The COVID-19 crisis has had a major impact on corporate balance sheets. The financial frictions resulting from impaired liability structures and higher credit risk are likely to reduce borrowing capacity and future investment, lowering economic growth and productive capacity in the longer run.

Our estimates indicate that the increase in financial frictions caused by the COVID-19 crisis will, all else being equal, entail a 3.4 percentage point decrease in potential output because of lower business investment.

We argue that the firm balance-sheet channel is important to understand the scarring effects of the ongoing crisis. However, assessing the overall impact of the COVID-19 crisis on potential growth goes beyond the reach of this study, which focuses on just one channel among many, some of them, such as faster digital adoption and some policy choices, having a positive impact on long term growth.

The COVID-19 crisis has had a major impact on corporate balance sheets and the composition of their liabilities. Firms have borrowed to cover the significant liquidity needs resulting from the crisis and have been enabled to do so thanks to the combined response of supervisory (eased prudential rules), monetary (rate cuts, refinancing operations, asset purchases, …) and fiscal (state guaranteed loans, tax deferrals, transfers …) authorities. Meanwhile, firms have already and are about to register losses that are eroding equity buffers. This will result in a transfer from equity to debt altering the composition of corporates’ liabilities.

The increase in the credit risk resulting from impaired liabilities’ structures is expected to increase financial frictions, that is to say the characteristics that prevent projects to be funded even if they could be profitable. Lower borrowing capacity is likely to reduce future investment and spending on capital equipment, thereby leading, all else being equal, to lower realised economic growth and reduced productive capacity in the longer run.

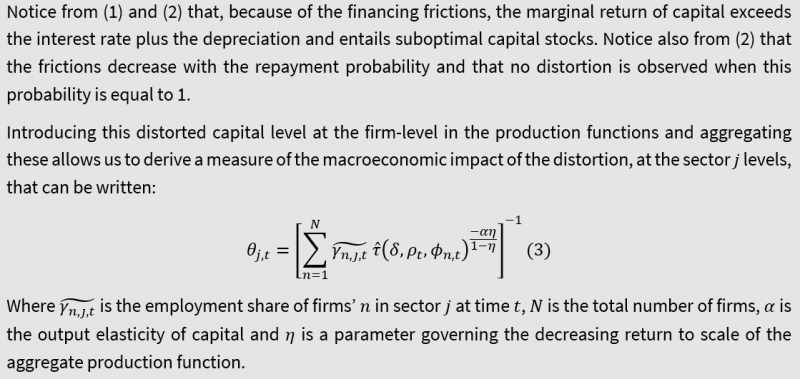

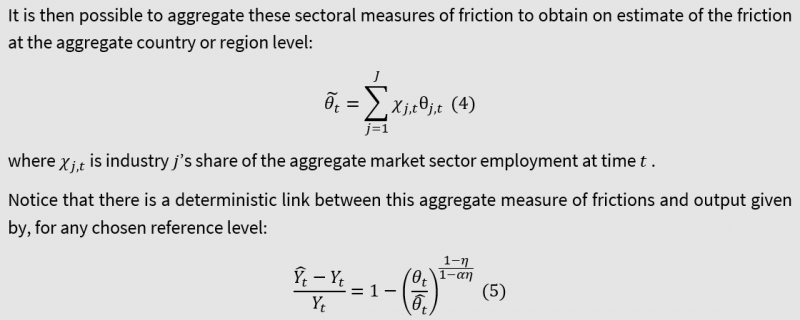

We draw on the recent literature that studies the aggregate impact of financing frictions, notably Catherine, Chaney, Huang, Sraer and Thesmar (2020) and Besley, Roland and Van Reenen (2020). Two distinct channels link financial frictions and output. Financial frictions can either affect capital accumulation, and result in suboptimal levels of aggregate capital, or induce misallocation of capital across firms. The afore-mentioned studies find that although firms’ difficulties to access external funding induce misallocation, the magnitude is not large and, quantitatively, the impact of the frictions on the level of capital matters more. In aggregate, these studies find that financial frictions have a substantial negative impact on output. Besley et al. suggest that the United Kingdom (UK) output is 28% lower each year than it would be without frictions while Catherine et al, using US data, find that financial constraints are responsible for 11% output losses.

In this study, we propose an early assessment of the impact of the increase in financing frictions caused by the COVID-19 on macroeconomic outcomes in the European economies. We rely on the financial accounts published by listed companies in the euro area and in the UK in 2020 as well as ratings of credit agencies to calibrate a theoretical model with financial frictions and heterogeneous firms, that we borrow from Besley et al., to derive quantitative results at the aggregate level.

The estimated increase in financing frictions associated with the COVID-19 crisis suggests sizeable potential output loss. We estimate that, at the European level, the output was lowered by 13.4% each year because of the financial frictions prior to the COVID-19 crisis. The new level of financial frictions at the end of 2020 indicates that potential output is now lowered by 16.8%. This result suggests that, all else being equal, the enhanced financial friction associated with the COVID-19 crisis, could lower the level of output by 3.4 percentage points (pp) medium term. Notice that the theoretical model that we calibrate is silent on the timing of this effect, but the underlying mechanisms suggest that the full effect would unfold between five and ten years2. It is important to keep in mind that this estimate only consider one of the many channels through which the ongoing crisis is affecting potential output – many others, such as scarring of human capital, are expected to have additional adverse effect, but some have positive impact such as the spurred digital adaption or bolder economic policies. One should thus not read our results as a final estimate of the impact of the crisis on potential output.

Listed firms’ financial accounts and credit ratings in 2020 are arguably the only information allowing such an early assessment of the scarring effect of the crisis on firms’ investment. This approach, however, suffers from two shortcomings that merit note. First, the dynamics observed on a sample of listed companies only offer a partial view of the impact of the crisis on the universe of firms. Firm level data, reflecting the effect of the COVID crisis on private firms, that is to say the financial accounts for the full year 2020, will, however, not be available before the end of 2021. Second, the crisis is still unfolding and its adverse consequences on corporates’ balance sheet and credit risks are arguably not yet fully observable. We thus view our results as a first and partial assessment of the crisis impact on financial frictions and of their effect on the macroeconomic outlook

In this first section, we document the shift in leverage among European listed firms and the associated increase in default probabilities assessed by credit agencies in 2020. We also report sectoral and country level summary statistics. The firm-level default probabilities presented in this section are then used to calibrate the model, designed to derive the macroeconomic impact of the financing frictions, described in the following section.

1.1 Data description

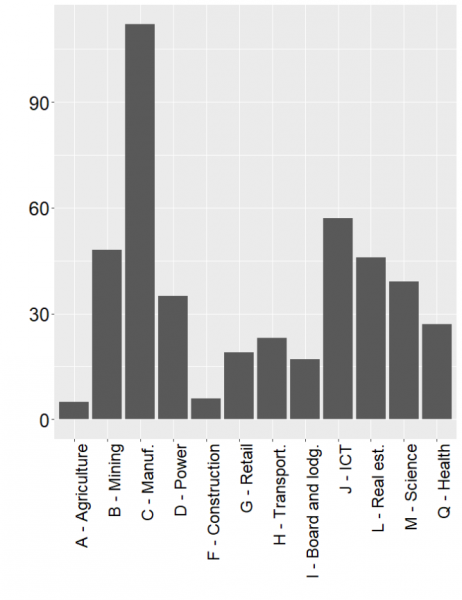

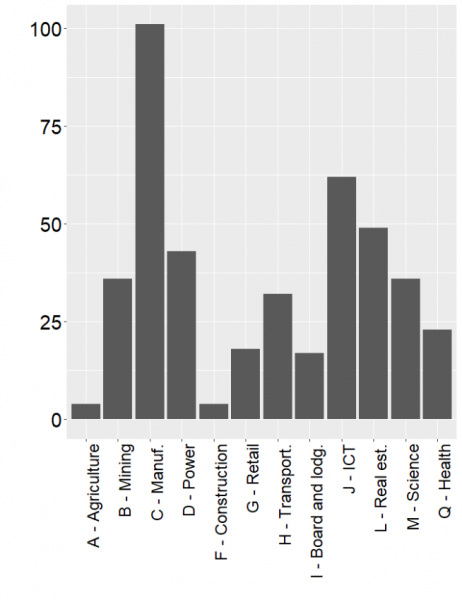

From a sample of 800 listed companies in the Euro area and the UK, we build two sub-samples – that overlap significantly – in order to, on the one hand, produce descriptive statistics on the distortion of firm’s balance sheets (for which we need quarterly financial accounts) and, on the other hand, investigate the variation in the probabilities of default (for which we rely on the assessment of credit rating agencies) that are used to calibrate a theorical model linking financing frictions to potential output. The decomposition into two sub-samples aims at maximizing the number of observations. The sub-sample used to document changes in the structure of corporates’ liabilities is made of 430 firms. The sub-sample used to assess default probabilities and to calibrate the theoretical model, partly overlapping the first one, is made of 420 firms for which we have a credit rating over the studied period. Our sample covers a broad sectoral spectrum (cf. figure 1 and 2) and includes only non-financial corporations (hereafter NFCs). We use the NACE rev 2 classification of economic activities for our sector breakdown.

| Figure 1: Number of companies by sector in the sample of 430 firms | Figure 2: Sectoral Number of companies by sector in the sample of 420 firms |

|

|

| Source: Eikon, SG Economic and Sector Studies | Source: Eikon, SG Economic and Sector Studies |

1.2 Weaker balance-sheets

Using the first sub-sample of 430 firms for which we observe financial data before and over the COVID-19 crisis, we study the dynamics of the book value of equity and financial debt3 and we document their impact on the distribution of leverage ratios that we compute as the total of gross financial debt4 divided by the book value of equity.

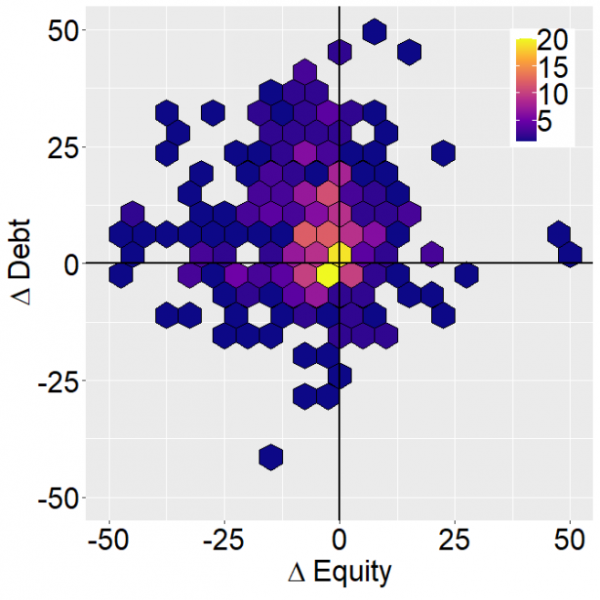

In Figure 3, we graph, at the firm level, on the x-axis the change in the book value of equity in percent between 4Q-19 and 2Q-20 and on the y-axis the change in financial debt in percent over the same period. Each cell represents one or more companies: the warmer the colour (maximum yellow), the more companies are located in the cell. We obverse that a large share (49%) of companies are in the upper left-hand quadrant, i.e. in a situation where debt has increased, and the book value of equity declined.

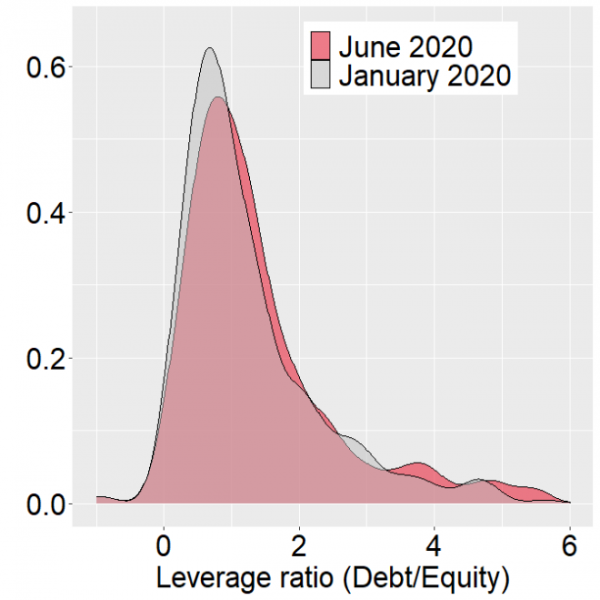

In Figure 4, we observe that the combined effects of reduced book value of equity, resulting from negative profits, and higher financial debt, lead to a noticeable rightward shift in the distribution of leverage ratios. The median increase of the leverage ratio in the sample is 13 pp.

| Figure 3: Joint distributions of the change in the book value of equity and the change in debt in 1H-20 in % | Figure 4: A comparison of the leverage distributions before the crisis and at the end of 1H-20 |

|

|

| Source: Eikon, SG Economic and Sector Studies | Source: Eikon, SG Economic and Sector Studies |

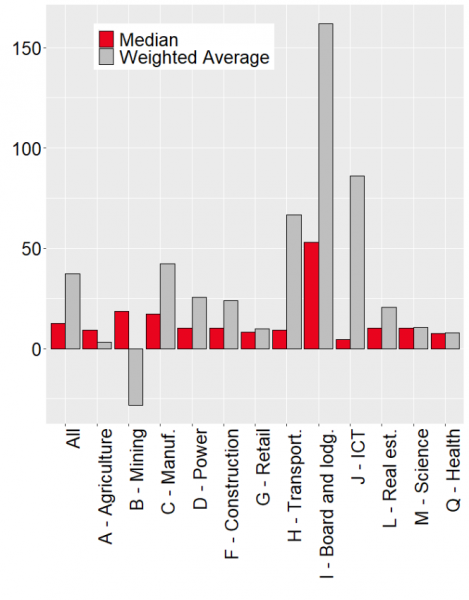

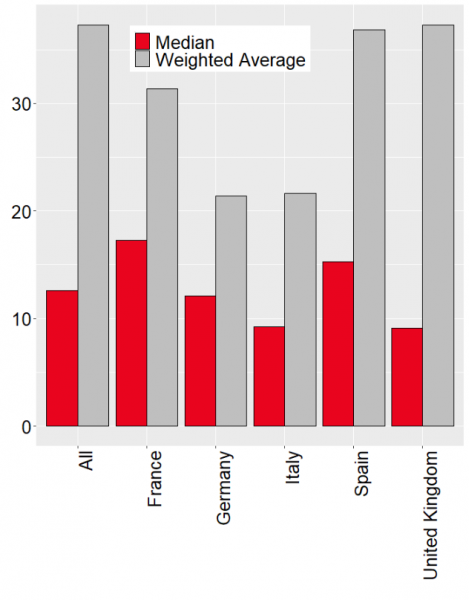

This result illustrates that firms’ credit quality, as measured by the leverage ratio, deteriorated as a result of the COVID-19 crisis. Results on the changes of the leverage ratios by sector (Figure 5) and by country (Figure 6) are shown below. We compute the median and the weighted average (by the number of employees of the companies over the studied period). For almost all sectors, the median change in the leverage ratio is positive reflecting, all else being equal, a deterioration of the credit quality. We find that the largest deteriorations are observed in the Accommodation and Food and the Transportation sectors and that there is also a strong heterogeneity within sectors, as reflected by the difference between the median and the weighted average change.

| Figure 5: Changes in firms’ leverage ratios over the 1H-20 in %- by sector | Figure 6: Changes in firms’ leverage ratios over the 1H-20 in % – by country |

|

|

| Source: Eikon, SG Economic and Sector Studies | Source: Eikon, SG Economic and Sector Studies |

Segmenting the sample by country, we observe that for all countries, both the median and the weighted average leverage ratios increased. In our sample, firms’ leverage ratios increased more in France and in Spain than in Germany and Italy. It is also worth notice that the median leverage ratio typically increased much less than the weighted averages. This finding indicates that aggregate dynamics are notably drawn by large and / or labour-intensive firms severely affected by the crisis in 1H-2020.

1.3 An increase in the default probability

We now turn to our second sub-sample, made up of 420 firms, for which credit ratings are observed from 2019 onwards.

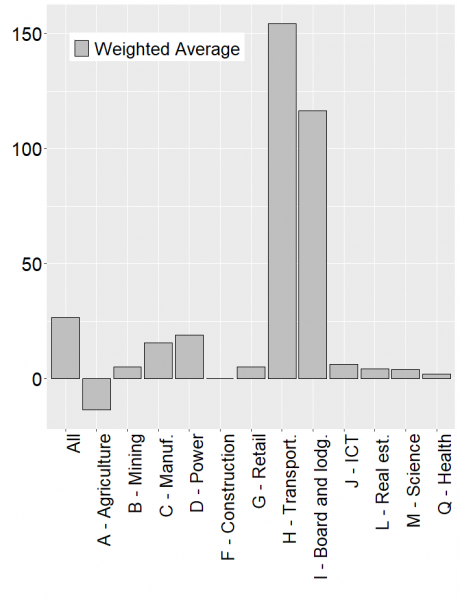

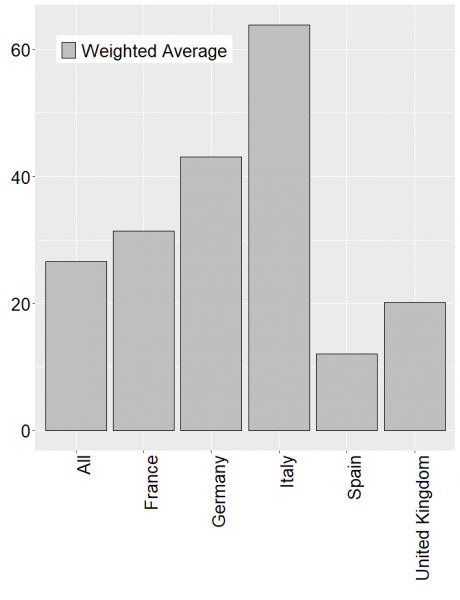

We quantify changes in firms’ default probabilities based on observed modifications of credit ratings by the three largest credit rating agencies between the end of 2019 and of December 2020. For each credit agency, we map bins of risk scores to default probabilities using a moving average of the Credit Ratings Performance Measurement Statistics published by the rating agencies. Figures 7 and 8 show the weighted average change in default probability between December 2019 and December 2020 by sector and by country.

| Figure 7: Changes in firms’ default probability over 2020 in % – by sector | Figure 8: Changes in firms’ default probability over 2020 in % – by country |

|

|

| Source: Eikon, SG Economic and Sector Studies Note: the samples are weighted using the average number of employees of the companies over the studied period. |

Source: Eikon, SG Economic and Sector Studies Note: the samples are weighted using the average number of employees of the companies over the studied period. |

At the aggregate level, the median probability of default is unchanged between the two periods (at 0.69% at 10 years). However, the weighted average increased by 26% between January 2020 and December 2020. The sectors “Transportation and Storage” and “Accommodation and food service activities” are again the two sectors for which the change is the more noticeable, respectively +154% and +116% in 2020. At the country level, Italian but also German and French firms seem more affected, while Spanish and to a lesser extent the British firms seem to have suffer less from downgrades in 2020, at least for large firms.

2.1 Corporate financial weaknesses tend to increase financing frictions

We have highlighted that corporates have been financially weakened by the COVID-19 crisis, be it through eroded equity cushions or higher financial debt.

The channel through which this weakening is affecting the macroeconomic outlook relates to the enhanced financing frictions. Financing frictions refer to any frictions preventing the financing of a project which has a marginal return on invested capital higher than the market cost of the required funding. In other words, financing frictions are at play when projects with positive net present value fail to find funding. Various micro foundations of financing frictions have been highlighted by the economic literature. They usually relate to the adverse selection issue (Stiglitz and Weiss, 1981) (a lender cannot observe the riskiness of a borrower) and the principal–agent problem (a lender cannot control the behaviour of a borrower that has incentive to shirk his repayment responsibility), linked to moral hazard (Holmstrom and Tirole, 1997) or costly enforcement (Gertler and Bernanke, 1989).

Financing frictions can be mitigated in three different ways: (i) firm collateral, that can be seized by creditors in the event of default; (ii) equity buffers, that cushion adverse shock and increase borrowers’ skin in the game; (iii) and higher profitability, that allows larger negative income shocks. By eroding equity buffers, potentially impairing collateral values and lowering short-term growth prospects, the COVID-19 crisis is set to impair these mitigating factors and, all else being equal, significantly increase financing frictions going forward. Notice that the changes in the credit ratings used in the empirical analysis below aim to capture these various elements in one synthetic metrics.

The post Great Financial Crisis environment was marked by high financial frictions reflecting weakened financial institutions. It led to tighter credit standards causing a certain degree of forced deleveraging of the private non-financial sector. The post COVID-19 crisis environment will probably also be characterized by more constrained borrowing capacities of firms, but the primary channel this time is weaker NFC balance-sheet.

2.2 The macroeconomics of financing frictions

Understanding the macroeconomic consequences of the NFC financial weaknesses inherited from the crisis is crucial to quantify the scarring effect of the unfolding events.

From a macroeconomic point of view, financial frictions are likely to damage future output through two distinct channels:

Empirically, the effects of financial frictions on firms’ behaviour have been widely documented.6 One strand of the literature has notably explored the impact of the value or the redeployability of firms’ collateral. Absent any financial frictions, any exogeneous change in the value of the collateral, typically land or real estate assets, should not affect firms’ borrowing or firms’ investment that is theoretically only determined by the return on the marginal investment and the cost of funding. The fact that empirical studies do find a causal relationship between exogeneous changes in the value of the collateral and the financing capacities7 illustrates the firm-level outcomes of financing frictions.

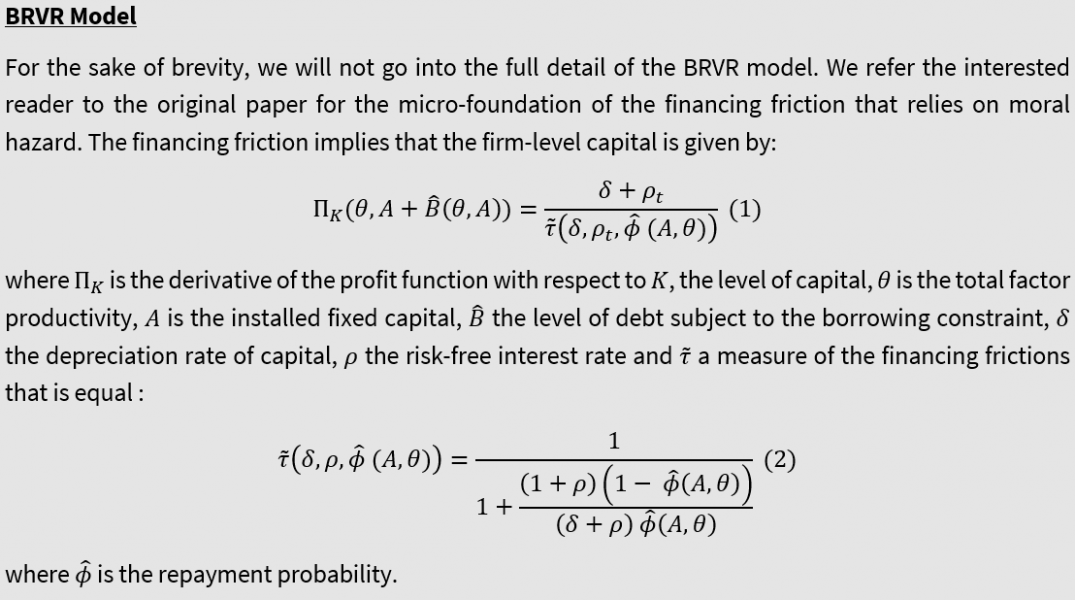

Quantifying these macroeconomic effects requires the estimation of structural models, allowing to build relevant counterfactual analyses that also capture general equilibrium effects. As mentioned in the introduction, two recent contributions propose such structural models: Catherine, Chaney, Huang, Sraer and Thesmar (2020) [hereafter CCHST] and Besley, Roland and Van Reenen (2020) [hereafter BRVR]. The first paper finds aggregate output loss from financing constraints of 11% in the US8. BRVR propose a theoretical model of credit market frictions that endogenizes default repayment probabilities. In their model that we here apply to estimate the impact of the current crisis, observed repayment probabilities determine borrowing capacities and thus the investment level. Higher default probabilities reveal higher financing frictions, either caused by lower profits or lower collateral values. The financial constraint is then embedded in a model with heterogeneous firms to derive empirical implications at the firm-level and for the aggregate economy. Calibrating the model using a large firm-level database made of UK firms between 2005 and 2013, BRVR find that the output was lowered in average by 28% each year because of the financial frictions when compared to a frictionless benchmark, defined as a world without default risk. The authors find that the level of output losses and their change over time are mainly driven by scale effects rather than misallocation.

Calibrating their model using the publicly available ratings of European firms, we find that, as of 4Q-19, output was lowered by 13.4% because of the financial frictions. The interest of the model is that this figure can be computed at various points in time to assess changes in output loss associated with varying levels of financial frictions prevailing in the economy.

2.3 The macroeconomic impacts of the financing frictions induced by the COVID-19 crisis

Our study builds upon the BRVR model to offer an early-stage quantitative assessment of the macroeconomic consequence of the financing friction directly linked to the COVID-19 crisis.

The interest of the BRVR model is that endogenously determined default probabilities are a sufficient statistic to quantify firm-level credit market frictions. We take advantage of the observed changes in credit rating in 1H-20 to infer changes in default probabilities caused by the COVID-19 crisis. We relate these default probability variations to an increase in a theoretically derived measure of financing frictions, denoted θt, that can be directly linked to output losses resulting from financing frictions if we retain, for the sake of simplicity, the assumption that the labour market is frictionless (see Appendix A).

Following BRVR, we then decompose aggregate financing frictions into two parts (i) a “scale effect”, ![]() which estimates the impact of financing frictions on output through its effect on the aggregate stock of capital and labour inputs, while holding the joint distribution of frictions and productivity constant; and (ii) a “TFP effect”,

which estimates the impact of financing frictions on output through its effect on the aggregate stock of capital and labour inputs, while holding the joint distribution of frictions and productivity constant; and (ii) a “TFP effect”, ![]() , which estimates the impact of financing frictions on output holding the aggregate capital stock and labour input fixed, thus measuring a misallocation effect.

, which estimates the impact of financing frictions on output holding the aggregate capital stock and labour input fixed, thus measuring a misallocation effect.

3.1. Estimation of financing frictions and output losses induced by the COVID-19 crisis

We use our firm-level database to calibrate the BRVR model at two points in times: before the COVID-19 crisis (at the end of 2019) and at the end of 2020, when a significant share of the direct effect of the pandemic were already accounted for by rating agencies. In the baseline estimates presented below, we retain the parameter values used by BRVR. Sensitivity analyses with respect to the values of these parameters are available upon request.

We first calibre the model using the full sample and we then segment our sample by country and by sector to assess both geographical and sectoral heterogeneity.

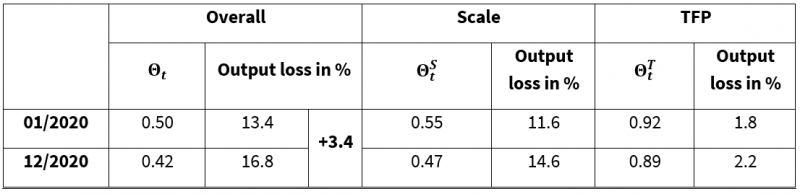

In Table 1, we report the aggregate financing frictions and the aggregate output loss estimated on both dates for our full database. We also report the scale effect and the TFP effect described above.

Table 1: Aggregate financing frictions and estimation of aggregate output loss in the euro area and the UK

Source: Refinitiv, SG Economic and Sector Studies

Reading notes: there is no friction when θt = 1 and frictions are maximal when θt = 0. Output loss in % has to be read as when compared to the % difference between the observed output and a frictionless counterfactual, defined as a world without default risk.

The results suggest that the COVID-19 crisis has increased the aggregate measure of financing frictions from 0.50 to 0.42. The estimated output loss associated with the frictions increased by 3.4pp, from 13.4% to 16.8%. By way of comparison, BRVR find that the output loss resulting from financial frictions increased in the UK from 25.6% in 2008 to 29.1% in 2009.

Decomposing the financial frictions between the scale effect and the TFP effect, we find that the frictions and the associated estimated output loss mainly result from the scale effect and much less from the misallocation effect. The scale effect explains a 3.0pp decrease in output between January 2020 and December 2020 whereas the TFP effect only explains a 0.4pp loss. These results corroborate the results of BRVR and CCHST and suggest that the effect on capital accumulation drives the output losses and has more impact than the way in which financing frictions are distributed across firms with varying productivity levels. A corollary result is that aggregate corporate investment is likely to remain durably depressed as a result of the financing frictions induced by the COVID-19 crisis, all else being equal.

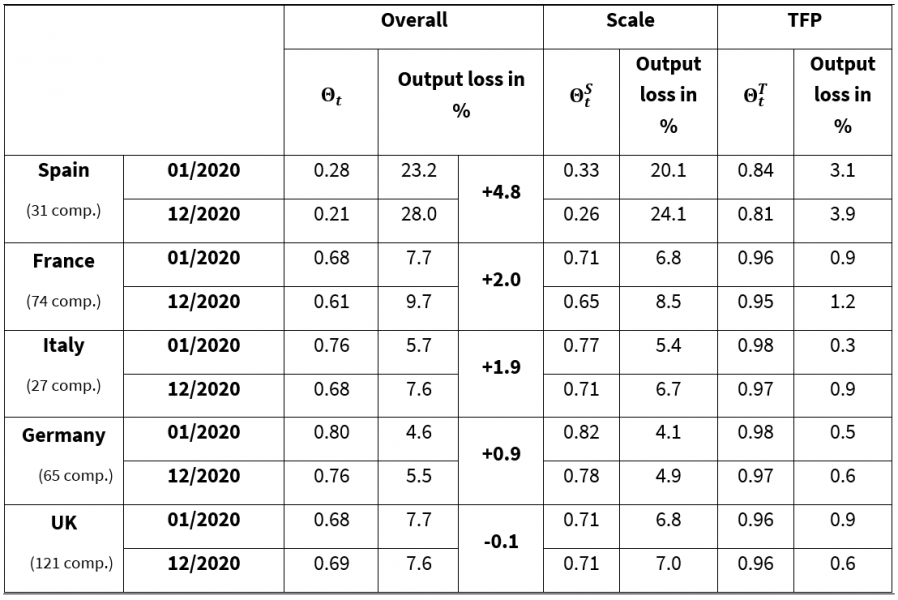

3.2. Country level results

Albeit with a warning on the small size of the sample of firms, we segment our sample by country of firm incorporation in order to derive some results for the largest European economies. Given that our analysis relies on large listed corporates operating globally, the estimated output losses at the country level have to be read as ballpark estimates. Indeed, increased financial frictions for global players will not only affect their investment capacities in their country of incorporation but the effect will not be delineated to this specific geographic area. We report estimates of financial frictions and output losses at the country level in Table 2.

Table 2: Aggregate financing frictions and estimation of aggregate output loss by country

Source: Eikon, SG Economic and Sector Studies

The results show that Spain is the country where additional financial frictions inherited from the COVID-19 crisis are the highest and are estimated to entail a decrease by 4.8pp of the potential output as compared to the situation pre-existing to the COVID-19 crisis. France is also hit with a potential output loss estimated at 2.0pp, above the figure estimated for Italy (1.9pp), Germany (0.9pp) and for the UK which appears not impacted by the crisis based on this sample made of large companies. For all of these countries, the scale effect is significantly larger than the misallocation effect.

It is also noticeable that the UK is suffering a lower increase in financing frictions than the other European countries. This is arguably explained by a lower increase in the leverage ratios in this country thanks to a dynamic primary equity market, sectoral composition effect or even higher flexibility on the labour market enabling firms to adjust more quickly the headcounts.

The sectoral composition of the sample of listed firms, notably at the country level, is a key determinant of our estimates of the output loses resulting from the crisis. As a robustness check, we compute alternative measures for the aggregate impact of the crisis by weighting the estimated measures of sectoral frictions (i.e. θjt ) by the sectoral weight of each sector in the economy, as measured by the number of employees by sector reported by Eurostat. The results reported in Appendix B suggest that these alternative weights do not significantly alter the results at the aggregate level.

3.2. Sector level results

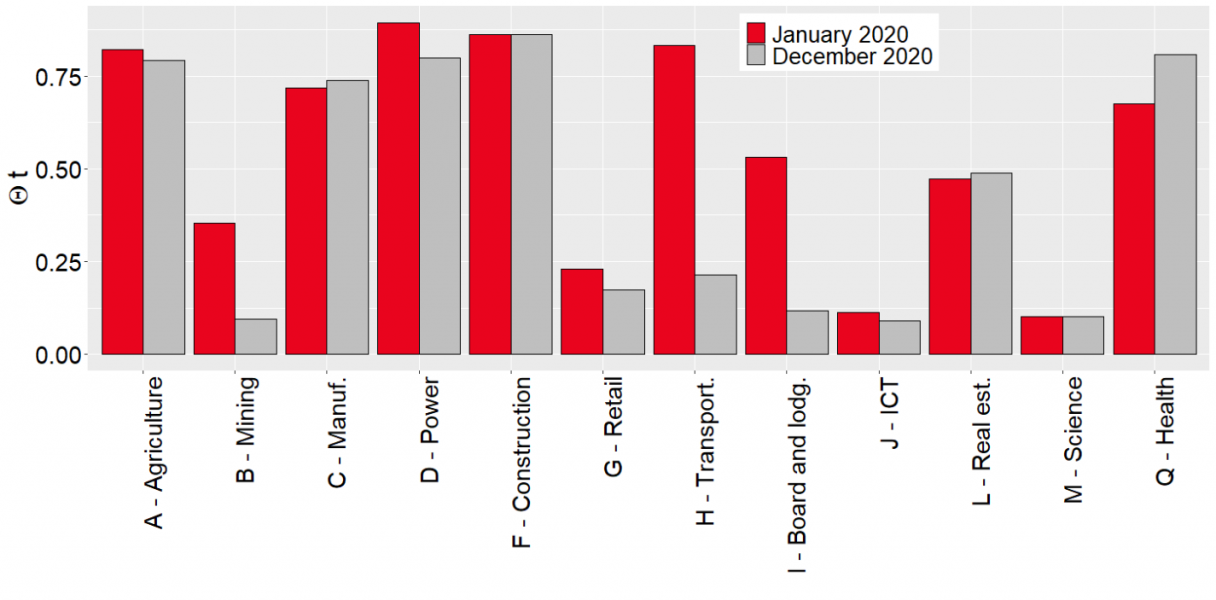

We now turn to a sectoral decomposition of the change in observed financial frictions. We compute the change in θt at sector level between January and December 2020. We report the results in Figure 9.

Figure 9: Evolution of θt between January and December 2020 by sectors

Source: Eikon, SG Economic and Sector Studies

The levels and the variations in financing frictions are heterogeneous across sectors. The sectors “Mining and quarrying”, “Transportation and storage”, “Accommodation and food service activities” are the ones that observe the largest increase in the estimated level of financing frictions. On the contrary, the sector “Human health” saw the level of financing frictions decrease in 2020.

In this study, we propose an early assessment of the effect of the ongoing economic crisis on potential GDP, focusing on the financial friction channel. This is not the only channel through which the current crisis is altering growth prospects – think of the hysteresis effect on the labour market or, on a more positive note, of the increased use of ICT by firms. Our paper shows that, all else being equal, the Covid19 crisis has caused significant financial frictions that will drag on growth over the coming years.

To quantify the macroeconomic effect of the financial frictions induced by the COVID-19 crisis, we took advantage of a model that related the assessed default probabilities to the firm-level financing frictions. We calibrated the model on a panel of European listed firms for which we observed a change in assessed default probabilities indicated by a rating change by credit agencies to find that the increase in the default probabilities of European firms assessed by credit rating agencies between January and December 2020 caused by the COVID-19 crisis could entail a 3.4 percentage points decrease in potential output.

The eventual impact of the ongoing crisis on the level of credit frictions remains partly unknown and will depend on the development of the health situation but also on policy measures. Recent national initiatives in Europe to favour equity financing, notably in France with the state guaranteed “prêts participatifs” initiative, could help to mitigate the impact of the crisis on financing frictions and to counter, at least partly, their negative impact on growth. A precise ex-ante evaluation of these initiatives goes beyond the scope of this study, but the foreseeable evolution of firms’ situation calls for updating our assessment in the future.

Besley, T. J., Roland, I. A., & Van Reenen, J. (2020). The aggregate consequences of default risk: evidence from firm-level data (No. w26686). National Bureau of Economic Research.

Buera, Francisco J. and Yongseok Shin. 2011. “Self-Insurance vs. Self-Financing: A Welfare Analysis of the Persistence of Shocks.” Journal of Economic Theory 146 (3): 845–862.

Catherine, S., Chaney, T., Huang, Z., Sraer, D. A., & Thesmar, D. (2018). Quantifying reduced-form evidence on collateral constraints. Available at SSRN 2631055.

Chaney, T., Sraer, D., & Thesmar, D. (2012). The collateral channel: How real estate shocks affect corporate investment. American Economic Review, 102(6), 2381-2409.

Fougère, D., Lecat, R., & Ray, S. (2019). Real estate prices and corporate investment: theory and evidence of heterogeneous effects across firms. Journal of Money, Credit and Banking, 51(6), 1503-1546.

Gertler, M., & Bernanke, B. (1989). Agency Costs, Net Worth and Business Fluctuations. American Economic Review, 79, 14-31.

Holmstrom, B., & Tirole, J. (1997). Financial intermediation, loanable funds, and the real sector. the Quarterly Journal of Economic, 112(3), 663-691.

Hsieh, C. T., & Klenow, P. J. (2009). Misallocation and manufacturing TFP in China and India. The Quarterly journal of Economic, 124(4), 1403-1448.

Khan, Aubhik and Julia K. Thomas. 2013. “Credit Shocks and Aggregate Fluctuations in an Economy with Production Heterogeneity.” Journal of Political Economy 121 (6): 1055–1107.

Midrigan, Virgiliu and Daniel Yi Xu. 2014. “Finance and Misallocation: Evidence from Plant-Level Data.” American Economic Review 104 (2): 422–458.

Moll, Benjamin. 2014. “Productivity Losses from Financial Frictions: Can Self-Financing Undo Capital Misallocation?” American Economic Review 104 (10): 3186–3221.

Stiglitz, J. E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. The American economic review, 71(3), 393-410.

Appendix A

Appendix B

|

Weighting sectors according to their actual size in the value-added The striking sectoral heterogeneity of the effects of the crisis suggests that the sectoral composition of the sample of listed firms, notably at the country level, is a key determinant of our estimates of the output loses resulting from the crisis. If the sectoral weights in the sample of listed firms significantly differ from the sectoral weights in the entire economy, our results are likely to be biased. As a robustness check, we compute alternative measures for the aggregate impact of the crisis by weighting the estimated measures of sectoral frictions (i.e. θjt) by the sectoral weight of each sector in the economy, as measured by the number of employees by sector reported by Eurostat. The results reported in Table 3 suggest that these alternative weights do not significantly alter the results at the aggregate level. At the European level, newly weighted frictions are estimated to increase the output loss from 12.0% to 15.2%, that is a 3.2 percentage point increase. At the country level however, the estimated output losses are altered, notably in Germany and in the UK, by this alternative weighting strategy. Using these alternative weights, we estimate that the output losses increase by +1.8pp in France, +1.7pp in Germany, +3.4pp in Spain, +2.6pp in Italy and +2.3pp in the UK.

|

Simon Ray is Economist at Société Générale. Théophile was an intern at Société Générale when he contributed to this research. The views expressed are attributable only to the authors and not to any institution with which they are affiliated. Corresponding author: simon.ray@socgen.com.

The level of financial frictions in the theoretical model determines the firm’s borrowing capacity. This impact of a change in the borrowing capacity on the firm’s level of capital depends on the maturity of the pre-existing debt.

We consider financial debt at its gross value and we add long-term and short-term bank and bond debt.

We use gross financial debt instead of net debt in this analysis as the cash accumulated by firms over this period is likely to be partly used to finance other short-term liabilities resulting from the crisis, notably fiscal ones.

During the past decade, there has been a considerable amount of research analysing the effect of financial frictions on misallocation of capital and aggregate total factor productivity. See for example, Buera and Shin, 2011; Khan and Thomas, 2013; Midrigan and Xu, 2014 or Moll 2014.

According to Chaney, Sraer and Thesmar (2012), over the 1993–2007 period, the representative US corporation invests $0.06 out of each $1 of collateral. Similar elasticities are documented for France in Fougère, Ray and Lecat (2019).

The authors use a structural model of firm dynamics with collateral constraints, and estimate the model to match the firm-level sensitivity of investment to collateral values. The losses arise in part from the misallocation of inputs across heterogeneous producers and in part from a sub-optimal aggregate capital stock. The authors find that aggregate capital matters twice as much as misallocation.