This Policy Brief is based on Deutsche Bundesbank Discussion Paper No 09/2024. This paper represents the authors’ personal opinions and does not necessarily reflect the views of the Deutsche Bundesbank or the Eurosystem.

Energy prices skyrocketed as a result of the Russian war of aggression. Government stabilization measures were intended to support overall economic development. Our study compares the effects of two fiscal stabilization measures for companies: subsidies in the form of quantity-limited price guarantees and production-independent direct transfers. It turns out that the effectiveness of the measures depends on how energy prices react to energy demand.

In our study (Hinterlang et al., 2024), we use a multi-sector macroeconomic model with endogenous entry and exit of firms. This allows us to depict the interaction of firm entry and exit and leads to endogenous variation in the price markups of firms through a competition channel. The model represents the interconnections between 53 production sectors, including clean and brown energy. All sectors use gas as an essential input factor. Gas is of different importance depending on the sector. Some of the modelled households cannot save. These households always spend their entire income immediately. It is assumed that gas is fully imported. Apart from that, the economy is closed. The model is calibrated for Germany.

In a baseline scenario, we first simulate an exogenous increase in gas prices without fiscal policy measures. It is assumed that the price temporarily rises and returns to the initial equilibrium after the shock. The basic production structure and energy efficiency do not change due to the shock. Then, we simulate two policy measures under two different assumptions regarding gas prices and supply. For both measures, the level of support is set at 70% of the previous gas consumption of the respective sectors. The level is based on the measure taken in Germany in the form of transfers.

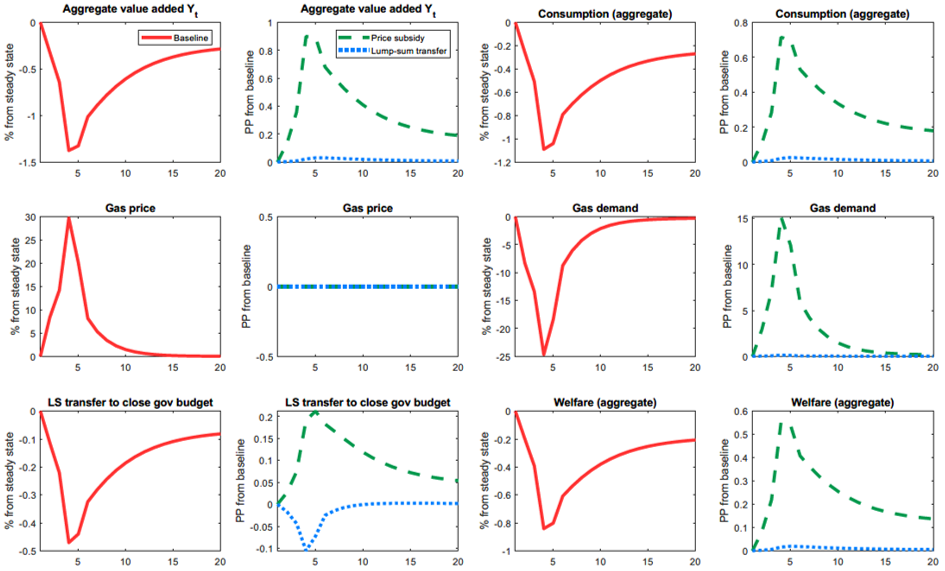

Figure 1 shows the paths of the baseline scenario (red) and the effects of the measures (transfer in blue, price guarantee in green) with variable gas quantity. In the baseline scenario, the import price for gas rises steeply. The demand for gas decreases significantly (largely without affecting the gas price). Consumption, investment, and overall economic production decline. Industries that consume a lot of energy suffer particularly.

Figure 1: Development of key variables in baseline scenario and effects of measures with fixed gas price and variable quantity (scenario 1) relative to baseline

The subsidy of import prices for gas leads to a strong increase in gas demand and production compared to the baseline scenario (Fig. 1), as the measure reduces average costs for gas consumption. Under the assumption mentioned above, these costs are crucial for the company’s optimization decision. The incentive to save gas decreases. Consumption, investment, and production are significantly stimulated.

In contrast, direct transfers have only minor effects on production and gas demand compared to the baseline scenario. Although more companies remain in the sector due to the transfers (as there are fewer bankruptcies), which reduces price markups and prices. However, since the support measure does not target the gas price itself, it has a comparatively small effect on production. Gas demand only increases slightly, as the incentive to save gas remains largely intact.

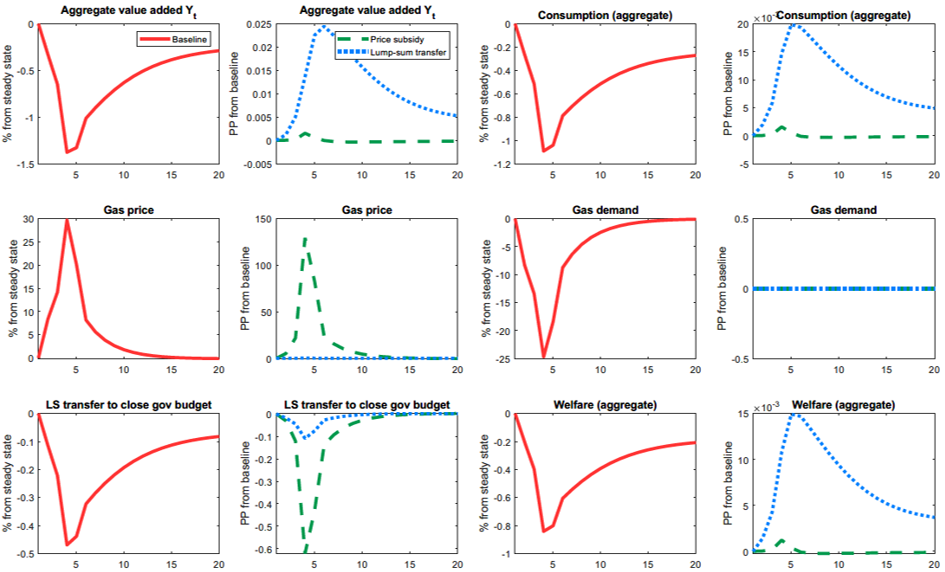

Figure 2 illustrates the effects when the gas supply does not react to demand. In this case, the subsidies further drive up the gas price because the incentive to save is greatly reduced. The strong price increase further hampers production in energy-intensive industries. The fiscal support largely dissipates in a price effect (which benefits the gas-supplying foreign countries). At the same time, the government costs for subsidies increase immensely, which in turn has a negative impact on the budgets of private households and overall economic demand. Direct transfers do not have these problems. The incentive to save remains intact, and the gas price is not further driven up. Production continues to be slightly stabilized, as bankruptcies are avoided. Therefore, in such a scenario, direct transfers to companies are the economically more sensible policy measure.

Figure 2: Development of key variables in baseline scenario and effects of measures with fixed gas quantity and variable price (scenario 2) relative to baseline

The results show that the effectiveness of differently designed stabilization measures depends crucially on the scenario, in our case primarily on the availability of natural gas. However, the findings can also be relevant for other important imported goods such as rare earths or microchips. Subsidies for production costs work better in the case of pure price shocks, while direct transfers to companies are preferable in the case of actual scarcity because they maintain the incentive to save. Furthermore, the design of the measures is important. With quantity-limited price guarantees, incentive effects can be maintained if the subsidized quantity is set sufficiently low. The effects of the instruments can also be similar depending on their design and circumstances. The political decision in Germany to pay transfers to companies appears reasonable against the background of the uncertain gas deliveries at that time.

Hinterlang, N., M. Jäger, N. Stähler und J. Strobel (2024). On curbing the rise in energy prices: An examination of different mitigation approaches. Deutsche Bundesbank. Discussion paper 09/2024.