Natural rates of interest have been trending downwards in developed and developing countries for many years. In a series of papers we explain how low fertility, rising longevity and lower productivity growth have contributed and will further contribute to this process in Europe, what it implies for monetary policy and to what extent it can be alleviated by migration flows or pension system adjustments. Our conclusion is that Europe is facing significant challenges – demographic forces may generate a deflationary bias and persistently raise the probability of hitting the zero lower bound on interest rates. Migration flows are unlikely to prevent these developments, nor are the projected pension system reforms.

Many countries, advanced and emerging markets alike, are experiencing a process called secular stagnation: populations are aging, and productivity growth is declining. These processes will have consequences for various aspects of economic activity. To mention just a few, they are likely to negatively impact the growth rate of GDP per person (Cooley and Henriksen, 2018), worsen the sustainability of pension systems (Boulhol and Geppert, 2018), and increase the share of GDP being spent on healthcare and related services (Breyer, Felder and Costa-Font, 2010). In a recent series of papers (Bielecki, Brzoza-Brzezina and Kolasa 2020, 2021, 2022), we show that these secular forces have already started to and will continue to affect monetary policy in Europe.

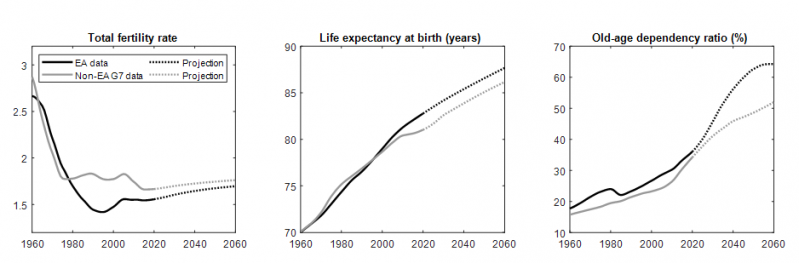

As evidenced by Figure 1, the euro area (EA) was experiencing a sharp decline in the fertility rate from 1970 to the mid-2000s, which then stabilized at sub-replacement levels and is projected to remain persistently low. The outcome is a continuing drop in the number of people entering the working-age period of life. Moreover, until the COVID-19 pandemic hit, the mortality rates in the EA were consistently falling and the currently born individuals are expected to face a life span that is longer by over 10 years compared to people born five decades ago. These two forces reinforce each other in leading to a rapid increase in the old-age dependency ratio.

Figure 1: Demographic trends in the euro area and other advanced economies

Source: Bielecki, Brzoza-Brzezina and Kolasa (2020)

Similar processes can be observed in other developed economies, with two important differences. First, in the aggregate of non-EA G7 economies, the fertility rate stopped declining already before 1980 and stabilized at higher levels than in Europe. Second, the life expectancy in this group of countries has been increasing at a slower pace since about 1990. The demographic processes described above affect the old-age dependency ratio with a delay, but eventually lead to significantly faster aging in the EA compared to other developed economies.

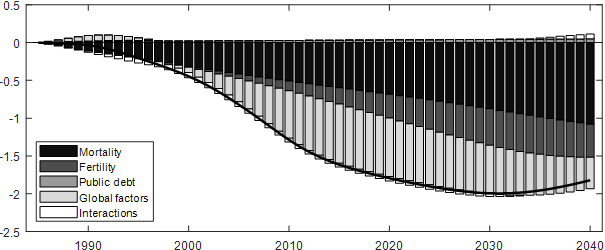

From a monetary policy perspective, these secular trends matter mainly because of their impact on key variables that are taken into account by central banks, including the natural rate of interest (NRI), on which we focus our attention in this policy brief. Using an open economy model with overlapping generations of households, we show that demographic factors are the key drivers of the secular decline in the EA NRI, observed since mid-1985 and projected to continue until about 2030. As shown in Figure 2, the estimated cumulative drop in this important variable is about 2 percentage points, and approximately two-thirds of it can be attributed to European demographics. Of the two demographic factors, mortality is the more important one. Fertility also plays a significant role, but only since about 2000, and its contribution is even slightly positive in the 1990s because of the echo effect of the post-war baby boom.

Figure 2: Decomposition of changes in EA NRI

Source: Bielecki, Brzoza-Brzezina and Kolasa (2020).

Global factors, which combine demographic trends in other developed economies as well as productivity growth at the world technological frontier had a neutral effect till about 2000, after which they started to pull the EA natural rate strongly down, reflecting secular stagnation forces described in detail e.g. by Rachel and Summers (2019) or Gagnon, Johannsen and Lopez-Salido (2021). Importantly, due to worse demographic conditions described above, the projected recovery in the EA NRI is postponed by about a decade relative to the rest of the world.

The NRI is a key object from the point of view of monetary policy. If the central bank is able to adjust its policy rate such that the actual real interest rate perfectly tracks the NRI, then (absent cost-push shocks) output should be close to its potential level and inflation close to the central bank’s inflation target. For a given target, the level of the NRI determines the average distance of the nominal interest rate from the zero lower bound (ZLB). Hence, the demographic transition poses a challenge for monetary policy as, by lowering interest rates, it raises the probability of the constraint to become binding. This possibility has been discussed in the theoretical literature (Eggertsson, Mehrotra and Robbins, 2019), and here we offer a quantitative assessment of the role of demographic forces from the European perspective.

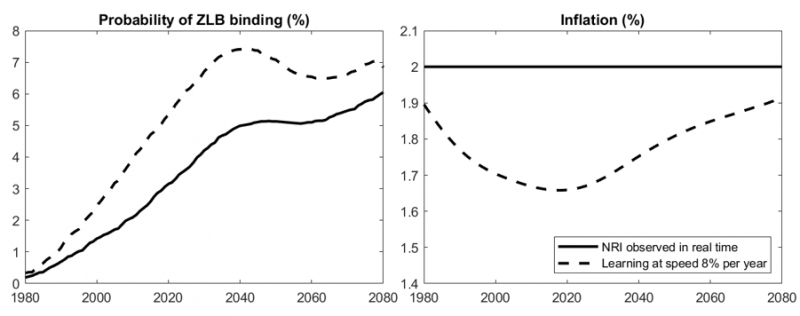

According to our estimates, the chance of hitting the ZLB constraint in the euro area, averaged over the business cycle, was only below 0.5% in 1980. However, demographic developments lifted this probability to almost 3% by 2015, and are projected to further increase it to around 4% by 2030 (see the left panel, solid line in Figure 3). This process looks even more dramatic if one compares the probabilities for longer periods. We estimate the chance of hitting the ZLB for at least one year during the 1980s decade at approximately 4%, and expect it to increase due to demographic changes to over 30% in the 2020s.

Figure 3: Probability of hitting ZLB and average inflation under full information and learning

Source: Bielecki, Brzoza-Brzezina and Kolasa (2022).

Importantly, these estimates assume that the central bank observes the evolution of the NRI in real time. However, the NRI is a latent variable and is usually inferred from the past data with a lag. When we take into account that the central bank may learn only gradually about changes in the NRI, our model implies that such imperfect knowledge creates a sizable deflationary bias. If the NRI exhibits a secular downward trend while the central bank estimates it only from the past data, it will systematically overestimate its level. As a result, the monetary policy stance will tend to be too restrictive, and inflation may run up to 0.35 percentage points below the target (see the right panel, dashed line in Figure 3). Since lower inflation results in lower nominal interest rates, the deflationary bias resulting from ignoring demographic trends implies an even higher probability of monetary policy being constrained by the ZLB (Fig. 3, left panel). In this case the probability of hitting the ZLB rises to 6.5% in 2030, and the chance of monetary policy being constrained for at least one year in the 2020s is around 45%.

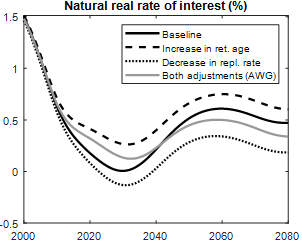

While increasing longevity is a significant factor responsible for the decline in the NRI, it also creates significant fiscal pressures on the retirement system. These pressures can be alleviated via a combination of three adjustments: higher taxes, higher retirement age, or lower replacement rate (ratio of pensions to wages). In the simulations presented above we kept the retirement age and the replacement rate constant, allowing only labor taxes to adjust. We now discuss the model implications of assuming an alternative type of adjustment, using the projections of the European Commission’s Ageing Working Group (AWG) in their 2018 Ageing Report, which assume some increase in the retirement age and a gradual decrease in the replacement rate.

As Figure 4 (a) reveals, the AWG projection implies a less dramatic fall in the NRI, but also its stabilization at a lower level. An interesting observation is that, while both reforms alleviate fiscal pressures and help avoid an increase in taxes, their implications for the NRI are very different. The higher retirement age reduces the need to accumulate old age savings, pushing the level of NRI up. By contrast, a lower replacement rate increases incentives for saving, hence leading to an even deeper drop in the NRI.

The key insight of this exercise is that the evolution of the NRI in the euro area will depend on the implementation details of future pension reforms. Quite paradoxically, the more the fiscal authorities will attempt to preserve the long-run sustainability of the pension system by moving towards a defined contribution design (effectively decreasing the replacement rate), the more downward pressure on the NRI it will create, constraining the monetary authority in its ability to avoid the ZLB.

Figure 4: Impact of pension system reforms and immigration

| (a) Impact of pension system changes on NRI | (b) Impact of immigration flows on NRI |

|

|

Source: Bielecki, Brzoza-Brzezina and Kolasa (2022).

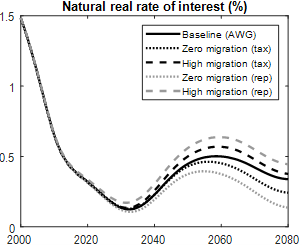

Another solution that can improve the sustainability of pension systems is to allow for a steady net inflow of productive immigrants, who are on average younger than the domestic population. Can the downward NRI trend, and hence its impact on monetary policy, be mitigated by allowing for increased migration? Based on the AWG pension system variant discussed above, we construct two alternative scenarios with increased migration flows: zero migration and high migration, based on the EUROPOP 2018 projections. Each of these scenarios is then split regarding the choice of pension system closure: immigration either allows to levy lower taxes (tax) or to limit the reduction in the replacement rates (rep).

As can be seen in Figure 4 (b), migration can have some impact on the NRI, with higher migration pushing this important variable up. However, the effects of changes in migration flows today are highly delayed. This is because migrants typically arrive with low amounts of assets and it takes years before they accumulate them in quantity sufficient to have a visible impact on the NRI.

All in all, due to secular stagnation forces and their impact on the increased ZLB probability, monetary authorities in Europe are at risk to remain significantly constrained in their ability to use conventional monetary policy to help the economy quickly recover from recessions. Pension system reforms aimed at reducing the replacement rate, while much needed to preserve fiscal sustainability, will make the ZLB problem even more challenging, unless they also lead to a significant increase in the effective retirement age. Allowing more immigration can somewhat alleviate the downward pressure on the NRI, but the size of this compensating impact is not large for reasonable magnitude of population inflows. Our analysis shows that it is very important to incorporate these powerful trends in monetary policy decisions, even though they move at glacial speed. Failing to do so can result in a deflationary bias, making the ZLB constraint even more problematic.

Bielecki, M., Brzoza-Brzezina, M., and Kolasa, M. (2020). Demographics and the natural interest rate in the euro area. European Economic Review, 129(C).

Bielecki, M., Brzoza-Brzezina, M., and Kolasa, M. (2021). Aging, migration and monetary policy in Poland. NBP Working Papers 341, Narodowy Bank Polski.

Bielecki, M., Brzoza-Brzezina, M., and Kolasa, M. (2022). Demographics, monetary policy, and the zero lower bound. Journal of Money, Credit and Banking, forthcoming.

Boulhol, H., and Geppert, C. (2018). Population ageing: Pension policies alone will not prevent the decline in the relative size of the labour force, VoxEu.org.

Breyer, F., Costa-Font, J., and Felder, S. (2010). Ageing, health, and health care. Oxford Review of Economic Policy, 26(4): 674-690.

Cooley, T., and Henriksen, E. (2018). The demographic deficit. Journal of Monetary Economics, 93(C): 45-62.

Eggertsson, G., Mehrotra, N., and Robbins, J. (2019). A Model of Secular Stagnation: Theory and Quantitative Evaluation. American Economic Journal: Macroeconomics, 11(1): 1-48.

Gagnon, E., Johansen, B.K., and Lopez-Salido, D. (2021). Understanding the New Normal: The Role of Demographics. IMF Economic Review, 69: 357-390.

Rachel, L., and Summers, L. (2019). On Secular Stagnation in the Industrialized World. Brookings Papers on Economic Activity, 50(1): 1-76.

The views expressed herein are those of the authors and do not necessarily represent the views of the ECB, NBP and IMF, nor of the Executive Board or management of these institutions.