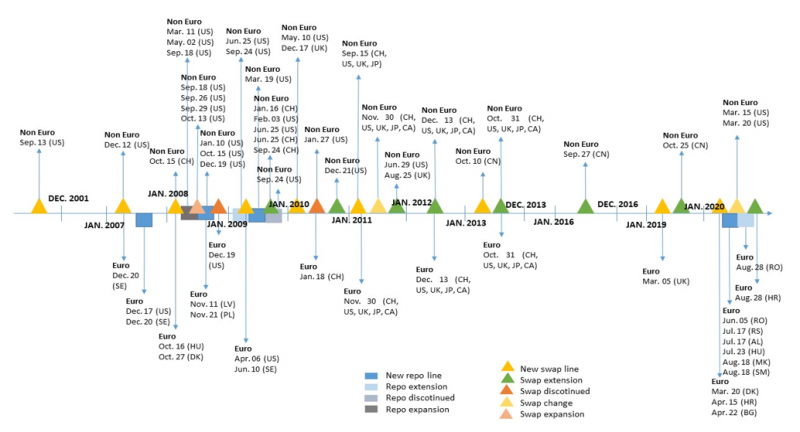

After some early precedents in the context of the Bretton-Woods era, a global network of swap lines gained increasing relevance as a cooperation tool across central banks following the September 11th terrorist attack, and more extensively during the Global Financial Crisis of 2007/2008 and after the recent Covid-19 pandemic. Most liquidity lines were established by the Federal Reserve, transforming the Fed into the global lender of last resort (Bahaj and Reis, 2021). Turning to the ECB, between October 2008 and August 2020 it established and/or extended a total of 28 swap and repo lines with 16 counterparts to provide euro liquidity. Counterparts were mostly outside the EA (Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden), but since 20th March 2020 other non-EU countries joined the network (Serbia, San Marino, Albania and North Macedonia). Therefore, in contrast with the Fed, the ECB role has been more of a regional lender of last resort than a global one. Figure 1 shows a detailed timeline of these ECB lines1.

Figure 1: Timeline of the ECB swap and repo lines announcements providing euros and liquidity in other currencies

Source: Albrizio et al. 2021. Database based on ECB Press Releases available online here.

Note: The figure reports the announcements of ECB liquidity facilities. Above the timeline, establishments of lines between the ECB and other central banks for the provision of foreign currencies (such as USD, GBP, CHF, CNY) are reported. Below the timeline, ECB euro liquidity facilities are recorded.

Previous empirical research shows that the Fed swap lines have been effective in lowering dollar borrowing costs (Bahaj and Reis, 2018), limiting assets fire sales and helping contain the risk of market contagion. Moreover, the mere announcement of the Fed facilities gave confidence to market participants without the need for activating them – the so-called signalling effect (Panetta and Schnabel, 2020, Aizenman et al. 2021).

To estimate the signalling effect in the case of the ECB lines we compare changes in the deviations from covered interest parity (CIP) for targeted currencies with those of currencies of similar non-targeted countries in a short window around the public announcement of the liquidity line. Theoretically, absent market frictions CIP holds and the implied euro interest rate in the FX market equals the euro money market interest rate. If the CIP does not hold – for example when the probability of not honoring the swap agreement is different from zero – the FX swap basis spread provides a measure of the premium paid by foreign agents to borrow euros in the FX market compared to the euro money market.

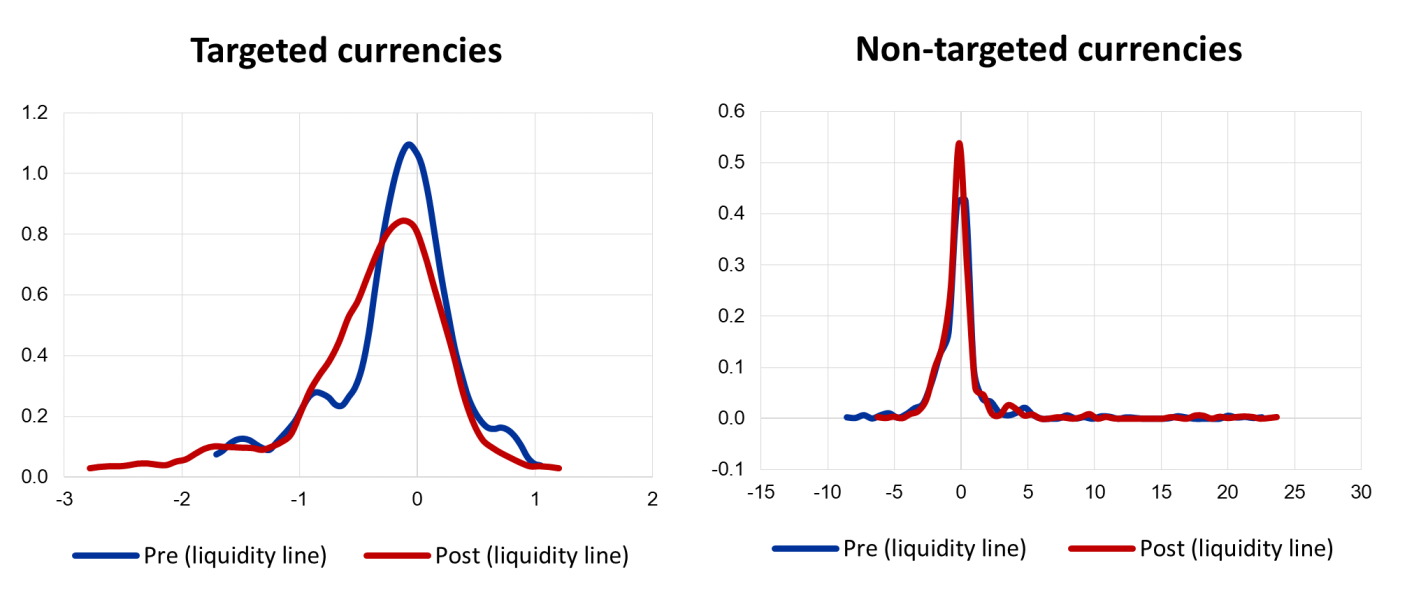

Figure 2: FX Basis Density Before and After Announcement

Source: Albrizio et al. 2021.

Note: FX basis density in a 4-day window around the announcement. For any announcement, the treated currency/ies is/are going to be the one/s targeted by the announcement, while the non-targeted currencies in the sample are untreated. Post-treatment is defined as the day of treatment and the day after (Post), while pre-treatment is the two days prior to treatment (Pre).

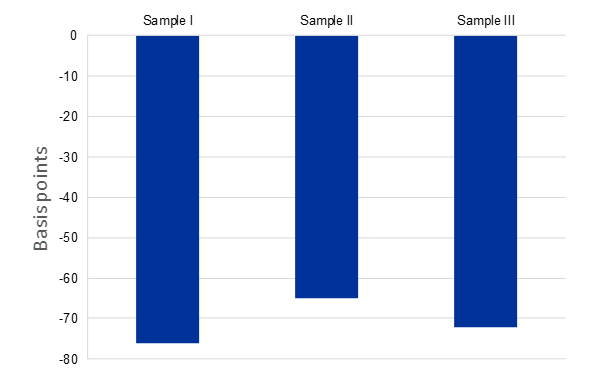

As can be seen in Figure 2 the density of the basis for targeted countries shifts to the left – lower CIP deviations – after the announcement, contrary to the non-targeted group. In a more formal assessment, relying on a difference-in-differences framework as in Cetorelli et al. (2020) and Bahaj and Reis, 2018, we estimate that the announcement of a swap line reduces the euro funding cost in foreign exchange swap markets significantly and by between 51 and 76 basis points (Figure 3). The results are robust to using alternative estimators (Abadie et al., 2015; Arkhangelsky et al. 2021) and the use of an event analysis framework. We find no effect when moving the announcement dates 3 days before the actual one, validating the difference-in-differences approach and indicating that there is no anticipation.

Figure 3: Estimated reduction in the FX euro funding cost – signaling effect

Sources: Albrizio et al. (2021).

Note: The blue bars represent the estimated effect on the FX swap basis of treated currencies with respect to a group of currencies non-targeted by lines announcements. Sample I includes countries whose currencies have been targeted at least once during the time frame considered (Bulgaria, Denmark, Croatia, Hungary, Poland, Serbia, Sweden). Sample II adds currencies of geographically contiguous countries that have never been targeted (Norway, Iceland). Sample III expands Sample II by considering G10 countries targeted (United States, Switzerland, Canada, United Kingdom, Japan) and additional control countries such as New Zealand and Singapore.

Liquidity shortage and turmoil in FX markets may spill back to the source country morphing into global financial instability, then increasing financing cost for domestic firms (McCauley and Schenk 2020) or negatively affecting the market valuation of domestic banks most exposed to the stressed markets. Central bank liquidity line announcements may prevent the materialization of these negative spillbacks by instilling confidence in recipient economies and reducing the risk of contagion. Recent empirical evidence has shown that the Fed lines generated positive spillbacks, since cheaper swap lines increase purchases of dollar denominated assets in banks located in targeted jurisdictions, relative to other banks and to other denominations (Bahaj and Reis, 2018).

In a stylized model we show that liquidity lines announcements reduce recipient-country intermediaries’ bankruptcy risk. Since the reduction is unexpected at the time of pricing of the forward rate, the announcement increases expected profits, and consequently stock prices, of the source country financial sector. To test for such effects, we exploit the fact that some euro area (EA) countries have stronger trade and banking ties with some of the targeted countries. Therefore, we would expect, for example, that an ECB announcement of a liquidity line with Romania will benefit Italian more than Belgian banks, since the latter do not have strong banking linkages with the recipient country.

We compare the change in average stock prices of banks in EA countries highly exposed to the targeted economies via banking linkages with those EA countries that are less exposed allows us to quantify the benefit of the announcement for EA banks. Our estimates suggest that domestic bank profitability, proxied by equity prices, increases by almost 7% in EA countries highly exposed upon announcement of the liquidity line.

Swap and repo lines are becoming an integral part of the ECB toolkit. They have proved to be effective in preventing liquidity shortage in time of crisis, turning the ECB in a Regional Lender of Last Resort. Moreover, these lines, not only prevent negative spillbacks to the euro area, but also push domestic bank equity prices in euro area countries highly exposed via banking linkages to targeted countries.

Abadie, A., A. Diamond, and J. Hainmueller (2015). “Comparative politics and the synthetic control method”, American Journal of Political Science, Vol. 59, No. 2, pp. 495-510.

Aizenman, J., H. Ito, and G. K. Pasricha (2021). “Central Bank Swap Arrangements in the COVID-19 Crisis”, Technical Report, National Bureau of Economic Research.

Albrizio, S., I. Kataryniuk, L. Molina and J.L. Scha fer (2021) “ECB Euro Liquidity Lines”, Banco de Espan a Working Paper No. 2125.

Arkhangelsky, D., S. Athey, D. A. Hirshberg, G. W. Imbens, S. Wager (2021). “Synthetic Difference-in-Differences”, American Economic Review, Vol. 111, No. 12, pp. 4088-4118.

Bahaj, S and R. Reis (2018). “Central Bank Swap Lines,” Bank of England Working Papers 741, Bank of England July 2018.

Bahaj, S., and R. Reis (2021). “Central Bank Swap Lines: Evidence on the Effects of the Lender of Last Resort”, The Review of Economic Studies, November 2021.

Cetorelli, N., L. S. Goldberg, and F. Ravazzolo (2020). “Have the Fed swap lines reduced dollar funding strains during the Covid-19 outbreak?”, Liberty Street Economics 22 May 2020.

IMF (2020), Central Bank Support to Financial Markets in the Coronavirus Pandemic, Special Series on COVID-19.

McCauley, R. and Schenk, R. Catherine (2020). “Central Bank Swaps Then and Now: Swaps and Dollar Liquidity in the 1960s”. BIS Working Paper No. 851, April 2020.

Panetta, F. and I. Schnabel (2020), “The provision of euro liquidity through the ECB’s swap and repo operations” ECB blog, 19th August 2020.