This policy brief is based on Rabobank Research Paper, 21 January 2025.

Abstract

The energy transition is set to transform the energy landscape and significantly impact inflation dynamics. Using the European Union’s ‘Fit for 55’ proposal, we can assess the effects on inflation until 2030 through: investments, raw materials demand, labor demand, and energy substitution. Overall, the transition is expected to be inflationary until 2030, increasing price volatility. Higher investments and labor demand will create inflationary pressures, while the shift from fossil fuels to renewables in electricity production will exert downward pressure on prices. In the short to medium term, inflationary pressures are likely to dominate. The impact of raw materials demand on inflation will likely be neutral on average but could be volatile depending on geopolitical and trade developments. These inflationary pressures could limit the scope for monetary policy easing, and the less predictable inflation dynamics may pose a challenge for the ECB in maintaining inflation near the 2% target.

The energy transition aims to substitute fossil fuels with sustainable and renewable energy sources. This transition was initially driven solely by the need to reduce greenhouse gas emissions. However, following Russia’s invasion of Ukraine, it has also become a matter of energy security for Europe. Achieving decarbonization and energy security have become key strategic challenges for the continent.

This transformation of the energy system will impact the economy, affecting capital and material needs, energy costs, and required labor skills, and it could lead to stranded assets. It will affect price levels and inflation during and after the transition.

Understanding the implications for inflation is crucial as central banks may respond by adjusting policy rates. In turn, (expectations regarding) inflation and interest rates matter for the feasibility of the energy transition, as higher (financing) costs lower the appeal of renewable energy projects.

We will explore four channels through which the energy transition impacts inflation: investment flows, subsequent increased raw material and labor demand, and energy substitution in electricity generation.

We use a qualitative approach to anticipate developments until 2030 based on the EU’s Fit for 55 package, which aims to reduce emissions by 55% by 2030. In our view, the EU’s medium-term goals can be achieved with current technologies. While costs are essentially uncertain, short- to medium-term analysis will be more accurate than longer-term projections. Indeed, long-run forecasts often overestimate costs, understating substitution possibilities and overestimating (future) inflationary pressures. For example, the costs of solar panels and EV batteries have fallen exponentially as the technology matured. The same may happen with green hydrogen, beyond the horizon of our analysis.

The energy transition will probably be inflationary until 2030. It could also make inflation more volatile. Additional investment spending and labor demand are the main factors exerting these positive price pressures. The knock-on effect through higher demand for key raw materials will be broadly neutral, in our view, though volatile. And it depends on geopolitical developments.

Finally, the substitution of renewable energy for fossil fuels in electricity production will exert downward price pressures. But in the short to medium term this will not fully offset the abovementioned drivers of additional inflationary pressures, we believe. Importantly, countries’ strategic choices with respect to geopolitics and fiscal policies will influence the speed with which objectives will be reached, and at what cost.

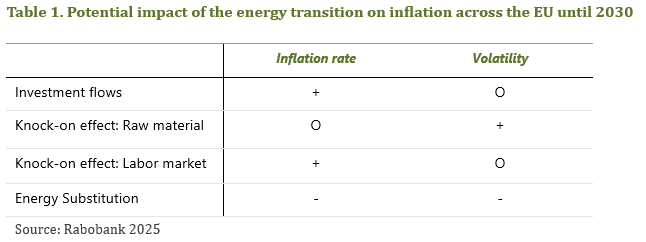

The European Commission’s modelling exercise indicates that achieving 2030 emission reduction targets requires an additional EUR 477 billion in investments per year, on top of the current EUR 764 billion. This would increase total expenditure to 7.8% of GDP, annually. The transition of the transport sector makes up for the biggest share of these required investments, followed by improving the energy efficiency of residential real estate (Figure 1).

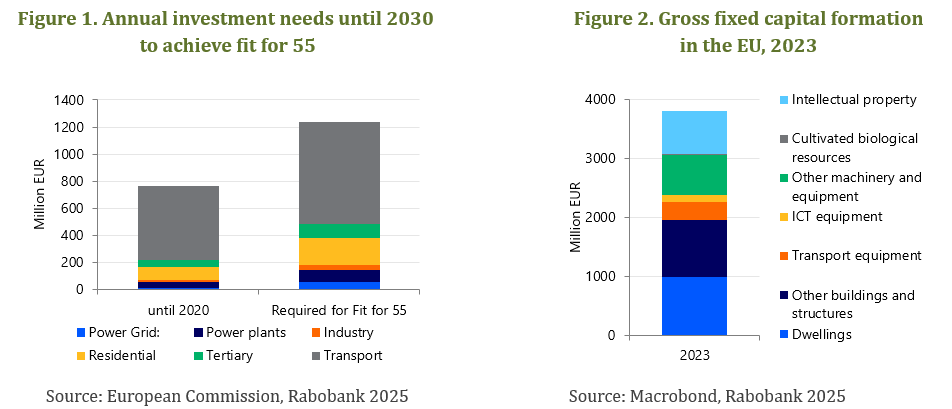

For context, gross fixed capital formation (GFCF) in the EU was 22% of GDP in 2023, or EUR 3.8 trillion (Figure 2). This includes both new capital and the investment needed to maintain the current capital stock. The latter is known as the consumption of fixed capital, or depreciation, and amounted 18.2% of GDP, or EUR 3.14 trillion.

Framework provides context, but is not sufficient to understand whether required energy transition investments cause a price effect or not. This depends on whether these investments:

The energy transition will probably increase overall investment demand, even though investments not related to the transition are likely to fall. Funding or capacity constraints, for example, could lead to the postponement of non-energy transition related investments. Furthermore, transition-related investments could replace other investments. You’re not going to buy a combustion engine and an electric vehicle at the same time, for example.

The level and speed at which investment increases matters. For one, because not all of the technologies that are required for the energy transition have reached maturity yet. In some cases, a policy push may be required for these investments as economic rationale alone isn’t going to do it at the moment. This is the case for heavy duty transport, for example. The price tag of many new technologies can exacerbate the inflationary pressures stemming from the energy transition. This is the case if it directly concerns consumer goods, but also if higher operating or investment costs are being passed on to consumer prices. Second, if demand for certain products grows faster than supply, prices tend to go up, as was the case with heat pumps and solar panels at the height of the energy crisis, for example, and construction works in Italy on the back of a generous tax credit system.

The effect of higher price tags for certain products or some of the green technologies on inflation is a first-order effect. But a large, rapid, and/or policy-induced boost in energy transition investment demand could also have second-order effects. These knock-on effects run through several channels. Most importantly, it could increase demand for production inputs (both materials and labor) that are also used in sectors that are not related to the energy transition. If the additional demand for these inputs drives up their prices, this would increase the costs of production and probably the selling price of otherwise unrelated consumer goods. Likewise, if the energy transition affects the availability of these inputs for other sectors, this could lower the availability of certain consumer goods. Assuming that demand does not decrease, this would lead to higher prices.

The additional investments in the energy transition will have a knock-on effect on the demand for and price of materials and labor, which may drive up the price of all final goods. The effect on the price of raw materials is likely to be broadly neutral, but volatile until 2030, while we expect the knock-on effects on the labor market to be mildly inflationary. Yet uncertainties are large, with geopolitical developments potentially having a large impact.

The energy transition is expected to more than double the global consumption of copper, steel, and aluminum by 2030, while the demand for lithium and graphite will increase tenfold. If supply doesn’t match demand, it could create a super-cycle of raw materials, leading to prolonged price increases and inflation.

The start of this super-cycle depends on the mining industry’s ability to forecast demand and invest accordingly. Long development times for new mines worsen the impact of an incorrect demand forecast. Overestimating demand can lead to price slumps, as seen with lithium, which fell from USD 80,000 per ton in 2022 to below USD 20,000 per ton in 2024. Conversely, copper prices in 2024 spiked due to an expected mismatch in supply and demand.

Recycling is another source of raw materials. The EU aims to recycle at least 25% of critical raw materials consumption by 2030. If recycling costs are lower than extraction, it can cap raw material prices. However, mandatory use of recycled materials could increase prices, if recycling is more expensive. For materials like aluminum and steel, recycling is already integrated in the supply chain, but for cobalt, lithium, and plastics, it is still developing.

In summary, the energy transition’s raw material demand will have inflationary effects if supply doesn’t meet demand. So far, most prices haven’t remained high, except for copper. Until 2030, the energy transition is not expected to create a super-cycle, so we expect the raw materials channel to have a broadly neutral impact on inflation. However, the energy transition could lead to temporary demand and supply mismatches and could therefore make price developments more volatile, as we have seen over the past years. Moreover, geopolitical developments pose a risk to the outlook.

In our view, labor shortages due to net job creation due to the energy transition amidst changing demographics will probably be inflationary. This is obviously a much broader trend, but we would argue that the energy transition exacerbates the impact on wages and inflation.

The energy transition will destroy fossil fuels jobs, but it will also create new ones in green sectors like offshore wind. Until 2030, implementing Fit for 55 is expected to create 204,000 net new jobs, according to Eurofound. This job creation is on top of the 1 million new jobs that are expected to be created in the reference scenario, while the total working age population across the EU will decline by 6 million people due to ageing and low birth rates. Plus, these new jobs will not be evenly distributed across countries. Spain will gain nearly 100,000 jobs, while Poland will lose 50,000. No country can match job creation with growth in the working-age population. Germany faces a significant mismatch, adding 27,700 jobs from the transition on top of 410,000 jobs in the baseline, while its labor force shrinks by nearly 2 million from 2023 to 2030.

On top of these shortfalls, filling energy transition jobs depends on the skill set of the unemployed. Re-training programs can help but are challenging, possibly making it difficult for workers to flow from ‘old’ industries to the newly created jobs.

Fit for 55 aims for a 42.5% renewable energy penetration rate in total energy consumption. As the share of electricity in final energy consumption rises, its impact on inflation will grow. From 2014 to 2021, a 1% increase in renewable energy, decreased wholesale electricity prices in Europe by 0.6% on average, due to near-zero fuel costs. For example, solar photovoltaic electricity costs 31-40 EUR/MWh to generate, while gas turbines cost 138-151 EUR/MWh in Spain.

The relationship between renewable energy penetration and price decreases is non-linear. The Bank of Spain found that increasing renewable energy from 26% to 40% of the mix reduced electricity prices by 40%.

Lower wholesale prices don’t necessarily lead to lower consumer energy bills, as taxes and network costs can comprise 32-42% of the bill. Grid upgrades to meet Fit for 55 targets will cost EUR 55 billion annually until 2030. This would raise consumer prices by 1.5 to 2 cents per kWh reflected in increasing network costs, according to Bruegel. Overall, the reduction in electricity prices is expected to be greater than the increase in network costs thus reducing the electricity bill if taxes remain constant.

The net effect of switching to renewable electricity is expected to be deflationary until 2030, with lower and more stable generation costs dominating electricity bills. Renewables’ more stable costs also reduce price volatility, as seen in fixed-price bilateral contracts for green energy. Power purchase agreements help firms reduce uncertainty by fixing a larger share of energy costs.

The channels discussed in this publication are crucial for understanding how the energy transition can influence inflation. Clearly, these channels are not all-encompassing, though. Government policy plays a significant role, for example, but that’s outside the scope of this article.

Furthermore, maintaining business as usual would also be inflationary due to climate change, which leads to a more unstable system. Global warming could increase food and headline inflation by 0.9-3.23 and 0.32-1.18 percentage points per year, respectively, by 2035. Additionally, without energy transition investments, the EU will remain energy-poor and import-dependent.

Even though the energy transition will likely bring short-term price pressures, inflation need not be persistently higher. The ECB will adjust monetary policy to keep inflation near its 2% target. However, we have identified some channels that could make inflation more volatile. The less predictable nature of these potential prices pressures may make it more difficult for the ECB to anticipate inflation developments.

The ECB’s models don’t fully incorporate the macroeconomic impact of climate change and the transition yet, but they are improving their tools. We expect their inflation projections to rise somewhat once the effects of the energy transition are considered. This may reduce the policy space for rate cuts in the coming years.