This policy note is based on Ebner and Westhoff (2022).

Regulatory reforms to counter the too-big-to-fail (TBTF) problem of systemically important institutions were largely developed and implemented independently of each other but are part of a fundamentally integrated concept. For regulators and policymakers it is important to understand how far supervisory and resolution policies are complementary or substitutable and how they could be best employed to reap the full benefits. The Financial Stability Board’s (FSB) TBTF reforms comprise (i) a higher loss-absorbing capacity in the form of capital buffers, (ii) more intensive and effective supervision and (iii) a recovery and resolution regime to cope with institutions in distress or when failing. Considering interdependencies between these policies as part of an integrated approach will be more effective and consistent and contribute to better regulation. This analysis focuses on TBTF reforms for banks and its implementation in the Basel framework and the EU.

The global financial crisis (GFC) that unfolded in 2007 and 2008 has shown that the failure of individual financial institutions can pose a threat to the financial system and the real economy if normal insolvency proceedings are lengthy and value destructing. Liquidation may also lead to fire sales, depressing asset prices and magnifying contagion and can be complex, especially in cross-border cases. The impact may not only be felt in the jurisdiction(s) where the failing institution operates but can affect other jurisdictions as well due to direct and indirect contagion. In those circumstances, institutions are regarded as systemically important institutions (SII)1. Absent an alternative in most jurisdictions to normal insolvency proceedings allowing to resolve them in a more value-preserving manner, the government often felt compelled to support them to contain negative consequences for the financial system and the real economy.2 Therefore, SII were deemed too big to fail3 (TBTF). The Financial Stability Board (FSB) TBTF reforms aim to address the risks from systemically important institutions and to overcome the TBTF problem by focusing on globally systemic important banks but also establishing a framework for domestically important ones. FSB (2021) finds progress in overcoming the TBTF problem, but gaps remain (see also e.g. Hellwig 2021).

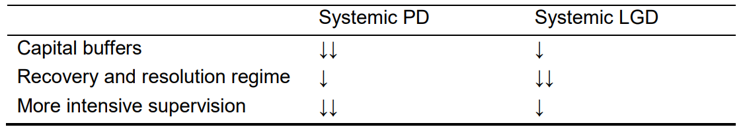

The regulatory approaches to tackle the TBTF problem aim to address the risks to the global financial system from SII (FSB 2011). TBTF policies try to reduce the systemic probability of default (sPDi) of the institution i and the systemic loss for the financial system and the real economy (sLGDi), which arises in the event of a default of the institution i via direct and indirect contagion. This should contain the expected systemic loss (sELi), the product of sPDi and sLGDi. The sPDi is derived from its on and off balance sheet risk at the asset and liability side, from operational risks as well as from the indirect risks to the institution resulting from e.g. reputational or network effects. The sLGDi is the total loss in the financial system and the real economy via multiple-round effects in the event of a default of the institution i, including the impact from the possible non-substitutability of functions performed by the failing institution. TBTF regulations affect both sPDi and sLGDi, with different instruments having different primary goals.

Table 1: Intended transmission channels of TBTF regulation and postulated effects

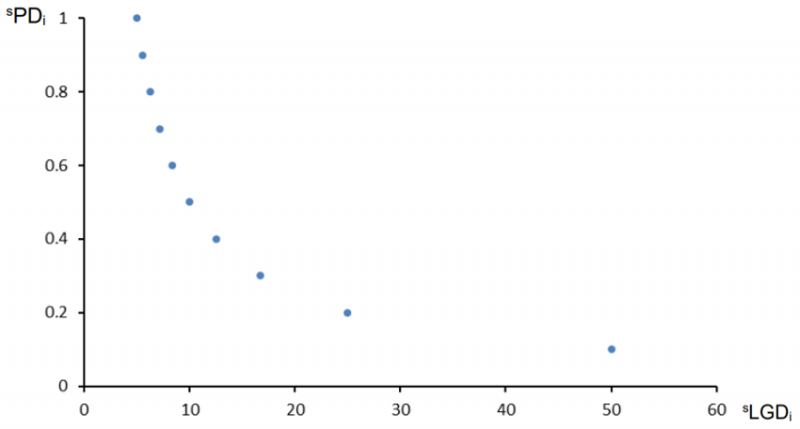

Through TBTF policies, the expected systemic loss of a market exit (sELi) should be lower than the expected losses or costs of a bailout (BELi).4 The latter include the direct costs of the bailout and the long-term indirect costs of the resulting moral hazard due to increased bailout expectations. Regulators can target a maximum sELi that is lower than BELi, and different combinations of sPDi and sLGDi can achieve the same outcome (Chart 1).

Chart 1: Isoline for combinations of sPDi and sLGDi when sELi = 5

However, measures, which primarily aim at reducing sPDi or sLGDi, are not perfect substitutes for solving the TBTF problem. In practice, neither a probability of default nor a loss given default of zero are possible. Further, measures that take sPDi as their starting point reduce both the expected losses of a market exit and of a bailout, thus not influencing the decision in favour of or against a bailout, unless they also reduce sLGDi (see Table 1).5 Measures that reduce sPDi and sLGDi therefore also complement each other, even if regulators have risk neutral preferences. This becomes ever more important if regulators are risk averse and try to avoid high impact events, such as those leading to a systemic crisis, even if these events occur with low probability. In this case, sLGDi should be reduced, also if the estimated sPDi is already low (resulting in lower sELi), or the regulator chooses measures that aim to yield a lower sLGDi while accepting a higher sPDi that leaves the sELi unchanged.

At present, the TBTF regulation generally calibrates the measures to reduce the sPDi and the sLGDi separately, although some measures ultimately have an impact on both target variables (see Table 1). The Basel Committee on Banking Supervision (BCBS), which implements the FSB framework, regards the going and gone concern regulations to reduce the sELi of global systemically important banks (G-SIB) as two equivalent and complementary approaches (BCBS 2018).

In principle, however, measures which influence the sPDi and sLGDi can be calibrated together so as not to exceed an economically still acceptable sELi. Such an approach could take account of interdependencies between going and gone concern regulations. Moreover, difficulties or progress in tackling risk using one regulatory strand, such as impediments to resolvability, could also be considered in another strand.

In the global framework for regulating SII, determining systemic importance and assessing resolvability are both based on the concept of sLGDi of an institution.

An institution is deemed resolvable by the resolution authority either if it can be liquidated under normal insolvency proceedings or resolved using resolution tools without negative systemic effects on the financial system and the real economy, thus minimising its sLGDi. In recovery and resolution planning and the resolvability assessment both firm-specific and system-wide stress scenarios should be used (FSB 2014). In the European Union (EU), the institution needs to remove any impediments to resolvability, or the resolution authority can impose such measures, including ring fencing of certain operations.

Similarly, the systemic importance of an institution is based on the effects of its failure on the financial system and the wider economy (sLGDi) and not by using its probability of default (sPDi). FSB (2010) defines institutions as systemically important if their “disorderly failure, because of their size, complexity and systemic interconnectedness, would cause significant disruption to the wider financial system and economic activity”. To designate G-SIBs, the BCBS uses a systemic importance score as proxy for the (relative) sLGDi. The score is based on indicators for size, cross-border activities, substitutability, connectedness and complexity. The quality of the resolution framework, including resolution challenges may be implicitly included in these indicators but are not explicitly considered, also not as part of the supervisory judgement. Based on their scores, G-SIBs are allocated to buckets that are assigned a capital buffer. National authorities can apply higher surcharges beyond the G-SIB one if there is no credible and effective recovery and resolution plan (BCBS 2018) but have not applied them so far. By contrast, BCBS reviewed the treatment of cross-border exposures within the European Banking Union (EBU) on the G-SIB methodology (BCBS 2022). Possible mitigating effects due to the development of the EBU, including the resolution framework, will be considered by calculating a parallel set of G-SIB scores for EBU headquartered banks that partially treats cross-border intra-EBU exposures as domestic exposures. While this calculation does not affect the classification of a bank as G-SIB, it can reduce its systemic importance score all else equal and possibly also allocate the bank to a score bucket that defines a lower G-SIB capital buffer.6

National macroprudential authorities in the EU can also take into account an institution’s degree of resolvability when assessing the systemic importance of a bank (other systemically important institution (O-SII); EBA 2014). Optional indicators are e.g. (1) degree of resolvability according to the institution’s resolvability assessment, (2) importance for an institutional protection scheme (IPS) of which the entity is a member, (3) interbank claims and/or liabilities (with limitation to bail-inable interbank liabilities, an indicator for potential impediments to resolvability due to contagion effects), (4) deposits guaranteed under deposit guarantee system (due to the possible impact on the guarantee fund and required ex-post contributions in case of failure).

The closest example in the EU of an integrated macroprudential and resolution approach to tackle the TBTF problem seems currently Austria, which integrates the O-SII and systemic risk buffer, the Deposit Guarantee Scheme (DGS) and the assessment whether resolution is in the public interest (PIA). Banks above a certain threshold of covered deposits need to hold an O-SII buffer that aims to reduce the probability that a bank fails and the risks of severe repercussions throughout the system, including on DGS (FMSG 2019).7 Additionally, the central bank works with the resolution authority so that the list of banks assessed as O-SII and the list of banks, for which resolution is deemed necessary are consistent (while allowing for some divergences as PIA is based on all resolution objectives and not restricted to financial stability only). Furthermore, Austria applies a systemic risk buffer that should enable banks to absorb potential losses stemming from the market exit of other banks (e.g. due to the resolution of an O-SII or the insolvency of smaller banks), strengthening the credibility of the resolution framework and complementing the O-SII buffer to tackle the TBTF problem (Posch et al. 2018).

Given different types of indicators used by resolution and supervisory authorities and possible differing risk preferences regarding the level of sLGDi that defines systemic importance and resolvability, the two concepts differ in practice. This can raise questions of consistency. In 2018 the Latvian ABLV bank was designated as SII but was wound down in normal insolvency proceedings. By contrast, Danish banks JAK Slagelse in January 2016 and København Andelskasse in 2018 were not designated as SII but resolved instead of liquidated to avoid negative systemic consequences. Italian banks Veneto Banca and Banca Popolare di Vicenza in 2017 were neither designated SII nor resolved, despite being earmarked for resolution in their resolution plans.8 However, to avoid an economic disturbance in the Veneto region, the government included in its Law Decree on the application of the compulsory administrative liquidation to the banks public support measures to facilitate the sale of assets and liabilities to a purchaser (liquidation aid).9

Conceptionally, one could argue that systemic importance and resolvability are two sides of the same coin called sLGDi . Mutual consideration of the respective assessments from the resolution and the supervisory authority could allow for an integrated and therefore more holistic assessment of the bank and its importance. A joined assessment that a bank’s sLGDi is too high could imply that the bank is both earmarked for resolution and designated as SII with respective requirements. Importantly, the designation as SII is also consistent if a bank earmarked for resolution is deemed resolvable, as heightened supervision and going concern loss absorbing capacity can contribute to resolvability and be an additional safety net, also considering that resolution is not tested in practice until it happens. By contrast, if the need for TBTF policies is assessed differently by authorities, sLGDi and sELi may not be sufficiently reduced to effectively contain systemic risk.

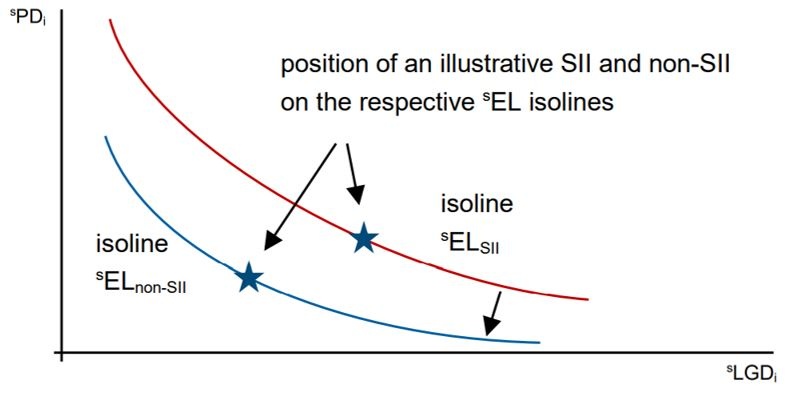

The BCBS framework uses the equal expected impact approach (EEI) as a basis for determining the size of the G-SIB capital buffer.10 In the EEI approach, the sELi of a systemically important institution should correspond to the sELi of a non-systemic one, which is still tolerable for the macroprudential authority and, due to its accountability to political decision-makers, for society as a whole (Chart 2).11 However, due to the current method, the G-SIB buffer cannot fully compensate the higher sLGDi of a significant institution (Passmore and von Hafften 2019; Jiron et al. 2021) even if the regulator is risk neutral.12 Further, the BCBS framework does not explicitly include in the sLGDi calculation whether an institution is regarded as resolvable, implying that systemic losses can be underestimated in case of impediments.

While the EEI approach focuses on the sELi , the resolution framework explicitely aims to avoid losses that are further in the tail, reducing sLGDi to a level where the financial stability and real economy effects are contained. Considering the resolvability assessment when calibrating buffer levels for SII could to some extent compensate for impediments to resolvability and in general facilitate resolvability by lowering sPDi and sLGDi.

Chart 2: The effect of TBTF policies on banks’ sELi

Note: Stylized graph for illustrative purposes. According to EEI approach, SII buffer is calibrated aiming to reduce sELSII to sELnon-SII (sELSII is shifted from red to blue isoline). The resolution regime primarily tries to reduce sLGDi but also affects sPDi (Table 1), shifting the position of the sELSII to a lower isoline.

In the O-SII framework of the EU, calibrating capital buffers is the responsibility of the national macroprudential authorities. However, in the Banking Union the European Central Bank (ECB) can top up the buffer, if it considers its level not to be risk-adequate.13 Resolution aspects could be considered in the calibration, but so far, neither the Member States nor the ECB made use of it. In the UK, however, the resolution regime was considered when assessing the appropriate level of the equity requirement for the banking system, including the calibration of the systemic risk buffer (SyRB) used instead of the O-SII buffer until December 2020.14

Capital buffers are part of the going concern regulation to tackle financial stability risks, as e.g. those emanating from SII. By acting like an airbag, they allow to absorb losses while keeping the bank as a going concern, thus cushioning the impact on the wider financial system and the real economy. To function as intended, buffers have to be usable, meaning that their loss absorption does not breach minimum requirements. Banks should therefore not rely on buffer capital to meet minimum capital requirements, Total Loss-Absorbing Capacity (TLAC) and Minimum Requirement for Own Funds and Eligible Liabilities (MREL).15

According to the TLAC standard of the FSB (FSB 2015), capital buffers should be usable without entering resolution, and capital used to meet TLAC must not be used to also meet capital buffers. However, in practice most jurisdictions follow the approach that risk-weighted buffers need only to stack above risk-weighted minimum requirements. This means capital used to meet risk-weighted capital buffers can be fully counted towards the minimum leverage ratio and towards TLAC/MREL in terms of the leverage exposure measure. ESRB (2021) finds that for more than 50% of banks of a large EU sample the ability to use capital buffers is significantly restricted or even inexistent due to the multiple use of capital for buffers and minimum requirements. Buffer usability is lower for SII as well as banks using internal ratings based approaches to calculate risk-weights than for other banks.

Buffer usability could be ensured through legal change by disallowing double counting of capital for buffers and minimum requirements such as TLAC/MREL. Mirroring risk-weighted buffers into a leverage ratio buffer would improve but not ensure buffer usability if double counting is allowed. Macroprudential authorities could also calibrate buffers higher. In this way, a higher share of buffer capital would be usable and not relied upon to meet minimum requirements (see ESRB 2021 for options to ensure or increase buffer usability).

In the EU, the size of the O-SII buffer additionally affects the institution specific MREL requirement. MREL expressed in terms of risk-weighted assets comprises a market confidence charge that aims to ensure the institution is sufficiently recapitalised in resolution to regain market access post-resolution. The default value of the confidence charge corresponds to the institution’s combined buffer requirement (of which the O-SII buffer is part) less the countercyclical buffer.16 Capital buffers and TLAC/MREL therefore depend to some extent on each other, which influences their ability to reduce an institution’s sELi.

To safeguard resilience in going concern, it is important that banks breaching their buffer requirements restrict their distributions such as dividends. While such restrictions are automatic when risk-weighted (leverage) buffers are breached on top of risk-weighted (leverage) minimum requirements, they are in the EU at the discretion of resolution authorities when risk-weighted buffers are breached on top of risk-weighted TLAC/MREL. In this case, macroprudential authorities are not involved and have no instrument to safeguard the banks’ resilience.17 Banks may operate below buffers for some time without distribution restrictions, rendering them more vulnerable when losses hit and undermining the macroprudential objective of those buffers. Automatic distribution restrictions in case of buffer breach on top of TLAC/MREL would simplify processes and help ensure resilience. At least, decisions about restrictions should be taken in consensus with macroprudential authorities.

In the EU, resolution authorities are also not obliged to share information, including MREL requirements and resources, with macroprudential authorities. This possibly renders the calculation of regulatory buffer usability, as discussed above, challenging. Further, microprudential supervisors are not obliged to inform macroprudential authorities when buffers are breached or supervisory or early intervention measures are taken; information valuable for timely assessing the impact of the stressed institution on financial stability. Information sharing is a precondition for an integrated regulatory approach and could be ensured by being mandatory.

Recovery and resolution plans (RRP) are part of the FSB Key Attributes of Effective Resolution Regimes for Financial Institutions and defined therein.18 Like other regulatory instruments, they aim to reduce sPDi and sLGDi. While the recovery plan identifies options to restore financial strength and viability when the firm comes under stress (going concern), the resolution plan aims to facilitate the effective use of resolution powers to achieve the resolution objectives when resolution has been triggered (gone concern). In the EU, financial institutions write recovery plans that are assessed by supervisory authorities, whereas resolution authorities write resolution plans. Despite these different competencies, RRP should be seen as one integrated planning process with recovery and resolution options aligned to enable a smooth transition from recovery to resolution when needed. If there is no alignment, an option (e.g. sale of business unit X) may be part of both plans while this is incompatible (unit X can only be sold once), leading to double counting for both recovery and resolution capacity. Further, recovery options may jeopardise the resolution plan, e.g. if business units or services deemed to be critical are reorganised or torn apart or if asset encumbrance increases and imperils funding in resolution.

The FSB recognises that the extent to which recovery measures support and are consistent with the resolution strategy needs to be assessed. In the EU, supervisory and resolution authorities have to consult each other on the respective recovery and resolution plans, thus coordination and willingness to cooperate are essential. EBA (2020)b concludes that still more progress is needed to align RRP.

Macroprudential authorities are not requested to be consulted by law, and there is no obligation to share recovery and resolution plans with them. This also applies to RRP under systemic stress scenarios or when assessing the feasibility of RRP options at the macro level. For an integrated approach to tackle the TBTF problem it would be necessary that all relevant authorities, including macroprudential ones, have access to the plans and assessments are shared.

Assessing the failure or likely failure of a bank marks the point when the resolution authority takes the lead from the supervisory authority. The bank is then resolved using resolution tools, if necessary to meet the resolution objectives, including safeguarding financial stability and containing negative effects on the real economy. Supervisory authorities responsible for going concern policies usually carry out the assessment of failure, but its timing can have major implications for the options available for resolution authorities when the bank enters resolution.

A late assessment may imply that liabilities already substantially exceed assets, exhausting a bank’s loss absorbing and recapitalisation capacity via bail-in. It could also mean that funding in resolution, one of the still remaining challenges for orderly resolution, becomes an even bigger problem when the bank’s assets are highly encumbered. Forbearance would increase the likelihood that bail-in also affects derivatives and deposits. This raises systemic loss and therefore increases the relative attractiveness of bailout.

To ensure sufficient resources are available in resolution, any (likely) breach of TLAC is treated as a (likely) breach of minimum capital requirements (TLAC principle X). There is also an expectation that at least 33% of TLAC is met with long-term debt (TLAC term sheet 6). By contrast, EU law does not implement this expectation and does not explicitly allow to take into account the resources needed in resolution when assessing the (likely) failure of an institution. The current review of the crisis management and deposit insurance framework in the EU should be used to explicitly allow considering resources necessary for resolution when deciding whether a bank is failing or likely to fail. Such a decision has to be made when the bank is still deemed to be resolvable, meaning when it still has sufficient easily bail-in able liabilities and unencumbered assets to ensure liquidity in resolution.

While largely implemented independently of each other, the regulatory strands interact in several ways. For regulators and policy makers it is important to understand and consider the different interplays to assess whether the current framework works as intended and is effective and how it can be improved.

The current approach of a largely independent implementation of policies implies that authorities responsible for going concern policies (micro- and macroprudential authorities) and those for gone concern policies (resolution authorities) have more or less clearly delineated policy areas, instruments and responsibilities. However, it may fall short of considering interdependencies outlined above and lead to inconsistencies. For instance, sLGDi and thus systemic importance and resolvability are assessed by supervisory and by resolution authorities, which may lead to different implications for using policy measures to reduce sPDi and sLGDi that are not necessarily consulted and aligned between authorities. Further, overall regulation and the calibration of capital buffers currently do not consider whether buffers are effectively usable or if their loss absorption would breach minimum requirements such as the leverage ratio or TLAC/MREL due to the multiple use of capital. Buffers that are not usable do not add loss absorbing capacity and consequently do not reduce sPDi and also not sLGDi. Another example is the possible missing alignment of recovery and resolution plans.

As instruments both from the going and from the gone concern regulation can contribute to achieving the regulatory objective of containing sPDi, sLGDi and therefore sELi, different implications follow. First, the different authorities (or departments if competences are bundled in one authority) in charge of regulatory policies should have a common understanding of whether sPDi and/or sLGDi are deemed excessive and instruments should be employed to contain the sELi. Second, authorities need a clear understanding of all instruments and their interplay affecting sPDi and/or sLGDi, also to improve regulation. Third, the most effective instrument (or combination of instruments) from the different regulatory strands can be calibrated accordingly.

What would this mean in practice? For instance, when both assessing whether an institution is systemically important and deciding on the measures needed to overcome any TBTF problem, authorities should take all relevant aspects into account. This could entail that all banks earmarked for resolution are also designated as systemically important and vice versa, reflecting their high sLGDi and thus the need to apply TBTF policies. In addition, interactions between requirements that may limit their effectiveness need to be taken into account. Macroprudential authorities should generally set buffers at a level where a sufficient amount is not constrained by parallel minimum requirements, including TLAC/MREL, as long as the multiple use of capital for buffers and minimum requirements is still allowed by law. To implement an integrated approach, authorities need to share all information relevant for the respective tasks. Further, if there are impediments to resolve a bank its sLGDi, and probably sELi, is too high, thus mitigating options should be employed until the impediments are removed.19 These could be higher TLAC/MREL requirements, but they may not be able to increase market discipline, if resolution is not deemed credible, and to reduce contagion risk, if resolution occurs.20 Moreover, TLAC/MREL may not be sufficient if the problem stems e.g. from a lack of liquidity in resolution. In this case, authorities could also find it appropriate to reduce the bank’s sPDi and sELi by increasing going concern resilience, e.g. via higher capital buffers, which are not constrained by parallel minimum requirements, and/or via liquidity requirements and/or by setting requirements regarding the maturity profile of the bank’s liabilities. Authorities may also ensure higher loss absorbing capacity of financial institutions that would be affected by the failure of the bank in question. From a resolution and financial stability perspective, it is also necessary that the authorities responsible for deciding whether a bank is failing (or likely) to fail could consider the impact of the timing of the decision on the available resources in resolution or liquidation. If resources are already largely eroded when a bank is (likely) failing, resolvability can be jeopardised, increasing the sELi via a rise in the sLGDi. Further, resolution and macroprudential authorities should work together to develop and apply systemic stress scenarios for recovery and resolution planning and to assess the feasibility of recovery and resolution options at the macro level.

An integrated approach certainly raises operational questions, some of which, however, also apply to the current setup. These encompass the institutional setup and agreements to ensure the necessary coordination and cooperation between authorities, the dealing with uncertainty surrounding sPDi and sLGDi and the impact regulatory policies have on them, as well as the type of approach to be followed, which could be symmetric or asymmetric. A symmetric approach, for instance, would try to compensate impediments to resolvability with going and/or gone concern requirements but similarly reduce those requirements when certain bank specific resolvability targets are met. Such an approach may increase incentives for banks to become more resolvable and to cooperate fully with authorities. By contrast, an asymmetric approach also would increase requirements in case of impediments to resolvability, but the absence of impediments would not lower requirements. This would reflect higher risk-aversion by authorities, acknowledging that any failure would entail costs. In addition, resolvability can only be assessed with certainty when resolution happens, and a reduction in requirements, such as capital buffers, may negatively affect resolvability in turn.

The only constant of regulation is that it always evolves. This analysis aims to contribute to this process by taking a bird’s eyes view on the origins and interplay of the regulations set in place to address risks from SII and to tackle the TBTF problem.

Bank of England (2016). The Financial Policy Committee’s framework for the systemic risk buffer.

BCBS (2018). Global systemically important banks: revised assessment methodology and the higher loss absorbency requirement.

BCBS (2019). An examination of initial experience with the global systemically important bank framework, BCBS Working Papers, no 34, February.

BCBS (2022). Basel Committee finalises principles on climate-related financial risks, progresses work on specifying cryptoassets’ prudential treatment and agrees on way forward for the G-SIB assessment methodology review, Press release, 31 May 2022.

Campbell, A. (2005). Issues in cross-border bank insolvency: the European Community directive on the reorganization and winding-up of credit institutions. Current developments in monetary and financial law, IMF, 3, 515-535.

Dombret, A. and Ebner, A. (2013). Default of Systemically Important Financial Intermediaries: Short-term Stability versus Incentive Compatibility? German Economic Review, 14(1), 15-30.

EBA (2014). Guidelines on the criteria to determine the conditions of application of Article 131(3) of Directive 2013/36/EU (CRD) in relation to the assessment of other systemically important institutions (O-SII).

EBA (2020). EBA report on the appropriate methodology to calibrate O-SII buffer rates.

EBA (2020)b. Report on the interlinkages between recovery and resolution planning.

Ebner, A. and Westhoff, C. (2022). Joining up prudential and resolution regulation for systemically important banks, SSRN.

ECB (2017). ECB floor methodology for setting the capital buffer for an identified Other Systemically Important Institution (O-SII). Macroprudential Bulletin, Issue 3.

ESRB (2021). Report of the Analytical Task Force on the overlap between capital buffers and minimum requirements, December 2021.

European Commission (2019). Study on the differences between bank insolvency laws and on their potential harmonisation.

Fender, I. and Lewrick, U. (2016). Adding it all up: the macroeconomic impact of Basel III and outstanding reform issues, BIS working papers No 591.

FSB (2010). Reducing the moral hazard posed by systemically important financial institutions.

FSB (2014). Key Attributes of Effective Resolution Regimes for Financial Institutions.

FSB (2015). Principles on Loss-absorbing and Recapitalisation Capacity of G-SIBs in Resolution. Total Loss-absorbing Capacity (TLAC) Term Sheet.

FSB (2021). Evaluation of the Effects of Too-Big-To-Fail Reforms.

Hellwig, M. (2021). Twelve Years after the Financial Crisis—Too-big-to-fail is still with us. Journal of Financial Regulation, 00, 1-13.

Hoelscher, D.S. (ed.) (2006). Bank restructuring and resolution. Palgrave Macmillan.

Hüpkes, E. (2005). Why a special regime for banks? Current developments in monetary and financial law, IMF, 3, 471-513.

Jiron, A., Passmore, W. and Werman, A. (2021). An empirical foundation for calibrating the G-SIB surcharge. BIS Working Papers No. 935.

Passmore, W. and von Hafften, A. (2019). Are Basel’s capital surcharges for global systemically important banks too small?, International Journal of Central Banking, 15(1), 107–56.

Posch, M., Schmitz, S. and Strobl, P. (2018). Strengthening the euro area by addressing flawed incentives in the financial system. OeNB, Monetary Policy & the Economy, 2, 34-50.

SRB (2022). Resolvability of Banking Union banks: 2021.

In the wake of the global financial crisis, FSB (2010) defined systemically important institutions as “financial institutions whose disorderly failure, because of their size, complexity and systemic interconnectedness, would cause significant disruption to the wider financial system and economic activity”

Already before the GFC, there was a discussion whether and how to implement a special regime to deal with failing banks, given experience of past banking crises and cross-border challenges. See e.g. Hüpkes (2005), Campell (2005) and Hoelscher (2006).

While a bank’s size is only one factor, and it would be more appropriate to speak of ‘too systemic to fail’ (Dombret and Ebner 2013), the term TBTF is commonly used.

We abstract from possible political costs that may be lower in case of bailout even if sELi < BELi, for instance if a considerable number of retail customers would take losses in resolution or liquidation, possibly provoking a backslash in the next elections.

The TBTF problem can therefore ultimately only be avoided if a market exit entails lower costs than a bailout, independently of sPDi (i.e. sLGDi < CiB + CiMH, with CiB being direct bailout costs and CiMH being indirect costs resulting from moral hazard).

This additional calculation is introduced despite the resolution framework is hardly tested in the EBU, and gaps in resolvability remain according to the Single Resolution Board (SRB 2022). In the EU, Art. 131 CRD establishes a complementary G-SII identification methodology that excludes a group’s intra-EBU activity from the cross-border activity category. Following BCBS (2022), supervisory discretion regarding cross-border intra-EBU exposure will be exercised using an Adjustment for STructural Regional Arrangements (ASTRA; link).

FMSG – Recommendation FMSG/4/2019: guidance on applying the O-SII buffer

SRB justified this deviation from the resolution plans with significant developments since the 2016 plans (link; link). Also the Austrian established Sberbank Europe AG was neither an O-SII nor resolution was assessed to be in the public interest when failing in 2022, despite being earmarked for resolution in the 2020 resolution plan (link). However, in this case the Austrian government did not use liquidation aid.

European Commission (2019), Annex 2, country report Italy, p. 31f. See also the EU Commission’s press release (link).

See BCBS (2018).

The G-SIB buffer should reduce sELi to the one of the reference institute by lowering sPDi, but it also has an effect on sLGDi if shareholders are better able to bear losses than creditors and contagion is lower.

For instance, there are no explicit PD and LGD functions, the reference bank score has not been updated since 2012 and was based on supervisory consensus, and buffers are applied using a step and not a continuous function (Jiron et al. 2021).

The top up power has not been used until the date of writing this article. In line with its macroprudential mandate and in collaboration with national authorities, the ECB has developed a methodology, which determines floors for the capital buffers for four buckets defined by the O-SII score. See ECB (2017). EBA (2020) gives an overview of the calibration methods of O-SII buffers in the EU and proposes to introduce an EU wide floor for O-SII buffers to reduce unwarranted heterogeneity.

Bank of England (2016). Results of possible mitigating effects of the resolution framework are, however, highly sensitive to assumptions. Fender and Lewrick (2016) assume lower effects and see room for welfare enhancing higher capital requirements.

TLAC and MREL can be met with capital and eligible liabilities and aim to ensure sufficient loss absorbing and recapitalization capacity in resolution.

Art. 45c(3) BRRD. Resolution authorities retain discretion to adjust the confidence charge.

While financial stability concerns justify automatic distribution restrictions in the capital framework, a serious disturbance to financial markets, determined solely by the resolution authority, may prevent the application of distribution restrictions if the combined buffer requirement is breached on top of risk-weighted TLAC/MREL (Art. 16a BRRD). This treatment of disturbances in Art. 16a BRRD should be removed, as it may undermine the effectiveness of macroprudential buffers.

FSB (2014). For EU legislation, see Art. 5 ff BRRD (recovery planning) and Art. 10 ff (BRRD) as well as Art. 8 ff (SRMR) (resolution planning).

For an aggregate resolvability assessment in the EBU see SRB (2022). Assessments, including bank specific ones, are published in CH (link), UK (link) and US (regarding living wills under title I Dodd-Frank Act; link).

In the EU, only G-SII have to deduct holdings of other G-SII’s issued TLAC (=statutory MREL minimum requirement) resources from their own TLAC and only for compliance with the statutory but not the overall MREL requirement. This falls short of the Basel TLAC holdings standard according to which all banks should deduct holdings of TLAC from their own Tier 2 capital.