References

ECB press release (2021). ECB presents action plan to include climate change considerations in its monetary policy strategy.

Eliet-Doillet A. and Maino A. (2022). Can Unconventional Monetary Policy Contribute to Climate Action? Unpublished manuscript.

Chen H., Chen Z., He Z., Liu J. and Xie R. (2022). Pledgeability and Asset Prices: Evidence from the Chinese Corporate Bond Markets. Journal of Finance, forthcoming.

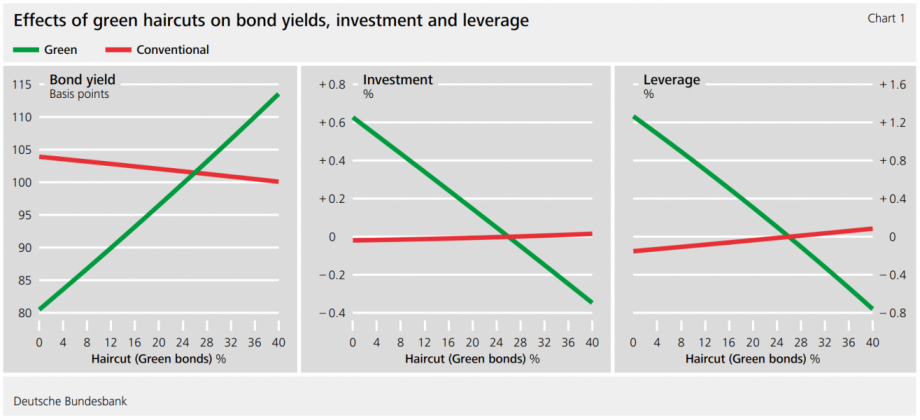

Giovanardi F., Kaldorf M., Radke L. and Wicknig F. (2022). The Preferential Treatment of Green Bonds. Deutsche Bundesbank Discussion Paper No 51/2022.

Grosse-Rueschkamp B., Steffen S. and Streitz D. (2019). A Capital Structure Channel of Monetary Policy. Journal of Financial Economics 133, 357-378.

IPCC (2021). Summary for Policymakers. In Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press.

Macaire C. and Naef A. (2021). Greening Monetary Policy: Evidence from China. Climate Policy 1-12.

Todorov, K. (2019). Quantify the Quantitative Easing: Impact on Bonds and Corporate Debt Issuance. Journal of Financial Economics 135(2), 340-358.