We study the link between central bank asset purchases and the repo market, to examine the impact of the Eurosystem’s increased footprint in financial markets resulting from the response to the Covid-19 crisis. To do so, we exploit highly granular data on government bond purchases and money market transactions. We find that both marginal purchases (flow effect) and aggregate holdings (stock effect) have a significant downward impact on repo rates. The stock effect is nonlinear, and is amplified when the central bank’s holdings are larger. Finally, we find that the Eurosystem’s Securities Lending Facility alleviates the downward pressure on repo rates for scarce bonds, but it does not fully compensate for the downward pressure created by purchases. This collateral scarcity may hamper a smooth functioning of repo and underlying bond markets. As these are important markets for the monetary transmission, central banks should take these side effects into account when implementing asset purchase programmes.

In response to the Covid-19 crisis, the Eurosystem took unprecedented measures to mitigate the impact of the pandemic on the euro area economy, with the goal of preserving price stability. The Eurosystem’s asset purchases substantially outpaced sovereign debt issuance following the onset of the Covid-19 crisis. This led to an increasing stake of the Eurosystem in the euro sovereign debt market. Such a sizeable presence of the central bank in the fixed income market involves potential trade-offs. While the upscaling of asset purchases helps to stabilize markets, restore confidence and support monetary transmission (Lagarde, 2021), the emergence of a unidirectional market participant as the largest buyer may also come at the cost of unwarranted side-effects. One side-effect of central bank asset purchases is asset scarcity (Altavilla et al., 2021). As the central bank behaves as a buy-and-hold investor in bond markets, its footprint increases and the remaining free floating availability of securities in markets diminishes. As a result, the ratio between the free float of sovereign bonds and the amount of extra liquidity in the system declined (Figure 1). Investors thus may face greater difficulties in finding a specific security, which may result in frictions in the smooth functioning of capital markets.

Figure 1: Ample cash regime following large asset purchase volumes (government debt)

Notes: Eurosystem holdings are based on aggregated data of government bonds (nominal holdings of bonds compared to their total outstanding amount). Free float is defined as the amount outstanding minus Eurosystem holdings. Excess liquidity is the amount of liquidity that banks hold at the Eurosystem minus their minimum reserve requirements.

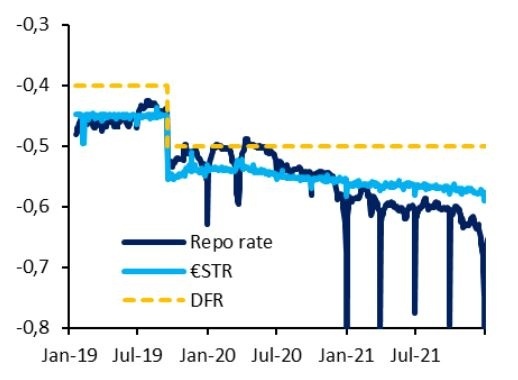

Figure 2: The evolution of money market rates in the euro area

Notes: DFR is the Deposit Facility Rate of the ECB. The Repo rate is a volume weighted average rate based on repo transactions backed by Euro area government bonds as collateral, based on a similar methodology as €STR. Before the start of €STR (2 October 2019), data is based on pre-€STR (both available in the SDW of the ECB).

The increase in excess liquidity following the crisis response measures exerted downward pressure on money market rates, which remained well below the deposit facility rate (DFR) of the ECB. The dynamics, however, have been dissimilar for collateralized (secured, or repo) and non-collateralized (unsecured) money market segments. Compared to pre-Covid levels, the aggregate decrease has been stronger for repo rates (10 bps) than for unsecured rates (€STR, 5 bps) (Figure 2). While rates in both segments are affected by the ample availability of cash, the stronger decline in repo rates can be interpreted as the effect of the underlying collateral becoming more valuable, as a consequence of asset scarcity. In other words, the lower cost of borrowing cash against securities in the repo market corresponds to a greater cost of sourcing a security in exchange for cash. This corresponds with the shift observed in the drivers for participation in the repo market during the years of active central bank purchases. Due to the increasing amount of liquidity in the system, and the ‘absorption’ of collateral by the ECB, repo market activity is increasingly driven by a search for collateral instead of a search for funding (ECB, 2021).

In a recent paper (Carrera de Souza and Hudepohl, 2022), we study the link between asset scarcity driven by the Eurosystem’s purchases of government bonds and the repo market, in particular to examine the impact of the large footprint caused by the Eurosystem’s response to the Covid-19 crisis. To do so, we exploit highly granular proprietary datasets administered by the Eurosystem (daily purchases and daily money market transactions). The repo market is a key component of the money market and a major channel for circulating cash and collateral through the financial system (Schaffner et al., 2019), and it is by far the largest segment of the euro area money market – representing more than two-thirds of total market turnover (ECB, 2021a). Thus, euro repo markets play a critical role in the transmission of monetary policy (Arrata et al., 2020).1

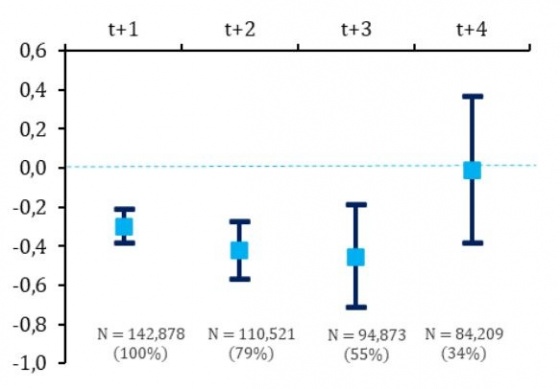

We differentiate between a couple of effects. First, we look into the flow effect of Eurosystem purchases on repo rates and find that a purchase of one percentage point of the free float (defined as the outstanding amount reduced with ECB’s purchases) of a bond, leads to a significant decrease of 0.3 basis points in that bond’s repo rate on the next day. This effect is persistent over time and increases at least up to three days after the purchase, up to -0.45 basis points (Figure 3). In addition to the flow effects, we also investigate whether there is a stock effect of asset purchases driving European repo rates lower. As a certain security may be harder to find in the repo market when the central bank holds a larger share of its outstanding amount, market participants may be willing to pay a higher price to source it, resulting in a lower repo rate, everything else constant. This stock effect is of particular relevance in the context of a large footprint of the Eurosystem in government bond markets. We find that asset purchases have a permanent negative effect on repo rates. This is plausible, as the Eurosystem’s purchases lower the availability of a bond in the private market and therefore increase its collateral value. More specifically, an increase in the Eurosystem’s market share of one percentage point of the total outstanding amount of a bond coincides with a lower repo rate of 0.11 basis points for that particular instrument (ISIN). For instance, holding 33 percent of a bond’s outstanding amount is associated with a lower repo rate of 3.6 basis points, everything else constant. This is also in line with the graphical evidence (Figure 2), showing – on an aggregate level – downward pressure on repo rates coinciding with a growing participation of the Eurosystem in the government bond market. It turns out that this stock effect is nonlinear: the effect of holding one additional percentage point of the outstanding amount of a security is amplified as the current market share of the Eurosystem gets larger.

Figure 3: Flow effect of asset purchases on repo rates, and its persistence over time (in basis points)

Note: The figure shows the estimated coefficient of the impact of the purchase of 1% of a bond’s free float on day t on the change in that bond’s repo rate up to the fourth day after the purchase. We obtain the coefficients from repeated panel regressions. The number of observations per regression and the percentage of original purchases that remain in each subsample are included at the bottom. Dark blue lines show 95% confidence intervals

To support repo market functioning, since April 2015 the Eurosystem has made purchased securities available for lending via the Securities Lending Facility (SLF). The SLF aims at mitigating scarcity issues, acting as a backstop for bond and repo market liquidity, without unduly curtailing private repo market activity (ECB, 2022). The repo transactions under the SLF can be either conducted against securities collateral or against cash collateral, both acting as a temporary positive supply shock for the lent bond. We find that when larger volumes of a security are lent via the SLF, its repo rate increases, implying that the SLF alleviates the downward pressure on repo rates for scarce bonds (i.e. the contrary impact of purchases). This increase is 0.1 basis points in the bond’s repo rate per percentage point lent of the bond’s free float. The increase is thus less than the downward pressure resulting from the flow effect (about one third). Although the SLF indeed alleviates the downward pressure on repo rates by providing purchased bonds back to the market, it does not fully compensate for the negative supply absorption initially caused by QE. One potential reason for this weaker pass-through may come from the different duration of their impact. QE acts as a permanent supply shock for collateral availability, while the SLF’s impact is temporary as it only influences the stock of available collateral during the time the repo with the central bank is outstanding.

It follows from our results that central banks may face increasing unintended side effects as their market share rises. Repo rates not only respond to the Eurosystem’s accommodative stance, but also to the availability of collateral in the market, as scarcer collateral is priced at a premium. The shift of repo rates away from the ECB-set rates – and the increased dispersion among them – may be considered an unwarranted side-effect of asset purchases, in particular because repo rates are key for the first step in the pass-through of monetary policy rates. Moreover, increasing difficulties in sourcing a specific security in repo markets – in particular bonds in high demand – can result in market frictions, which may hamper a smooth functioning of repo and underlying bond markets. For example, collateral scarcity has been linked to more frequent fail-to-deliver episodes in repo markets (Corradin and Maddaloni, 2019) and with a less efficient price discovery mechanism in the cash bond market (D’Amico et al., 2018). Also, bond specialness may cause frictions in bond market intermediation (Huh and Infante, 2021). When a repo rate is significantly below prevailing market rates, borrowing the asset is more expensive, resulting in higher bid-ask spreads. Central banks should take these side effects into account when implementing asset purchases. Reverse repo operations (such as the SLF) provide a useful supplement to quantitative easing programmes, as they attenuate the scarcity effect of asset purchases.

Altavilla, C., Lemke, W., Linzert, T., Tapking, J., von Landesberger, J. (2021), Assessing the efficacy, efficiency and potential side effects of the ECB’s monetary policy instruments since 2014, ECB Occasional Paper no. 278.

Arrata, W., Nguyen, B., Rahmouni-Rousseau, I., Vari, M. (2020), The scarcity effect of QE on repo rates: Evidence from the euro area, Journal of Financial Economics 137(3), 837-856.

Carrera de Souza, T.A., Hudepohl, T.S.M. (2022), The Eurosystem’s bond market share at an all-time high: what does it mean for repo markets? DNB Working Paper No. 745.

Corradin, S., Maddaloni, A. (2020), The importance of being special: Repo markets during the crisis, Journal of Financial Economics 137(2), 392-429.

D’Amico, S., Fan, R., Kitsul, Y. (2018), The scarcity value of treasury collateral: repo-market effects of security-specific supply and demand factors, Journal of Financial and Quantitative Analysis 53 (5), 2103–2129.

ECB (2021), Euro Money Market Study 2020, Money market trends as observed through MMSR data, Euro Money Market Study 2020

ECB (2022), Securities lending of holdings under the asset purchase programme (APP) and pandemic emergency purchase programme (PEPP), Securities lending of holdings under the asset purchase programme (APP) and pandemic emergency purchase programme (PEPP) (europa.eu)

Huh, Y., Infante, S. (2021), Bond market intermediation and the Role of Repo, Journal of Banking and Finance 122 (105999), 1-19.

Lagarde, C. (2021), One year of the PEPP: many achievements but no room for complacency, 22 March 2021, One year of the PEPP: many achievements but no room for complacency (europa.eu)

Schaffner, P., Ranaldo, A., Tsatsaronis, K. (2019), Euro repo market functioning: collateral is king, BIS Quarterly Review December 2019, 95-108.

See Carrera de Souza and Hudepohl (2022) for an elaborate description about repo market dynamics/functioning.