This Policy Note is based on ECB Occasional Paper Series No. 332. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

On the distributional impact of the inflation shock, including the role of fiscal support measures, see Amores et al. (2023).

IMF (2023) report contains a description of how inflation typically affects fiscal accounts.

Among many others, Hilscher et al. (2022) explore the plausibility of inflating away government debt, while Brunnermeier et al. (2023) describe the broader consequences of such an action for the real economy.

Briodeau and Checherita-Westphal (2023) find evidence of non-linear effects of inflation (actual or surprise) on the primary balance in a panel of euro area countries over the period 1999-2022.

Other recent contributions to the conversation about the effects of high inflation on public finances include works by Burriel and Odendhal (2023), focusing on external price shocks, notably oil price shocks; Cornille et al. (2023), Holler and Reiss (2023), and García-Miralles and Martínez Pagés (2023), who examine country-specific aspects; and IMF (2023), which provides a comprehensive multi-country study.

Bańkowski at al. (2023b) take a detailed look at tax progressivity and other indexation aspects of taxes in euro area countries.

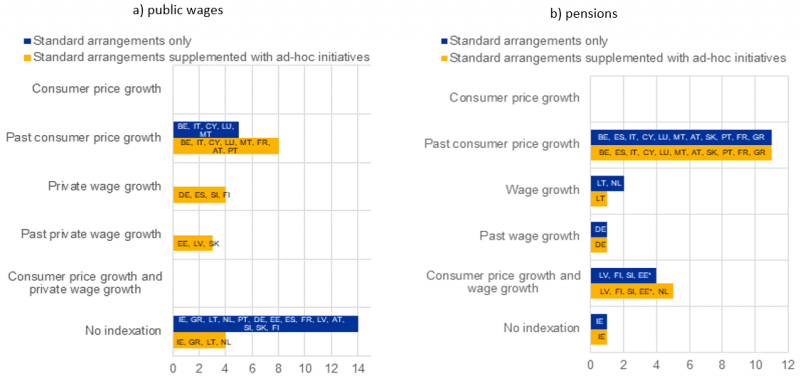

Checherita-Wesphal (2022) provides an overview of indexation schemes and other mechanisms for setting public wages and pensions across the euro area countries.

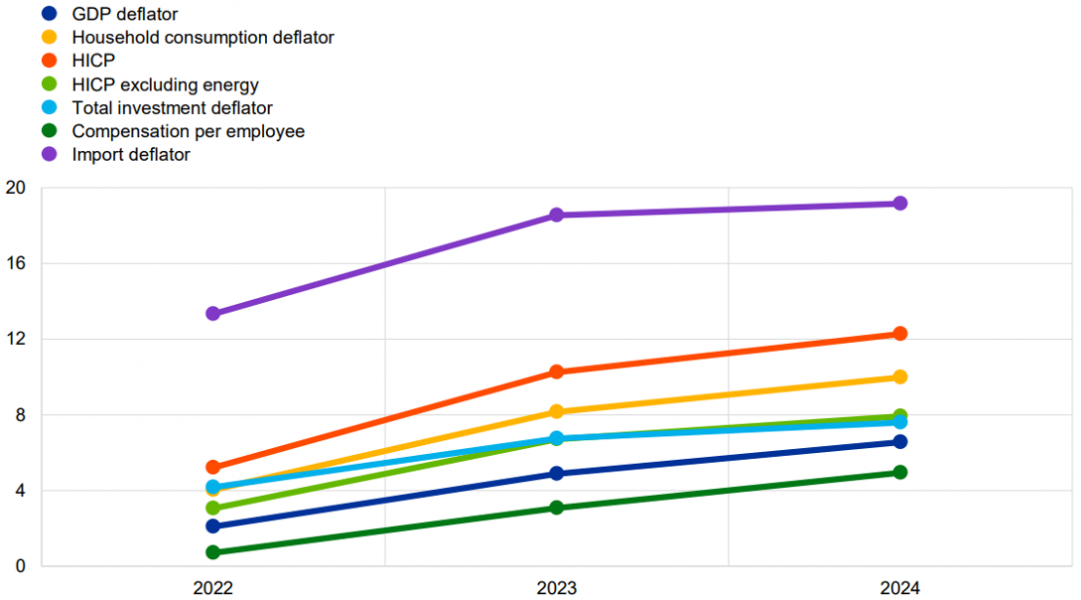

For discretionary spending, the simulations assume a link to price dynamics estimated based on historical data, as documented in Bańkowski et al. (2023b).

The simulations with the platform are partial equilibrium and come with two main limitations: they use price revisions as proxies for exogenous inflation shocks and only account for the most direct effects on fiscal variables by not altering real variables. Consequently, they do not capture the broader impacts of inflation on real economic activities, including those associated with monetary policy, which would bring additional indirect fiscal costs.

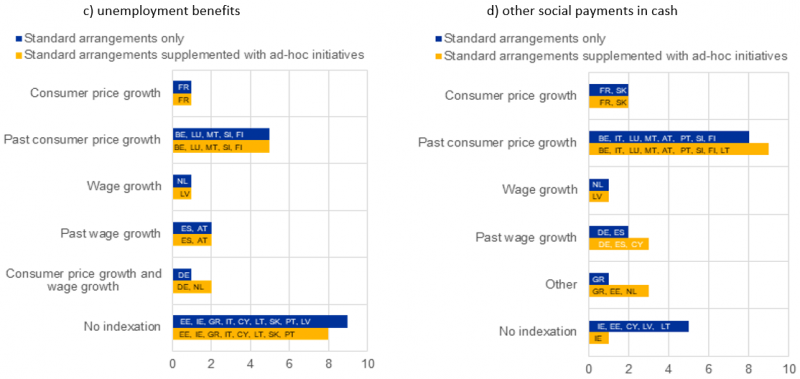

The dispersion between prices has somewhat narrowed since the post-inflation forecast vintage (i.e., December 2022), primarily due to a sharp moderation in import prices. However, the broad picture remains unchanged, with the cumulative price increases since the start of the inflation episode still expected to continue varying across different prices in the coming years.

See Bańkowski et al. (2023a) for an assessment of the effects of fiscal measures undertaken in the face of high inflation.

The appendix of Bańkowski at al. (2023b) contains country-specific results.