Quantitative easing (QE) was used as an emergency measure during the 2008 global financial crisis. It has since remained in place as part of the monetary policy toolbox. Yet, after more than a decade of experience, the possible downsides of QE are poorly understood. In this paper, we document the effects of QE on the market liquidity of Swedish government bonds. Using unique data, we find that the Riksbank’s (Sweden’s central bank) purchases of government bonds improve liquidity, although only initially. There are opposing forces at work. We show that the deterioration in the level of market liquidity from QE by the so-called scarcity effect tends to outweigh the improvement in liquidity from the demand effect. It does so nonlinearly.

The severity of the financial crisis in 2008 was a catalyst for central banks to introduce unorthodox measures such as quantitative easing (QE) to safeguard market liquidity and prevent a collapse of the financial system. QE has since remained in place and become a part of the toolbox for monetary policy makers. Nevertheless, after more than a decade of experience with QE policies, the impact of asset purchases by central banks on market liquidity is poorly understood. The general consensus is that QE can help central banks to support the economy during a crisis by preventing the economic outlook from deteriorating further (BIS, 2019). However, beyond periods of crisis, the effects of QE are much less understood or analyzed. As central banks continue to pursue their objectives by using QE programs, market participants have increasingly voiced concerns about the undesired consequences of QE, in particular regarding its adverse impact on market liquidity (BIS, 2019). Because of the Covid-19 pandemic, many central banks have expanded QE programs further. There is thus an urgent need for a better understanding of QE.

Our work contributes to the discourse on central bank QE programs by studying the effects of the QE program of the Riksbank (Sweden’s central bank) on government bond market liquidity (Blix Grimaldi, Crosta and Zhang, 2021). We use a rich and granular dataset based on Markets in Financial Instruments Directive (MiFID) transaction data. A distinct advantage of using MiFID transaction data is that it enables us to compute several measures of liquidity, including transaction price-based measures, and thereby present a better picture of market liquidity than in the existing literature, in which liquidity measures are mainly based on aggregate or noisy data. Our dataset extends from January 2012 to the end of April 2020 – to our knowledge the longest period that has been analysed in this line of research.

We examine the effects of QE on the different aspects of liquidity by relating the level of liquidity prevailing in the market to the outright purchases of the central bank and its holdings on each bond included in the QE program. We find that market liquidity increases following the outright purchases of the central bank. In particular, the demand from the central bank acts as a double booster for liquidity. Outright purchases increase liquidity directly by promoting trade, but they also increase liquidity indirectly. By announcing its purchase plans in detail, the Riksbank commits to buy a predetermined amount of certain bonds. Consequently, the Riksbank creates incentives for market participants to trade or hoard those securities it has committed to buy. It is worth noting that while the central bank aims to buy the bonds at a price as close as possible to the market price, it is likely to prioritize its mandate and therefore be rather price insensitive. This demand effect entails a positive relationship between market liquidity and the central bank’s QE program.

We also find market liquidity to be a declining function of the holding ratio of the central bank. That is, the larger the share of the total outstanding amount of a government bond held by the central bank, the lower the market liquidity. This scarcity effect on the government bond market has been documented for the QE programs of several central banks, such as the ECB (Ferdinandusse, Freier and Ristiniemi, 2020) and the Bank of Japan (Han and Seneviratne, 2018), for example.

We document that the negative relationship between holdings and liquidity can be non-linear. Scarcity becomes material only when the share of bonds held by the central bank grows above a certain threshold, and only then does it affect market liquidity adversely. Identifying a threshold is no trivial matter.

To determine the threshold, we rely on the unique data that the Swedish debt management office (DMO) owns on its security lending facility (SLF) volumes on a bond-by-bond basis. The primary aim of the SLF is to contribute to the liquidity of the Swedish central government debt to support the smooth functioning of the short-term funding market. The facility is demand-driven and is offered to the DMO’s primary dealers regardless of the bonds’ outstanding volume. Usage of the DMO’s facility has increased significantly since the Riksbank launched its QE programs. The unusually high SLF volumes are likely to be related to bond scarcity. As the so-called free float – the amount of bonds available for trade to investors – diminishes when the central bank’s holdings increase, the primary dealers resort to the SLF to avoid “fail to deliver” and fulfill their market-making commitments.

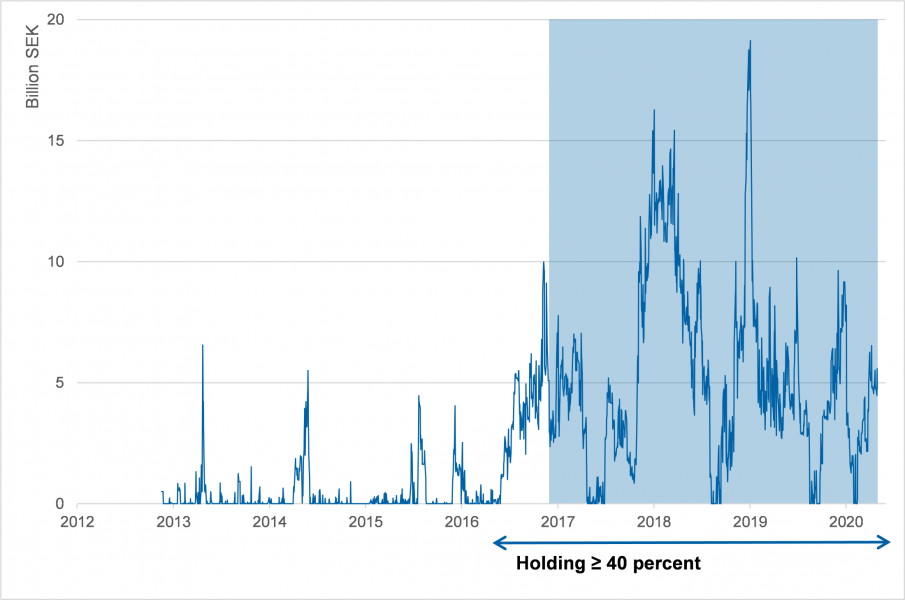

We find a clear trend in the usage of SLF. Most of the SLF activity for nominal bonds, both in terms of volume and volatility, increases significantly when the share of the Riksbank’s holdings become larger than approximately 40 percent. To illustrate this, Figure 1 shows the data for a representative bond. We interpret such evidence to be supportive of the non-linearity of the scarcity effect.

Figure 1: The Riksbank’s holdings and SLF usage

Note: Figure 1 illustrates the usage of the security lending facility (SLF) for one Swedish government bond. The shaded area marks the period in which the Riksbank’s holdings of that bond are at or above 40 percent.

Our analytical results confirm the existence of both a positive demand effect of QE on market liquidity, i.e. the Riksbank’s purchases increase market liquidity, and a scarcity effect of QE, as the Riksbank’s holdings decrease market liquidity. It is worth noting that the impact of the scarcity effect is more persistent than the demand effect. The outright purchases are a one-time-event, while holdings are not. In fact, holdings capture the cumulative effect of all previous purchases. The effect of holdings lasts as long as the central bank holds the bond, i.e., de facto until its maturity. In practical terms, this means that the scarcity effect tends to outweigh the demand effect.

The results of our analysis also show a significant non-linear impact of bond scarcity on market liquidity. When the central bank’s holdings are lower than 40 percent, we find no impact from the Riksbank QE, neither from the demand nor scarcity effect. When the central bank’s holdings become larger than 40 percent, we find a significant and adverse impact on price-based liquidity measures via the scarcity channel.

Our paper presents our studies of QE’s effects on market liquidity. We show that the demand effect of QE can cause market liquidity to improve – but also that the scarcity effect can cause it to deteriorate. We find that the scarcity effect tends to outweigh the demand effect non-linearly, i.e. the scarcity effect tends to materialize only when the share of the central bank’s holdings surpasses a critical cut-off point. Our findings do not imply that the central bank should abstain from adopting QE for its policy purposes. Instead, the conclusion is that when the central bank’s holdings reach a certain critical level, QE unduly weakens market liquidity and may even create market dysfunction, potentially hampering the monetary policy transmission mechanism and the effectiveness of monetary policy.

BIS (2019), “Monetary policy frameworks in EMEs: inflation targeting, the exchange rate and financial stability”, Annual Economic Report 2019.

Blix Grimaldi, M., Crosta, A. and Zhang, D. (2021), “The Liquidity of the Government Bond Market – What Impact Does Quantitative Easing Have? Evidence from Sweden”, Sveriges Riksbank Working Paper No. 402.

Ferdinandusse, M., Freier, M. and Ristiniemi, A. (2020), “Quantitative easing and the price-liquidity trade-off”, ECB working paper series No. 2399.

Han, F., and Seneviratne, D. (2018), “Scarcity effects of quantitative easing on market liquidity: evidence from the Japanese government bond market”, IMF working paper No. 18/96.