The views expressed in this policy brief are those of the authors and do not necessarily reflect those of the Deutsche Bundesbank.

Many economies around the world have committed to ambitious climate goals. Discussions on policies that could mitigate climate change are under way. These include approaches to pricing carbon and avoiding carbon leakage. We study the macroeconomic implications of such measures using the environmental multi-sector dynamic stochastic general equilibrium model EMuSe. In doing so, we consider several different scenarios: Different regions introduce carbon-pricing schemes unilaterally or in cooperation, and in the presence or absence of border adjustment schemes. This policy brief summarises the effects on output and welfare. We find that carbon pricing generates an economic downturn initially, which is eventually followed by an upswing when emissions damage is reduced. Border adjustment taxation reduces carbon leakage but does not prevent it altogether. Concerning welfare, carbon pricing generates higher losses in low-income countries with low per-capita consumption levels. This might deter those regions from joining global carbon pricing. As high-income regions benefit if more regions participate, they could incentivise low-income regions to do so, too.

Key policy insights:

Many economies around the world have committed to ambitious climate goals. In order to reach these goals, they are searching for suitable policies to mitigate climate change. From an economic point of view, carbon pricing is a promising approach. However, it might trigger carbon leakage – i.e. the relocation of the carbon-intensive production of “dirty” goods to regions without a carbon price. Not least for this reason, international cooperation on climate policy is key. A carbon border adjustment mechanism might also limit carbon leakage. One prominent idea is that regions get together to form a “climate club” as described in Nordhaus (2015), i.e. with a common carbon price and a carbon border adjustment mechanism. Ernst et al. (2022) analyse the macroeconomic and welfare implications of different policy scenarios. These comprise carbon pricing, border adjustment and a climate club. This policy brief presents our approach and depicts the main results.

The model is a multi-region extension of the multi-sector model EMuSe presented by Hinterlang et al. (2021). Countries are grouped into three regions according to their current assumed attitude towards climate protection. The regions roughly represent Europe, North America and the rest of the world, and are labelled as such for brevity. Each region consists of eleven different production sectors. The sectors are multiply interrelated, also internationally because economic agents engage in international trade. The sectors vary in factor intensity, use of intermediate inputs, and contribution to final demand. We derive the sector-specific parameters using the most recent release of the World Input-Output-Database (WIOD) (see Timmer et al. (2015)). Emissions occur as a by-product of production and carbon intensities differ by sector, too. The latter are measured as emissions per unit of output. To calibrate sector-specific carbon intensities, we use environmental accounts provided by the European Commission and output data from the WIOD. Firms in each sector can engage in costly abatement activities. They do so only in case of a positive carbon price and the higher the price is, the more emissions they abate. Unabated emissions increase the stock of carbon in the atmosphere. Firms face production damage resulting from the stock of pollution, e.g. due to extreme weather events. Due to a lack of data, we calibrate the abatement cost and damage functions equally across sectors and regions. Also, note that direct welfare implications of pollution on households’ utility are not included.

Apart from the production structure, the model is rather standard. In each region, a representative household maximises the stream of expected utility by choosing consumption, labour supply, physical capital investment and purchases of internationally traded assets. Labour and the capital stock are only imperfectly mobile across sectors, and not at all across regions. However, domestic households can indirectly invest in foreign capital by purchases of internationally traded assets. A fiscal authority runs a balanced budget by paying out lump-sum transfers and receiving income from taxes on labour income, consumption and emissions as well as from border adjustment.

We introduce carbon pricing either regionally (in one or two regions) or worldwide (in all regions) and with or without border adjustment. This leads to five different policy scenarios:

Scenario 4 corresponds to a climate club following Nordhaus (2015), whereas scenario 5 shows what would happen if the entire world participated in carbon pricing.

Based on NGFS (2021), we feed the carbon price path exogenously into the model. Thus, the results presented below depend on these price developments. If a region introduces carbon border adjustment, it taxes all imports from regions without (or with lower) carbon prices. In doing so, it taxes the carbon emissions of imported goods with a tax rate equal to the domestic carbon price.1 Carbon leakage refers to a situation in which countries with stricter emission constraints purchase emissions-intensive products from countries with laxer ones to reduce costs related to climate policies.

The model contains endogenous change in abatement, but apart from this, no technological change. More specifically, the parameters concerning production, damage function and the factor intensities are constant over time. This also holds for the inter-sectoral linkages. Hence, the model abstracts from likely, but unknown, future changes due to structural transformation.

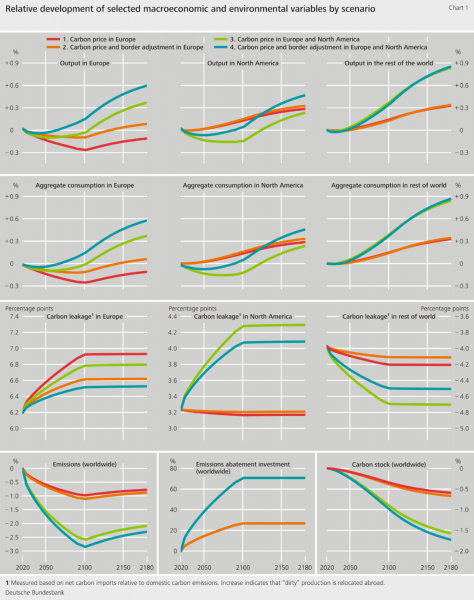

The simulations show that regions that impose a carbon price suffer macroeconomic losses initially and catch up again over time (see Chart 1). The losses arise because production costs increase and products become more expensive relative to those of the other regions. Higher prices reduce demand and income, causing consumption to fall. At the same time, emissions decline because of the increased carbon price. Hence, the world emissions stock falls. This eventually translates into a reduction in economic damage, which causes relative productivity gains. Once they are sufficiently strong, the downturn is over and the economy starts catching up. Other regions without a carbon price benefit directly from positive trade effects (and indirectly from falling emissions), while some of the carbon emissions saved domestically are relocated abroad (carbon leakage).

The border adjustment mechanism changes these trade effects only marginally, given that the resulting relative price increase for foreign goods is rather small (see scenarios 2 or 4 in Chart 1). Hence, the border adjustment mechanism does only little to prevent carbon leakage. If, however, domestic exports abroad were exempted from the carbon levy or a much higher tax rate was chosen, this effect could be greater in size. Scenarios in which North America joins Europe in imposing carbon pricing indicate a significantly stronger decline in global emissions (scenarios 3 and 4). Then losses fall worldwide and the catch-up process starts sooner. In addition, a higher long-term level of production is achieved. The effects of scenario 5 match those of scenario 4 in qualitative terms. They are, however, significantly larger and are omitted here in order to improve the clarity of the remaining scenarios.

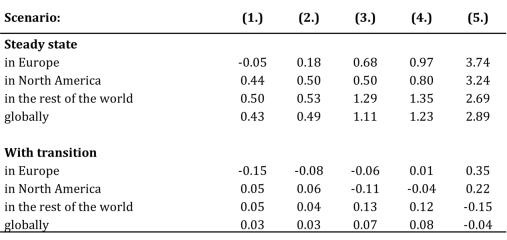

The results indicate that, in the long run, and from a pure steady-state comparison, the best situation is achieved if all regions participate in carbon pricing. Then, households can increase consumption and leisure most (see Table 1). If such a global approach to carbon pricing does not come about, it still holds that the more regions that participate, the better. However, the transition to the new steady state takes time, and people initially lose when introducing carbon pricing. This raises the question of how to evaluate carbon pricing overall, taking into account the steady state implications and the transition paths. We seek to answer this question within our model by conducting a welfare analysis. In doing so, we compute the lifetime consumption-equivalent gain of the representative household in line with Lucas (2003) as a result of the change in tax policy (Table 1).

Table 1: Welfare effects

Table shows welfare implications of different carbon pricing scenarios, expressed in consumption-equivalent gain for the representative household of Europe, North America and the rest of the world as well as the weighted average of households in the entire world in line with Lucas (2003) in percentage deviation from initial steady state.

The analysis shows that the transition is extremely costly: While welfare gains seem large when comparing steady states, the picture reverses itself once the transition paths are taken into account. In particular, households from the rest of the world with low per-capita income in the initial steady state face disproportionately large welfare losses. Another finding is that, when one or more regions introduce carbon pricing, it is generally not beneficial for the remaining regions to join. This already holds for a steady-state comparison (except for the situation in which all regions participate). It becomes even more relevant when taking into account the transition paths. In the model, comparing columns (3.) or (4.) with (5.) shows that the rest of the world has no incentive to join carbon pricing if the regions Europe and North America do so.

This leads to the question: Can high-income regions incentivise low-income regions to participate, too? Indeed, the model can identify an equilibrium in which all regions benefit over time from a global carbon-pricing regime. To this end, the wealthier regions will have to surrender some of their welfare gains from the global carbon price – for example, by means of direct transfers or carbon price discrimination. However, given the nature of model analyses of this kind, the quantification is highly uncertain. This is particularly true for welfare functions.

Our model simulations show that carbon pricing generates an economic downturn initially as production costs rise. Benefits from lower emissions damage materialise only in the medium to long run. A border adjustment mechanism mitigates but does not prevent carbon leakage. From the perspective of a region that introduces carbon pricing, the downturn is shorter and long-run benefits are greater if more regions levy a price on emissions. However, for non-participating regions, there is no incentive to participate as they would forego trade spillovers from carbon leakage and face higher production costs along the transition. In the end, they may be better off not participating. Because of a costly transition, average world welfare may fall as a result of global carbon pricing unless the rich assist the poor. Our analysis clearly highlights the importance of comprehensive coordinated action against climate change, able to factor in the needs of different regions.

Ernst, A., N. Hinterlang, A. Mahle and N. Stähler (2022). Carbon pricing, border adjustment and climate clubs: An assessment with EMuSE. Discussion Paper 25/2022, Deutsche Bundesbank.

Hinterlang, N., A. Martin, O. Röhe, N. Stähler and J. Strobel (2021). Using energy and emissions taxation to finance labor tax reductions in a multi-sector economy: An assessment with EMuSe. Discussion Paper 50/2021, Deutsche Bundesbank.

Lucas, R. E. (2003). Macroeconomic Priorities. American Economic Review 93(1), 1-14.

NGFS (2021). NGFS climate scenarios for central banks and supervisors. Technical Report June 2021, Network of Central Banks and Supervisors for Greening the Financial System.

Nordhaus, W. (2015). Climate Clubs: Overcoming Free-Riding in International Climate Policy. American Economic Review 105(4), 1339-1370.

Timmer, M. P., E. Dietzenbacher, B. Los, R. Stehrer and G. J. De Vries (2015). An illustrated user guide to the world input-output database: The case of global automotive production. Review of International Economics 23(3), 575-605.