This policy brief focuses on the direct and indirect effects of the Covid-19 pandemics on the sales of fast-moving consumer goods (FMCGs) in the grocery chain stores. We summarize the findings of a recent paper on the Italian case during the first wave of the pandemics. We document a sustained growth in revenues for storable products, such as food staples and household supplies, beginning right before the introduction of restrictions on mobility, and lasting throughout the lockdown period. We find that the increase was driven by the dynamics of smaller outlets, located in urban areas and closer to the city centre, while hypermarkets experienced a drop during the lockdown, probably relating to their more peripheral position. Exploiting the uneven geographical distribution of contagions as well as the staggered implementation of restrictions confirms that mobility constraints have negative effects on large grocery chain revenues.

Italy has been among the first European countries to experience a widespread diffusion of the Covid-19, as well as one of those most hit in terms of deaths during the first wave of the pandemics, in 2020. Since early March, several measures were put in place to limit individuals’ exposure to the virus in workplaces and public spaces. The productive activities deemed “non-essential” were suspended from March 22nd until May 4th; they represented about one third of total value added, with percentages of up to around two thirds for the accommodation and catering services component and almost 100 percent for recreational activities.

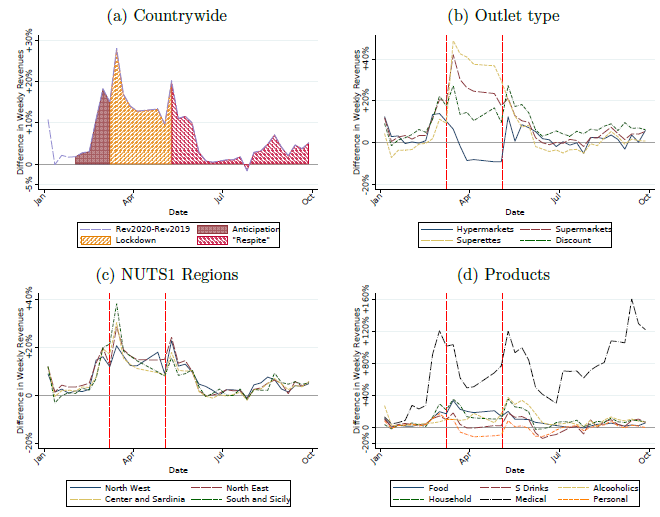

The impact on the various economic sectors, also due to the unprecedented fall in demand, was uneven. Severe downturns were recorded in manufacturing, transports, catering, accommodation, recreation and culture, personal services, and in large swathes of retail trade (-45 percent excluding the food subsector). On the other hand, Fast-Moving Consumer Goods1 experienced a sustained growth, which translated in strongly positive year-on-year dynamics throughout all the first wave period of the pandemics – figure 1, panel (a).

In a recent research paper (Ciapanna and Rovigatti, 2021) we use detailed scanner data sourced from Nielsen, to unveil the remarkable degree of variation that underlies such a massive increase in revenues, and to understand the mechanisms linking mobility restrictions to the performance of FMGC stores. Distinguishing across different store types2 reveals that the sales surface and the distance from the city center matters when mobility restrictions are in place. In particular, large hypermarkets (typically located outside residential neighborhoods) recorded negative year-on-year revenue performance during the lockdown period to the advantage of smaller, family-owned shops located closer to city centers, as shown in figure 1, panel (b).

The mobility restrictions seem to play a compelling role in driving the revenues, even more than the fear of contagion. In fact, despite the different degree of exposure to the contagion that characterized the various areas in the country during the first wave, with the vast majority of cases recorded in Northern regions and virtually no infection risk in the South, we do not find any evidence of a North-South divide in consumer behavior – figure 1, panel (c). The most striking evidence of the lockdown effects on consumption patterns is reported in panel (d), where we distinguish the revenues by product class: while the reduced mobility depressed the consumption of personal products (e.g. cosmetics), it boosted the revenues coming from food, alcoholics and mostly medical products, whose year-on-year changes reached a +160% variation in September.

Figure 1: Year-on-year changes in revenues, 2019-2020

Notes: Year-on-year % changes in revenues for the FMCG sector in Italy, 2020. (a) countrywide; (b) divided by outlet type: hypermarkets (solid blue), supermarkets (dashed red), superettes (dotted yellow) and discounts (dotted green); (c) divided by NUTS1 regions: North West (solid blue), North East (dashed red), Center and Sardinia (dotted yellow), and South and Sicily (dotted green); (d) divided by product groups: Food (solid blue), Soft Drinks (dashed red), Alcoholics (dotted yellow), Household products (dotted green), Medical appliances (dashed black), and Personal goods (dotted orange). The vertical, dashed lines mark the starting and end date of the lockdown.

Moving from the above evidence, we tested whether the increase in revenues reflected higher quantities purchased (demand-driven shock) or increases in prices charged. We found that, while both margins co-moved with the revenues, the main driver was an abrupt increase in consumption, whereas prices only partially followed the dynamics of revenues, but for the smallest, family-owned, and less structured outlets (the superettes), which could more easily adjust their prices in response to changes in demand.

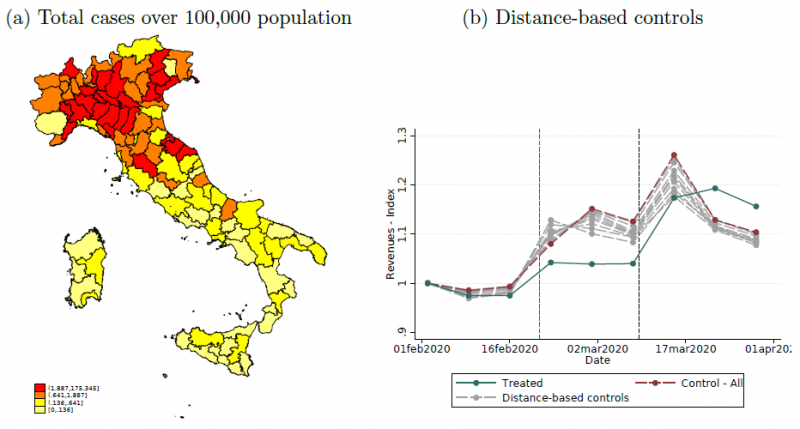

We also exploited the staggered implementation of the mobility restrictions and the different degree of infection risk across provinces to estimate how the containment measures affected consumption patterns. The Lodi province was partially quarantined two weeks prior to the declaration of the national lockdown because of the high number of infections. The municipalities involved lied at the epicenter of the infection spreading trajectory, as reported in figure 2, panel (a); the provinces in the South, on the other hand, were virtually untouched by the first wave of Covid-19 infections.

In order to capture the effect of the mobility restrictions, we contrasted the dynamics of revenues in the province of Lodi before and during the partial lockdown against the same measure in various groups of the other provinces, exposed to the infection risks at various degrees – figure 2, panel (b). We estimate a negative effect of the lockdown on FMCGs, and show that stores in quarantined areas earn around 10 per cent less than outlets located in areas not subject to any restriction.

Unsurprisingly, the mobility channel drives most of the effect. Using the data provided by Pepe et al. (2020), we have been able to track down the within-province mobility patterns and contrast Lodi with the other provinces during the lockdown. We found that the dynamics of personal mobility perfectly reflect that of FMCGs revenues, and that the relatively weaker growth in quarantined zones was almost entirely due to the reduced mobility within Lodi: as soon as all the country entered the lockdown and the mobility gap disappeared, the revenue trends converged, too.

Figure 2: Covid incidence and lockdown trends

Notes: (a) Total Covid-19 identified cases between March and September 2020, per 100,000 inhabitants at the province level (February/August, 2020). (b) Revenues indexed at February 1, 2020, reported for the treatment group (Lodi, solid blue), averaged across the control group provinces for the baseline control (Control – All, dashed maroon), and across all distance-based control groups (dashed grey).

Our analysis yields three major findings related to the performance of FMCGs during pandemics outbreaks and under lockdown restrictions. First, changes in quantity purchased, rather than price movements, drive most of the revenue dynamics; second, there exist huge variations in both quantity demanded, prices charged and dynamic response across areas and distributive types. Third, lockdown measures soften revenue increases by a considerable amount; in particular, they do so through the mobility channel, which mainly affects larger peripheral outlets.

Ciapanna, E. and Rovigatti, G. (2021). “The grocery trolley race in times of Covid-19. Evidence from Italy”, Bank of Italy Working Papers (Temi di Discussione), N 1341.

Pepe, E., Bajardi, P., Gauvin, L., Privitera, F., Lake, B., Cattuto, C., and Tizzoni, M. (2020). “Covid-19 outbreak response, a dataset to assess mobility changes in Italy following national lockdown”. Scientific data, 7(1):1-7.

Also known as packaged goods, these are products that sell quickly at relatively low cost. FMCGs have a short shelf life either because of high consumer demand (e.g., soft drinks and confections) or because they are perishable (e.g., meat, dairy products, and baked goods). They are purchased frequently, consumed rapidly, priced low, and are sold in large quantities.

The outlet types are defined according to the sales surface in hypermarkets, supermarkets and superettes, or according to the menu of available products (discounts typically feature a different set of brands).