A central tenet of bank regulation holds that bank disclosures provide market discipline and reduce banks’ risk-taking incentives. In a recent paper, we argue that disclosures can increase banks’ leverage and risk. Disclosure of bank-specific information reduces the agency problem between uninsured debt and equity, thereby lowering banks’ cost of leverage. By issuing uninsured short-term debt that is repaid ahead of insured deposits when economic conditions deteriorate, banks can dilute insured deposits. Increasing leverage by issuing more uninsured short-term debt raises the subsidy provided by deposit insurance, which increases banks’ risk-taking incentives. The total effect of disclosures on banks’ risk-taking depends on the magnitude of the leverage adjustment. Our model implies that disclosure requirements succeed in reducing banks’ risk-taking when capital requirements are sufficiently tight or when deposit insurance premiums explicitly take into account banks’ issuance of short-term debt.

In 2004, the Basel Committee introduced Pillar 3 (market discipline) into the Basel II Accord, making disclosure requirements a complement to minimum capital requirements (Pillar 1) and the supervisory review process (Pillar 2) (BIS, 2004). The recommendation of mandatory disclosure requirements in the Basel Accord was justified on grounds that the disclosure of bank-specific information would prompt banks to reduce their risk and leverage. In particular, the Basel Committee argued that disclosures lead to lower risk and leverage because “the market will require a higher return from funds invested in, or placed with, a bank that is perceived as having more risk” (BIS, 1998, p. 6).

In a recent paper, “The Leverage Effect of Bank Disclosures”, we challenge this view and show that the disclosure of bank-specific information (e.g., a bank’s risk exposure or risk assessment processes) can actually lead banks to increase their leverage and, as a consequence, their risk. We refer to the increase in risk-taking due to increased leverage in the case of disclosure as the “leverage effect” of bank disclosures.

Disclosing information can mitigate banks’ risk-taking by making the price of uninsured debt more sensitive to banks’ risk-taking decisions. Empirical studies find that the price of subordinated debt is sensitive to information about banks’ risk (Flannery and Bliss, 2019) suggesting that disclosures reduce informational asymmetries and agency problems between banks and their creditors and force banks to internalize the consequences of their risk-taking decisions. We refer to this channel as the “direct market disciplining effect” of bank disclosures.

While the direct market disciplining effect is present in our model, we show that it is only one part of the total effect of disclosures on banks’ risk-taking. The reason is that disclosures, by lowering the agency cost of debt financing, change the cost of debt relative to equity and make debt issuances less expensive for banks. The effect of disclosures on banks’ leverage is typically absent in the standard argument that disclosure requirements reduce risk-taking. However, our paper shows that this leverage channel can be important.

To understand the effect of leverage on banks’ risk-taking, we build on two key features of banks’ capital structure. First, banks finance a considerable part of their balance sheets with senior insured retail deposits. Since deposit insurance premiums do not (fully) reflect banks’ risk, issuing insured deposits generates a subsidy for banks. Second, because the supply of insured deposits is relatively inelastic, many banks also rely on wholesale debt markets to cover residual funding needs that exceed their insured retail deposits. We show that banks optimally raise short-term wholesale debt (rather than long-term debt or equity) because it allows them to ratchet up the deposit insurance subsidy. The reason is that short-term wholesale creditors can withdraw their funding quickly following a deterioration in economic conditions that may impair the future solvency of the bank. By withdrawing short-term debt before regulators or resolution authorities can intervene and resolve the bank, creditors leapfrog the priority of insured depositors and dilute their claims.

Such dilution occurred, for example, when wholesale creditors withdrew from U.S. banks in 2008 during the financial crisis. Rose (2015) shows that around 70 percent of the deposits withdrawn from large commercial banks were uninsured even though the majority of these banks’ funding came from insured deposits. In addition, recent empirical findings by Chen et al. (2020) highlight that the sensitivity of deposit flows to bank performance is stronger for uninsured deposits, implying that these claims are withdrawn quicker and in larger quantities than insured claims.

In our model, the possibility to dilute retail deposits generates a cost advantage of short-term wholesale debt over equity financing even absent other factors that may render equity more expensive than debt (e.g., debt tax shields or implicit bailout guarantees). The bank’s optimal funding decision between short-term debt or equity trades off the dilution benefit from issuing short-term debt against the agency cost of debt.

For given leverage, disclosing bank-specific information alleviates the agency problem between the bank and its uninsured creditors and reduces the bank’s risk-taking incentives (direct market discipline effect). However, the very fact that information disclosures lower the agency cost of debt incentivizes the bank to increase its leverage in order to maximize the dilution benefits of debt. We show that this increase in leverage has the same negative effect on the bank’s risk-taking incentives as increasing the amount of insured deposits. This leverage effect of bank disclosures counteracts and may even overturn the reduction in risk due to the direct market discipline effect.

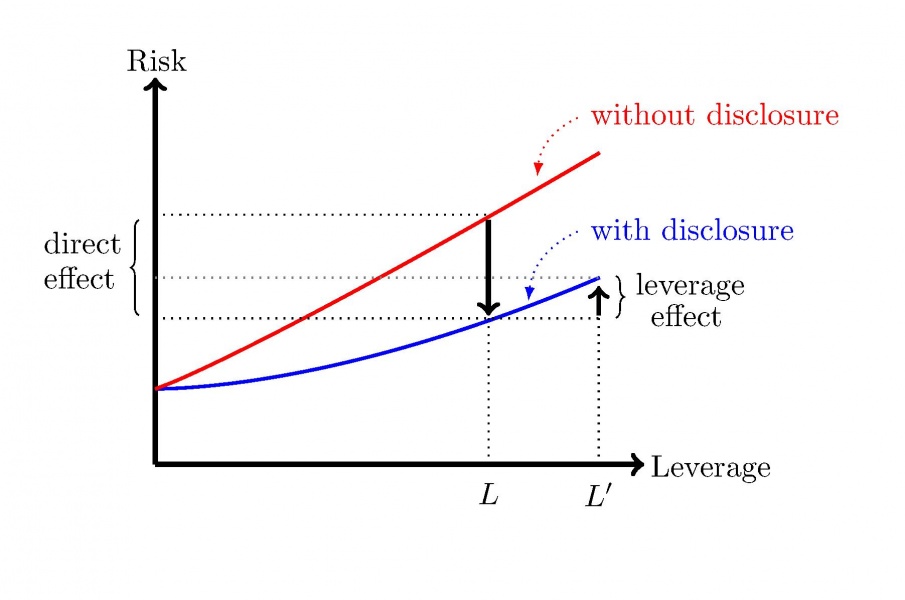

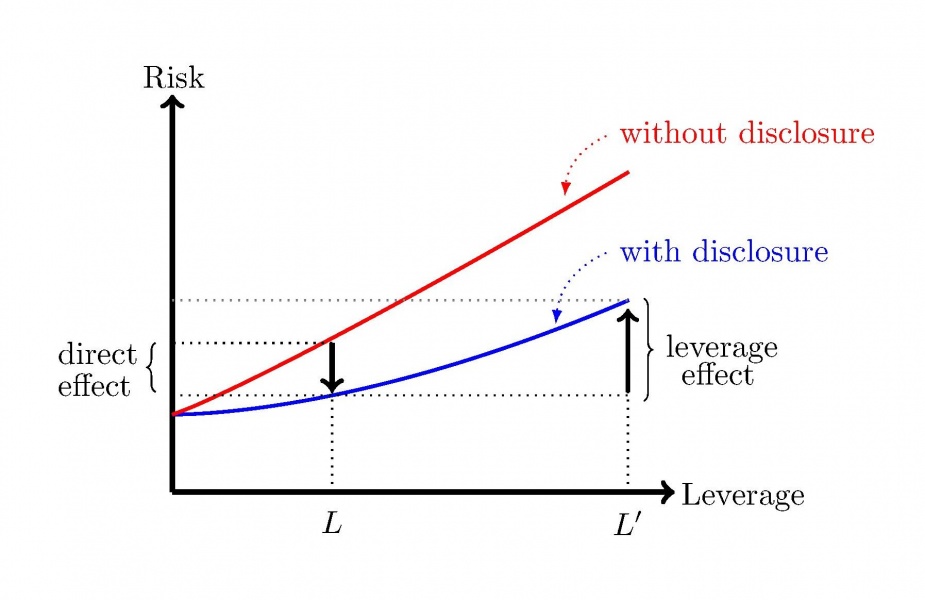

Figures 1 and 2 illustrate how the direct market discipline and the leverage effect interact to determine the total effect of disclosures on the bank’s risk-taking. The graphs show the bank’s risk choice as a function of leverage stemming from short-term debt financing for the case where no bank-specific information is disclosed (red curve) and for the case where bank-specific information is disclosed (blue curve).

Regardless of whether or not bank-specific information is disclosed, the bank’s risk choice is increasing in leverage. Without disclosure, the reason is that the presence of agency costs implies that higher leverage exacerbates the bank’s debt overhang problem and leads to higher risk-taking. This effect of leverage on risk is absent with disclosures because the disclosure of information eliminates the agency problem between debt and equity. However, with disclosure, the dilution benefits of short-term debt create an externality that distorts the bank’s risk-taking decision. The reason is that a risky bank is more likely to face withdrawals by uninsured creditors compared to a safer bank. Hence, a riskier bank benefits more from the wealth transfer implied by the dilution of retail deposits. This increase in dilution benefits incentivizes a bank to increase its risk-taking when its leverage increases even under disclosure, i.e., in the presence of market discipline.

The fact that the red curve is located above the blue curve reflects the direct market discipline effect. Given leverage L, disclosing information implies a downward movement from the red to the blue curve and a corresponding reduction in the bank’s risk level.

Importantly, disclosure not only leads to a downward shift from the red to the blue curve, but also to a movement along the blue curve from L to the bank’s optimal leverage under disclosure L’. The associated increase in risk that occurs by moving from L to L’ along the blue curve reflects the leverage effect of bank disclosures.

Figure 1 shows the case where the direct market discipline effect outweighs the leverage effect, so that information disclosure leads to a reduction in the bank’s risk level. Figure 2 shows the opposite case where the direct market discipline effect is small compared to the leverage effect, so that information disclosure increases the bank’s risk-taking. Our model shows that whether the disclosure of information leads the bank to take more or less risk depends on the magnitude of the leverage adjustment (L’-L): if the increase in leverage is sufficiently large, disclosures lead to greater risk-taking.

| Figure 1: Disclosures reduce the bank’s total risk because the direct market discipline effect dominates the leverage effect. | Figure 2: Disclosures increase the bank’s total risk because the leverage effect dominates the direct market discipline effect. | ||

|

|

Our model has implications for prudential regulation. Banks can only increase their leverage in response to disclosures if their regulatory capital constraint is not binding. Hence, disclosures are more likely to have the desired effect of reducing banks’ risk if capital requirements are sufficiently tight. Alternatively, the negative externality implied by the dilution of insured deposits can be eliminated by taxing short-term wholesale debt. Taxing away the dilution benefits of debt eliminates the cost advantage of debt over equity and reduces banks’ risk-taking incentives. Such a tax can be implemented by requiring banks to pay a deposit insurance premium that increases as their total leverage increases. This result is in line with recent reforms of deposit insurance schemes. For example, the Dodd-Frank Act required the Federal Deposit Insurance Corporation (FDIC) to revise its methodology for calculating risk-based premiums by requiring the FDIC to broaden its definition of the assessment base from domestic deposits to average consolidated total assets minus average tangible equity (FDIC, 2020). A consequence of this revision is that the total burden of assessments has shifted from smaller banks to larger banks that rely more on short-term wholesale funding (Kreicher et al., 2014).

BIS. 1998. Enhancing bank transparency. Bank for International Settlements / Basel Committee on Banking Supervision. URL: https://www.bis.org/publ/bcbs41.pdf

BIS. 2004. International Convergence of Capital Measurement and Capital Standards. A Revised Framework. Bank for International Settlements / Basel Committee on Banking Supervision. URL: https://www.bis.org/publ/bcbs107.pdf

Chen, Q., I. Goldstein, Z. Huang, R. Vashishtha. 2020. Liquidity transformation and fragility in the US banking sector, NBER Working Paper 27815, National Bureau of Economic Research. URL: https://finance.wharton.upenn.edu/~itayg/Files/depositflows.pdf

FDIC. 2020. A History of Risk-Based Premiums at the FDIC. Federal Deposit Insurance Corporation. URL: https://www.fdic.gov/analysis/cfr/staff-studies/2020-01.pdf

Flannery, M., R. Bliss. 2019. Market discipline in regulation: Pre and post crisis. In A. N. Berger, P. Molyneux, J. S. Wilson (Eds.). The Oxford Handbook of Banking. Oxford University Press. pp. 339 – 356.

Koenig, P. J., C. Laux, D. Pothier. 2021. The leverage effect of bank disclosures. Discussion Paper 31 / 2021. Deutsche Bundesbank. URL: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3934775

Kreicher, L., R. McCauley, P. McGuire. 2014. The 2011 FDIC assessment on banks’ managed liabilities: interest rate and balance-sheet responses. In R. de Mooij, G. Nicodème (Eds.). Taxation and Regulation of the Financial Sector. MIT Press. Ch. 15.

Rose, J. N. 2015. Old-fashioned deposit runs. Working Paper 2015 / 111. Board of Governors of the Federal Reserve System. URL: https://www.federalreserve.gov/econresdata/feds/2015/files/2015111pap.pdf