This policy brief explores to what extent macroprudential policies (MPPs) had an impact on capital flows in Central, Eastern and Southeastern Europe (CESEE) – a region that experienced a substantial boom-bust cycle in capital flows amid the global financial crisis (GFC) and where policymakers had been quite active in adopting MPPs already before the GFC. Our results suggest that tighter MPPs, measured by a newly constructed intensity-adjusted macroprudential policy index, curb not only private sector credit growth but also gross capital inflows in most of the countries analyzed. We provide evidence that the effects of MPPs are generally stronger in a low interest rate environment, which suggests that MPPs are more effective if conventional monetary policy is faced with constraints.

Research on macroprudential policies (MPPs) in Central, Eastern and Southeastern Europe (CESEE) provides important lessons for other countries. As some CESEE countries adopted macroprudential policy measures rather early, we can draw on relatively long time series. The data therefore lend themselves to assessing the impact that different MPP measures have on the domestic credit and financial cycle – and on financial stability more generally. In this note, however, we also provide evidence for the direct response of capital flows, and their corresponding volatilities, to changes of MPP measures. While there is a growing number of studies investigating the effects of MPPs on domestic financial and macroeconomic conditions, the literature linking MPP measures with capital flows (global dimension of MPP) is still rather scarce (e.g., Ostry et al., 2012; Forbes et al., 2015; Beirne and Friedrich, 2017; Fendoğlu, 2017; Igan and Tan, 2017; Aizenman et al., 2020). Some studies focus on cross-border capital flows, often in the context of circumvention of MPP measures, and arrive at mixed conclusions (e.g., Buch and Goldberg, 2017; Cerutti and Zhou, 2018; Cizel et al., 2019; Frost et al., 2020; Ahnert et al., 2021).

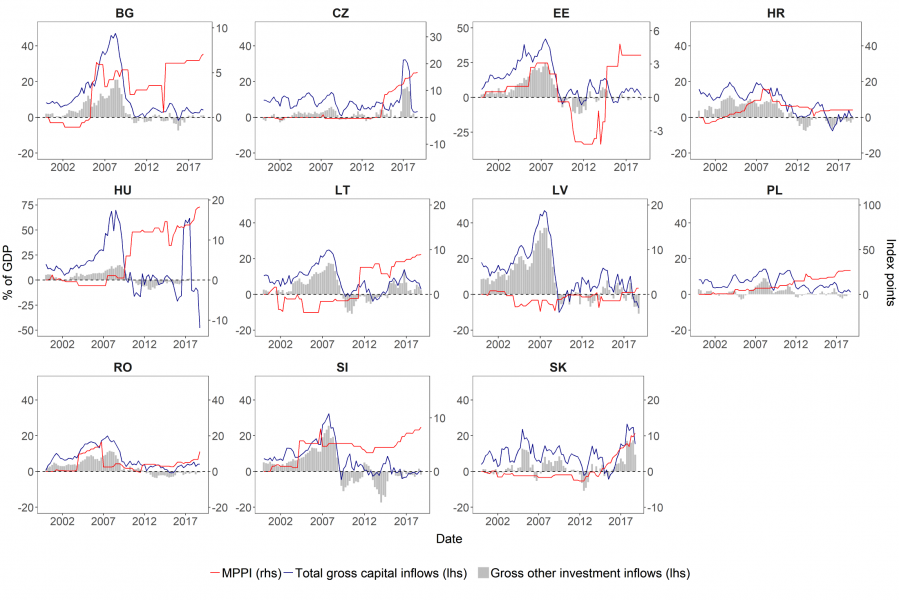

As small open economies, the CESEE countries show considerable external vulnerabilities – among others because a large share of public and private sector debt is denominated in foreign currency – and are therefore susceptible to global risk fluctuations that often result in sudden shifts in international capital flows. In the wake of the global financial crisis (GFC), CESEE countries experienced a substantial boom-bust cycle in (foreign) credit and capital flows (see figure 1). At the same time, several CESEE countries had been quite active in implementing MPPs already before the GFC, mostly to rein in extraordinarily strong credit growth at the time, which was fueled by a surge in capital inflows (Hegerty, 2009). This contrasts with countries in Western Europe, which mostly became active in macroprudential terms only in the aftermath of the GFC. The investigated CESEE sample therefore provides an appealing case for studying the impact of MPPs on capital flows.

MPP measures typically are not intended to directly smooth the capital flow cycle. However, they could still affect the financial account via different transmission channels (for a policy-oriented overview, see IMF, 2017).

First, as the closest link, several MPPs directly address the denomination of banks’ assets and liabilities in foreign currency (FX). FX-based MPPs have often been designed with the explicit aim to limit capital flows, complementing or substituting traditional capital flow management measures such as capital controls. For empirical evidence of this channel, see for instance Forbes and Warnock (2012), Frost et al. (2020) or Ahnert et al. (2021).

Second, tighter MPPs are expected to curb domestic agents’ borrowing from domestic banks. Especially borrower-based MPPs (e.g. tighter lending requirements) can be regarded as taxes on consumer and housing loans meant to discourage excessive borrowing. But also lender-based MPPs (e.g. higher capitalization requirements for banks) can act as a factor limiting credit supply. Therefore, domestic credit extension depends less on cross-border funding from parent banks, or generally from financial institutions and financial investors abroad. In a tighter MPP environment, direct foreign lending to resident banks would thus decline. The funding of substantial credit booms, mostly in foreign currency, via cross-border bank flows was particularly pronounced in most of the CESEE countries in the run-up to the GFC, with a large share of inflows consisting of flows from large global banks to their local subsidiaries (see Eller et al., 2016). There is also a strong correlation between capital flows and the share of foreign currency lending to households, nonfinancial corporations and banks in almost all of the CESEE countries (see Bakker and Klingen, 2012).

Third, as a more indirect channel, MPP tools may limit excessive capital inflow episodes by containing the procyclical interplay between asset prices, private credit and non-core bank funding. By restricting increases in leverage and volatile funding, such measures may improve resilience regarding fluctuations in the global financial cycle (see e.g. Cesa-Bianchi et al., 2018; Coman and Lloyd, 2019; Bergant et al., 2020; and for a recent literature review, Forbes, 2020). Moreover, the frequency of disruptive capital outflows could be reduced by MPPs, such as countercyclical capital buffers and liquidity requirements during financial stress episodes.

We use a recently developed intensity-adjusted macroprudential policy index (MPPI, documented in Eller et al., 2020), which covers a period of more than 20 years. This index captures a large variety of instruments and differentiates between the announcement and implementation dates of measures. In our empirical exercise, we also include a global financial factor (extracted from a set of financial variables for 45 countries), domestic macroeconomic and macrofinancial measures (GDP growth, inflation, private sector credit growth, short-term interest rates, equity price growth, exchange rate volatility) and the levels and volatilities of gross capital in- and outflows. With respect to capital flows, we consider either total gross capital flows (i.e. total direct, portfolio and other investment flows) or gross other investment flows only; the latter as a proxy for cross-border banking flows. The sample covers the 11 EU member states in CESEE, with time series available at quarterly frequency from 2000Q1 until 2018Q4. Figure 1 depicts the MPPI alongside gross capital inflows as a share of GDP, highlighting also the substantial share of gross other investment inflows – especially before the GFC. At first glance, the relation between the MPPI and capital flows is not always clear cut. Before the GFC, several countries had tightened their MPP stance, but capital inflows still surged. At the same time, we do not know the counterfactual: the surge of capital flows could have been considerably stronger in the absence of tighter MPPs. After the GFC, the capital flow reversal coincides with a procyclical tightening of the MPP stance in most, but not all, countries.

Given pronounced cross-country heterogeneity, especially in the development of the MPPI, as visible in figure 1, we decided to depart from simple fixed-effects panel regressions – the dominant econometric tool in existing papers – and to analyze responses to a macroprudential tightening country by country. For this purpose, we use a regime-switching factor-augmented vector autoregression (FAVAR) framework that allows us to study country-specific capital flow responses to MPP shocks, while capturing the dynamics in a closed economy and simultaneously accounting for global factors, such as the global financial cycle. Moreover, we allow for nonlinearities in the form of regime switches to study whether capital flow responses to MPP tightening differ in high and low interest rate environments. For the related technical details, see Eller et al. (2021a).

Figure 1: Intensity-adjusted macroprudential policy index (MPPI) and capital flows

Note: Intensity-adjusted MPPI (red line) using announcement (implementation) dates for tightening (loosening) measures together with gross total capital inflows (blue line) and gross other investment inflows (gray bars), the two latter measured as cumulative four-quarter moving sums and as a share of GDP, for the period 2000Q1–2018Q4. The MPPI has been rescaled to start at 0; an increase (decrease) signals a net tightening (loosening) in the overall macroprudential environment. Based on authors’ calculations and data from IMF-IFS.

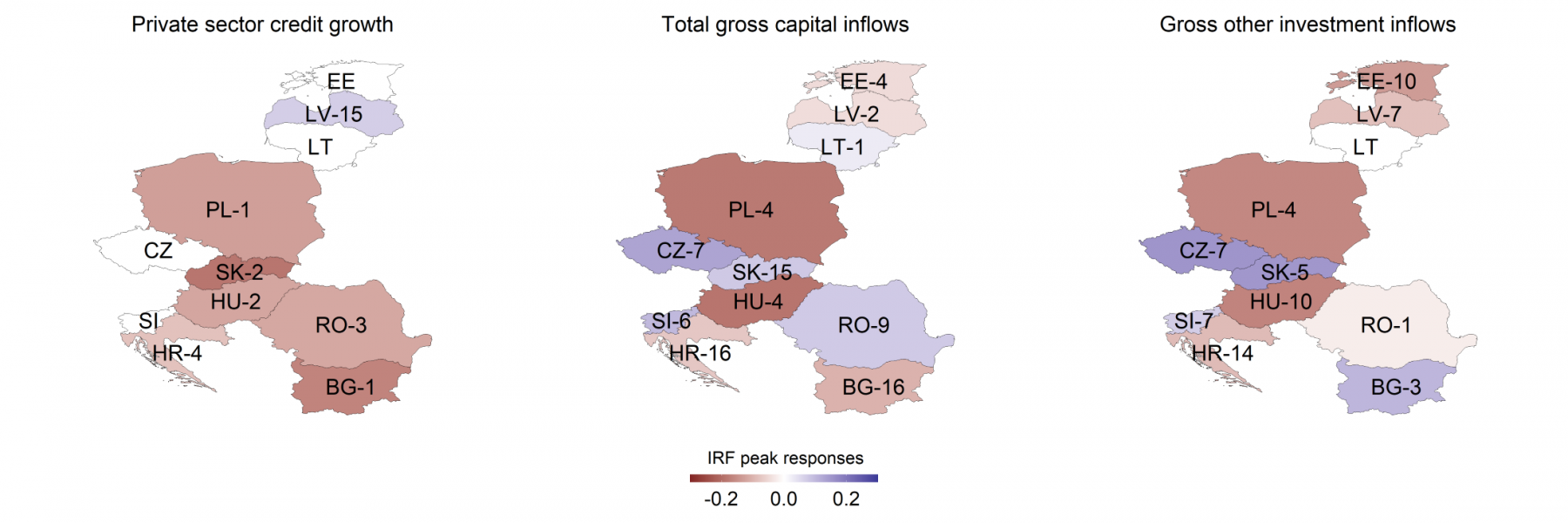

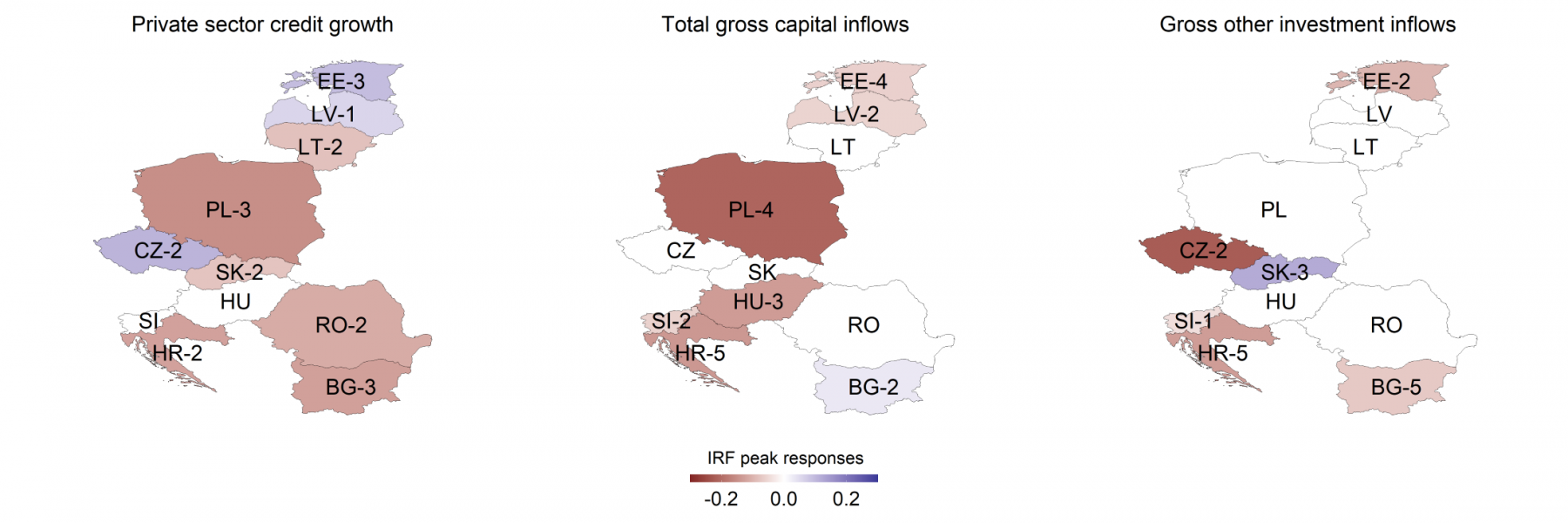

Figures 2 and 3 show the main results of the empirical exercise. In particular, they depict peak responses to a structural macroprudential shock obtained from the abovementioned model, both for a linear specification covering the whole period (figure 2) and for a low interest rate regime (figure 3), which can be viewed as most relevant for the current policy situation. Given these findings (for a complete set of results, see Eller et al., 2021a), we conclude the following:

First, regarding the impact of MPPs on domestic credit, in most of the covered CESEE countries private sector credit growth declines in response to a macroprudential tightening, and does so relatively quickly – within one year after the shock. Compared to other reference periods, this negative response is somewhat more pronounced, and manifests itself more quickly, in the low interest rate regime. In light of the COVID-19 crisis, this would be a good signal in the current low interest rate environment, as an MPP easing would give a positive impetus to lending activities and thus contribute to crisis mitigation (for an overview of MPP measures implemented in the region following the outbreak of the COVID-19 pandemic, see Eller et al., 2021b).

Second, in a majority of countries capital inflow volumes respond negatively to a MPP tightening, which indicates that MPPs can help bring back capital inflows to more sustainable levels in the case of an overshooting and would thus contribute to stabilization in the CESEE countries. Notably, negative volume responses are identified more often in a low than a high interest rate environment (stronger evidence for total than for other investment flows; results for the high interest rate regime are shown in Eller et al., 2021a). In the post-GFC episode marked by low interest rates, macroprudential tightening could thus have reinforced cross-border deleveraging effects. On the other hand, this result also signals that MPPs would be more effective if conventional monetary policy faced constraints. This is an important point for authorities to consider: in other words, the interest rate environment should be considered carefully when conducting macroprudential policy, especially with respect to the intensity of adjustments.

Third, as regards the expectation of declining capital flow volatility in response to macroprudential tightening, our results indicate a somewhat mixed pattern (see Eller et al., 2021a): positive volatility responses are often found in combination with significantly positive level responses. By contrast, if the level reaction of capital flows is negative, volatility reactions are often negative as well. This suggests that tighter MPPs that succeed in reducing capital inflows would then most often also shield CESEE countries from capital flow volatility.

Figure 2: Peak responses to a tightening macroprudential policy shock for the entire period

Note: Entire-period (posterior median) peak responses of private sector credit growth, total gross capital inflows, and gross other investment inflows to a 1 standard deviation tightening macroprudential shock. Red shading denotes negative and blue shading denotes positive responses. Numbers indicate the quarter in which the response reaches its peak. White shading indicates insignificance regarding the 68% credible interval.

Figure 3: Peak responses to a tightening macroprudential policy shock in a low interest rate environment

Note: Low interest rate regime (posterior median) peak responses of private sector credit growth, total gross capital inflows, and gross other investment inflows to a 1 SD tightening macroprudential shock. Red shading denotes negative and blue shading denotes positive responses. Numbers indicate the quarter in which the response reaches its peak. White shading indicates insignificance regarding the 68% credible interval.

To summarize, the results suggest that MPPs do have an impact on credit growth and cross-border capital flows. This implies that MPPs may play an important role in the regulatory toolkit for shielding the financial system from destabilizing forces emerging both from domestic financial sector developments and from international capital flows. The finding that the effects of MPP tightening are in most cases stronger in an economic environment characterized by low interest rates has important implications for policymakers, especially in times when conventional monetary policy is close to the zero-lower bound as is currently the case in many countries following the COVID-19 crisis.

Ahnert T, Forbes K, Friedrich C and Reinhardt D (2021) Macroprudential FX regulations: shifting the snowbanks of FX vulnerability? Journal of Financial Economics 140(1), 145–174.

Aizenman J, Chinn MD and Ito H (2020) Financial spillovers and macroprudential policies. Open Economies Review, 1–35.

Bakker BB and Klingen C (2012) How Emerging Europe Came Through the 2008/09 Crisis: An Account by the Staff of the IMF’s European Department, International Monetary Fund.

Beirne J and Friedrich C (2017) Macroprudential policies, capital flows, and the structure of the banking sector. Journal of International Money and Finance 75, 47–68.

Bergant K, Grigoli F, Hansen NJ and Sandri D (2020) Dampening global financial shocks: can macroprudential regulation help (more than capital controls)? IMF Working Paper 20/106, International Monetary Fund.

Buch CM and Goldberg LS (2017) Cross-Border Prudential Policy Spillovers: How Much? How Important? Evidence from the International Banking Research Network. International Journal of Central Banking 13(S1), 505–558.

Cerutti E and Zhou H (2018) Cross-border banking and the circumvention of macroprudential and capital control measures. IMF Working Paper 18/217, International Monetary Fund.

Cesa-Bianchi A, Ferrero A and Rebucci A (2018) International credit supply shocks. Journal of International Economics 112, 219–237.

Cizel J, Frost J, Houben A and Wierts P (2019) Effective Macroprudential Policy: Cross-Sector Substitution from Price and Quantity Measures. Journal of Money, Credit and Banking 51(5).

Coman A and Lloyd SP (2019) In the face of spillovers: prudential policies in emerging economies. ECB Working Paper 2339, European Central Bank.

Eller M, Hauzenberger N, Huber F, Schuberth H and Vashold L (2021a) The impact of macroprudential policies on capital flows in CESEE. Journal of International Money and Finance, forthcoming, 102495.

Eller M, Huber F and Schuberth H (2016) Understanding the drivers of capital flows into the CESEE countries. Focus on European Economic Integration Q2/16, 79–104.

Eller M, Martin R, Schuberth H and Vashold L (2020) Macroprudential policies in CESEE – an intensity-adjusted approach. Focus on European Economic Integration Q2/20, 65–81.

Eller M, Martin R and Vashold L (2021b) CESEE’s macroprudential policy response in the wake of the COVID-19 crisis. Focus on European Economic Integration Q1/21, 55–69.

Fendoğlu S (2017) Credit cycles and capital flows: effectiveness of the macroprudential policy framework in emerging market economies. Journal of Banking & Finance 79, 110–128.

Forbes K (2020) The International Aspects of Macroprudential Policy. NBER Working Paper 27698, The National Bureau of Economic Research.

Forbes K, Fratzscher M and Straub R (2015) Capital-flow management measures: what are they good for? Journal of International Economics 96, S76–S97.

Forbes K and Warnock FE (2012) Capital flow waves: Surges, stops, flight, and retrenchment. Journal of International Economics 88(2), 235-251.

Frost J, Ito H and van Stralen R (2020) The effectiveness of macroprudential policies and capital controls against volatile capital inflows. BIS Working Papers 867, Bank for International Settlements.

Hegerty SW (2009) Capital inflows, exchange market pressure, and credit growth in four transition economies with fixed exchange rates. Economic Systems 33(2), 155–167.

Igan D and Tan Z (2017) Capital inflows, credit growth, and financial systems. Emerging Markets Finance and Trade 53(12), 2649–2671.

IMF (2017) Increasing resilience to large and volatile capital flows: the role of macroprudential policies. IMF Policy Paper, International Monetary Fund.

Ostry JD, Ghosh AR, Chamon M and Qureshi MS (2012) Tools for managing financial-stability risks from capital inflows. Journal of International Economics 88(2), 407–421.

This policy brief is a shortened, policy-oriented version of Eller et al. (2021a).

The views expressed here are those of the authors and do not necessarily reflect the official viewpoint of their respective institutions.

Author contacts: markus.eller@oenb.at; helene.schuberth@oenb.at; niko.hauzenberger@sbg.ac.at; florian.huber@sbg.ac.at; lukas.vashold@wu.ac.at.