With nominal interest rates close to zero, the scope for using conventional monetary policy becomes very limited. However, this liquidity trap does not undermine central banks’ capacity for action. A recent study shows that they can stimulate the economy even in periods of low interest rates, and that they are therefore equipped to act effectively in response to the Covid-19 crisis.

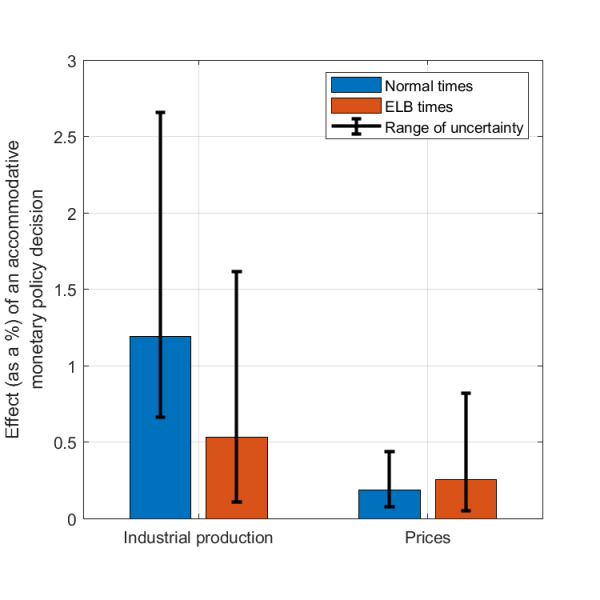

Chart 1 – The effect of monetary easing remains positive in the euro area in ELB times

Source: Lhuissier, Mojon and Jubio-Ramirez (2020).

NB: The accommodative monetary policy decision (“monetary policy shock”) corresponds to a fall in two-year sovereign interest rates of the order of 10 basis points.

Confronted with the economic crisis linked to Covid-19, the scope for the major G7 countries to use so-called conventional monetary policy (consisting in steering the very short-term interest rate) has become very limited. Inherited from the Great Recession, central banks’ key interest rates (the rate on the deposit facility and the rate on the central bank’s short-term lending to commercial banks) are close to zero or slightly negative in most developed countries. It is generally very difficult for a central bank to lower its key rates substantially below zero. Indeed, a time comes when commercial banks – and their customers – would rather hold physical money (coins and banknotes), which de facto provide zero return, than deposits, the returns on which would be very negative.

The liquidity trap refers to this “effective lower bound” (ELB) on short-term interest rates that makes conventional monetary policy ineffective to kickstart the economy. According to a number of studies, such as those by Krugman (1998) and Williams (2009), the presence of a lower bound undermines central banks’ ability to support economic activity by lowering key interest rates and to achieve their price stability objectives. Eventually, if the central bank is unable to stimulate demand sufficiently to achieve its inflation objective with interest rates close to zero, the major risk is that the liquidity trap generates a deflationary spiral. This situation is amplified by a fall in inflation expectations and a rise in real interest rates, thereby increasing the debt burden of borrowers and weighing on economic activity and wages, which in turn dampens demand from consumers and businesses and drives prices further down.

In response to the economic crisis sparked by Covid-19, and as they had already done following the 2008 financial crisis, central banks therefore swiftly introduced or reactivated so-called unconventional measures as substitutes for their key interest rates. However, are these measures still effective in the current context?

The measures adopted since the onset of the current crisis, which are both diverse and large-scale (details of which are set out in the recent Post by Odendahl et al.), can be grouped into three categories: quantitative easing (QE – involving large-scale purchases of private and public assets), support for the flow of credit (by providing abundant liquidity to banks), and communication on the future direction of policy rates (“forward guidance”).

While support for the flow of credit aims to act directly on the cost and availability of credit, QE and forward guidance enable the central bank to influence the prices of riskier and longer-term financial assets, the return on which is a function of three components: current and expected short-term interest rates, term and risk premiums, and expected inflation. In principle, QE influences term and risk premiums directly, whereas forward guidance acts on expected interest rates by committing to keep them low over a prolonged period.

Thus, in a world in which central banks have several instruments at their disposal to achieve their primary objective of price stability, keeping short-term interest rates low does not necessarily mean that a central bank’s ability to act on the economy and prices is weakened.

Lhuissier, Mojon and Jubio-Ramirez (2020) test whether monetary policy remains effective in a low interest rate environment in the United States, the euro area and Japan, using a statistical model. The study compares the effects of monetary policy on economic activity and prices, distinguishing between two periods: one in which nominal short-term interest rates have reached their effective lower bound (“ELB times”), and one in which interest rates can fluctuate normally in positive territory (“normal times”). One of the major advantages of this methodology is that the model is devoid of any theoretical assumptions and, as a result, neither the sign, the duration nor the magnitude of the responses of the economic variables following an easing of monetary policy are determined ex ante.

By way of example, the findings of this study for the euro area are shown in Chart 1. Each column represents the response of an economic variable following an unexpected accommodative monetary policy decision (modelled by a fall in the two-year sovereign interest rate of the order of 10 basis points), more commonly referred to as a “monetary policy shock”. The choice of this rate is justified by the fact that it has remained well above the policy interest rate in the three major economic areas under review (and is therefore not constrained by its ELB), and that it makes it possible to capture unconventional measures that act directly on medium- and long-term interest rates. The normal times (blue column) cover the period from January 1999 to mid-2012, while the ELB times (red column) cover the period from mid-2012 to end-2018. It can be clearly seen that the effects on the economy remain positive in both monetary periods, and that therefore a low interest rate environment does not impede the monetary policy transmission mechanism. Regarding industrial production (our economic activity variable), although its median response appears higher in normal times than in ELB times, the ranges of uncertainty indicated in black, representing the 68% probability intervals, in part cover the same values on the vertical axis, indicating that the effects are similar between the two periods. With respect to the impact on prices, we do not observe a significant difference between the two periods. Moreover, the effects appear larger for industrial production than for prices, a finding that is well known to economists. These findings also hold for the United States and Japan, and corroborate notably the recent work by Debortoli, Gali and Gambetti (2019), who show that US macroeconomic dynamics remain unchanged by the ELB constraint.

This study therefore shows that monetary easing affects economic activity and price levels positively, including when short-term interest rates are close to their effective lower bound. Thus, central banks remain equipped to act effectively in response to the current economic crisis.