References

Berrospide, J. and R. Edge (2016). The effects of bank capital requirements on bank lending: What can we learn from the post-crisis regulatory reforms. Working Paper, Federal Reserve Board.

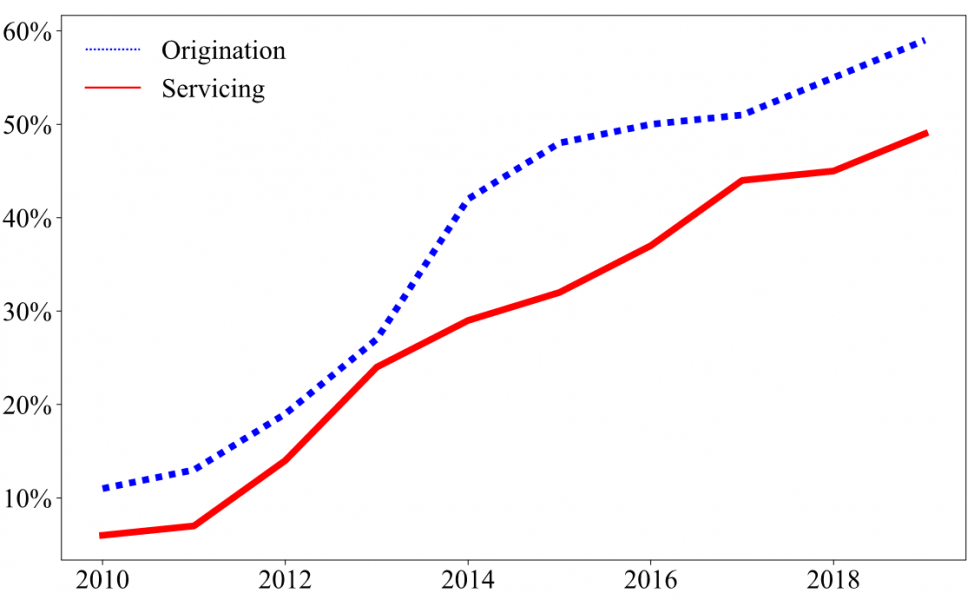

Buchak, G., Matvos, G., Piskorski, T., & Seru, A. (2018). Fintech, regulatory arbitrage, and the rise of shadow banks. Journal of financial economics, 130(3), 453-483.

Drechsler, I., Savov, A., & Schnabl, P. (2022). How monetary policy shaped the housing boom. Journal of Financial Economics, 144(3), 992-1021.

Gürkaynak, R., Karasoy‐Can, H. G., & Lee, S. S. (2022). Stock market’s assessment of monetary policy transmission: The cash flow effect. The Journal of Finance, 77(4), 2375-2421.

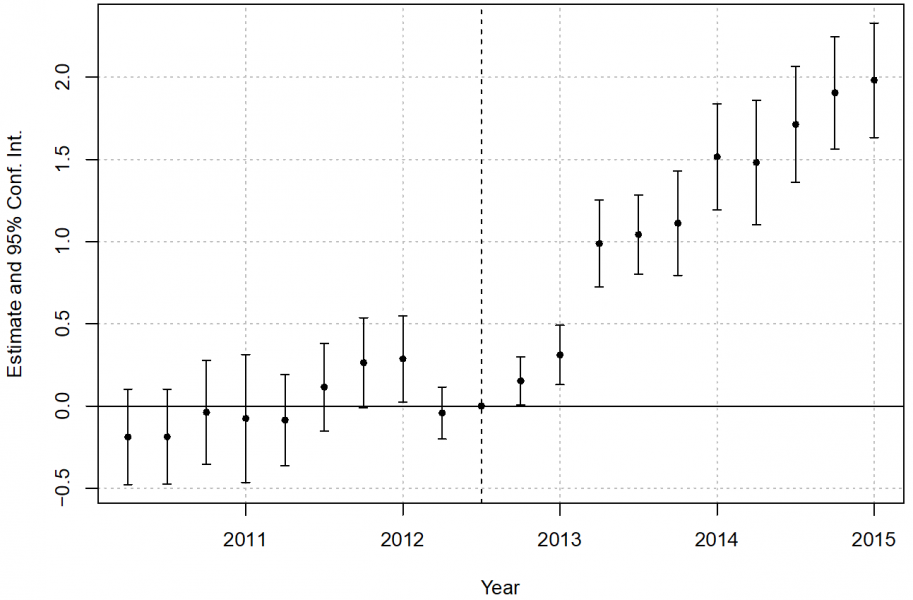

Jiang, E.X., Financing Competitors: Shadow Banks’ Funding and Mortgage Market Competition, The Review of Financial Studies, 2023; https://doi.org/10.1093/rfs/hhad031.

Kim, Y. S., Laufer, S. M., Stanton, R., Wallace, N., & Pence, K. (2018). Liquidity crises in the mortgage market. Brookings Papers on Economic Activity, 2018(1), 347-428.

Irani, R. M., Iyer, R., Meisenzahl, R. R., & Peydro, J. L. (2021). The rise of shadow banking: Evidence from capital regulation. The Review of Financial Studies, 34(5), 2181-2235.