This Policy Note is based on “The end of free EU ETS rights: The missing bricks in the CBAM wall”, RaboResearch, 2023.

In this article we analyze the Carbon Border Adjustment Mechanism (CBAM) – a levy on carbon-intensive imports – which will be phased in as EU industry’s free carbon allowances are phased out. The loss of free EU ETS allowances will greatly increase companies’ carbon bills, potentially affecting their competitiveness. The CBAM aims to mitigate possible unfair competition from non-EU industry that doesn’t face carbon-related regulation. The level of mitigation depends on a) the European producer’s relative carbon intensity compared to foreign products and b) the importance of extra-EU trade in their sector. We identify three ways the CBAM might function in different sectors.

We also illustrate how conventional competitive advantages may interact with the EU’s new carbon policies. High natural gas prices, for example, can add extra pressure on firms to decarbonize by altering or even canceling out the CBAM’s intended protection against carbon leakage. The examples provided in this article should encourage companies not yet prepared for the wave of change approaching their sector to reflect on their next steps.

In the first article in this series, we analyzed the potential financial impacts for EU companies covered by the EU Emissions Trading System (EU ETS) following the end of freely allocated carbon emission rights (EUAs). We concluded that the growing carbon bill they can expect will partly reshape intra- and inter-sectorial cost competitiveness within EU industry. Companies are urged to take action to avoid a substantially higher carbon bill, which could increase from 2.5 times up to twentyfold for a median company in the sectors we analyzed.

In this follow-up chapter, we focus on the potential changes that the phasing in of the Carbon Border Adjustment Mechanism (CBAM) could mean for both intra- and extra-EU trade competition.

Our colleagues previously discussed the essentials of the CBAM, which is basically a levy on carbon-intensive goods entering the EU. We begin our analysis here by considering how sensitive EU companies’ cost competitiveness is compared to non-EU competitors, and how the CBAM might influence their trade positioning. We go on to offer a simplified example to illustrate how “traditional” cost components – such as natural gas prices – might interact with the EU’s new carbon policies and how they might affect the carbon cost compensation designed to be provided by the CBAM.

The CBAM is designed to comply with WTO rules on the basis of the diverse carbon intensities seen across different producers for the same products. Within the EU market, the CBAM aims to ensure that both domestically produced goods and those imported to the EU face similar carbon cost pressure. It will do so by applying a levy to imported goods equal to the internal EU ETS-related carbon price, based on the compared carbon intensities of the relevant production processes.

This design will result in a higher cost increase for the more carbon-intensive producer.

In a nutshell, the CBAM has different implications for different industrial players. In principle, it will deflect competition from more carbon-intensive imports but, on the other hand, its combination with the phaseout of free EUAs may also result in increased competition from foreign producers with a lower carbon intensity. And if no additional measures are implemented, European producers not taking action to decarbonize and facing higher carbon costs might lose their export market share.

How sensitive EU firms will initially be to this change in EU carbon policy depends on, among other factors, a) the relative carbon intensity of an EU producer compared to competing non-EU producers and b) the level of competition with non-EU companies regarding imports and exports.

The size of the imports in a given sector hints at the existing level of competition from non-EU producers. If imports to the EU in a particular sector are low, it implies that the current level of competition with foreign producers in the EU market is low. High imports imply that competition is already substantial in a given sector, indicating that the pressure on companies to decarbonize to remain cost competitive may be even stronger.

For products sold by EU producers outside of the EU, the current formulation of CBAM does not (yet) have mechanisms to restore a level carbon playing field. Whether Europe can avoid this so-called carbon leakage – an increase in emissions in one place as a result of stricter emissions regulations in another – depends on whether additional policy measures are implemented to compensate for the loss of cost competitiveness. Such measures might be introduced after the transition period, as indicated in the current version of the EU regulation on the CBAM.1 Without them, carbon-intensive EU producers might (additionally) lose part of their export shares.

Overall, a company’s competitiveness will be most sensitive to the new industrial carbon policy if competition pressure from imports is already high, and if the carbon intensity of (a large share of) imports is lower. In this case the incentive to decarbonize will be strongest.2

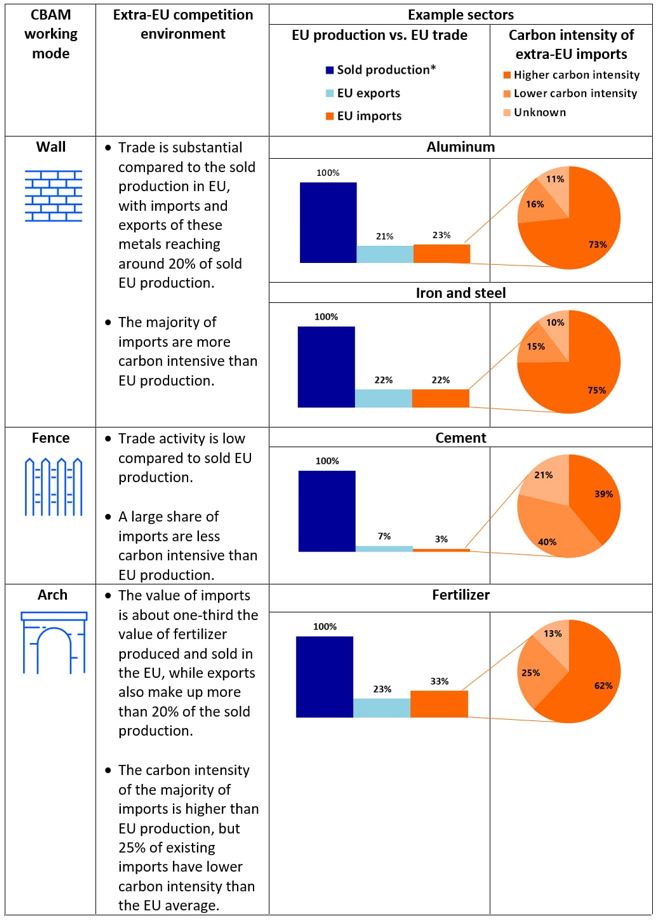

In table 1 we analyze the above factors – import and export competition, plus relative carbon intensity – for a sample of relevant EU sectors that will be covered under the CBAM. We present this analysis through what we refer to as different CBAM “working modes,” characterized by a wall, a fence, and an arch. While the European Commission has already signaled that the CBAM could be extended to almost any sector at risk of carbon leakage, our analysis initially covers cement, iron and steel, aluminum, and fertilizers. (The choice of sectors is based on data availability.)

Table 1: Competition modes after the introduction of CBAM for selected sectors*

*Note: the analysis in this table is based on the monetary value of sold production by EU-27 producers, imports to the EU-27, and exports from the EU-27 from Prodcom. Sold production is defined as the production that is sold outside of a company and does not include production used by the same company to produce other outputs. It also excludes production that goes to the inventory. We also use detailed WITS trade data on imports to the EU combined with carbon intensity data from the World Bank to show the size of imports that are already more carbon intensive relative to the EU average. Average emissions intensity data includes direct emissions for iron, steel, and aluminum. For cement and fertilizers, indirect electricity emissions are included as well. The average emissions intensity data may be subject to inaccuracy due to sector aggregation. Data from 2019 was used to exclude disturbances from the Covid-19 pandemic and the war in Ukraine. Figures are subject to errors which may result from a) misalignment of Prodcom classifications and the CN codes used to specify CBAM products in the EU Regulation 2023/956 and b) missing data points for subcategories. For subproducts where EU production data was available but no data on imports or exports was available, we excluded EU production data as well.

Source: Prodcom, World Bank, WITS, Rabobank 2023.

Looking at the aluminum or iron and steel industries, we can see that the average producer in both sectors faces considerable foreign competition. And the majority of imports are more carbon intensive on average. In these sectors, the CBAM can be seen as a quite protective “wall” for EU producers against more carbon-intensive imports. The increasing EU ETS charges will be lower than the CBAM levy that the majority of non-EU imports will face. Additionally, there is considerable potential in the home market to claim market share from these more carbon-intensive non-EU producers. On the other hand, without additional support measures, the average player in this market may risk losing its EU export share.

In other sectors, like cement, the CBAM is likely to play a not-so-close border role. In what we’re calling the “fence” working mode, the CBAM should filter out the light stream of imports with a higher carbon intensity. For sectors like this, both imports and exports to the EU are relatively low (<10%) when compared with the domestic market size.3 This partly owes to the fact that cement is relatively low in value and difficult to transport. The low volume of EU exports means that the average player in this market is not critically dependent on additional measures to mitigate carbon leakage via the export channel. The story is more interesting regarding the EU internal market. Low imports indicate there is currently not a lot of competition from outside the EU. However, in the cement sector, the carbon intensity of a large share of current imports is lower than that of domestic production. External competitors might therefore become more cost competitive, especially when the non-free EU ETS allowances and CBAM duet is fully enforced. In short, competition in this market may intensify.

Last but not least, we introduce the “arch” CBAM mode, in which the CBAM will not significantly protect the current level of competitiveness. Companies in this situation, like fertilizer producers, are comparatively more sensitive to the analyzed policy changes. In markets like these, imports are more than one-third the size of production sold by EU producers in Europe and exported. These sectors show a relatively high level of competition. Although the majority of exporters to the EU are currently more carbon intensive, at least a quarter of non-EU imports are less carbon-intensive. This quarter is well positioned to significantly increase competition in the years to come.

While Table 1 provides an overview of the main possible sectorial situations and strategic considerations, corporate decision-makers are strongly advised to extend their analysis far beyond the assessment of the carbon intensity of extra-EU importers or import and export shares. For example, some countries, like Norway, are exempted from the CBAM or might introduce a comparable carbon price. Yet, at this high level, our analysis shows where and how companies in the four sectors analyzed are most sensitive to changes in EU carbon policy.

As explained, the CBAM will, to different extents, filter out the potential advantages of those competitors facing comparatively lower carbon costs. However, if their advantages stem from non-carbon related cost components, the competition will not be alleviated by the new European carbon policies. In those cases, foreign competitors will still be able to maintain, or even leverage further, their relevance in the European market. The new carbon policies are only one of the elements shaping the competition ahead.

To illustrate the interplay in the cost race between carbon-related and “traditional” cost components (such as capital, energy, or raw materials), we have created a simplified example. It incorporates characteristics of industries traditionally relying on natural gas supply, like the pulp and paper industry or some of the production of non-ferrous metals.

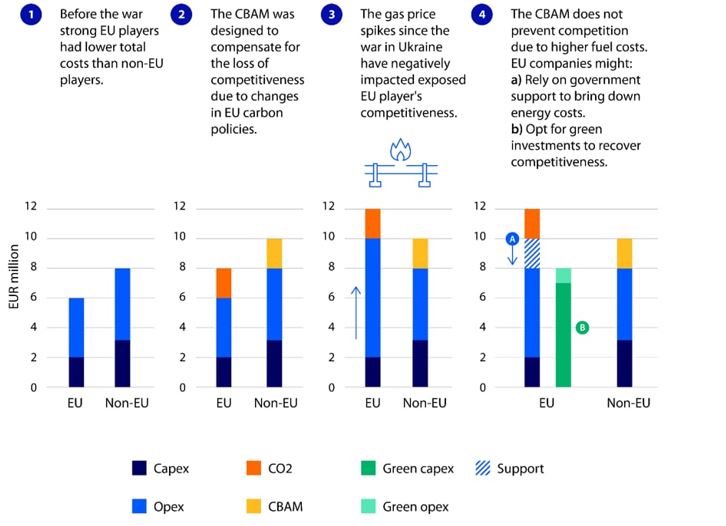

Figure 1 depicts how the intended effect of the CBAM on extra-EU competition might be canceled out due to a more expensive gas supply, such as after the Nord Stream gas pipeline explosion. The figure shows a simplified version of the complex interplay of all cost components, but it also incorporates the core elements playing a role in the decarbonization decisions of a company.

Figure 1: Potential impact of high gas prices on how the CBAM operates

Note: Numbers are for illustrative purposes only and do not represent actual company or industry data.

Source: Rabobank 2023.

Prior to 2022 (see the first graph in figure 1), our illustrative EU company, like others, had a cost structure made of capital expenditures, or capex, and operating expenses, or opex. For an industrial company like the one in our example, capex is largely technology-related and opex is to a great extent fuel-related. It is reasonable to assume that, if our company was performing well in a market that wasn’t flooded by competitors, it must have been thanks to a lower total cost of production compared to non-EU competitors. (In figure 1 this is depicted as EUR 6m for our EU company versus EUR 8m for a non-EU peer.) Extrapolating from historical industrial developments in Europe, we can argue that EU producers’ higher and earlier technology investments yielded this lower capex. Given this advantage, they would have been able to compete with the assumed similar (mainly gas-related) opex of extra-EU players.

The second section in figure 1 illustrates how the CBAM was designed against this backdrop to compensate for the progressively higher carbon bills that only producers in the EU will face, providing EU producers a level playing field in their home market. In the pre-2022 situation, the CBAM would have bought EU producers investment decision time, sustaining their positioning in front of their non-EU competitors, (at least partially) compensating for the increasing CO2 costs imposed on EU-based players.

But, as captured in the third part of figure 1, gas prices in the EU jumped significantly in the wake of the war in Ukraine. Specifically, the gas price in the EU increased from the pre-2022 average of EUR 15/MWh to the current level of around EUR 30/MWh, with various peaks in between. As a result, in our example, those non-EU players with access to cheaper gas become more cost competitive, since CBAM isn’t meant to compensate for non-carbon-related competition. If this situation persists, it may effectively pierce a hole in the CBAM’s intended protection, shortcutting the adaptation period for European companies.

The fourth and final scene in figure 1 shows the two choices left for EU companies that want to remain in business in the current gas price environment.

Such investments will change these company’s cost structures. In the simple case of low- and medium-temperature industrial processes, green electrification is the easiest route toward decarbonization. Such investments would make their technology (namely, capex) carbon free, as depicted in green in the fourth graph in figure 1. Such green capex would typically be higher than companies’ former, carbon-intense capex that is already somewhat paid off. On the other hand, fuel costs (opex) can be expected to become smaller than the previous gas-fueled costs. Moreover, decarbonized companies will not face any EU ETS-related costs.

An industry frontrunner would make such an investment when the new cost structure would allow retaining (or even enhancing) their former competitiveness. As a result of a gas price hike, decarbonization could turn out to be the only option for companies meeting the described conditions to remain competitive.

While this example illustrates a clear interaction between traditional cost components and carbon policies, every player needs to take on board their own starting situation and their sector’s relative position compared to non-EU players, both in terms of carbon and total cost competitiveness.

Despite being a simplification of the more complex reality, our example should still point out that, while the CBAM may offer EU companies some reflection time, it isn’t a cushion to rest on, even less so given the current geopolitical climate and high energy prices.

In this second article of our series on the EU ETS reforms, we analyzed the main changes in the competition that could be triggered by the EU’s new carbon policy: namely, the phaseout of free EUAs given to EU industry combined with a CBAM imposed on extra-EU producers.

The analysis illustrates how sensitive different EU sectors and producers might be to the policy change. The new carbon policy may have different impacts for EU producers, depending on a) the current level of foreign competition in their market and b) the relative carbon intensity of foreign competitors’ products. Based on different potential configurations of these factors, we have mapped three main starting positions for the CBAM, baptized as working modes.

These CBAM working modes – the wall, the fence, or the inviting arch – represent the different sensitivities EU industry might have toward the EU’s carbon policy change. For the design case, the CBAM can indeed work as protective “wall” against the significant share of cheaper, more carbon-intensive imports to the EU. Yet, without further protective policy measures, EU companies in this scenario may lose some of their export share. The CBAM can also function as a “fence,” when trade from outside the EU is not very significant compared to the internal market size. In this case, there is little competition and CBAM will keep filtering out the few imports from more carbon-intensive foreign producers. Finally, CBAM may work in a weak or “arch” mode, when there is already significant cross-border trade and a noticeable share of imports have a lower carbon intensity than their European counterparts. In this case, higher levels of competition from non-EU players can be expected.

The CBAM only prevents EU producers from losing competitiveness due to the difference in carbon-related costs. However, other non-carbon related differences in expenses – such as higher natural gas prices – will not be balanced by the CBAM. Thus, in the current geopolitical context, increased pressure to decarbonize may come not only from higher carbon prices and from a company’s relative carbon intensity, but also from other “traditional” cost differences, like gas prices.

In the next article we will propose how to weigh the different decarbonization policies together. We will also include complementary considerations regarding alleviating measures, such as hedging or adopting EUA buying strategies to lessen carbon bills. As EU ETS reforms and the CBAM come into force, such complementary strategies may be the glue to help companies hold the decarbonization puzzle together.

See Article 30, paragraph 5, of Regulation (EU) 2023/956.

Further factors, such as the implementation of carbon policies in regions that EU sectors compete with, will also play a significant role in the equation.

To approximate the EU market size, we used data about EU sold production by EU producers from Prodcom.