This Policy Note is based on “The End of Free EU ETS Rights: the Carbon Bill Reshaping European Industry”, RaboResearch, 2023.

The carbon costs for the industry in the European Union will significantly rise due to recent changes in regulation. The article assesses the magnitude of these changes and their implications for the main industrial sectors. As the supply of EUAs becomes progressively more restricted and their demand grows, the unit costs will go up. According to our business-as-usual scenario assessment, costs may increase between 2.5 times to more than twentyfold, depending on the sector.

In the light of those findings, we discuss the main change drivers for the industrial competitiveness in the years ahead. A new carbon-driven competitiveness will emerge in the EU market. The decision will no longer be if to invest in decarbonization, but where and when.

This May, the Official Journal of the EU published the agreement reached by European Parliament and the European Council on proposed regulation to reform the European Union Emissions Trading System (EU ETS) and to establish a Carbon Border Adjustment Mechanism (CBAM). Launched in 2005, the EU ETS is a “cap and trade” carbon market under which companies are required to buy or trade rights to emit carbon dioxide. The newer CBAM is a levy on carbon-intensive goods entering the EU, with the goal of leveling the playing field for EU companies subject to carbon pricing, and encouraging emissions reductions in industry outside the EU. (See Rabobank’s previous articles explaining the fundamentals of the EU ETS and the CBAM regulation for more detail.)

The approved text contains provisions that mark a significant step forward in political ambition in terms of increasing economic pressure to reduce industry-related CO2 emissions. It is therefore essential for affected EU industry players to understand the implications of the approved regulation on their businesses and competitiveness.

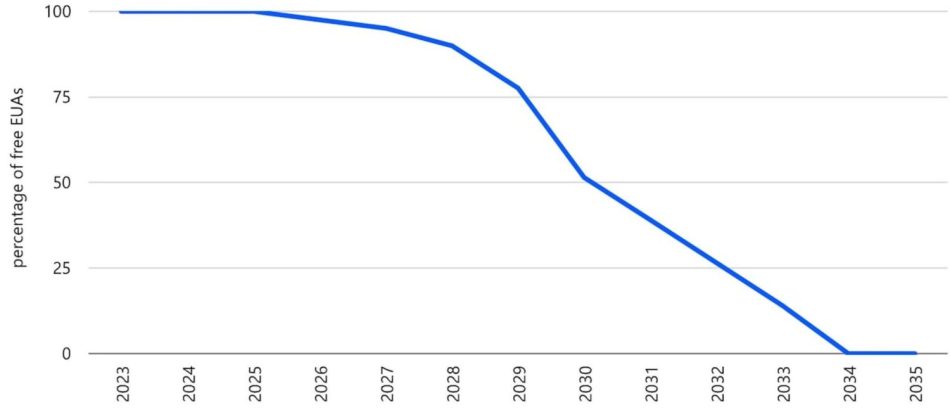

In a nutshell, the new regulation includes gradually phasing out the free share of EU ETS emission rights – the so-called EU Allowances, or EUAs – currently given to the industry. Figure 1 shows the proposed phaseout. The CBAM’s CO2-related levy will be inversely phased in, as the free EUAs are phased out.

Figure 1: European Parliament’s agreed proposal to phase out the EUAs

Source: European Commission, Rabobank 2023.

The economic sectors covered by the EU ETS (namely, power production and industries designated as energy intensive) must cut their joint emissions by 62% by 2030 from 2005 levels. To ensure success, the phasing out of free EUAs will be accompanied by an annual reduction of the total number of EUAs made available to the covered sectors. A yearly 4.3% reduction from 2024 to 2027 and a 4.4% reduction from 2028 to 2030 will be drained from the market supply. In parallel, the CBAM will be gradually applied starting in 2026, and fully phased in by 2034.

While the new regulation includes other relevant measures – such as the establishment of an additional ETS scheme for buildings and road transport emissions, and provisions for the shipping sector – this article focuses on assessing the implications that the end of the era of free CO2 allowances will have for the currently regulated industry. We also outline key considerations for companies deciding how to ride out the perfect storm hitting the European industrial energy supply following the Russian invasion of Ukraine.

EU industry will get its final push for decarbonization under the EU ETS amid challenging circumstances. Leaving behind the days when EU ETS allowances became an unexpected and perverse source of income, and deprived of cheap Russian gas, carbon-intensive industries will now also face an increasingly high emissions bill. If that weren’t enough, the approved new regime includes multiple provisions to disincentivize lagging strategies. For example, Article 10a’s obligation to perform energy audits could result in the further reduction of a given company’s free allocation, if that company does not implement the audit’s recommendations in a timely manner.

The current political context in the EU only fuels the need to prepare for this paradigm shift. The current European Commission term runs until the elections in June 2024, with a new commission likely in place by Q4 2024. We expect one of two possible outcomes:

Either way, the greener direction of EU policies is likely to remain. What’s more, EU ETS regulation is now more entangled than ever with the redesign of the EU’s industry policy, kickstarted with the Net-Zero Industry Act and the Green Deal Industrial Plan. In the context of a war-shaken, expensive gas supply, both streams of regulation – industry support and decarbonization – are difficult to understand in isolation. They are also likely to be further tightened, given the global geopolitical context.

Mastering these emerging dynamics is, and will be, essential for any industry player – especially those who want to remain leaders in their business. Prime movers now have the chance to leverage their currently not-so-evident advantages, while the wait-and-see window is rapidly closing for the followers. After 2025, laggards will face both carrot and ever-greater stick policies to start decarbonizing.

Each industrial subsector has its own particularities, and successful strategies to navigate the changing regulation must take these also into account. Below, we outline the essential points that any decarbonizing investment decision must weigh: from estimating a company’s increasing carbon bill to understanding the main forces reshaping industrial competitiveness ahead.

As discussed, the supply of EUAs will become progressively more restricted and expensive after 2025. In short:

To balance such an increasingly tight market, the EU ETS also includes a market stability reserve (MSR) mechanism. The MSR regulates the number of EUAs in circulation. Having been designed learning from past price hikes, it can be expected to temper extreme market fluctuations.

Weighing these pressuring and balancing forces in the market, we expect a gradual upward price evolution for the EU ETS going forward, as depicted in the curve in Figure 2 from BloombergNEF.

Figure 2: EUAs’ expected price evolution

Source: BloombergNEF, Rabobank 2023.

Only in the event of an industry or economic collapse would these EUA market dynamics move in a direction other than up. If too many players cease their activity, the supply and price dynamics may be disrupted. But, as hinted by the events after the Russian war in Ukraine, policymakers will go to great lengths to prevent this scenario from happening. From this perspective, the described upward dynamics are the optimistic scenario for the future. That is, apart from the other, also unlikely, even brighter side of the coin: If a very relevant share of companies swiftly make their required decarbonization investments, then the carbon price could temper its expected growth temporarily.

Given the clear expectation of a restricted and increasingly expensive supply of EUAs, it is critical for companies to have perspective on what their future carbon budgets might be. Carbon budget projections should, at a minimum, link expected short- and mid-term production with the required expenditure in EUAs. They have to provide the context required for framing key operational decisions for the road ahead. Having foresight on future carbon needs and spending can also help companies evaluate decarbonization strategies or help them understand the implications of an early or delayed investment decision.

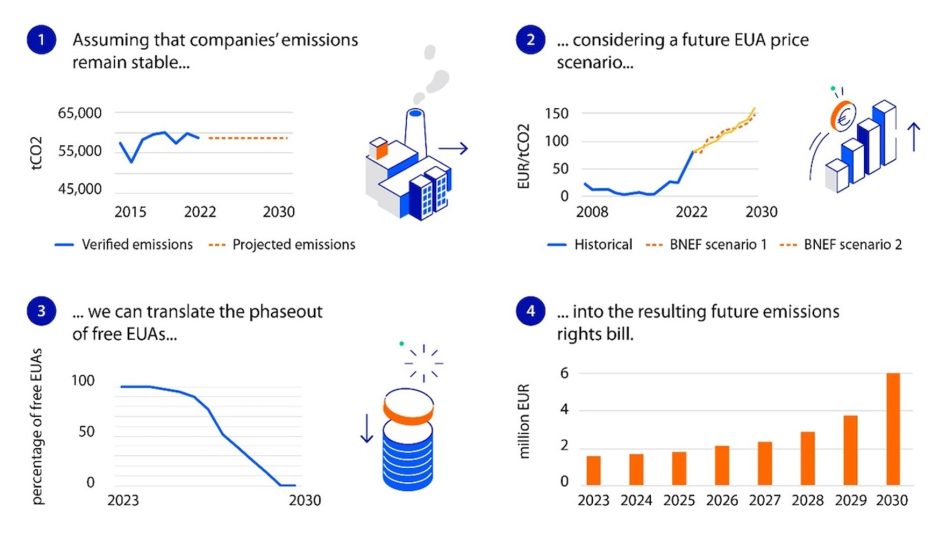

As Figure 3 depicts, it is possible to anticipate a given company’s basic carbon budget in the future using mostly publicly available EU ETS data. The process includes determining:

Figure 3: A future carbon budget assessment

Source: European Commission, BloombergNEF, Rabobank 2023.

Considering the layout of information that this exercise requires, it becomes clear that the longer a company waits to invest in decarbonizing technologies, the more expensive its EUA bill will become. Unspent free allowances can be used to finance decarbonizing investments. The earlier the investment decision is made, the bigger the EU ETS-derived support it may leverage.

Of course, an increasing carbon bill is only one part of the story. Any serious planning for the bumpy road ahead will also have to consider all the “regular” strategic concerns and the ever-evolving context of things like fuel prices, the positioning of the competitors, substitutive products, and trade dynamics.

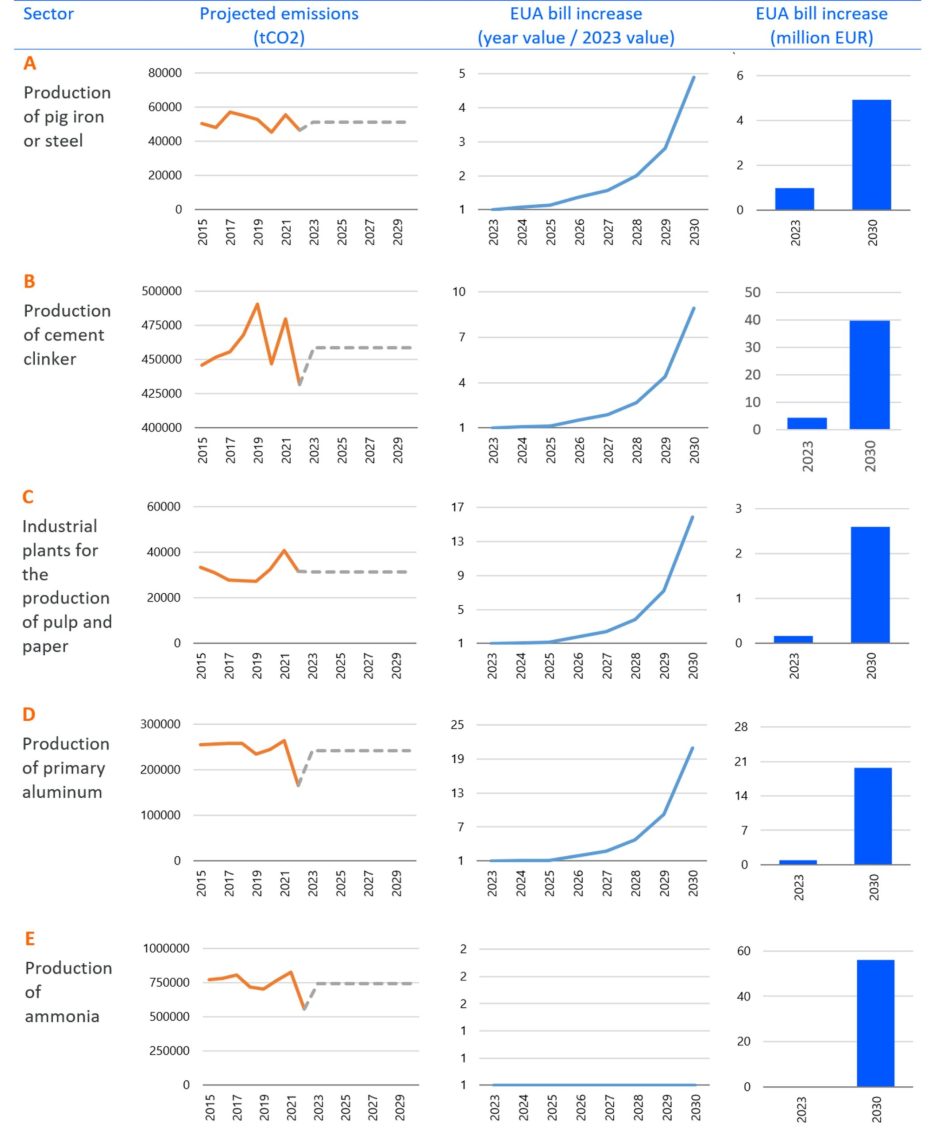

To illustrate the conditions in which industry players need to learn to navigate, Figure 4 presents examples of carbon budget projections from different industrial sectors. Using the method outlined in Figure 3, we built projections for five imagined companies representing the “median” of their sector. They show an ideal company with a median emissions intensity – with half of the sector emitting more CO2 and the other half emitting less.

For the sake of comparison, we have opted to assume a business-as-usual scenario, in which all players continue to emit the same quantity of CO2 as their corresponding 2015-2022 average. This scenario also assumes that the companies won’t make any energy transition investments during the period assessed. A company conducting an actual exercise in this type of strategic thinking would naturally benefit from using more detailed demand and expected activity forecasts, and incorporating more sophisticated investing perspectives.

Figure 4: Increased EUA bills for median sectorial emissions, 2023-2030

Source: European Commission’s EU ETS Registry, BloombergNEF, Rabobank 2023.

The key takeaway from these examples is clear: Under a business-as-usual scenario, no matter the sector, without any strategic reaction, the cost of CO2 will be multiplied several times along the way to 2030. A “no-action” strategy will, thus, have an increasingly negative impact on companies’ operational results due to their growing carbon bills. The 2023-2030 cost increase per company ranges from 2.5 times for a median company in the pulp and paper sector to a twentyfold increase for the median aluminium production facility. The median production facility for ammonia registered a surplus of EUAs in 2023 so its expected cost increase can only be measured in absolute terms: from zero in 2023 to EUR 56m by 2030.

The EUA cost projections provide valuable insights into what each sector can expect in terms of increase CO2 costs. Under a business-as-usual scenario, the way a sector is projected to evolve is influenced by:

Within a given industrial sector, companies will experience the future’s pricy CO2 environment in different ways. Decarbonization outcomes will depend on companies properly tuning their decision-making for their unique carbon situation.

Company leaders need to be asking: Where am I? Where does my company stand, carbon wise? To what extent will a growing EUA bill affect my business’s financial returns? Answers to these questions require looking at both market and production variables.

On the market side, companies first need to determine how demand for their products might react to carbon-driven price increases: Will demand follow, contract, or move? Are customers willing and/or able (or forced) to absorb a higher EUA bill? Are they able or willing to go the opposite route and even pay more for a less-carbon-intensive product, for example, due to their corporate decarbonization strategies or regulations forcing them to do so? Understanding customers’ demand elasticity, and how it may change in the coming years, will be one of the key elements to determining a corporate EU ETS/decarbonization strategy. The complete picture should incorporate potential spillover effects as customers and producers move to sourcing from less carbon-exposed products or sectors. Companies should also look for opportunities to replace other sectors’ products as well.

From a production and process perspective, a company’s carbon competitiveness will be the result of its interlinked carbon and energy intensities.

Ultimately, all of EU industry – except for the hardest-to-abate sectors, which can only consider carbon capture and storage – will have to become carbon free. So, for players that choose to remain in their activity, investing in decarbonization is matter of a) carbon financials b) technology choice and, c) timing.

Since 2005, the EU ETS regulation has been deployed gradually, in differentiated phases. There is already plenty of publicly available information to build an operational roadmap through the decarbonization on the horizon. Companies restricting their planning to a business-as-usual way of thinking may critically compromise their viability.

In this article we have analysed the main changes that the new EU ETS regulation has introduced for European industry. While one can expect that major corporations are very aware of the impact of the coming changes, it is essential for any player to understand the dynamics that are head of us.

We have illustrated how the size of the changes ahead for a given company or sector can be quantified, to a great extent, using publicly available data. Without decarbonizing investments, the carbon bill will grow several times between now and 2030 – from two- to threefold up to twentyfold – for the median company in a given sector, depending on their carbon intensity. These numbers can go even higher for carbon-intense plants in the most critical sectors.

Such increases will reshape the way industry looks in the next ten years. We have explained how sectorial resilience and carbon exposure define the starting points for the road ahead. Setting the optimal transition speed requires a good understanding of other players (or even other sectors). Ultimately, the match will be decided through the interplay of one’s own carbon and energy intensity, and those of the connected players and sectors.

The key decision for companies to make is when and how to invest in decarbonizing. As with every investment, decision-makers will have to weigh timing, finances, and technology advantages. But within the EU ETS, strategic timing will also determine the extent to which a company benefits from laggards’ need to keep emitting.

And of course, the changing forces depicted in this article are just the tip of the melting iceberg. In the next article in this series, we will dive into trade: how and if growing carbon costs will affect the trading competitiveness of companies covered under the Carbon Border Adjustment Mechanism. Finally, in a last chapter of this series, we will discuss how EU industry players can ultimately integrate all these carbon-related forces into “traditional strategic thinking.”