This policy brief is based on “The German and Italian government bond markets: The role of banks versus non-banks“, published in Banca d’Italia MISP Paper, No. 57, January 2025 and Deutsche Bundesbank Technical Paper, No. 12/2024, January 2025. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

Government bond markets are pivotal for the functioning of the financial system, the trans-mission of monetary policy, and economic stability; investors, moreover, consider government bonds as a safe haven, and such bonds also influence bank liquidity creation. Since the global financial crisis, issuance has surged in advanced economies. While government bonds are typically characterized by high liquidity levels, recent events like the March 2020 ‘dash for cash’ and the September 2022 UK Gilt crisis showed that also these markets may be subject to liquidity shocks. Changes in market structure, such as the shift from bank-centric to hybrid models and technological advancements, may have increased the sensitivity of government bond markets to stress. Against this background, Banca d’Italia and Bundesbank initiated a joint project to analyse German and Italian government bond markets using granular data across cash, repo, and futures segments. The focus of the project is on liquidity and on the roles of banks and non-banks.

Government bond markets play a critical role in the smooth functioning of the financial system, in the conduct and transmission of monetary policy and in the economy. Maintaining resilient government bond markets is fundamental for policymakers and authorities.

Investors see government debt as a ‘safe haven’, as a way to enhance portfolio returns and as a mean of portfolio diversification. In addition, government bonds influence liquidity creation by banks, which is an essential process for monetary policy and for the smooth functioning of financial markets and the economy (Aiyagari and Gertler, 1985; Chatterjee, 2015; Manganelli and Wolswijk, 2009). Sovereign bonds are also often used by intermediaries to fulfil capital and/or liquidity regulatory requirements (Bonner, 2016; Curfman, Kandrac, 2022).

Since the global financial crisis, government bond issuance has increased substantially in many advanced economies. Government bond markets in these jurisdictions are typically characterised by high levels of liquidity, which is an essential ingredient of a modern and efficient financial system. However, sound liquidity conditions are not to be taken for granted under any circumstances. On recent occasions in fact – such as the March 2020 ‘dash for cash’ or the September 2022 Gilt crisis in the UK – government bond markets have become focal points of turbulence. The lack of liquidity in financial markets can increase volatility and the cost of capital (Elliott, 2015). Given the existence of a two-way relationship between stock and bond market liquidity, shocks can transmit across these sectors (Goyenko and Ukhov, 2009). Having relaxed liquidity conditions is also important for financial intermediaries, given that market and funding liquidity may be connected and mutually reinforcing under adverse conditions (Brunnermeier and Pedersen, 2009).

Resilient, liquid, and well-functioning government bond markets are critically dependent, among others, on the existence of a stable and diversified investor base and robust market infrastructures. Several changes that have occurred over the past decades may have con-tributed to making core government bond markets more sensitive to liquidity imbalances, particularly in times of stress (FSB, 2022). For example, market making has shifted from a bank-centric to a hybrid-model, in which non-bank financial intermediaries play a much more important role (Eren and Wooldridge, 2021). At the same time, technological innovations have increased the speed at which trades can be executed. While these transformations have con-tributed to broadening participation, it is likely that the sensitivity of government bond markets to shocks has increased. Indeed, these changes have taken place in a changed environment, with dealers’ intermediation capacity reduced, and other non-bank liquidity providers not al-ways ready to scale up their activities, particularly in times of stress (Duffie, 2023; FSB, 2022). These findings emphasise the importance of investors’ behaviour in mitigating or amplifying financial stress episodes (Abbassi et al., 2016; Arrata et al., 2020; He et al., 2010; He and Krishnamurthy, 2013; Hanson et al., 2015; Panzarino, 2023;). How these securities are traded and settled also play a significant role in shaping market outcomes (Aquilina et al., 2024; De Roure et al., 2019; Deutsche Bundesbank, 2022; Duffie et al., 2005; Hüser et al., 2024).

Against this background, Banca d’Italia and Bundesbank launched a joint project on German and Italian government bond markets, with a special focus on liquidity and on the role played by banks vs. non-banks. Drawing on a broad set of granular data, we cover the cash, the repo and the futures segments to gather a comprehensive view of the whole market.1

At the end of 2023, the outstanding volume of German and Italian central government bonds amounted to EUR 1.8 trillion and EUR 2.4 trillion, respectively. At the same date, a significant fraction of these bonds was held by the Eurosystem.2

German government bonds are mostly held by foreign investors. Based on bond-sector-level securities holdings (SHSS) data, by the end of 2023 foreign investors held about 77% of the German government bonds, with around 50% held outside the euro area (investors from China, followed by US and UK). NBFIs located in the euro area (excluding Germany) held ap-proximately 20% of the bonds, with half of these held by investment funds (IFs). In Italy, in contrast, around 60% of sovereign bonds were held domestically as of the end of 2023, with banks accounting for the largest share, followed by households (HHs) and insurance corporations (ICs). The footprint of investors from other euro area countries (mostly IFs) is comparable to Germany, but the share of non-euro area investors is much smaller (around 16%). The high share of foreign investors leads to diversified holdings of German government bonds and therefore creates additional demand, also in the event of changing market conditions. How-ever, it may temporarily increase market price volatility due to potential international contagion. In Italy, the relatively high share of domestic investors, mostly characterised by buy-and-hold strategies, tends to favour stability; on the other hand, it leads to a higher level of interconnectedness within the economy.

Trading activity of German and Italian bonds on secondary markets relies on different infra-structures. While German government bonds are mostly traded OTC and bilaterally, Italian government securities are traded on a regulated inter-dealer electronic platform that includes a settlement and a clearing system (MTS Italy Cash). In the “dealer-to-customer” segment, as opposed to the interdealer segment, the non-bank sector, particularly asset managers and hedge funds, is strongly represented in both markets and plays an important role. How and to what extent foreign investors and NBFIs are involved is a significant feature for the price discovery and liquidity of government bond markets.

Repos backed by German and Italian government bonds are cleared in a similar manner but differ in terms of volumes and counterparties. The daily transaction volume of repos using German government bonds increased from around €140 to €180 billion from August 2021 to August 2024. Over the same period, the transaction volume of repos with Italian government bonds grew from around €160 to about €280 billion. About 65 and 70% of the German and the Italian repos, respectively, is centrally cleared. In both markets, most transactions involve dealer-banks, but hedge funds are other active players.

Futures based on both Italian and German government bonds are mostly traded at Eurex. The German government bond futures market is extremely liquid and offers four types of contracts, while the Italian futures market is characterised by two actively contracts. The trading volume of German futures is around ten times larger than for the cash market, while in Italy the trading volumes in the cash and futures markets are comparable.

Scarcity in repo markets and the role of ‘inelastic investors’

The unprecedented levels of excess liquidity, which followed the implementation of non-standard monetary policy measures by the Eurosystem, exerted downward pressure on money market rates, including in secured markets where rates declined also as a reflection of the overall lower collateral supply (scarcity). Especially for the safest forms of collateral, borrowing specific securities was associated with a premium (specialness), which may have several implications (Corradin and Maddaloni, 2019; Huh and Infante, 2021; Heider et al., 2015).3

Since the beginning of 2021 it has been relatively more expensive to source German compared to Italian collateral on repo markets (Figure 1). Scarcity, measured by the difference between repo rates and the deposit facility rate, reached a peak in September 2022, surging again shortly after, when about 80 percent of repos collateralised with German government bonds were traded with a premium of at least 60 basis points. In the same period, for repos backed by Italian sovereign collateral the share of trades with such a premium was significantly lower. As the Eurosystem’s balance sheet is gradually reduced, the size of the premium for German government bonds has fallen significantly and the premium paid on Italian collateral is less pronounced. In addition, the supply of government bonds has been further increased by several measures, including securities lending by central banks and participation in repo markets by public authorities.4

Figure 1. Scarcity on the repo market for German and Italian government bonds

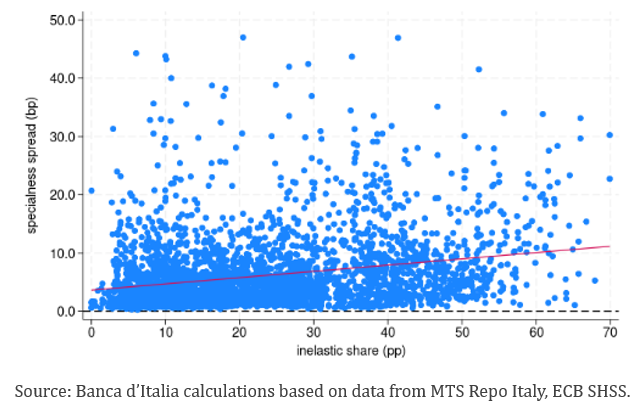

The premium may also be affected by the investor base (Arrata et al., 2020). Holdings of bonds by so-called ‘inelastic investors’, i.e. – which are more insensitive to repo market conditions and unlikely to lend their bond holdings in the market – may have an impact on repo rates. This hypothesis has been tested on the repo market for Italian government bonds, considering one-day maturity transactions executed on MTS Italy Repo. We consider ICs and pension funds, HHs and non-financial corporations to be ‘inelastic investors’. The footprint of these investors on the Italian government bond market is material. We use the spread be-tween the general collateral and the special repo rate to measure ‘specialness’ (Duffie, 1996). A simple correlation indicates that the share of debt held by ‘inelastic investors’ may have a role in explaining the degree of specialness on the Italian MTS repo market (Figure 2).

To investigate the role of ‘inelastic investors’ on the repo market for Italian government bonds, we run an analysis where specialness is regressed against the share of ‘inelastic investors’ together with a set of control variables (e.g. determinants of the spread, bond characteristics and market factors). Estimates show that the investors base in the Italian government bond market matters for the repo segment. An increase of 10 percentage points in the bond holdings of ‘inelastic investors’ can be associated with a higher premium of about 3.7 basis points in the repo market, which represents about 40 per cent of the standard deviation over the period.5 The impact of ‘inelastic investors’ varies depending on the monetary policy cycle, be-coming more significant when: i) excess liquidity is higher and/or ii) there are expectations of monetary policy tightening. Importantly, the activation by the Bank of Italy in July 2019 of a direct securities lending program through the MTS Repo platform is associated with a de-crease in specialness as it raised the availability of collateral.6

Figure 2. Specialness and inelastic investors share

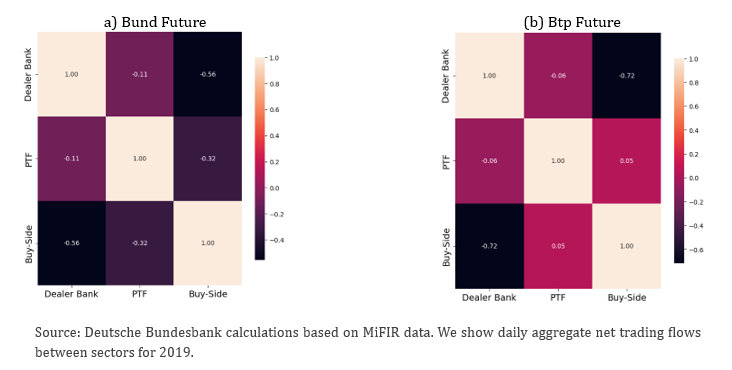

The Eurozone future market provides a compelling context to analyse the role of different liquidity providers during turbulent times. At the onset of the COVID-19 pandemic, there was a significant increase in trading volumes of Bund and Btp futures. To study liquidity provisioning during that crisis, we conducted an analysis correlating daily net trading flows on Btp and Bund futures at the sector level before and during the COVID-19 outbreak. Entities are clustered considering: dealer banks, Principal Trading Firms (PTFs), and buy side investors (e.g. asset managers and other financial institutions).

Figure 3 illustrates the daily net correlations (net buying) among dealers, PTFs, and buy side investors before the pandemic. In the Bund future market, dealer banks and PTFs exhibit a negative correlation with the buy-side, thus indicating that when end-investors are buying, dealer banks and PTFs are typically selling, thereby facilitating market clearing. In the Italian futures segment dealer banks also consistently absorb net trading flows, underscoring their role as reliable liquidity providers; in contrast, the correlation between PTFs and the buy-side is weakly positive, highlighting that PTFs may adopt multiple trading strategies, conditional on the market where they are operating.

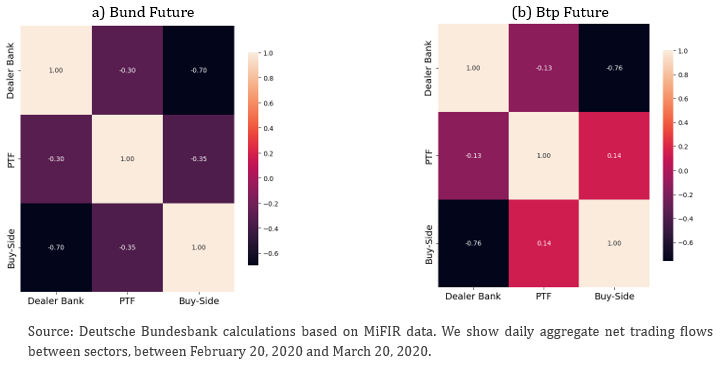

Figure 4 shows the correlation during the COVID-19 period. For both Btp and Bund futures, there is no evidence that the market turmoil which followed the outbreak of the pandemic altered trading behaviour of liquidity providers.

Figure 3. Trading before COVID-19

Figure 4. Trading during COVID-19

The project by Bundesbank and Banca d’Italia investigates the German and Italian government bond markets, focusing on liquidity and the roles of banks versus non-banks. Key findings reveal that German bonds are largely held by foreign investors; this contributes to diversified holdings but potentially increases volatility due to international contagion. Conversely, Italian bonds are predominantly held by domestic investors, which promotes stability but increases internal economic interconnectedness. The trading mechanisms differ, with German bonds traded OTC and Italian bonds on regulated electronic platforms, and each mechanism has distinct trade-offs. Moreover, NBFIs may significantly impact government bond market dynamics. All in all, ensuring resilience in government bond markets requires understanding the interplay of market structures, investor behaviors, and macro-financial conditions, and needs granular data to close existing gaps.

Abbassi, P., Iyer, R., Peydró, J. and Tous F. R., 2016. Securities trading by banks and credit supply: Micro-evidence from the crisis, Journal of Financial Economics, vol. 121, issue 3, pp. 569 – 594.

Aiyagari, S. R. and Gertler, M., 1985. The backing of government bonds and monetarism, Journal of Monetary Economics, vol. 16, issue 1, pp. 19 – 44.

Arrata, W., Nguyen, B., Rahmouni-Rousseau, I. and Vari, M., 2020. The scarcity effect of QE on repo rates: Evidence from the euro area. Journal of Financial Economics, vol. 137, pp. 837-856.

Aquilina, M., Scheicher M. and Schrimpf, A., 2024. Central clearing in government bond markets: keeping the “safe asset” safe?, Bis Bulletin No. 92.

Bonner, C., 2016. Preferential Regulatory Treatment and Banks’ Demand for Government, Journal of Money, Credit and Banking, vol. 48, issue 6, pp. 1195 – 1221.

Brand, C., Ferrante, L. and De Fraisse, A. H., 2019. From Cash- to Securities-Driven Euro Area Repo Markets: The Role of Financial Stress and Safe Asset Scarcity. ECB Working Paper No. 2232 (2019) ISBN 978-92-899-3494-7.

Brunnermeier, M. K. and Pedersen, L. H., 2009. Market Liquidity and Funding Liquidity. The Review of Financial Studies, vol. 22, pp. 2201–2238.

Chatterjee, U. K., 2015. Bank liquidity creation and asset market liquidity. Journal of Financial Stability, vol. 18, pp. 139-153.

Corradin, S. and Maddaloni, A., 2019. The Importance of Being Special: Repo Markets During the Crisis, Journal of Financial Economics.

Curfman, C. J. and Kandrac, J., 2022. The Costs and Benefits of Liquidity Regulations: Lessons from an Idle Monetary Policy Tool, Review of Finance, vol. 26, issue 2, pp. 319–353.

De Roure, C., Mönch, E., Pelizzon, L. and Schneider, M., 2024. OTC Discount. Leibniz Institute for Financial Research SAFE Working Paper Series, No 298.

Deutsche Bundesbank, 2022. Financial Stability Review.

Duffie, D., Garleanu, N. and Pedersen, L. H., 2005. Over-the-Counter Markets. Econometrica, vol. 73, pp. 1723-2038.

Duffie, D., 2023. Resilience Redux in the U.S. Treasury Market. Stanford University Graduate School of Business Research Paper No. 4552735.

European Central Bank (ECB), 2023. Money market trends as observed through MMSR data; Euro money market study 2022.

Elliott, D. J., 2015. Market Liquidity: A Primer. Economic Studies at Brookings.

Eren, E. and Wooldridge, P., 2021. Non-bank financial institutions and the functioning of government bond markets, BIS Paper No. 119.

Ferdinandusse, M., Freier, M. and Ristiniemi, A., 2020. Quantitative Easing and the Price-Liquidity Trade-Off. ECB Working Paper No. 20202399.

Financial Stability Board (FSB), 2022. Liquidity in Core Government Bond Markets. FSB Report.

Goyenko, R. Y. and Ukhov, A. D., 2009. Stock and Bond Market Liquidity: A Long-Run Empirical Analysis. Journal of Financial and Quantitative Analysis, vol. 44, pp. 189 – 212.

Hanson, S. G., Lucca, D. O. and Wright, J. H., 2018. Rate-Amplifying Demand and the Excess Sensitivity of Long-Term Rates. FRB of NY Staff Report No. 810.

He, Z., Khang, I. G. and Krishnamurthy, A., 2010. Balance Sheet Adjustments in the 2008 Crisis. NBER Working Paper No. 15919.

He, Z. and Krishnamurthy, A., 2013. Intermediary Asset Pricing. American Economic Re-view, vol. 103, no. 2, pp. 732–70.

Huh, Y. and Infante, S., 2021. Bond market intermediation and the Role of Repo. Journal of Banking & Finance, vol. 122, 105999.

Heider, F., Hoerova, M. and Holthausen, C., 2015. Liquidity Hoarding and Interbank Market Spreads: The Role of Counterparty Risk, Journal of Financial Economics (JFE), vol. 118, pp. 336-354.

Manganelli, S. and Wolswijk, G., 2009. What drives spreads in the euro area government bond market?, Economic Policy, vol. 24, issue 58, pp. 191–240.

Panzarino, O., 2023. Investor Behavior Under Market Stress: Evidence from the Italian Sovereign Bond Market, Banca d’ Italia Working Paper No. 33.

A broad set of data was used: i) bond-level information on sectoral holdings of euro-denominated bonds were obtained from the Securities Holding Statistics by Sector (SHSS) collected by the European Central Bank; ii) data col-lected under the EU Securities Financing Transactions Regulation and proprietary data from MTS (Repo) Italy; iii) data collected under the European Market Infrastructure Regulation and the EU Regulation on markets in financial instruments; iv) financial market data.

Since the Eurosystem acts market-neutrally in purchases and sales, central bank holdings are not included in this analysis. The holding shares reported are net of the Eurosystem.

The phasing-in of Basel 3 liquidity requirements may have exacerbated these frictions (ECB 2023). Some studies also suggested the existence of ‘country-specific channels’ on top of bond-specific issues (Brand et al., 2019; Ferdinandusse et al., 2020).

See Federal Ministry of Finance (2023) for Germany and Department of the Treasury of Italy (2021) for Italy.

Moreover, ‘specialness’ is higher: i) in the last day of a quarter, when banks engage in window dressing to fulfil regulatory requirements, ii) for cheapest-to-deliver bonds, and iii) for securities eligible under the PSPP and PEPP.

When the Banca d’Italia securities lending facility was launched in 2015, securities were offered exclusively via the main international central securities depositories. Since July 2019, Banca d’Italia has been lending government securities to market counterparties via the MTS Repo platform or bilaterally.