We develop an integrated assessment model to analyse the effectiveness of central banks changing the composition of their portfolio towards green assets in complementing fiscal policies for climate change mitigation. We model green quantitative easing (QE) through an outstanding stock of privately-issued bonds held by a monetary authority and its portfolio allocation between a clean and a dirty sector of production. Green QE leads to a partial crowding out of private capital in the green sector and to a modest reduction of the global temperature by 0.04 degrees of Celsius until 2100. A moderate global carbon tax of 50 USD per tonne of carbon is 4 times more effective.

A growing number of central banks have committed to integrating climate change considerations into their monetary policy frameworks. This column analyses the effectiveness of one type of “green monetary policy” in limiting global warming. The idea is that central banks contribute to limiting the rise in global temperatures by changing their portfolio to exclusively contain ‘green’ bonds, which would make the financing of carbon-intensive industries more expensive than that of green ones.

In Abiry, Ferdinandusse, Ludwig and Nerlich (2022), we examine whether central banks can effectively contribute to mitigating global warming through a shift of a monetary authorities’ privately-issued financial asset holdings towards the green sector of the economy. As a secondary question we investigate the effectiveness of this green quantitative easing policy in combination with fiscal policies to counter climate change, more precisely, a carbon tax.

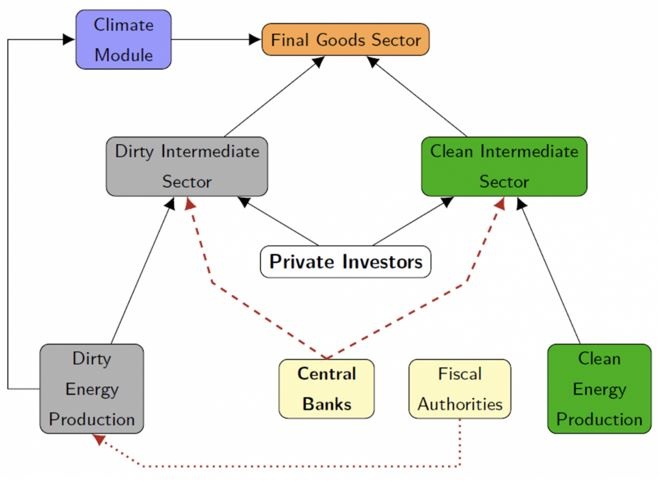

To answer the question on the effectiveness of green quantitative easing, we develop an integrated assessment model with green and dirty capital. An integrated assessment model unites a macroeconomic perspective with the possible damages of climate change, which are modelled as future output losses due to an increase in temperature that is caused by the build-up of carbon emissions in the atmosphere. In our stylised global model, aggregate output is produced employing intermediate goods that are in turn produced in the dirty sector and in the clean (green) sector. Intermediate goods are produced using capital, labour and energy as inputs, with the dirty sector using carbon-based energy and the green sector using renewable energy. Capital is supplied to the intermediate firms by private investors.

Figure 1: Stylised interactions between the world economy and the climate

Note: The illustration above is a simplification of the model used in Abiry et al. (2022).

We assume that since markets do not take future climate damages into account, they rely too much on the dirty sector for the production of intermediate goods in the absence of policy interventions. Over time, this negative production externality leads to a reduction of total output as the global temperature increases and damages the productive capacity of the economy. Without policy intervention, the global temperature increases by 3.5 degree of Celsius above pre-industrial levels by 2100 in our model. This is in line with IPCC scenarios of climate change and well above the Paris agreement target to mitigate global warming.

In our model, we analyse how the monetary authority can influence the relative production across the two sectors in the economy through the allocation of its asset portfolio. Green quantitative easing is modelled as a stylised scenario where the monetary authority’s private capital portfolio, which is initially split across both sectors in proportion to total capital in the economy, is reallocated to clean capital only. This additional supply of capital to the clean intermediate sector reduces its return and households will find it optimal to partially reallocate their savings to dirty capital.

The return on the capital used in the firms is stochastic and imperfectly correlated across sectors, which presents an income risk for the private investors. They seek to optimise their consumption over time by allocating their savings between bonds issued by both the clean and the dirty intermediate sectors. This feature of the model is of central importance as the imperfect correlation of returns calibrated according to the data realistically implies that, in response to the portfolio allocation decision by the monetary authority, households will not perfectly reallocate their portfolios towards dirty assets. As a net effect, the capital stock employed for production in the clean sector will increase relative to the capital stock in the dirty sector, which triggers a relative expansion of the output of the green sector.

In this model setting, we simulate three policy experiments. First, we model the effect of green quantitative easing, where the monetary authority changes the composition of its private asset portfolio from proportional to the total economy to only green bonds. Then we investigate the effect of carbon pricing by a fiscal authority, which increases the price of dirty energy through a carbon tax. Finally, we consider both policies in combination.

Since our model is calibrated to the world – global warming knows no borders – these simulated fiscal and monetary policies would require cooperation across countries that we abstract from. We also abstract from any ambiguity about the classification of green and dirty bonds.

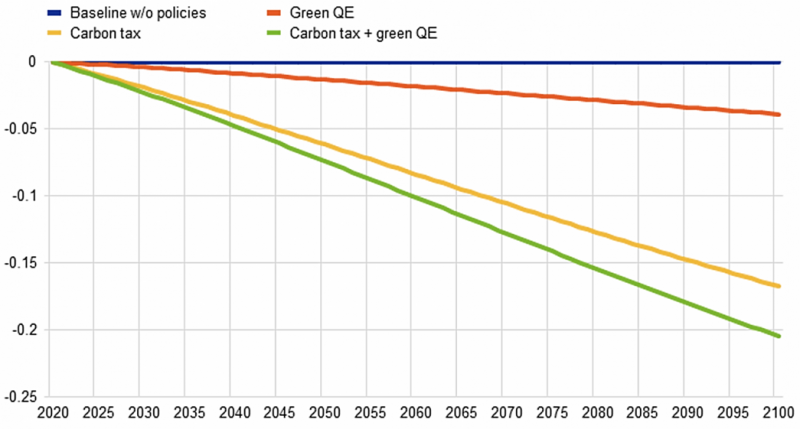

We find that green quantitative easing can help to reduce global warming, but its effectiveness is modest compared to a carbon tax. In our first policy experiment, we consider a complete and immediate switch to green bonds in the portfolio of the monetary policy authority. The share of private assets held by the monetary authority (~10 percent of GDP) is calibrated based on the privately issued securities holdings of central banks of advanced economies, i.e. including asset-backed securities as well as commercial bonds. Despite this calibration tailored to consider its maximum possible effect, the impact of green quantitative easing is rather modest compared to the carbon tax. We find that the temperature reduction through this green quantitative easing policy by 2100 would be 0.04 degrees Celsius.

In the second policy experiment, we consider an initial carbon tax of 50 USD per tonne of carbon in 2021 (equivalent to 13.6 USD per tonne of CO2), which is at the low end of many policy proposals to reduce carbon emissions and chosen to facilitate the comparison with green quantitative easing. We keep the carbon tax rate proportional to the price of dirty energy along the transition. Such a tax would reduce the global temperature increase by 0.17 degrees Celsius, compared to the baseline. Put differently, this relatively modest carbon tax is about 4-times more effective than the green quantitative easing considered in the first experiment.

When combining both policies in the third policy experiment, we find that that they somewhat reduce each other’s efficiency. Although green quantitative easing can complement fiscal policy, i.e. green quantitative easing on top of a carbon tax will reduce the increase of global temperature further, the marginal effect of the two policies in combination is lower than in isolation. The reason is that both policies partially counteract each other. Within the dirty sector, a carbon tax increases the production costs of energy relative to the costs of capital, which triggers a decline in dirty energy demand. In turn, green quantitative easing increases the costs of dirty capital, which partially leads to higher dirty energy demand.

Figure 2: Temperature reduction scenarios (in degrees Celsius)

Carbon pricing is widely recognised as an effective policy for combatting climate change as it reduces the use of carbon. At the same time, climate change mitigation strategies centred on carbon pricing face numerous obstacles to implementation, such as distributional effects and intergenerational hurdles (see Van der Ploeg 2022). Green quantitative easing may be an effective complementary policy instrument, in particular if governments around the world fail to coordinate on introducing a sizeable carbon tax.

Abiry, Raphael, Marien Ferdinandusse, Alexander Ludwig and Carolin Nerlich 2022, Climate change mitigation: how effective is green quantitative easing?, ECB Working Paper No. 2701

Van der Ploeg, Rick 2022, Obstacles and the need for radical climate policies, key note speech in Workshop on fiscal policy and climate change