The surge in savings following the 2008-2009 Global Crisis and the recent pandemic have rekindled the interest of economists and policymakers in the paradox of thrift, formulated by Keynes in the 1930s. Subsequent research on the Great Depression of the 1930s, however, has not addressed the link between precautionary savings and growth. Using data on deposits in savings institutions of 22 countries, this paper studies the fate of savings during the Great Depression and shows that Keynes’ intuition was right. Banking crises had an impact on economic growth not only through the direct lending channel, but also indirectly through an increase in precautionary savings. This bears important lessons for today.

An important feature of the Global Crisis of 2008-2009 was a sharp increase in precautionary savings (Mody et al. 2012). This renewed interest in the paradox of thrift (Chamley 2012, Eggertsson and Krugman 2012, Guerrieri and Lorenzoni 2017, Fornaro and Romei 2019). A building block of Keynesian macroeconomics, the paradox of thrift states that an increase in savings does not naturally lead to an increase in investment. On the contrary, precautionary savings is detrimental to growth because it crowds out consumption and depresses aggregate demand.

The issue is once again at the forefront as the COVID-19 pandemic has caused an unprecedented increase in savings. In the EU, the savings rate of households has jumped from 12.5% to 17%. In 2008-2009, it had moved from 12.5% to 14% (Dossche and Zlatanos 2020). Even if the source of the current surge in savings is different from the one of 2008, it is obvious that this increase does not currently result in more investment and growth. Because of pessimistic expectations and uncertainty in the labour and credit markets, it is also likely that the forced savings accumulated during the lockdown will be partly transformed into precautionary savings. For these reasons, policymakers eagerly encourage consumption when health conditions permit. The way to respond to the current challenges would probably have seemed familiar to Keynes, since the current issues are quite similar to the situation he faced in 1931: “There are today many well-wishers of their country who believe that the most useful thing which they and their neighbours can do to mend the situation is to save more than usual. […] It is utterly harmful and misguided – the very opposite of the truth” (Keynes 1931, II.6: 151).

Is there anything we can learn from Keynes and from the Great Depression about the negative effect of increased savings? Surprisingly, despite several new theoretical formulations of the paradox of thrift (Chamley 2012, Eggertsson and Krugman 2012, Guerrieri and Lorenzoni 2017, Fornaro and Romei 2019), empirical studies on the consequences of precautionary savings on output are still limited. Even more surprising, the literature on the Great Depression has not provided evidence that Keynes’ intuition was right. Keynesian interpretations of the great slump of the 1930s has emphasised the role of a drop in consumption, especially in the US (Temin 1976, Romer 1990), but no statistics document a sizeable international increase in precautionary savings during those years. Following Fisher (1932), a traditional story is that households hoarded cash. Estimates of the size of cash hoarding remain rare however and are not compared with other potential forms of savings. This lack of evidence is particularly surprising because the Great Depression period offers an ideal setting to test paradox of thrift theories. First because virtually every country suffered from banking crisis. Second, because of the lack of financial and unemployment insurance. When confronted to financial and economic uncertainty, consumers had a strong incentive to accumulate savings as a buffer against future shocks. Precautionary savings were consumers’ only line of defence against financial uncertainty.

Important data limitations prevent scholars from estimating a reliable savings rate for a large number of countries during the 1930s. Acknowledging such difficulties, we do not attempt to build a comprehensive estimation of precautionary savings but focus on the institutions that, given the structure of financial systems of the time, were the most likely to attract precautionary savings – ‘savings institutions’. The legal forms and business models of savings institutions differed across countries, but they were everywhere distinguished from commercial (or universal) banks in the eyes of depositors, as well as in official statistics. Contrary to banks or other financial institutions (trusts, building societies, etc.) savings institutions were not primarily aimed at lending but at encouraging and protecting savings. They were usually created in the 19th century by the state or paternalistic movements to encourage savings by the lower classes (but eventually also welcomed deposits from the wealthiest and from companies). They often collected money saved for retirement or unemployment insurance, at a time when pension funds and social welfare systems were almost non-existent.

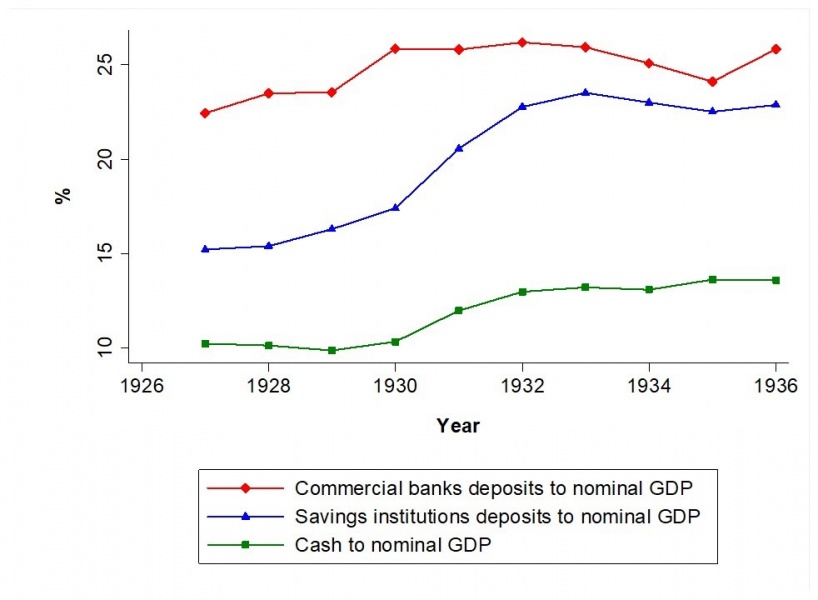

In Degorce and Monnet (2020), we collect data on deposits in savings institutions for 22 countries (representing 75% of world real GDP in 1930). Figure 1 compares the deposits in savings institutions to deposits in banks and cash (banknotes), with all variables scaled by nominal GDP. Deposits in savings institutions increased from 16% to 24% of GDP on average. By contrast, deposits in banks fell in the same way as GDP during the same period, so that their share in GDP remained constant. Cash-to-GDP increased from 10% to 12.5%. In most countries (16 out of 22), however, the increase in the ratio of cash to GDP was in fact mainly due to the decrease in GDP. By contrast, deposits in savings institutions increased everywhere in nominal terms. On average, bank deposits decreased by 14.4% between 1928 and 1933 while savings bank deposits increased by 116.5%. The increase in savings institutions deposits was a key feature of the international Great Depression.

Figure 1. Average ratio of bank deposits, savings institutions deposits, and cash in circulation to nominal GDP, 1926-1936

Source: Degorce and Monnet (2020).

The detailed country-by-country chronology of our series reveals that a surge in savings was usually associated with banking crises. As in the models of Mody et al. (2012) and Guerrieri and Lorenzoni (2017), a credit crunch triggers a rise in precautionary savings because it increases uncertainty about future economic outcomes. In the US case, Romer (1990) has shown that uncertainty caused by the 1929 financial crash led people to forego the purchase of durable goods, at the expense of non-durables. Yet, in other countries, the historiography has emphasised that banking crises were the most dramatic events likely to create liquidity constraints and uncertainty (Grossman and Meissner 2010: 320). Our international perspective confirms this view and argues that the rise in precautionary savings caused by banking crises was an important channel of transmission of the Depression.

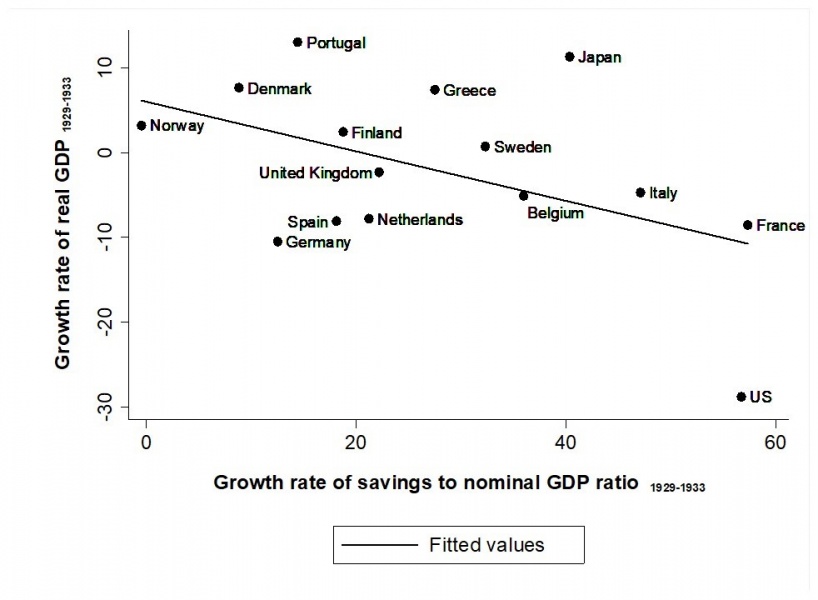

Documenting a surge in precautionary savings is not sufficient to document that Keynes’ paradox of thrift was at work. A simple look at the data suggests that, indeed, savings institutions deposits to GDP increased more in countries where real GDP experienced lower growth (Figure 2). Yet, this correlation could simply be driven by the growth of GDP. We thus propose an econometric test where we use the fact that the sudden surge in precautionary savings was caused by banking crises. We interact a banking crisis dummy with the volume of deposits in savings institutions. If we follow Keynes, this interaction term measures an aggregate demand shock that was relatively independent from the level and growth of output.

We find a negative conditional correlation between real GDP and savings in a dynamic panel estimation with country-fixed and year-fixed effects when a banking crisis hit. This negative correlation provides evidence of a paradox of thrift. On the contrary, outside banking crises, savings and GDP were positively correlated. This positive correlation is expected because of the usual endogeneity between savings and income – through the accounting identity: falling output pushes income and savings down (even if the fall in output was initially caused by an exogenous rise in savings).

Figure 2. Cross-country correlation between the increase in savings rate and real GDP growth during the Great Depression, 1929-1933

Source: Degorce and Monnet (2020).

The negative correlation between savings and GDP is identified conditionally on the evolution of bank deposits and a banking crisis dummy. This means that there was a negative effect of precautionary savings that worked separately from the direct effect of banking crises on growth (i.e. through the decline in bank deposits and credit). A back-of-the-envelope calculation suggests that the negative effect of precautionary savings on growth was at least as large as the direct effect of the decline in banking activity during the years when the banking crises were most intense (1930-1932). Each of these two factors accounted for about 15 % of the overall decline in real GDP.

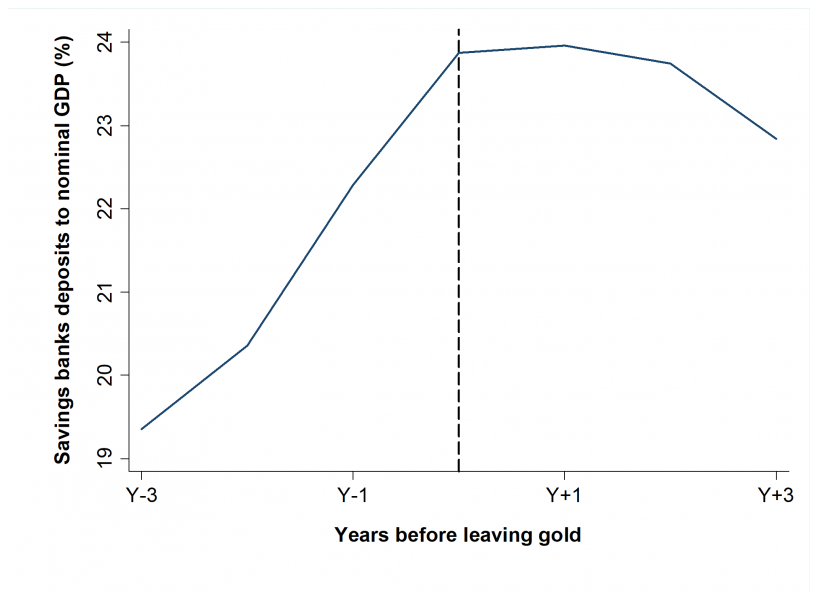

How should governments and central banks respond to the large increase in savings rates? What kind of policy was likely to end the accumulation of precautionary savings during the Great Depression? According to the literature on the sources of economic recovery in the 1930s (Temin and Wigmore 1984, Eichengreen 2002, Eggertsson 2008), leaving the gold standard proved to be the typical and most effective way for authorities to signal a change in policy, stabilise business and consumer expectations, and implement countercyclical policies to foster recovery. As can be seen in Figure 3, the ratio of savings to nominal GDP levelled off (and eventually decreased) once a country had left gold.

Figure 3. Ratio of savings institutions deposits to nominal GDP before and after leaving the gold standard

Source: Degorce and Monnet (2020).

A clear commitment to countercyclical policies was a sine qua non condition for stopping the detrimental accumulation of precautionary savings. But Figure 3 and, more generally, the history of recovery from the Great Depression in the 1930s (Eichengreen 1992, Romer 1992) also reveal that the situation did not come back to normal quickly. As in 1937 in the US for example, the first attempt to relax accommodative policies came at a high cost. The efforts of governments are here to stay if we want to prevent uncertainty about economic outcomes from incentivising a high level of precautionary savings.

Chamley, C (2012), “A paradox of thrift in general equilibrium without forward markets”, Journal of the European Economic Association 10(6): 1215-1235.

Degorce, V and E Monnet (2020), “The Great Depression as a Saving Glut”, CEPR Discussion Papers 15287.

Dossche, M and S Zlatanos (2020), “COVID-19 and the increase in household savings: precautionary or forced?”, ECB Economic Bulletin, Issue no 6.

Eggertsson, G B (2008), “Great Expectations and the End of the Depression”, American Economic Review 98(4): 1476-1516.

Eggertsson, G B and P Krugman (2012), “Debt, deleveraging, and the liquidity trap: A Fisher-Minsky-Koo approach”, The Quarterly Journal of Economics 127(3): 1469-1513.

Eichengreen, B J (1992), Golden fetters: the gold standard and the Great Depression, 1919-1939, Oxford University Press.

Fisher, I (1932), Booms and Depressions, Adelphi.

Fornaro, L and F Romei (2019), “The paradox of global thrift”, American Economic Review 109(11): 3745-79.

Keynes, J M (1931), Essays in Persuasion, MacMillan & Co.

Mody, A, F Ohnsorge and D Sandri (2012), “Precautionary savings in the great recession”, IMF Economic Review 60(1): 114-138.

Romer, C D (1990), “The Great Crash and the onset of the Great Depression”, The Quarterly Journal of Economics 105(3): 597-624.

Romer, C D (1992), “What Ended the Great Depression?”, Journal of Economic History, 757-784.

Romer, C D and D H Romer (2017), “New evidence on the aftermath of financial crises in advanced countries”, American Economic Review 107(10): 3072-3118.

Roodman, D (2009), “How to do xtabond2: An introduction to difference and system GMM in Stata”, Stata Journal 9(1): 86-136.

Temin, P (1976), Did monetary forces cause the Great Depression?, Norton.

Temin, P and B A Wigmore (1990), “The end of one big deflation”, Explorations in Economic History 27(4): 483-502.