References

Barrage Lint, and William D. Nordhaus. Policies (2023), “Projections, and the Social Cost of Carbon: Results from the DICE-2023 Model”, Working Paper #31112, National Bureau of Economic Research.

Ecorys (2009), “Study on the competitiveness of EU eco-industry”, Report for the European Commission, Ecorys Macro and Sector Policies.

IPCC, Intergovernmental Panel on Climate Change (2021). “Climate change 2021: The physical science basis”, contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change.

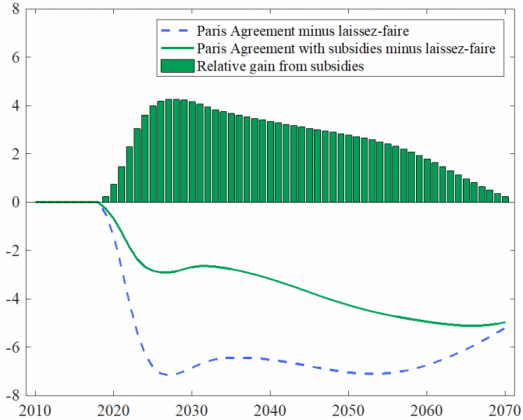

Jondeau Eric, Gregory Levieuge, Jean-Guillaume Sahuc, and Gauthier Vermandel (2023), “Environmental Subsidies to Mitigate Net-Zero Transition Costs”, Working Paper #910, Banque de France.