S&P Global Ratings expects the next European Commission to continue to prioritize EU competitiveness and the digital and green transition, as well as defense, security and immigration issues. In this series of Policy Notes, we take a closer look at the issues of:

• the enforcement of EU fiscal rules in a context of rising defense spending,

• Energy market integration,

• Capital market union, banking union and financial services regulation.

On the third point, the subject of this note, we see renewed political impetus to drive the CMU forward – in the direction of developing a pan-European capital markets infrastructure, improving access to finance to enable companies to innovate, and broadening investment opportunities for EU citizens. We do not see much political will to complete the banking union but expect some incremental changes to enhance regulatory and crisis management frameworks for banks. We believe that without material progress on the CMU and the BU, the European economy will not be empowered to tap all its ample financing resources and could continue to have low potential growth and little capacity to absorb asymmetric shocks without massive transfers of public money.

Accelerating the integration of European financial markets by advancing the CMU is likely to be one of the next European Commission’s agenda items.

The European Council’s Strategic Agenda is heading in this direction, and it echoes several reports that the EU has commissioned from former European officials such as former Italian prime minister Enrico Letta and former governor of the Bank of France Christian Noyer, as well as policy recommendations that the Eurogroup, the ECB Governing Council, and the European Securities and Markets Authority (ESMA) have issued recently. The next European Commission’s roadmap will borrow extensively from the Strategic Agenda and these policy recommendations.

Advancing the CMU may improve the EU’s strategic autonomy by promoting the international use of the euro and reducing the EU’s dependence on external sources of funding. It could also support the transition toward a green and digital economy, improve risk-sharing, and mitigate the spread of income shocks between EU countries. Finally, advancing the CMU could help boost the EU’s competitiveness, which is essential for Europe not only to keep pace with China and the U.S., but also return to its own long-term growth trajectory.

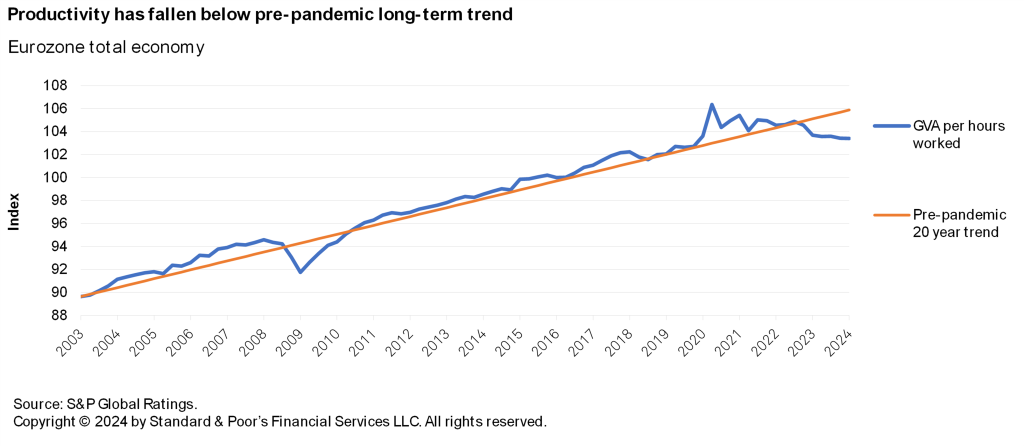

The European economy was well on its way out of the pandemic before the war in Ukraine derailed it. The European economy is now 2.5% below its historical productivity trend (see chart 1). Although the shortfall is largely due to high energy costs and labor hoarding, the rebound we expect over the next two years will probably only make up for half of it. So, without vigorous economic reforms, some of the current productivity losses could turn into permanent losses.

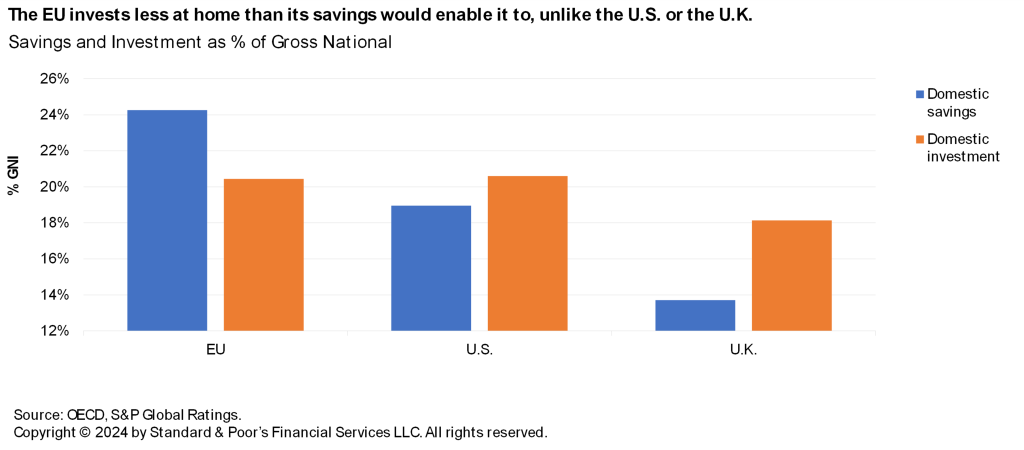

We see the fragmentation of Europe’s capital markets as an obstacle to Europe’s economic development. European capital markets are deemed too small, too national and therefore too illiquid, and too expensive for small investors and issuers. This translates into limited cross-border capital flows between EU members, lower private investment than savings alone could provide (see chart 2), and a flight of savings abroad.

Chart 1.

Chart 2.

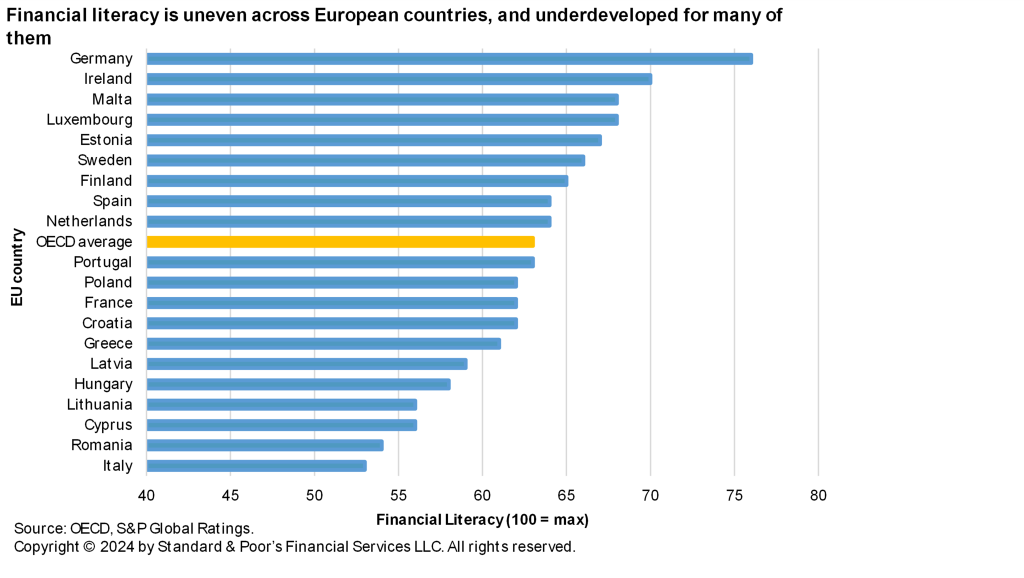

The Noyer report recently highlighted the fact that almost 20% of European savings are invested in foreign debt securities. We might add that the eurozone has become the largest foreign holder of U.S. Treasury securities. It is common knowledge that the European economy’s market capitalization is about one-third that of the U.S. economy, and even lower in the EU’s Eastern region, where capital markets have a short track record (see chart 3).

Chart 3.

Private equity in Europe accounts for only one-sixth of that in the U.S. And to underline the relationship between equity capital and investment, the EIB estimates that in the U.S., productive investment–gross fixed capital formation excluding residential investment–has outpaced that in Europe by an average of 1.5% of GDP every year since 2012.

For ten years now, Europe has been trying to integrate and develop its capital markets within the framework of the CMU initiative. It has taken a few important steps, for instance, the introduction of legislation on European long-term investment funds in 2015; the creation of a European single access point for financial disclosure, which should become operational in 2027; and the recent decision to have a consolidated tape for equity markets.

While most observers welcome these measures, all acknowledge that they have not had a transformative impact. The reasons observers often give for this are that policy makers at both national and EU levels have had to prioritize measures in response to the multiple external shocks that have occurred in quick succession since the CMU agenda was launched (Brexit, the COVID-19 pandemic, and the Russia-Ukraine war), and the fact that most of the measures will take time to implement.

What’s more, a survey by the Organization for Economic Co-operation and Development and the International Network on Financial Education confirms that financial literacy remains uneven across European countries and underdeveloped in some of them (see chart 4). This doesn’t help savers diversify their investments away from bank deposits. Such deposits absorb 34% of household savings in Europe, compared with 14% in the U.S., and have a lower return than other forms of savings.

Chart 4.

The Association for Financial Markets in Europe, which regularly reports on the CMU’s key performance indicators, finds that compared to five years ago:

• European corporates’ access to market-based finance has deteriorated;

• The amount of loans turned into capital market vehicles like securitization transactions has declined significantly;

• Intra-EU integration has deteriorated slightly; and

• The amount of household assets in capital market instruments has not increased much.

The general conclusion is that neither the depth nor the architecture of European financial markets has advanced.

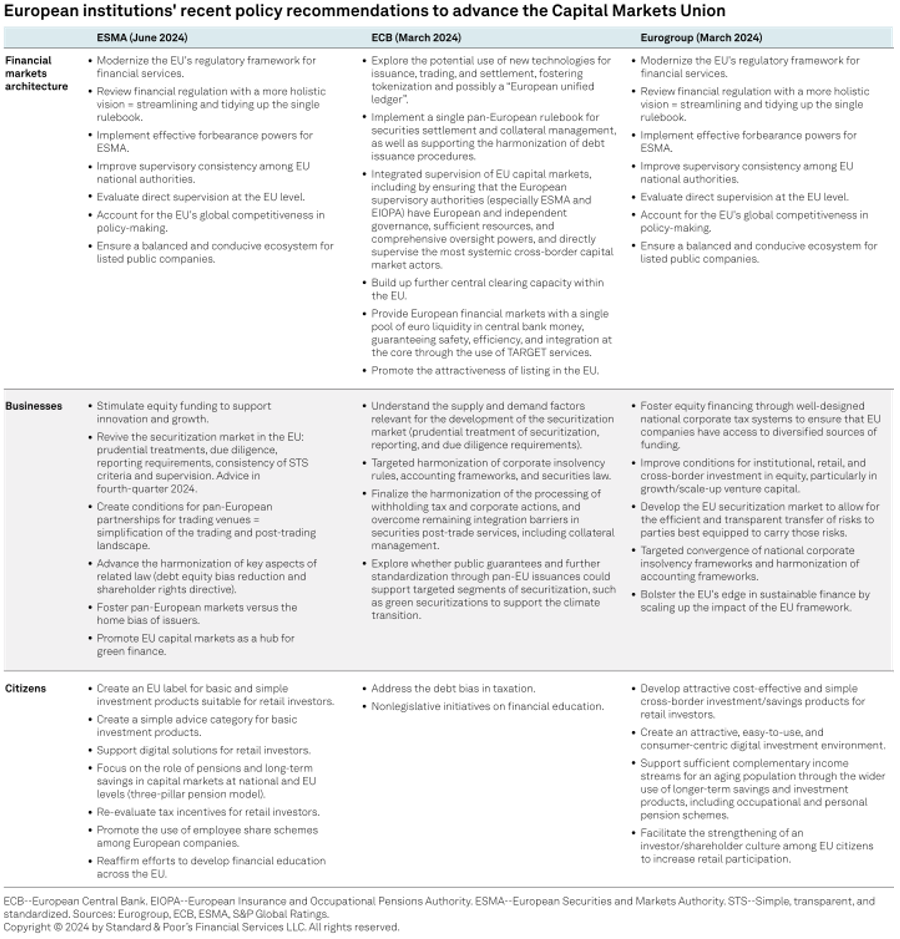

This overall lack of progress on the CMU, together with the need to boost investment at a time when several European governments appear to have limited fiscal space, and the start of a new political cycle following the European parliamentary elections, has given new impetus to the CMU agenda. The recommendations by the Eurogroup, ECB, and ESMA underline this. The impetus takes three directions (see table 1):

• Developing pan-European capital market infrastructure: All three European institutions recommend modernizing the EU regulatory framework for financial services, promoting the attractiveness of listing on stock exchanges in the EU and a convergence of EU capital market supervision, with ESMA assuming a more prominent role.

• Ensuring better access to finance for companies to innovate and expand in the EU : The main avenues that the Eurogroup, ECB, and ESMA envisage are the development of the securitization market and the promotion of EU capital markets as a hub for green finance. The ECB sees these two aspects as complementary.

• Broadening investment opportunities for EU citizens : It’s not just a question of improving financial literacy, but also of developing simple investment products, reevaluating tax incentives for retail investors, especially in equity securities, and promoting the use of employee share schemes across European companies and capital market-based pension schemes.

Table 1.

It remains to be seen whether this new impetus will translate into real progress on the CMU. Without such progress, the European economy will not be empowered to tap all of its ample financing resources and could continue to have low potential growth and little capacity to absorb asymmetric shocks without massive transfers of public money.

Ten years after their creation, the single supervisory mechanism and the single resolution mechanism have largely achieved their main objectives of improving banks’ financial soundness and ensuring that the most systemic banks can be resolved in case of failure with no systematic recourse to taxpayers’ funding. That said, we expect some further incremental changes to enhance these first two pillars of the banking union.

First, the EU Commission and its financial agencies will need to complete the regulatory rollout of the latest Basel accords on banks’ capital requirements following the adoption of legislative instruments earlier this year (see “EU Banking Package: Inconsistencies Temper Framework Improvements,” published on Jan. 9, 2024).

Second, negotiations between representatives of the EU Parliament, the Council, and the Commission to reform the crisis management and deposit insurance framework are due to start. This reform aims to include midsize banks in the group of banks prepared for resolution. To do that, it proposes to facilitate the use of funds currently held in national deposit guarantee schemes and resolution funds. We expect these negotiations to take time as there are some material differences between the European Council’s current position and the European Commission’s initial proposal.

Beyond that, at this stage we do not see a clear political will to make further progress toward the completion of the banking union, mainly due to opposition at a national level. In its June 2022 meeting, the Eurogroup once again discussed but did not reach a compromise on the three outstanding issues:

The creation of a European Deposit Insurance Scheme.

The EU Commission tabled a legislative proposal in 2015, but the potential mutualization of bank losses at a European level that could result from the scheme remains a major obstacle in reaching a compromise.

The diversification of banks’ sovereign bond holdings in the EU.

Several EU countries consider that a reduction in banks’ exposures to their own sovereign is a precondition for envisaging a potential mutualization of bank losses. But such diversification would in turn require risk-weighting government bond holdings, which could prove costly for banks in terms of additional capital. Here again, a compromise is difficult to imagine at this stage.

A greater integration of the banking markets.

The key issue here revolves around the free allocation of capital across EU borders within EU banking groups, which today is not wholly possible. The EU Parliament put forward proposals to waive the capital requirements for the EU subsidiaries of cross-border groups in the last legislature, but these were not agreed. Beyond this, more harmonization of banking products and practices would be necessary to generate more synergies and incentivize further EU banking consolidation. However, this would likely require legislative changes at national levels, which is also unlikely.

Despite the limited progress we expect toward completing the banking union, we believe that the EU authorities will press on with several other important banking regulations. EU banks’ management of climate risks remains a priority within the broader green agenda, and banks will soon need to submit transition plans detailing how they will cope with climate change.

The management of operational risks is also a priority, as banks gradually increase their reliance on third parties to leverage technology for example, cloud technology, and face mounting cyber threats. The implementation of the Digital and Operational Resilience Act will be another area of focus for EU banks and regulators in the years to come (see “Supervising Cyber: How The ECB Stress Test Will Shape The Agenda,” published on March 6, 2024).

Related Research from S&P Global Ratings

• CreditWeek: What Does The U.S.-Eurozone Interest Rate Differential Mean For Currencies And Capital Flows, June 20, 2024

• Supervising Cyber: How The ECB Stress Test Will Shape The Agenda, March 6, 2024

• EU Banking Package: Inconsistencies Temper Framework Improvements, Jan. 9, 2024

• Europe’s Power Push: Can Project Finance Help Fund Interconnections?, Nov. 16, 2023

• Thirty Years Of The EU Single Market: Why Cross-Border Capital Flows Remain Sluggish, Despite Positive Developments, May 25, 2023

• How the Capital Markets Union Can Help Europe Avoid A Liquidity Trap, April 15, 2021

• The EU Capital Markets Union Can Turn The Tide in Europe, Feb. 25, 2020

External Research:

• AFME, Capital Markets Union Key Performance Indicators – Sixth Edition

• Christian Noyer, Developing European Capital Markets to Finance the Future – Proposals for a Savings and Investments Union (economie.gouv.fr)

• EIB Investment Report 2023/2024: Transforming for competitiveness

• Enrico Letta, Much more than a Market – empowering the Single Market to deliver a sustainable future and prosperity for all EU citizens (April 2024) (europa.eu)

• European Council Strategic Agenda 2024-2029 (europa.eu)

• Nicolas Véron, Capital Markets Union: Ten Years Later, an in-depth analysis requested by the ECON Committee at the European Parliament

• OECD/INFE 2023 International Survey of Adult Financial Literacy, OECD Business and Finance Policy Papers, No. 39, OECD Publishing, Paris

• Statement by the ECB Governing Council on advancing the Capital Markets Union (europa.eu)

• Statement of the Eurogroup in inclusive format on the future of Capital Markets Union (europa.eu)