The EU is planning to introduce a Carbon Border Adjustment Mechanism (CBAM). The greatest strength of this instrument is its international orientation. Should the EU succeed in minimizing political risks through smart negotiations and with diplomatic skill, the CBAM can be an opportunity for global climate action and pave the way for a global climate club. This will require a differentiated treatment of international partners, depending on the intensity of trade relations and on the respective climate policy ambitions. Ideally, the CBAM leads to an international convergence of carbon pricing – which would ultimately render the instrument itself superfluous again.

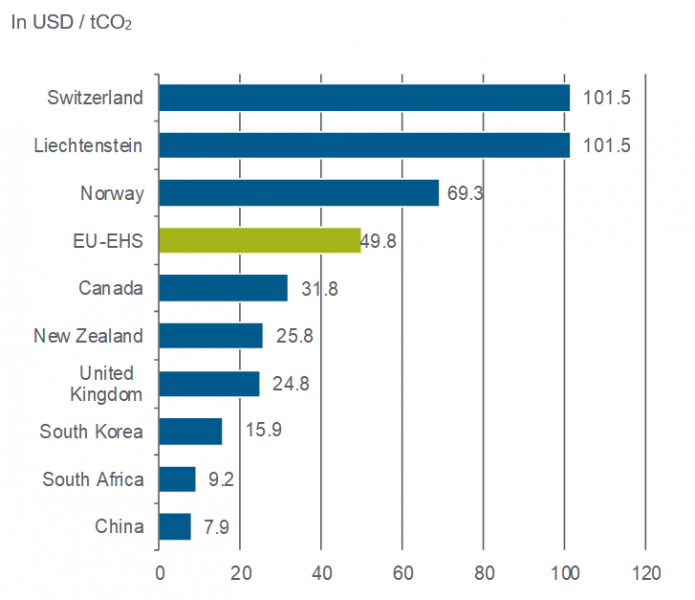

The European Union (EU) is stepping up its efforts on climate action. Under the Green Deal, the EU wants to cut its greenhouse gas emissions by 55% by 2030 relative to the 1990 baseline level and be the first climate-neutral continent in the year 2050. As the EU Emissions Trading System (EU ETS) is to remain a key instrument of European climate policy, the carbon price is likely to rise significantly in the coming years. Only few countries among the EU’s trading partners have comparatively high explicit carbon prices even today (Figure 1). This constellation could lead to a loss of competitiveness particularly in emissions-intensive industries whose products are traded globally – and to a shift of production and emissions (carbon leakage) outside the area of validity of the EU ETS. Although this would lower emissions in the EU territory, nothing would be gained for the climate.

Figure 1: National carbon prices outside the EU 27 in comparison with the EU ETS (top 10)

Note: Carbon prices as of 1 April 2021 and for China as at the first trading date under China’s Emissions Trading Scheme (16 July 2021). Figures based on national carbon pricing initiatives (carbon tax or carbon emissions trading) outside the EU 27 that either have already been implemented in the corresponding country or for which there is a planned starting date. The comparability of the pricing systems is limited in part by differences in the number of sectors and greenhouse gases covered. Source: World Bank.

At this stage, empirical ex-post analyses do not yet provide any indications of carbon leakage as a direct consequence of the EU ETS.2 However, the carbon leakage protection currently implemented under the EU ETS through free allocation of certificates to emission-intensive enterprises reduces incentives for the enterprises to decarbonise, and delays the necessary transition to climate neutrality into the future. The existing instrument of free allocation of certificates is thus no longer sustainable.3

A carbon border adjustment mechanism (CBAM) is an alternative tool to address the issue of carbon leakage. Under a comprehensive CBAM, imports would incur a levy at the border in accordance with their product-specific carbon footprint, while exports would attract a refund of carbon prices. In essence, the mechanism represents a transition from production-side to consumption-side pricing of emissions. As it is less easy for consumers than for producers to shift locations in order to avoid paying a price, a comprehensive border adjustment represents a highly effective instrument for carbon leakage protection. It also creates competitive neutrality both in domestic and foreign markets because it does not burden domestic producers with additional costs not levied from foreign competitors. A free allocation of certificates is no longer required. Accordingly, incentives for enterprises to decarbonise remain in place.

Nevertheless, such an ideal adjustment mechanism is difficult to implement in practice as it would have to be placed in the fraught area between legal frameworks, external policy implications and administrative feasibility. The fact that there is no international experience of such a mechanism is proving to be a major challenge. In the light of these difficulties, it does not come as a suprise that the draft regulation for a European CBAM differs significantly from a textbook version of such mechanism.

On 14 July 2021 the EU Commission presented a proposal for a European CBAM to be introduced by the year 2023.4 The draft regulation has four key elements.

First, the CBAM is to cover only imported goods – while the carbon costs of export goods are not going to be refunded. Cost refunds on exports under a carbon adjustment mechanism would probably be incompatible with the current rules of the World Trade Organisation (WTO).5 Furthermore, expanding the mechanism to exports could provoke greater trade conflicts with partner countries. If the free allocation of certificates ends in the future and exports are not included in the border adjustment scheme, European producers face competitive disadvantages in export markets. Prospectively, the EU will therefore need to find a solution with regard to this issue.

Second, the CBAM is only to apply to imported goods in sectors at greater risk of carbon leakage in the EU (aluminium, iron, steel, cement, fertiliser and electricity). To reduce bureaucratic effort and with a view to administrative manageability, this limitation is appropriate. Moreover, the Commission would have the power to expand or shorten the list of sectors covered.

Third, the CBAM is to use carbon benchmarks from the EU ETS to measure the carbon footprint of individual goods. Alternatively, foreign suppliers can claim a lower basis for calculation after demonstrating their actual emissions. Both options are not free of problems. As measuring the carbon footprint along the whole value chain of a good is quite challenging, benchmarks are an inevitable simplification to allow for practical feasibility of the CBAM. They do, however, take into account only a portion of the goods used all along the value chain of production, probably reducing the efficacy of the CBAM in a decisive manner.6 The right of foreign suppliers to claim a lower basis for calculation will provide foreign producers with greater incentives to innovate. The danger here, however, is that the validation of lower emissions abroad is difficult to verify.7

Forth, if importers can demonstrate that a carbon price was already paid in the production of an imported good, they may be granted corresponding discounts on the basis of national agreements. These intended exemptions for countries with equivalent carbon pricing systems are a key element of the draft regulation. First, they will likely be crucial for the CBAM’s international acceptance. Second, the opportunity of recognising climate action policies of other countries can unfold climate leverage vis-à-vis countries that so far have unambitious climate targets.

The more a country’s exports are affected by the European CBAM and the lower its own current ambitions for action on GHG reduction, the more confrontational a response to the (planned) introduction should be expected. A glance at the most important trading partners of the EU 278 shows that by far the greatest import value of those goods that would incur a levy through the CBAM come from Russia. Other major import countries are Turkey, China and the UK. China has already declared that it would respond with countermeasures to a carbon border adjustment scheme imposed by the EU.9

The international orientation of the CBAM, however, is its greatest risk and its greatest strength at the same time. It may also have the potential to give global climate policy new impetus, as it will no longer be possible for other countries to use the absence of ambitious carbon pricing as a locational advantage.10 Some countries have already started considering drafting its own carbon tax as a response to the EU considering the implementation of a CBAM, including Russia and the US.11

Under the condition that the most important trading partners mutually recognise climate action measures adopted in the country of origin, coordinated border adjustment systems might enable the idea of a climate club12 to be realised, allowing progress to be made towards global carbon pricing.13 Within the climate club, the EU could then dispense with the CBAM. This option would represent a strong incentive for other countries to join the club and undertake greater efforts for climate action themselves. The larger such a climate club, the greater are the positive effects of the CBAM. Ideally, the CBAM would lead to an international convergence of carbon pricing – which would ultimately render the instrument itself superfluous again.

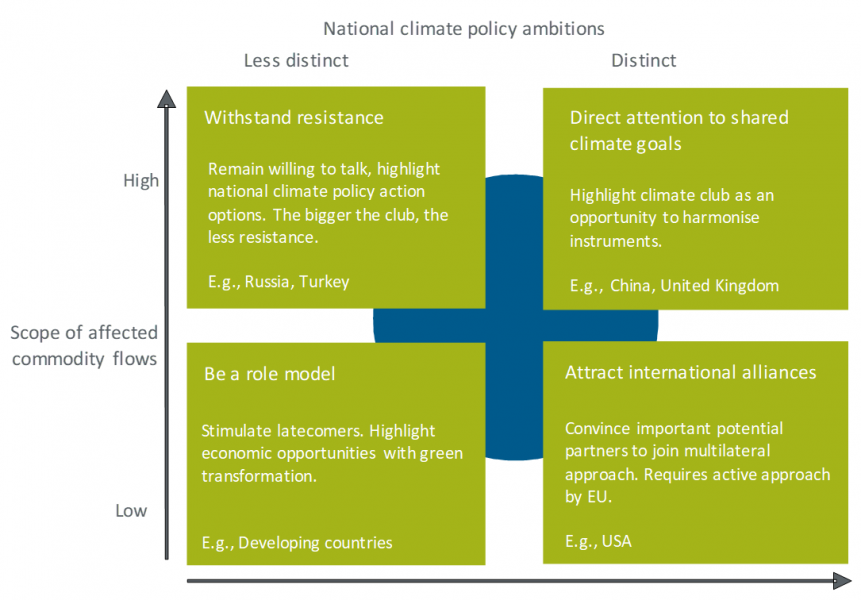

Paving the way for a global climate club will require a differentiated treatment of international partners (Figure 2). The impact on the trading partners from the EU’s initiative will be decided along the lines of two dimensions: First, the intensity of the trade relations in the market segments that are affected by the planned CBAM. Second, the degree of their own climate policy ambitions.

Figure 2: The CBAM as a trailblazer for a climate club

Source: Own rendition. Examples located based on commodity flows in Eurostat (2021) and climate policy ambitions clustered based on “policy and action” classification of Climate Action Tracker (https://climateactiontracker.org/countries/).

If a country is generally affected but already pursuing national climate action approaches – as is for example the case with China and the United Kingdom – that will provide an important starting point for bilateral negotiations. For example, the newly introduced carbon trading system in China opens up opportunities for agreements. Entry points also exist for countries whose exports would initially be unaffected by the European CBAM, as is for example the case for the US. Here, the mechanism does not have substantial immediate (negative) consequences, but it underscores the determination of the EU, so that it could become easier to attract international alliances.

With regard to countries whose exports are not directly affected by the CBAM and which do not show distinct national climate policy ambitions, as is the case for example for many developing countries, the CBAM offers opportunities to develop a leverage effect on climate policy as well. First, the EU can act as a role model here and highlight economic opportunities with green transformation. Second, the proceeds generated from a CBAM could be used as transfer payments in a system of international climate finance.14

A successful club would be strong enough to resolutely counter the resistance of countries whose exports are significantly impacted by the introduction of the CBAM and which, at the same time, exhibit little national climate policy ambition. The most important countries that would have to be won over to join such a strong club are the US and China.15 If the EU succeeds in explaining its approach to potential cooperation countries in detail, and if it remains willing to negotiate details of implementation and exemptions, the CBAM can become an opportunity for global climate action.

This note contains the opinion of the authors and does not necessarily represent the position of KfW.

Dechezleprêtre et al. (2021): Searching for carbon leaks in multinational companies, Grantham Research Institute on Climate Change and the Environment Working Paper No. 165. Naegele, H., and Zaklan, A. (2019): Does the EU ETS cause carbon leakage in European manufacturing? Journal of Environmental Economics and Management, 125: 147.

For sectors with a high leakage risk, the current legislation provides for a continuation of the free allocation along the benchmark values with a cross-sectoral correction factor up to 2030. It is to be reduced to 30% by 2026 and expire entirely in 2030.

For the time being, the draft regulation is just a proposal. The European Parliament and the Council of Ministers still need to consult and agree on it. Experience shows that the package is likely to be revised in many points and might even be fundamentally modified.

Droege, S. (2021), Ein CO2-Grenzausgleich für den Green Deal der EU: Funktionen, Fakten und Fallstricke (A carbon border adjustment mechanism for the EU’s Green Deal: Functions, facts and pitfalls – our title translation, in German only), SWP study 2021/p 09, 5 July 2021. Scientific Advisory Board to the German Federal Ministry of Economic Affairs (2021), A CO2-Border Adjustment Mechanism as a Building Block of a Climate Club, report dated 22 February 2021.

Garnadt, N., Grimm, V. and Reuter, W. (2020), Carbon Adjustment Mechanisms: Empirics, Design and Caveats, SVR working paper 11/2020. Kolev et al. (2021), Carbon Border Adjustment Mechanism: Motivation, Ausgestaltung und wirtschaftliche Implikationen eines CO2-Grenzausgleichs in der EU (Motivation, configuration and economic implications of a carbon border adjustment in the EU – our title translation, in German only), IW Policy Paper 6/21.

Scientific Advisory Board to the German Federal Ministry of Economic Affairs (2021), A CO2-Border Adjustment Mechanism as a Building Block of a Climate Club, report dated 22 February 2021.

Roemer, D., M. Schwarz and E. Liem (2021), The EU’s carbon border adjustment: A trade barrier or an opportunity for global climate action, KfW Research Focus on Economics, No.345, https://www.kfw.de/PDF/Download-Center/Konzernthemen/Research/PDF-Dokumente-Fokus-Volkswirtschaft/Fokus-englische-Dateien/Fokus-2021-EN/Focus-No.-345-September-2021-CBAM.pdf

For an overview on political reactions cf.: Droege, S. (2021), Ein CO2-Grenzausgleich für den Green Deal der EU: Funktionen, Fakten und Fallstricke (A carbon border adjustment mechanism for the EU’s Green Deal: Functions, facts and pitfalls – our title translation, in German only), SWP study 2021/p 09, 5 July 2021. The political environment has probably improved noticeably in the meantime, however.

Scientific Advisory Board to the German Federal Ministry of Economic Affairs (2021), A CO2-Border Adjustment Mechanism as a Building Block of a Climate Club, report dated 22 February 2021.

Cf. i. a. Nasdaq (2021): Russia considering own carbon tax as EU prepares one, https://www.nasdaq.com/articles/russia-considering-own-carbon-tax-as-eu-prepares-one-vedomosti-2021-09-23 (accessed on 29 October 2021). E&E News (2020): Senate Republicans in Talks about Border Carbon Fee, https://www.eenews.net/stories/1063733955 (accessed on 23 July 2021). Just one week after the EU Commission published the draft legislation for the European CBAM, US Democratic representatives presented a bill for a US carbon border tax. Cf. also: https://www.coons.senate.gov/imo/media/doc/GAI21718.pdf

Nordhaus, W. (2015), ‘Climate Clubs: Overcoming Free-riding in International Climate Policy’, American Economic Review 105 (4): 1339–1370. Cramton, P., MacKay, D. J. C., Ockenfels, A. and Stoft, S. (eds.) (2017), ‘Global Carbon Pricing: The Path to Climate Cooperation’, MIT Press.

E.g. the Scientific Advisory Council to the Federal Ministry of Economics also recommends this in its current report: Scientific Advisory Board to the German Federal Ministry of Economic Affairs (2021), A CO2-Border Adjustment Mechanism as a Building Block of a Climate Club, report dated 22 February 2021.

German Council of Economic Experts (2020), Corona-Krise gemeinsam bewältigen, Resilienz und Wachstum stärken (Overcoming the coronavirus crisis together, strengthening resilience and growth – our title translation, in German only), annual report 2020/21.

Germany’s G7 presidency from next year might be a suitable framework in which to forge such an international alliance, cf. BMF (2021), Bundesregierung will Staaten für “internationalen Klimaclub” gewinnen,

https://www.bundesfinanzministerium.de/Content/DE/Pressemitteilungen/Finanzpolitik/2021/08/20210825-bundesregierung-will-internationalen-klimaclub-gruenden.html (Federal Government wants to win over countries for an ‘international climate club’ – our title translation, in German only).