The European Central Bank (ECB) decided to lower interest rates on June 6. This decision was, among other reasons, based on its forecast of inflation in the medium term. In this policy brief, we discuss why this line of reasoning is problematic. Based on empirical evidence, we argue that the ECB’s inflation forecasts are uninformative for horizons of more than one year. The ECB should consider this insight when designing its monetary policy.1

Inflation forecasts are of central importance for the monetary policy decisions of the European Central Bank. But how well and over what horizons can the ECB predict inflation? We argue that the ability to forecast future inflation rates is generally limited and that the ECB should account for this limitation in its monetary policy strategy. In our view, the ECB responded late to the inflation surge in 2021-2022 because it focused too much on projections of inflation at horizons for which the projections are not informative. Nevertheless, and despite the large forecast errors in recent years (see below), the ECB justified the rate cut on June 6 with its most recent medium-term projections:

“I think the second element that we took very much into account was the reliability and the strength of our projections. And there is one particular line of projections which to many of us was relevant. If you look at Q4 2025 projections – you look at September, you look at December, you look at March, you look at June – there’s a variation between those projections of 0.10 percentage points. So it’s either 2 or 1.9 or 2 or 1.9 or 2. And it’s on the basis of this reliability and solidity and robustness of those projections that we have made that decision to actually cut.” (Lagarde, 2024)

The first element that President Lagarde referred to in the Q&A of the press conference after the governing council meeting on June 6 was that Eurozone inflation has strongly decreased since the peak in October 2022. The fact that she emphasized the “reliability” of the ECB’s projections when referring to the forecast of inflation in Q4 2025 is surprising, given how she commented on the quality of the projections in 2022:

“We can no longer rely exclusively on the projections provided by our models – they have repeatedly had to be revised upwards over these past two years. There are things that the models don’t capture,” (Lagarde, 2022)

and how the President of the French central bank, François Villeroy de Galhau, downplayed the importance of the projections for policy decisions last year:

“We are data driven, we are not forecasts driven.” (de Galhau, 2023)

Those statements were made at a time when trust in the ECB’s projections had eroded after a series of particularly large forecast errors. Since then, ECB officials seem to have regained confidence in their projections. This is presumably due to the fact that inflation developments are now more in line with the ECB’s projections. However, as there have been no major changes in forecasting methodologies, it seems questionable to us why forecast “reliability” should have increased since the above statements in 2022 and 2023.

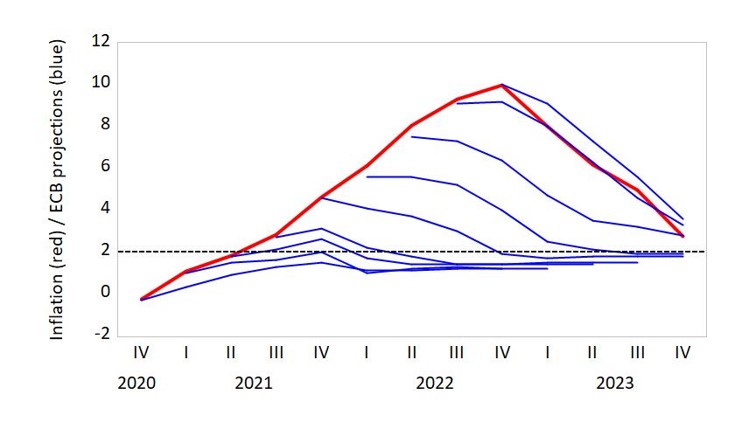

The discontent with the projections was due to the fact that the ECB had significantly underestimated the actual development of inflation in 2021 and 2022, even over short forecast horizons. Figure 1 shows the development of inflation in the euro area from the fourth quarter of 2020 to the fourth quarter of 2023. The blue lines represent the ECB’s inflation projections, starting from the quarter in which they were published. The forecast for the current quarter is referred to as the nowcast. Since the fourth quarter of 2020, the ECB has significantly underestimated the rise in inflation in the short term. The projection from the second quarter of 2022 was the first to predict an inflation rate of over 2% in the medium and long term. These misjudgments regarding inflation have contributed to the ECB not raising the key interest rate before July 2022, which has led to increasing criticism of its forecasts and, therefore, its monetary policy. For example, in a guest article for the Frankfurter Allgemeine Zeitung (FAZ) in December 2021, we pointed out the uncertainties associated with the long-term projections and argued that aligning monetary policy with these projections is problematic (Conrad et al., 2021).

Figure 1.

Figure 1: The red line shows realized inflation (percentage change in the HICP compared to the same quarter of the previous year) in the euro area. The blue lines show the ECB projections from the respective quarters. The black dashed line corresponds to the 2% target.

While the ECB primarily points to problems with the technical assumptions regarding energy commodity prices when analyzing its forecast errors (Chahad et al., 2023) and promises methodological improvements, we see a more fundamental problem. In our view, the focus of monetary policy on the medium- and long-term inflation forecast horizons, as described in the ECB’s strategy review in 2021, can only be justified if inflation forecasts at these horizons are informative.2 In Conrad et al. (2024), we systematically evaluate the performance of the ECB’s forecasts. We do not exclusively focus on the 2021-2022 period but investigate the informational content of the forecasts since 2001. For the entire observation period, we initially come to a positive conclusion: For forecast horizons of one to eight quarters, we find no evidence of a systematic bias in the ECB’s forecasts. This means that the ECB has neither systematically underestimated nor overestimated inflation. There is also no evidence that available information is not used efficiently.

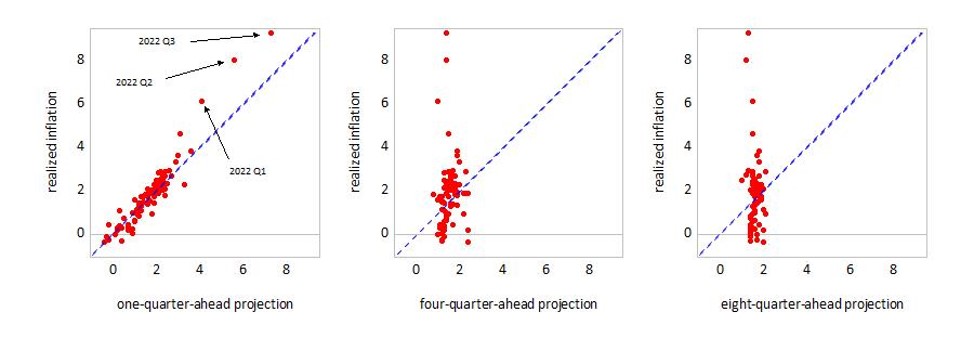

To illustrate our further results, Figure 2 shows a scatter plot of the ECB’s projections and the subsequent realized inflation. Forecast horizons of one quarter (left), four quarters (center), and eight quarters (right) are considered. The dashed line corresponds to the 45-degree line. If the projections were perfect, i.e., if projections and subsequent realizations matched exactly, all points should lie on this line. For the one-quarter-ahead projections, all points of the scatter plot are indeed close to the 45-degree line. A regression of realized inflation on the ECB projections for this horizon has a coefficient of determination of 92 percent, and the joint null hypothesis that the intercept is zero and the slope is one cannot be rejected. The large forecast errors for the quarters 2022Q1-2022Q3 are nevertheless clearly visible.

Looking at the middle and right-hand charts, the impression changes completely. At four- and eight-quarters horizons, the coefficient of determination falls to 10 and below 10 percent, respectively, which means that the projections at these horizons have hardly any explanatory power for the inflation realized later. However, this does not necessarily mean that the quality of the forecasts can be improved. Assuming a stationary process for inflation with an unconditional mean of “close to, but below 2%”3 and a quadratic loss function on the part of the ECB, the optimal projections should converge towards this unconditional mean as the forecast horizon increases. This is exactly what the chart reflects. As the forecast horizon increases, the variance of the forecasts falls. Hence, the forecast performance will deteriorate as the forecast horizon increases until it corresponds to the forecast performance of a “naive forecast” that always predicts the unconditional mean. How quickly the projections should converge toward the unconditional mean depends on the persistence of the inflation process.

Figure 2.

Figure 2: Scatter plot of realized inflation and ECB projections. Left: Forecast horizon of one quarter; center: forecast horizon of four quarters; right: forecast horizon of eight quarters. Data for the period 2001Q2-2024Q1 are used.

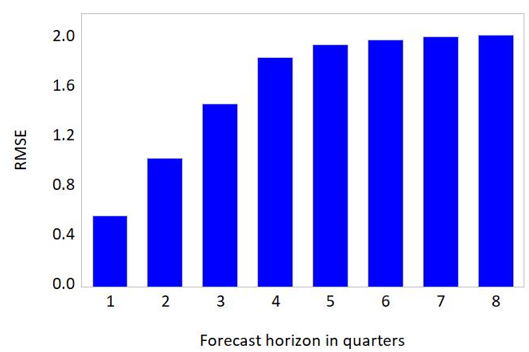

Forecasts are, therefore, only informative on forecast horizons on which their forecast performance is significantly better than the forecast performance of the naive forecast. Breitung and Knüppel (2021) proposed an econometric test for investigating up to which horizons forecasts are informative. We have applied this test to the ECB’s projections. Due to the medium-term orientation of monetary policy, the question of informative forecast horizons is particularly relevant. Our empirical results show that the ECB’s forecasts are informative for horizons of up to one year, with the greatest improvement compared to the naïve forecast being achieved at the shortest horizon. However, we find that the ECB’s forecasts are uninformative for forecast horizons of more than one year. Put differently, as the forecast horizon increases, the impact of currently available information on the forecasts diminishes: Forecasts are scattered around the inflation target, but realizations are not. We are, therefore, skeptical about placing a large weight on these forecast horizons when deciding about current interest rates. When President Lagarde argues that there is little variation in the September 2023, December 2023, March 2024, and June 2024 projections of inflation in Q4 2025, this is fully in line with the hypothesis that at these forecast horizons (6 to 9 quarters), the forecasts are essentially equal to the unconditional mean. Yet, the fact that there is little variation in these forecasts should not be confused with forecast accuracy. The opposite is true: Forecast uncertainty is close to the maximum at these horizons. This is illustrated in Figure 3, which shows how the ECB’s historical root mean squared forecast errors increase with the forecast horizon.

Figure 3.

Figure 3: Root mean squared forecast errors (RMSE) of the ECB’s projections for forecast horizons of one to eight quarters. Data for the period 2001Q2 2001Q2-2024Q1 are used.

The fact that the uninformative horizon is already reached after one year, despite the considerable effort that the ECB puts into producing its forecasts, seems sobering at first. However, we can show that other forecasters, for example in the “Survey of Professional Forecasters,” do not deliver more informative predictions. In principle, it is important to acknowledge that there are limits to predictability that are determined by the characteristics of the underlying inflation process, irrespective of the forecasting models used. Although we cannot generally rule out that more informative forecasts are possible, our results suggest that this forecasting limit is already reached after four quarters. Thus, we cannot conclude from our empirical results that the ECB’s forecasts are not optimal, as even optimal forecasts can quickly become uninformative. The underlying inflation process and hence the limit of predictability, however, can also vary over time and depends, in particular, on the conduct of monetary policy. We can indeed show in a theoretical macroeconomic model that a successful monetary policy makes inflation less predictable. The intuition for this is simple: in the extreme case, monetary policy is so successful in fighting inflation that in every period the realized inflation corresponds to the inflation target plus a purely random shock. This means that the optimal forecast corresponds to the inflation target, i.e., the unconditional mean, even at a horizon of one period. Thus, at the shortest horizon, the optimal forecast is already uninformative.

We already referred to the forecast limits and implications for the design of monetary policy in a guest article for the FAZ in September 2022 (Conrad, 2022). In the meantime, similar arguments have found their way into the discussion on how forecasts should influence monetary policy. For example, Alfred Kammer (IMF) argued in June 2023 at the ECB Forum on Central Banking in Sintra in his presentation on “Lessons from recent experiences in macroeconomic forecasting”:

“We tend to find that at relatively short horizons (same year mainly) projections tend to do reasonably well. But moving out to even a 1.5 to two-year horizon both our and others’ forecasts deteriorate very fast.” (Kammer, 2023)

What follows from these findings? The ECB aims to achieve its inflation target over the medium term and, therefore, does not need to react to purely temporary deviations. However, if it turns out that it is only possible to predict very imprecisely whether deviations are temporary or permanent, i.e., how high inflation will be in twelve to 18 months’ time, it is questionable whether the medium and long-term forecasts should be used as a policy guide. In our opinion, the ECB has overestimated its forecasting capabilities by basing its monetary policy on these horizons. Tying monetary policy decisions to forecasts with a horizon of more than one year is not sensible.

Moreover, emphasizing the importance of forecasts on horizons for which the forecasts are not informative can lead to a loss of reputation in the long term. This can be harmful for an institution that is keen to build confidence in its own currency. To counteract this, the ECB should at least clearly state the uncertainties associated with its forecasts, i.e., publish probabilistic forecasts – such forecasts indicate probabilities that inflation will remain within certain bounds.

Instead, the ECB temporarily refrained from quantifying forecast uncertainty when publishing its forecasts during and after the coronavirus pandemic. It presented alternative scenarios showing how the inflation forecasts would behave under different assumptions. But these scenarios are not informative about the inherent forecast uncertainties and the likelihood of the alternative scenarios. In addition, empirical estimates suggest that monetary policy works faster than often presented by the ECB (e.g., Jannsen et al., 2019, Corsetti et al., 2022, Mandler et al., 2022). Therefore, in our view, monetary policy should react to deviations of forecasts from the inflation target at shorter horizons already. In this respect, we advocate a more transparent approach that places greater emphasis on informative forecast horizons and the communication of forecast uncertainties. This includes reporting the forecast horizons up to which the ECB’s own inflation forecasts have been informative in the past.

Breitung, J. and M. Knüppel (2021), How far can we forecast? Statistical tests of the predictive content, Journal of Applied Econometrics, 36, 369-392.

Chahad, M., A.-C. Hofmann-Drahonsky, B. Meunier, A. Page and M. Tirpák (2023), An updated assessment of short-term inflation projections by Eurosystem and ECB staff, ECB Economic Bulletin, 2023(1), 61-65.

Conrad, C. (2022), Prognose-Grenzen, Frankfurter Allgemeine Zeitung, September 29.

Conrad, C. and Z. Enders (2023), The spectre of inflation. The forecasts of the European Central Bank, Ruperto Carola, 22, 24-31.

Conrad, C. and Z. Enders (2024), Die Grenzen der EZB Prognosen, AWI Discussion Paper No. 747. Prepared for Binder, J., W. Kohler, G. Müller and M. Nettesheim (eds.), Die EZB in der Krise: Ökonomische und juristische Perspektiven, Mohr-Siebeck, Tübingen.

Conrad, C., Z. Enders and G. Müller (2021), Die EZB setzt ihre Glaubwürdigkeit aufs Spiel, Frankfurter Allgemeine Zeitung, December 15.

Conrad, C., Z. Enders and G. Müller (2024), The ECB’s projections and their limits, Mimeo.

Corsetti, G., J.B. Duarte and S. Mann (2022), One money, many markets, Journal of the European Economic Association, 20(1), 513-548.

de Galhau, F. V. (2023), The euro as a complementary asset in a more multilateral system, speech at the conference: The internationalization of the euro and the creation of the EU Capital Markets Union, Paris, 16 June, The euro as a complementary asset in a more multilateral system | Banque de France (banque-france.fr)

Jannsen, N., G. Potjagailo and M. H. Wolters (2019), Monetary policy during financial crises: Is the transmission mechanism impaired?, International Journal of Central Banking, 15(4), 81-136.

Kammer, A. (2023), Remarks at the ECB Forum on Central Banking: Lessons from recent experiences in macroeconomic forecasting, June 28, Alfred Kammer’s Remarks at the ECB Forum: “Lessons from recent experiences in macroeconomic forecasting” (imf.org)

Lagarde, C. (2022), Interview with Christine Lagarde, conducted by Morgane Miel, Interview with Madame Figaro (europa.eu) (29.5.2022).

Lagarde, C. (2024), Questions and Answers, ECB Press Conference of June 6, PRESS CONFERENCE (europa.eu).

Lane, P. (2021), The new monetary policy strategy: implications for rate forward guidance, The ECB Blog, The new monetary policy strategy: implications for rate forward guidance (europa.eu)

Mandler, M., Scharnagl, M. and Volz, U. (2022), Heterogeneity in euro area monetary policy transmission: results from a large multimulti-country BVAR model, Journal of Money , Credit and Banking, 54(2 2-3), 627 627-649.

This text is based on Conrad and Enders (2023, 2024) and provides an overview of the results in Conrad et al. (2024).

Philip Lane, the ECB’s Chief Economist, said in 2021: “Specifically, our forward guidance now reads: In support of its symmetric two per cent inflation target and in line with its monetary policy strategy, the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two percent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realized progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target.” (Lane, 2021).

For the largest part of our evaluation period, this corresponds to the ECB’s inflation target.