The Covid-19 pandemic has hit international trade hard, creating concerns of serious disruptions to global value chains (GVCs). Preliminary data analysis suggests, however, that the pandemic has not hit GVC production and trade especially hard, although the sector of transport equipment makes a notable exception. Experiences from previous crises suggest the feared massive restructuring of GVCs will likely be avoided. The optimal strategies for preparing for a crisis might vary across industries and companies not necessarily involving value chain restructuring. The Covid-19 crisis can amplify other long-term trends affecting GVC development. While the effects of these trends are ambiguous, it seems that the most intense phase of GVC expansion has already passed. But the requisite complexity and high restructuring costs of existing GVCs make it unlikely that they will be dismantled anytime soon.

The IMF estimates that the volume of global trade declined about 10% in 2020, i.e. at the same pace as in 2009. Taking into account the steep contraction in global GDP, goods trade has so far fallen more moderately in relative terms than during the global financial crisis.2 This reflects the fact that pandemic hit the service sector particularly hard, but it seems that contagion effects to manufacturing, international trade and GVCs have not been as great as feared.

While the pandemic has led to a decline in international trade and disruptions in GVCs, the preliminary data analysis in Simola (2021) suggests that GVCs have not been hit particularly hard. The analysis is based on statistics on goods trade flows by product group during the deepest crisis period in 2Q20. The data covers key GVC hubs: the EU27, the US, Japan and China. The product categories most relevant for GVCs are intermediates, i.e. industrial supplies and parts and accessories (P&A)3. Fuels are excluded from the analysis as they are highly sensitive to price changes and not central to the analysis.

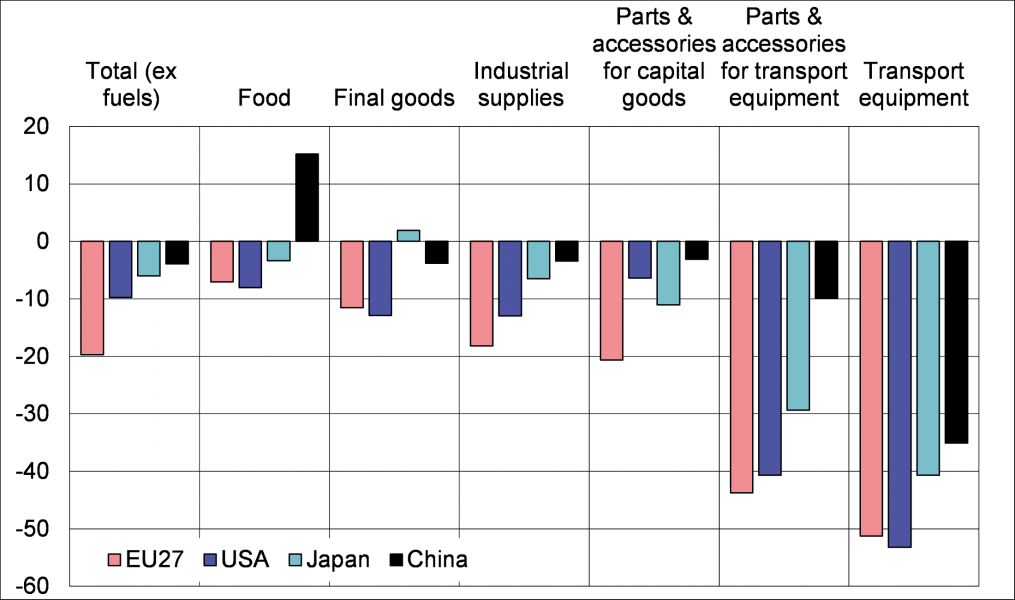

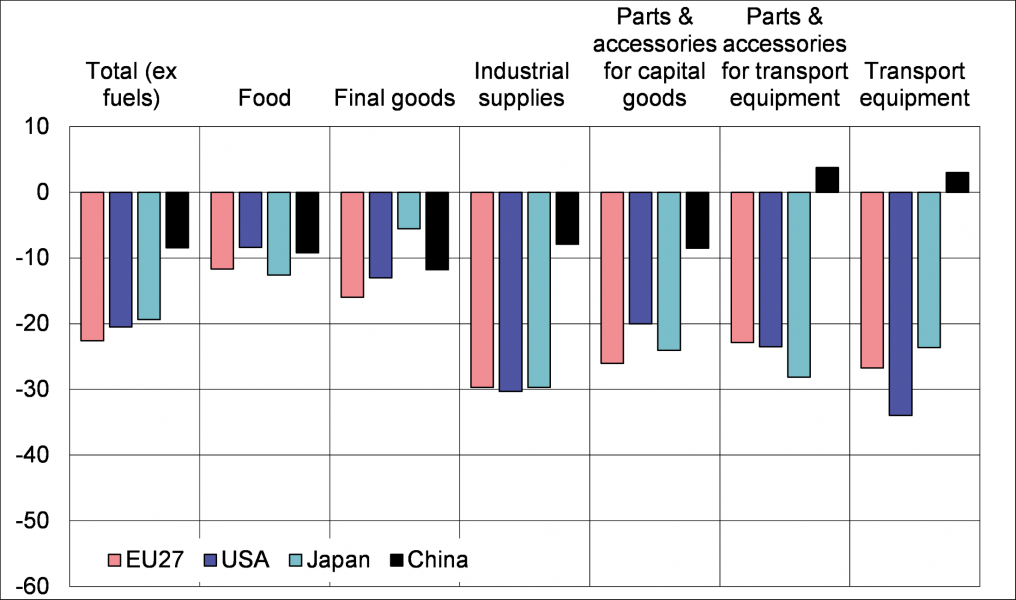

The trade data show that the main trends are quite are similar for the EU, the US and Japan, while the case of China has some differences. In all countries, import development has varied considerably across product categories (Figure 1). In the EU, the US and Japan imports of final goods tend to have declined less than the imports of intermediate products. Imports of most intermediates have contracted roughly at the same pace as total imports excluding fuels. For China, there are no major differences across final goods and intermediates (with the exception of food imports, which have grown substantially). In all countries, a key exception are the categories of transport equipment and their parts & accessories. Imports in these product categories have contracted much more sharply compared to other major product categories.

In comparison to the global final crisis, the total imports of other countries have declined more mildly than the EU imports. For the US, this reflects mainly the development in intermediate imports, while for Japan and China it mainly concerns final goods. In all countries the import development seems to differ from the global financial crisis particularly with the much sharper contraction in the imports of transport equipment and their parts and accessories compared to other product categories.

Figure 1. Change in the value of imports of the EU27, the US, Japan and China in a) 2Q20 (1Q20 for China) and b) full year 2009, % y/y.

|

|

Source: Simola (2021) based on data from Eurostat, US Census Bureau, UN Comtrade.

Some of the unique features of the current crisis defy historical comparison, but previous crises nevertheless may help shed light on the potential consequences for GVCs this time around. The obvious reference points are the global financial crisis and the massive natural disasters in East Asia in 2011. The first crisis was global in nature and closest in magnitude of global economic consequences as the current Covid-19 crisis. The latter crisis specifically concerns supply chain disruptions.

GVC trade collapsed during the global financial crisis but recovered quite rapidly to pre-crisis levels. Based on the experiences from the global financial crisis, the current crisis might not lead to a major restructuring of GVCs (Antras, 2020; Miroudot, 2020). At least on the aggregate level, there is no indication of a clear trend towards more geographical diversification or concentration across value chains in different industries after the global financial crisis. The trade collapse was mainly due to a substantial reduction in demand. Although the current crisis is also associated with supply shocks, it now seems that the main blow has again come from the sharp drop in demand. Supply chain problems have affected production in several countries and sectors, but most GVCs appear to have been quite resilient.

From the perspective of supply shocks, the most commonly mentioned reference points are the massive earthquake in Japan and flood in Thailand in 2011. These two events caused serious supply disruptions for GVCs, particularly in the car and computer industries. It seems that these catastrophes resulted in some diversification of suppliers and may have contributed to the slowdown in GVC expansion. They did not, however, lead to any major reshoring, and quite the opposite in some cases. For example, the share of Thai value added in other country exports in the hardest hit sectors actually increased slightly after the natural disaster. Anecdotal evidence and more formal studies also have similar findings (Miroudot, 2020).

The fact that crises have not led to major restructurings of GVCs can reflect the various adjustment capabilities that firms have for risk management – many of them more appropriate than value chain restructuring. Firms face multitude of risks and may value different features that also require partly different management strategies. Also in aggregate terms, GVC restructuring – especially reshoring – is typically not the optimal solution. For example, the results of Bonadio et al. (2020) suggest that, without GVCs at their current scale, the negative effects of the current crisis on production and employment could have been more severe for some countries. OECD (2020) simulations also show that a more localized regime of world production is more vulnerable to shocks than the type of GVC network currently in place.

Although the Covid-19 crisis may not result in major GVC restructurings, it can amplify other trends that will shape GVCs in the future. Key trends that are expected to affect the future development of GVCs include the rise of protectionism, technological development (especially automation and digitalization), environmental issues and trends in emerging markets, particularly China (Antras, 2020; OECD, 2017; UNCTAD, 2020). Covid-19 has increased protectionist pressures, but also illustrated the importance of GVCs during the current crisis e.g. for test kit and facial mask production (Baldwin & Evenett 2020). Covid-19 experiences can increase incentives for further automation to reduce risks related to human employees, but the pandemic has also taught companies to utilize digitalization and teleworking possibilities more efficiently.

The key trends can have mixed effects on the future development of GVCs. Automation and increasing costs in emerging markets tend to reduce incentives for dispersion of production. Increasing environmental awareness could also push for shorter and more local value chains. Intensification of protectionist pressures would be particularly damaging for GVC trade. On the other hand, increasing digitalization facilitates wider participation in GVCs and the rising income level in emerging economies can support GVC expansion based on motives such as economies of scale or proximity to final consumers. The importance of various factors is also likely to be different across sectors.

The trends discussed above do not necessarily imply substantial changes in existing GVCs, but rather affect the design of future GVCs. Profound transformation of a complex GVC could be difficult and costly as GVC structures involve many relatively fixed relationships and linkages. Nevertheless, the main drivers of rapidly expanding global dispersion of production seem to have faded substantially. This development might get further boost from the Covid-19. Thus, it seems that GVC development will continue to stall, but complexity and high restructuring costs related to GVCs will likely prevent any wide-scale dissolution of existing GVCs.

The main drivers of expanding global dispersion of production seem to have faded, but artificial barriers to GVC development should be avoided. Policy measures that hamper GVC development could weigh on global productivity and economic growth in the coming years. During the past decades, GVC expansion has improved firm productivity and supported economic growth globally. Many developing countries have received a boost for growth from participating in GVCs that has created millions of jobs and lifted people from poverty. However, the gains from GVC expansion have not been distributed equally across countries, firms and individuals. Appropriate policy measures are needed to mitigate these adverse effects, but excessively protectionist policies are not the optimal solution. Even reshoring of GVC production is unlikely to bring back jobs that were previously shifted abroad.

Antras, P. (2020). De‐Globalisation? Global value chains in the post‐COVID‐19 age, CEPR Discussion Paper 15462, November 2020.

Baldwin, R. E. and Evenett, S. J. (eds.) (2020). COVID-19 and trade policy: Why turning inward won’t work. VoxEU e-book.

Bonadio, B., Huo, Z., Levchenko, A. and Pandalai-Nayar, N. (2020). Global supply chains in the pandemic. NBER Working Paper 27224, May 2020.OECD (2017). The future of global value chains. Business as usual or “a new normal”? OECD Science, Technology and Innovation Policy Papers No. 41, July 2017.

OECD (2020). Shocks, risks and global value chains: Insights from the OECD METRO model.

Miroudot, S. (2020). Reshaping the policy debate on the implications of COVID-19 for global supply chains. Journal of International Business Policy, 3, 430-442.

Simola, H. (2021). The impact of Covid-19 on global value chains. BOFIT Policy Brief 2/2021.

UNCTAD (2020). World Investment Report 2020.

Senior economist, The Bank of Finland Institute for Emerging Economies (BOFIT); heli.simola@bof.fi

The decline would apparently have been even more modest if fuel trade was excluded. Global oil demand dropped much more sharply this spring than in 2009.

The correlation between the share of these intermediates in goods imports and the backward participation index for manufacturing sector is comparatively high 0.6. As a result, the analysis focuses on imports as a proxy for overall GVC development.