The views expressed in this paper are the ones of the authors and not necessarily the ones of the ECB, SNB, and CSH.

The role of supply chains in the transmission of climate-related physical risks across countries has received surprisingly little attention so far. Our research uses a novel approach to engage with this gap. We use climate-related GDP-at-risk data to quantify the potential direct impact of physical risks on GDP at the country or regional level. This direct impact on GDP is then used to shock a global Input-Output model so that we can estimate the propagation of the initial shock to country-sectors around the world. The findings suggest that direct GDP loss estimates can severely underestimate the ultimate impact of physical risk: trade disruptions can lead to GDP losses that are up to 30 times higher in the EA than what looking at the direct impacts of climate change would suggest. However, trade can also mitigate losses if substitutability across country-sectors’ inputs is possible.

The estimation of real-economic damages due to climate change physical risks remains an important challenge in the face of a rapidly advancing global warming: in January 2024, we recorded a 12-months period of global temperatures more than 1.5°C above the pre-industrial reference period, already higher than the Paris Agreement targets (Copernicus Climate Change Service, 2024). Properly understanding the economic consequences of climate change is of paramount importance to shape sustainable policies for the future. However, as many economic analyses of climate change have limited a priori the possible transmission channels from climate change to the economy (Keen, 2022), these analyses cannot be used to assess climate change impacts and associated risks in a comprehensive manner. These studies can in particular not be used to reach conclusive policy recommendations.

It is precisely such conclusive assessments that are often suggested, but without highlighting the uncertainties and the ignored risk channels. Consider for example the first paragraph of the Intergovernmental Panel on Climate Change’s Executive Summary of Chapter 10 on key economic sectors and services from 2014 (Arent et al., 2014):

“For most economic sectors, the impact of climate change will be small relative to the impacts of other drivers (medium evidence, high agreement). Changes in population, age, income, technology, relative prices, lifestyle, regulation, governance, and many other aspects of socioeconomic development will have an impact on the supply and demand of economic goods and services that is large relative to the impact of climate change.”

Such a relative classification of the influence of climate change appears questionable, as, for example, the possible transmission and amplification of physical climate risks along supply chains were not taken into account.

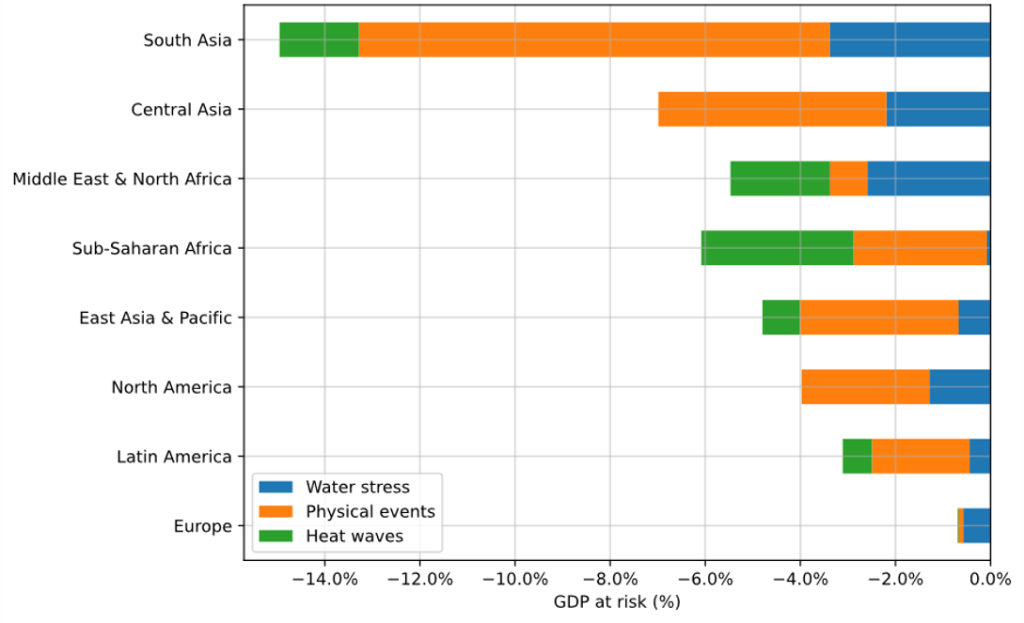

In general, physical risks describe the increased risk of natural hazards or risk associated with the chronic worsening of the physical conditions for living on the planet derived from climate change (Dikau & Volz, 2019). Including global supply chains in the analysis of such risks appears particularly relevant for regions like the Euro Area because climatologists predict that direct impacts from climate change-induced natural disasters will materialize mainly outside of this region. Figure 1 shows the percentage of GDP at risk for global regions in the adverse RCP8.51 climate scenario, i.e. GDP that might be lost if climate hazards realise (SPGlobal, 2022). At first sight, the GDP-at-risk for Europe amounts to only 0.7%, so that European policymakers might conclude that physical risks are not particularly worrying for the Euro Area. However, economic production and consumption in the Euro Area is highly dependent on the flow of goods in the global trade system. The Euro Area could import losses from abroad if its supply chains are disrupted, as it happened during the COVID-19 pandemic, the temporary closure of the Suez Canal in 2021 or the global microchips shortage in 2022. Moreover, Europe could face a significant reduction in demand from other economic regions, which might suffer more direct climate-related destruction.

Our research for the first time combines country-level GDP losses from the local realization of climate-related physical risks with a global Input-Output (IO) model at country- sector level (Fahr et al, 2024). We show that economic disruption in Europe can be more significant than what the direct damage predictions imply. However, trade can also mitigate losses if substitutability across country-sectors is possible.

Figure 1. GDP at risk from climate events under the RCP8.5 scenario (projections until 2050 for global regions)

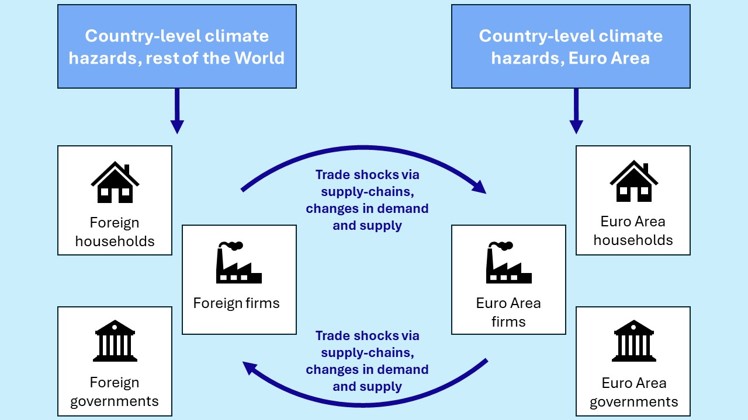

To address the challenge of incorporating the role of supply chains in climate physical risks analysis, our research (Fahr et al, 2024) for the first time combines country-level GDP losses from the local realization of climate-related physical risks with a global Input-Output (IO) model at country-sector level (see figure 2).

Figure 2. Transmission mechanisms of climate change physical risks via supply chains, in a stylized representation with firms, governments, and households

We develop an IO methodology which relies on a bottom-up algorithm for finding feasible market allocations given the exogenous climate shocks, starting from a matrix of global trade flows. We obtain the data for the network of trade flows between country-sectors from the OECD’s Inter-Country Input-Output tables. Our model is based on the work of Pichler and Farmer (2022) for the simulation of simultaneous shocks to final demand and productive capacities in an IO framework. This is a useful reference because the realization of physical risks from climate change reduces both domestic final demand and production capacity (Feng and Li, 2021), thus causing simultaneous shocks. As an example, the realization of a climate change related hazard in South Asia will result in less final demand in South Asia for the output produced domestically and abroad, because of the reduction in population and incomes which are likely to follow the occurrence of natural disasters. Moreover, production sites in South Asia will also be damaged or destroyed, reducing their productive capacity – in other words, there will also be a supply shock.

We use country-level GDP-at-risk data from SPGlobal (2022) to simultaneously shock final demands and productive capacity. The data covers 135 countries and losses are estimated without considering trade amplifications. The exogenous shocks are introduced into the IO model as a reduction in final demand and maximum productive capacity corresponding to the GDP-at-risk values for each country.

In the simulation algorithm, our model assumes that all country-sectors place orders to their suppliers based on the incoming total demand they face (see Fahr et al, 2024, for details). Because suppliers’ production capacity can be constrained, either directly by the exogenous production shock or by insufficient inputs, suppliers might not be able to satisfy the orders they receive, thus creating input shortages for other country-sectors. We also assume that country-sectors who face demands which are less than their production capacity accumulate inventories without incurring additional costs.

Lastly, we assume that country-sectors which are input-constrained can shift their input sourcing away from their original suppliers and towards other country-sectors which operate in the same global sector (e.g. steel production) and have accumulated inventories. To make an example, this means that the auto industry in Germany needs a minimum quantity of steel to produce a car, but it does not matter what the composition of the supply of steel is (whether it comes from North America, Europe or Asia). With this assumption, country-sectors have the possibility to reallocate their input sourcing to mitigate the input bottlenecks they face. We perform a sensitivity analysis ranging from the case where no such reallocation was possible (worst-case scenario) to the case where there is absolutely no cost in shifting suppliers (best-case scenario).

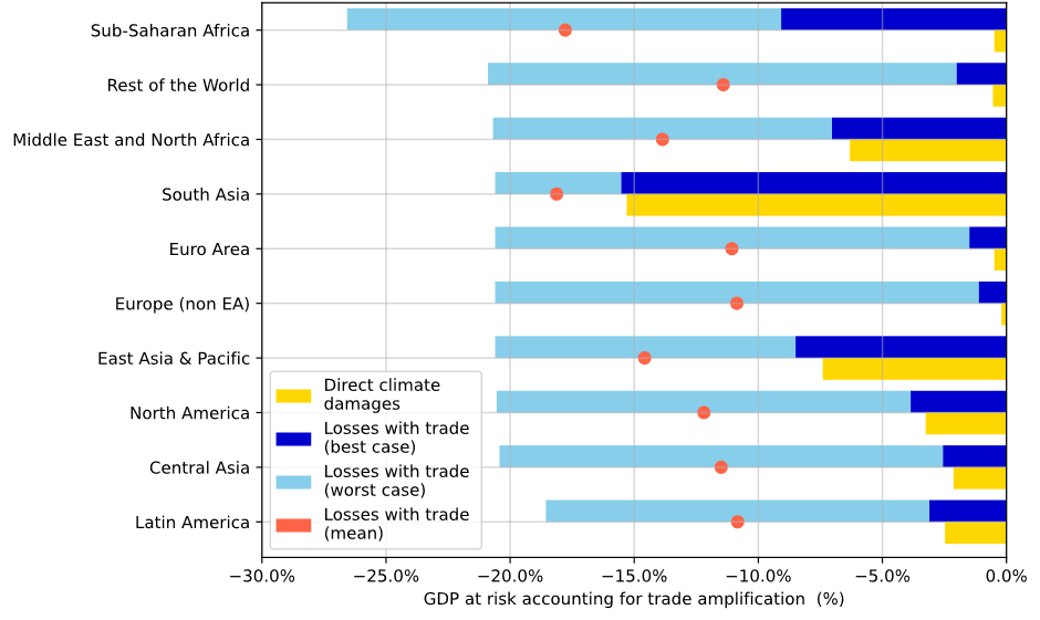

In our research, we consider the most adverse climate scenario, where all physical hazards under the RCP 8.5 scenario in 2050 materialize globally. In this scenario, the GDP in the global regions falls by their respective direct GDP-at-risk value (see Figure 1, and figure 3). Once these initial shocks propagate through IO-linkages, GDP-losses are amplified manifold. Figure 3 reports the total GDP losses per region after accounting for trade interconnections. Note that the losses in this very adverse scenario can alternatively also be read at the GDP-at-risk with and without taking supply-chains into account.

Sub-Saharan Africa is the region that suffers the highest losses from the IO amplification, with the best-case scenario showing losses of around 9% of GDP on average for the region. The high loss happens despite the relatively low direct shock. A counter example is South Asia, the region with the highest direct climate shock, which faces a relatively negligible amplification of losses through IO linkages. In the EA, the amplified GDP loss is on average more than 15 times the direct climate shock, with a worst-case scenario showing aggregate losses of around 20% of GDP. In the EA, highly trade-dependent countries like Germany and Luxembourg suffer particularly high losses from imported risks despite their relatively small direct exposure to climate physical risks.

Figure 3. GDP at risk across world regions due to direct climate physical risk and amplified through trade interconnections (RCP 8.5)

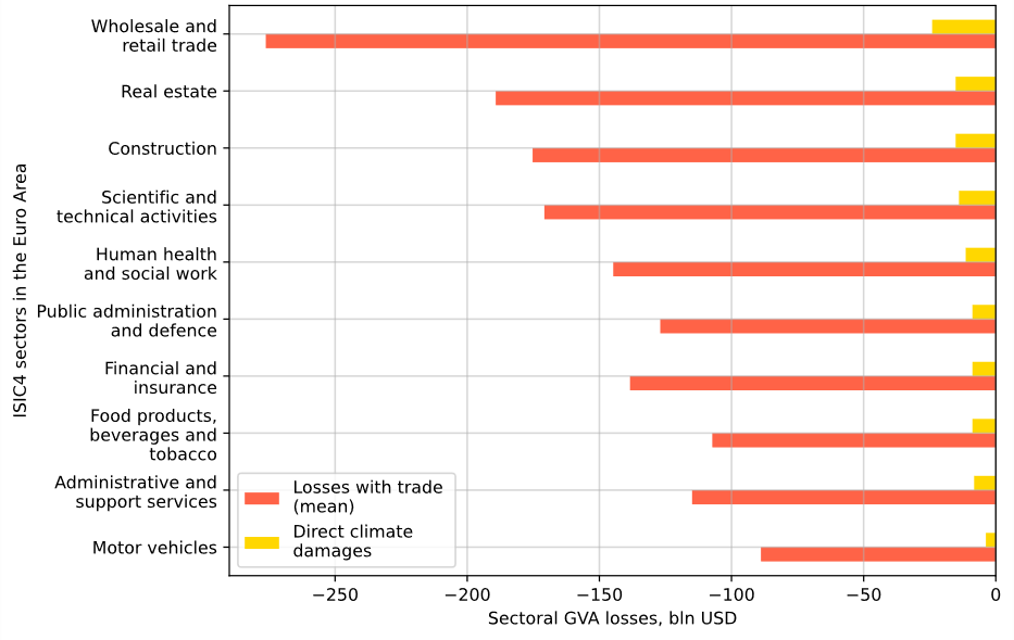

Figure 4 presents a breakdown of the most affected sectors in the EA, in terms of Gross Value Added (GVA) losses, again considering the most adverse RCP 8.5 scenario where all hazards realize simultaneously (again, the numbers can thus also be interpreted as the GVA-at-risk). The results are computed by assuming a trade reallocation capacity of 50%. This means that we allow 50% of the demand to be satisfied from excess capacity in other country-sectors. If Europe, for example, faces input bottlenecks due to steel production reductions in India, we allow Europe to import more steel from Asia – if Asia itself has excess supply that is not demanded by other countries.

Figure 4. GVA at risk for Euro Area sectors due to direct climate physical risk and amplified through trade interconnections (RCP 8.5)

The wholesale and retail trade sector shows the most significant losses by far. A detailed analysis shows that the loss in GVA in these two sectors is due to a production shortage caused by the global shortage of two key sectoral inputs: IT products and raw materials produced in the mining sector. In general, the global production of technology largely depends on input production which takes place in countries in Asia, which will be strongly affected by climate change. Moreover, sectors such as construction, finance and insurance, and the public administration are expected to face significant losses. These sectors are key for the delivery of climate risk mitigation and adaptation policies. Significant losses in the wake of the realisation of climate physical risks could create a vicious cycle were those productive sectors which could act as barriers to the cascading impact of climate risks find themselves unable to intervene because of their reduced economic capacity.

Our main result is very intuitive: once global supply-chains are considered, climate-related hazards can damage GDP significantly more heavily than direct impacts would suggest. Nevertheless, the absolute numbers presented in our paper (Fahr et al, 2024) should be treated with caution or seen as GDP-at-risk. There are a few factors that could lead to GDP-at-risk numbers that are smaller than suggested in this paper: hazard impacts are not necessarily additive, i.e. if a flood destroys a field, a drought cannot destroy it a second time. In addition, adaption across various dimensions can lower GDP impacts: firms could change their input composition to produce similar outputs and reduce their reliance on global supply chains. However, there are also factors which could lead to larger GDP impacts. Tipping points, interdependent hazards as well as wildfires are not part of the physical risk data used. Similarly, climate-related migration, diseases and political instability are not accounted for but could significantly lower GDP. Finally, GPD losses can feed into financial sector losses, which can in turn influence the real economy.

A second important outcome of our research is that the substitutability across country-sectors can decrease hazard-related GDP impact. In this sense, building resilient supply chains could contribute to adaptation efforts in the face of progressing climate change. Future research should examine more closely the role of both partially substitutable inputs as well as critical inputs that are less substitutable or not substitutable at all, such as in the food sector or specific technologies.

Overall, it appears that various analytical tools to increase our understanding of climate-related risks are available. IO models, empirical methods to estimate substitutability and others have long been studied in economics and other social sciences. Looking ahead, the ultimate bottleneck to more realistic climate change assessments appears to be the availability of granular, hazard-level physical risk data that are forward-looking and cover different, including adverse scenarios for the whole world. It is surprising that the international community has not yet produced and made such data available – because from a scientific point of view, such data would be at the beginning of any discussion about climate change.

Arent, D.J., R.S.J. Tol, E. Faust, J.P. Hella, S. Kumar, K.M. Strzepek, F.L. To th, and D. Yan (2014): Key economic sectors and services. In: Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects. Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Field, C.B., V.R. Barros, D.J. Dokken, K.J. Mach, M.D. Mastrandrea, T.E. Bilir, M. Chatterjee, K.L. Ebi, Y.O. Estrada, R.C. Genova, B. Girma, E.S. Kissel, A.N. Levy, S. MacCracken, P.R. Mastrandrea, and L.L. White (eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA, pp. 659-708

Copernicus Climate Change Service (2024). Warmest January on record, 12-month average over 1.5°C above preindustrial. Monthly Climate Bulletin

Dikau, S., & Volz, U. (2019). Central banking, climate change and green finance. In J. Sachs, W. Thye Woo, N. Yoshino, & F. Taghizadeh-Hesary (Eds.), Springer handbook of green finance: Energy security and sustainable development (pp. 81–102). New York: Springer.

Fahr, S., Vismara, A., & Senner, R. (2024). The globalization of climate change: amplification of climate-related physical risks through input-output linkages. ECB Working Paper.

Feng, A., & Li, H. (2021). We are all in the same boat: Cross-border spillovers of climate risk through international trade and supply chain. International Monetary Fund.

Keen, S. (2022). The appallingly bad neoclassical economics of climate change. In Economics and Climate Emergency (pp. 79-107). Routledge

Pichler, A., & Farmer, J. D. (2022). Simultaneous supply and demand constraints in input–output networks: the case of Covid-19 in Germany, Italy, and Spain. Economic Systems Research, 34(3), 273- 293.

SP Global (2022). Weather Warning: Assessing Countries’ Vulnerability to Economic Losses From Physical Climate Risks

RCP 8.5 is one of a set of scenarios which describe potential future pathways based on greenhouse gas concentrations. RCP 8.5 delivers an increase of about 4.5˚C by 2100, which is considered adverse by climatologists.