The views expressed in this note are those of the authors and do not involve the responsibility of the Bank of Italy.

Our research analyses how the currency of denomination and the degree of financial openness of the market of issuance influence the yield differential between green and equivalent non-green bonds. We find that the difference is smaller for bonds denominated in highly volatile currencies and for those issued in financial markets that are more closed to foreign investors. Therefore, we offer a possible explanation for the higher financing costs of green projects in many emerging economies compared with advanced countries (the green sin).

Several studies suggest that the yield on green bonds is lower than that of equivalent brown bonds: the negative spread being labelled as greenium. This empirical evidence can be easily rationalized also from a theoretical perspective when assuming that investors have non-pecuniary environmental concerns (Gianfrate and Peri, 2019; Zerbib, 2019; Fatica and Panzica, 2021; Fatica et al., 2021; Pastor et al., 2021; Baker et al., 2022; Pastor et al., 2022).

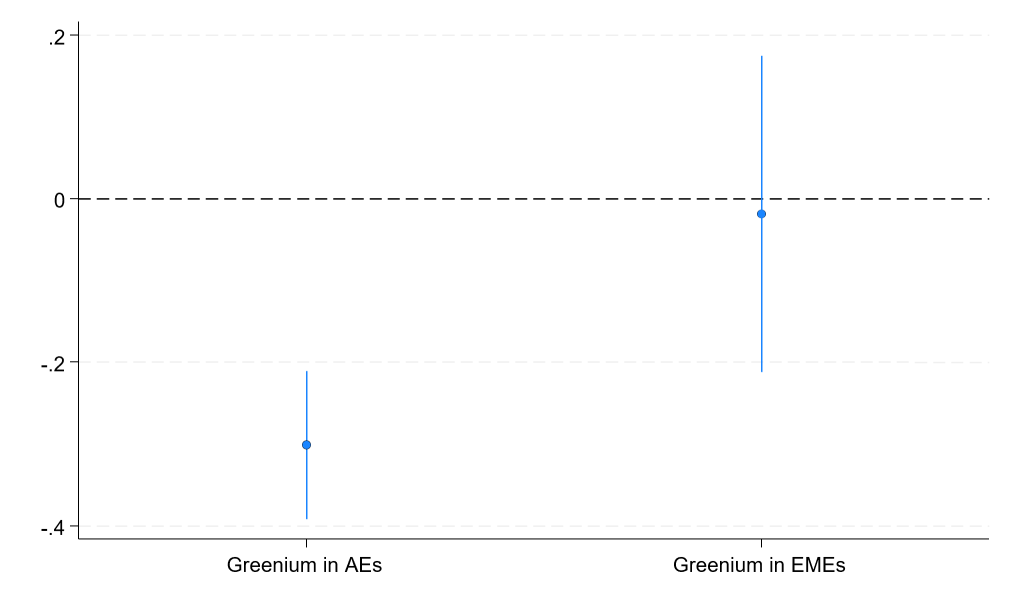

However, there is still limited empirical evidence in the literature about the differences in green premia across markets and currencies. In Moro and Zaghini (2024), we attempt to fill this gap using a global market dataset of bond placements in the primary market, over the period 2014-2021. Controlling for a rich set of bond and market characteristics, we show that bonds issued in advanced economies (AEs) have a statistically significant negative greenium of 30 basis points, while emerging market economies (EMEs) exhibit a negligible greenium of 2 basis points, not statistically different from zero (fig. 1).

Figure 1: Estimate of the greenium in advanced and emerging economies (percentage points)

Notes: the figure reports the coefficients and the 95% confidence intervals of the regression in which the dependent variable is the yield at issuance on bonds placed during the 2014-2021 period in global markets. The independent variables shown are the dummy variable tracking green bonds interacted with the dummy denoting advanced economies (AEs) and with the dummy denoting emerging market economies (EMEs). Addition controls are: bond maturity, amount issued, the frequency of coupon, the interest rate type (fixed, floating, variable), a dummy for collateralized bonds, a dummy for subordinate bonds, a dummy for callable bonds, the rating of the bond, the rating of the issuer, issuer’s sector-specific fixed effects, time varying and market-specific fixed effects and time varying fixed effects taking into account the currency of denomination and its interaction with the nationality of the issuer. Ordinary least squares estimates and cluster-robust standard errors at issuer level are displayed.

Notes: the figure reports the coefficients and the 95% confidence intervals of the regression in which the dependent variable is the yield at issuance on bonds placed during the 2014-2021 period in global markets. The independent variables shown are the dummy variable tracking green bonds interacted with the dummy denoting advanced economies (AEs) and with the dummy denoting emerging market economies (EMEs). Addition controls are: bond maturity, amount issued, the frequency of coupon, the interest rate type (fixed, floating, variable), a dummy for collateralized bonds, a dummy for subordinate bonds, a dummy for callable bonds, the rating of the bond, the rating of the issuer, issuer’s sector-specific fixed effects, time varying and market-specific fixed effects and time varying fixed effects taking into account the currency of denomination and its interaction with the nationality of the issuer. Ordinary least squares estimates and cluster-robust standard errors at issuer level are displayed.

As a possible explanation of the heterogeneity in the greenium between advanced and emerging economies, we develop a partial-equilibrium model featuring foreign investors with mean-variance preferences and a convex disutility associated to brown bond holdings. According to the model, green premia should be smaller (less negative) in countries with more closed financial accounts and highly volatile exchange rates. The rationale being that since foreign investors tend to invest smaller amounts of their wealth in such economies, they care relatively less about the moral costs of investing in brown assets. Foreign investors might also face transaction costs discouraging them from diversifying the investment into multiple financial vehicles, including those specialized in the financing of green projects, when the size of the investment is small. In turn, the higher demand for brown bonds pushes their yield closer to the green one, narrowing the greenium.

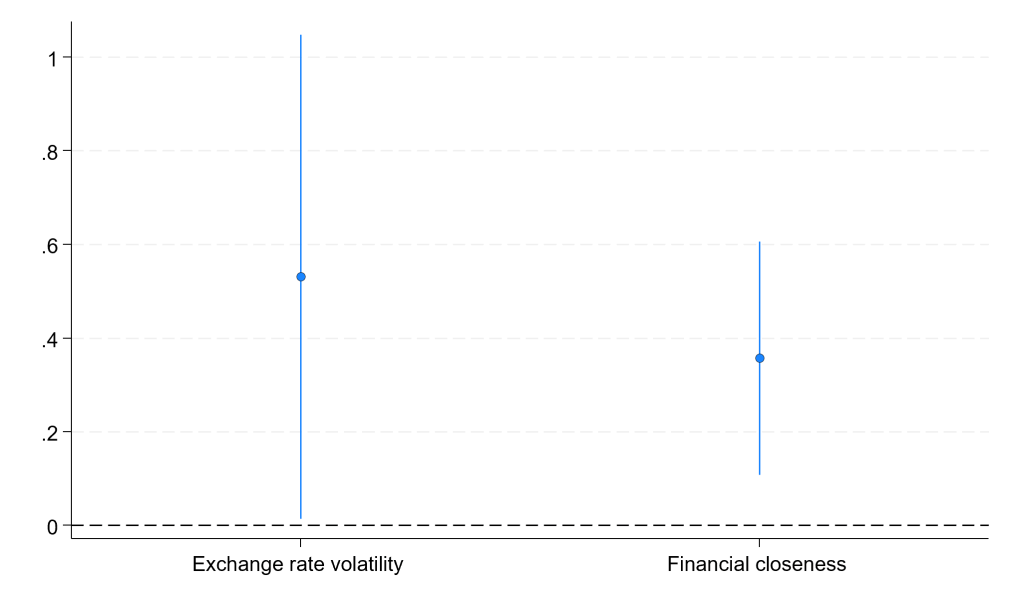

In order to test these theoretical implications, we estimate the effect on green premia of the exchange rate volatility of the currency in which bonds are denominated (against the US dollar) and the financial account closeness of the market in which bonds are issued. We find that both variables have a dampening effect on the greenium: in other words, it emerges that the greenium is smaller (less negative) when the exchange rate volatility is sizable and when there are stringent domestic restrictions on foreign financial flows (fig. 2).

Figure 2: Estimates of the effect of exchange rate volatility and financial account closeness on the greenium (percentage points)

Notes: the figure reports the coefficients and the 95% confidence intervals of the regression in which the dependent variable is the yield at issuance on bonds placed during the 2014-2021 period in global markets. The independent variables shown are the dummy variable tracking green bonds interacted with the exchange rate volatility (against the US dollar) of the currency in which bonds are denominated and with the financial account closeness indicator (based on Chinn-Ito, 2006) of the market in which bonds are issued. All these indicators are computed as standard deviations or averages over the 2000-2021 period, and re-scaled to vary between zero and one. Addition controls are: the dummy tracking green bonds, bond maturity, amount issued, the frequency of coupon, the interest rate type (fixed, floating, variable), a dummy for collateralized bonds, a dummy for subordinate bonds, a dummy for callable bonds, the rating of the bond, the rating of the issuer, issuer’s sector-specific fixed effects, time varying and market-specific fixed effects and time varying fixed effects taking into account the currency of denomination and its interaction with the nationality of the issuer. Ordinary least squares estimates and cluster-robust standard errors at issuer level are displayed.

Notes: the figure reports the coefficients and the 95% confidence intervals of the regression in which the dependent variable is the yield at issuance on bonds placed during the 2014-2021 period in global markets. The independent variables shown are the dummy variable tracking green bonds interacted with the exchange rate volatility (against the US dollar) of the currency in which bonds are denominated and with the financial account closeness indicator (based on Chinn-Ito, 2006) of the market in which bonds are issued. All these indicators are computed as standard deviations or averages over the 2000-2021 period, and re-scaled to vary between zero and one. Addition controls are: the dummy tracking green bonds, bond maturity, amount issued, the frequency of coupon, the interest rate type (fixed, floating, variable), a dummy for collateralized bonds, a dummy for subordinate bonds, a dummy for callable bonds, the rating of the bond, the rating of the issuer, issuer’s sector-specific fixed effects, time varying and market-specific fixed effects and time varying fixed effects taking into account the currency of denomination and its interaction with the nationality of the issuer. Ordinary least squares estimates and cluster-robust standard errors at issuer level are displayed.

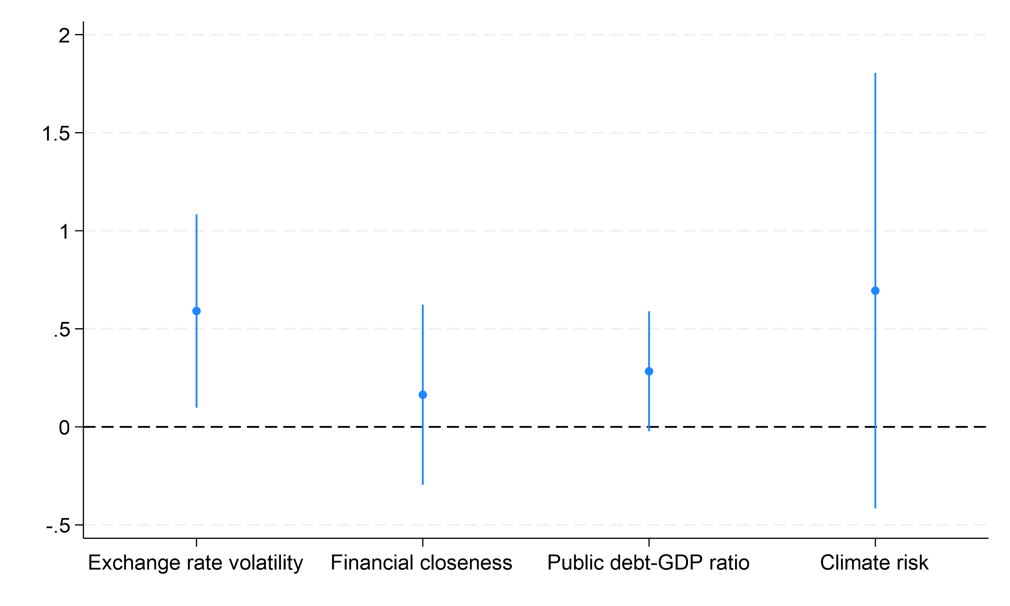

Even when controlling for a richer set of possible determinants of the greenium, including public debt to GDP ratio as a proxy of fiscal vulnerability and climate vulnerability as measured by the ND-GAIN index, the coefficient associated to the exchange rate volatility remains statistically significant (fig. 3).

Figure 3: Estimates of the effect of exchange rate volatility, financial account closeness, fiscal vulnerability and climate risk on the greenium (percentage points)

Notes: the figure reports the coefficients and the 95% confidence intervals of the regression in which the dependent variable is the yield at issuance on bonds placed during the 2014-2021 period in global markets. The independent variables shown are: the interaction between the dummy variable tracking green bonds and the exchange rate volatility (against the US dollar) of the currency in which bonds are denominated, the interaction with the financial account closeness indicator (based on Chinn-Ito, 2006) of the market in which bonds are issued, the interaction with the debt-to-GDP ratio, the interaction with the climate risk indicator (based on the ND-GAIN index). All these indicators are computed as standard deviations or averages over the 2000-2021 period, and re-scaled to vary between zero and one. Addition controls are: the dummy tracking green bonds, bond maturity, amount issued, the frequency of coupon, the interest rate type (fixed, floating, variable), a dummy for collateralized bonds, a dummy for subordinate bonds, a dummy for callable bonds, the rating of the bond, the rating of the issuer, issuer’s sector-specific fixed effects, time varying and market-specific fixed effects and time varying fixed effects taking into account the currency of denomination and its interaction with the nationality of the issuer. Ordinary least squares estimates and cluster-robust standard errors at issuer level are displayed.

These results are relevant from a policy perspective. First, they help explaining why only a limited share of total investments goes to companies involved in carbon solutions in emerging markets (OECD, 2023; IMF, 2023; IEA, 2023). Indeed, these countries are characterized by more closed financial accounts, less developed institutional frameworks, and their currencies are more volatile in comparison to the hard currencies of advanced economies. Paralleling the literature on the “original sin”, which refers to the difficulties emerging markets face in issuing debt denominated in their local currencies, the higher financing costs of green projects in emerging markets – especially when denominated in local currency – can be labelled as the “green sin” of such economies.

Second, the results of the analysis suggest that interventions aimed at the liberalization of the financial account could help emerging economies in attracting foreign capital inflows to finance the transition towards a low-carbon economy. This must be coupled with an improvement in their institutional framework and macroeconomic fundamentals. In particular, a well-managed exchange rate could help emerging market economies attracting foreign capital inflows in the domestic green bond market and lowering the financing costs of domestic green projects. A possible alternative to encourage foreign capital inflows, at least in an early phase, would be the issuance of green bonds denominated in hard currencies.

Baker, M., Bergstresser, D., Serafeim, G., and Wurgler, J. (2022). The pricing and ownership of US green bonds. Annual Review of Financial Economics, 14, 415-437.

Chinn, M. D., and Ito, H. (2006). What matters for financial development? Capital controls, institutions, and interactions. Journal of development economics, 81(1), 163-192.

Gianfrate, G., and Peri, M. (2019). The green advantage: Exploring the convenience of issuing green bonds. Journal of cleaner production, 219, 127-135.

Fatica, S., and Panzica, R. (2021). Green bonds as a tool against climate change?. Business Strategy and the Environment, 30(5), 2688-2701.

Fatica, S., Panzica, R., and Rancan, M. (2021). The pricing of green bonds: are financial institutions special?. Journal of Financial Stability, 54, 100873.

IEA (2023). Scaling up Private Finance for Clean Energy in Emerging and Developing Economies. Report, Paris.

IMF (2023). Financial sector policies to unlock private climate finance in emerging market and developing economies. Global Financial Stability Report (October). International Monetary Fund, Washington.

Moro, A., and Zaghini, A. (2024). The green sin: how exchange rate volatility and financial openness affect green premia. Bank of Italy Working Paper, No 1447.

OECD (2023). Towards Orderly Green Transition–Investment Requirements and Managing Risks to Capital Flows. OECD Report to the G20 Finance Ministers and Central Bank Governors.

Pastor, L., Stambaugh, R. F., and Taylor, L. A. (2021). Sustainable investing in equilibrium. Journal of Financial Economics, 142(2), 550-571.

Pastor, L., Stambaugh, R. F., and Taylor, L. A. (2022). Dissecting green returns. Journal of Financial Economics, 146(2), 403-424.

Zerbib, O. D. (2019). The effect of pro-environmental preferences on bond prices: Evidence from green bonds. Journal of Banking and Finance, 98, 39-60.