The views expressed here are those of the authors and do not necessarily reflect those of the RBI or the BIS. We are grateful to comments from the Department of Payment and Settlement Systems (DPSS) at the RBI, from Edona Reshidi at the Bank of Canada and from Xavier Lavayssière at the Université Paris I Panthéon Sorbonne.

Abstract

In India, the Unified Payments Interface (UPI) has become a leading payment system – processing more than 13 billion transactions per month as of March 2024. The strong growth of UPI can be attributed to the ease of development of applications, and an open, technology-agnostic architecture which enables transactions across multiple third-party application providers. User-friendly interfaces and zero transaction costs for end-users have also helped to increase adoption. Transactions are possible through mobile number-based or identity-based proxies and interoperable quick response (QR) codes. The system has been strengthened by active partnership with the private sector. UPI is governed by strict regulations on data storage and use. Adept regulatory conditions have been critical in laying the foundation for this success, and in addressing challenges that have arisen such as technical glitches, non-uniform interoperability and scalability for cross-border transactions. The UPI model has made rapid strides in India’s financial inclusion, while preserving consumer protection and financial stability.

India’s payment market has changed dramatically in the past decade. Among the most consequential changes is the rapid adoption of the Unified Payments Interface (UPI) – a fast payment system that is often referred to by authorities as a ‘digital public good’.1 As part of broader efforts to modernise India’s payment systems and promote digital transactions, the Reserve Bank of India (RBI) launched UPI in 2016. It is operated by the National Payments Corporation of India (NPCI), a non-profit entity. Since then, UPI has seen remarkable growth. This article seeks to understand the factors behind success of UPI, and its impact on industrial organisation of India’s payments market.

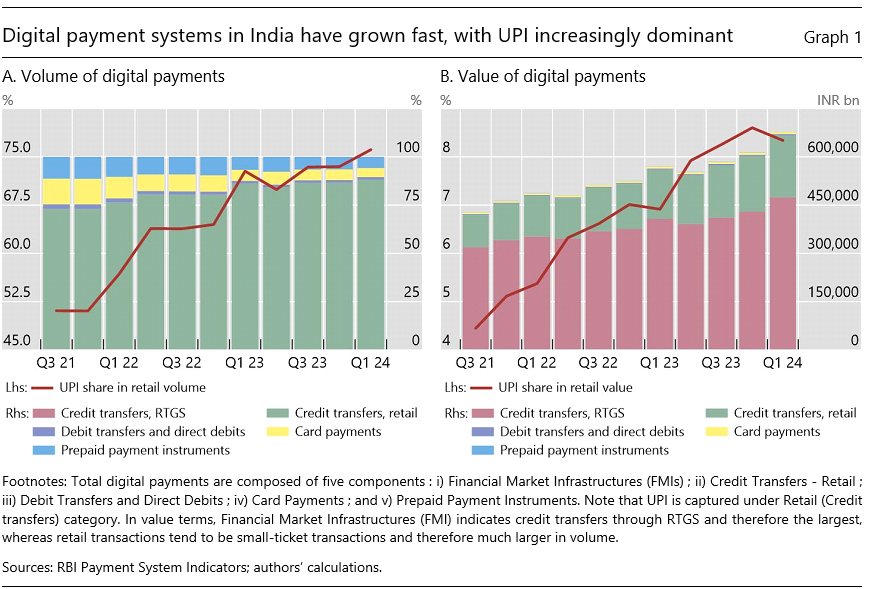

To understand the scale and scope of UPI, it is important to put it into the context of India’s overall digital payments infrastructure. As of February 2024, this market was worth INR 21,000,000 crores (USD 2.52 trillion).2 Total digital payments in India encompass five main components: financial market infrastructures (FMIs); retail credit transfers; debit transfers; card payments and prepaid payment instruments. UPI falls under the retail credit transfers category.

Over the past few years, the volume of digital payments in India has surged significantly, expanding by 3.2 times since June 2021 (see Graph 1.A).3 UPI has played a pivotal role in this growth. As of March 2024, UPI accounted for a staggering 81.8% of the volume of total digital payments in India, with over 13 billion transactions per month. This demonstrates its widespread adoption for everyday transactions. Still, despite dominating volumes, UPI transactions contributed only 8.7% by value (Graph 1.B). This indicates a prevalence of small-ticket transactions through the platform. This not only underscores the increasing reliance in India’s evolving financial landscape on digital payment solutions, particularly UPI; it also points to increased adoption by a wider user base.

India also observed a surge in digital payments in other real-time payment products after the Covid-19 pandemic. These included the National Electronic Fund Transfer (NEFT), the Immediate Payment System (IMPS) and the Real Time Gross Settlement (RTGS) for credit transfers and retail transactions. Each of these are secure, reliable and competitive systems. These payment systems often compete with one another in value or volume, and there is considerable product differentiation across products like UPI, IMPS and NEFT. Each of these is available 24×7, but they have various modes of use and associated transaction fees. Payment systems like NEFT and IMPS are facilitated through a consumer’s internet banking; for payment initiation, the payer needs the receiver’s bank account details. The NEFT allows for inter-bank fund transfers in batches in both offline and online modes, ie customers can use these facilities either electronically or by physically going to a bank. The IMPS is a real-time interbank electronic funds transfer service that allows customers to transfer funds instantly to any bank account using mobile phones or internet banking and offers a 24×7 instant fund transfer service. However, both NEFT and IMPS require users to have a bank account that can be accessed through internet banking or a mobile application of the bank in which they hold an account. Further, the transaction fees also differ by product. NEFT and IMPS levy a transaction fee for customers ranging from INR 1 to INR 25 (USD 0.012 to 0.3) depending on the volume of transaction.4 In comparison with these products, UPI is a real-time payment service with zero transaction fees for end-users. UPI apps are enabled across multiple third-party application providers (such as big tech and fintech companies) or banks for facilitating fund transfers services using a single platform. UPI uses an open architecture, which enables quick and safe transactions. UPI is governed by strict data regulations.

This article draws lessons from the success of UPI. We argue that this success majorly owes to ease of development of applications, easy use and zero-transaction fees for end-users. Further success factors have been strict data protection rules, active partnership with the private sector and adept regulation. In the following sections, we discuss the organisation of the Indian payment market since the launch of UPI. Section 2 discusses the changes in digital payment market in India, with a focus on payment volumes and values. Section 3 highlights the increasing investments in the payments market and increased adoption over time. Section 4 provides insights into the implications of payment systems for financial inclusion in India, and touches upon some challenges UPI faces. Section 5 concludes.

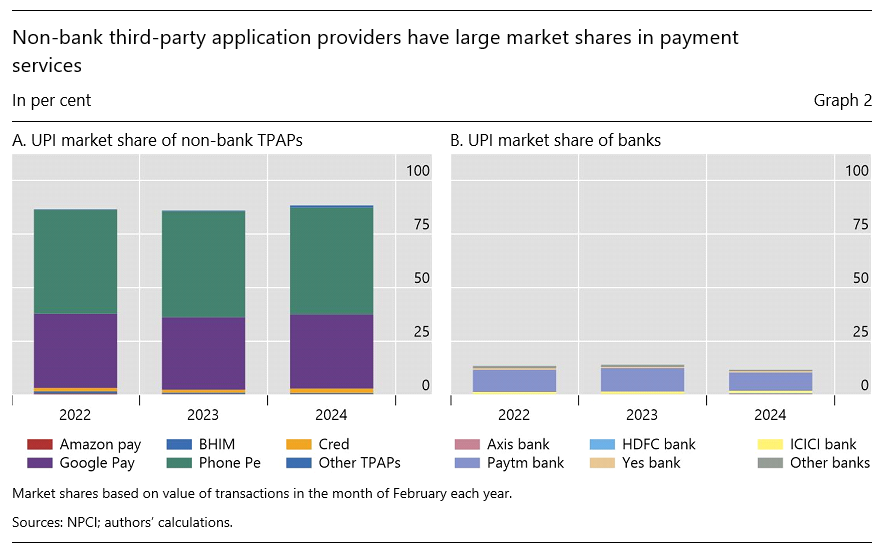

Globally, UPI is among the most successful retail fast payment systems (FPS). Like other widely adopted FPS, it provides simplicity, safety and security to person-to-person (P2P) and person-to-merchant (P2M) transactions (see CPMI, 2021; Frost et al, 2024). In many countries, such as China and Kenya, digital payment adoption has been driven by dominant private systems (“walled gardens”). In India, different firms compete in the same system. Big tech and fintech companies like Google Pay and PhonePe5 have achieved very large market shares in payment services (Graph 2.A). These firms have the advantage of having a wider user base, larger marketing and promotional budgets for advertising and dedicated customer support. Banks have a small market share in the initiation market (Graph 2.B), but they still actively provide payment services.6

UPI has five key attributes – i) an open architecture infrastructure, ii) multi-party transactability, iii) ease of doing transactions, iv) strict data regulations, and v) a carefully calibrated regulatory environment.

An open infrastructure simply means that UPI allows third-party developers to build on top of its open platform and create their own app that can be integrated with UPI. Tech companies (big tech and fintech) and banks have free entry to use UPI and/or build their own apps with UPI as the third-party application. UPI allows users to make payments from one bank account to another. They can initiative these payments from their bank account through third-party application providers (TPAPs) such as Amazon Pay, Google Pay and PhonePe.7 Big techs can be defined as large companies whose primary activity is digital services (BIS, 2019; Frost et al, 2019). Examples include Google, Apple or Amazon in the US, and Alibaba or Tencent in China. To build a UPI-enabled platform, third-party developers must obtain authorisation from NPCI and comply with technical specifications, security and privacy standards, testing and certification processes, and other relevant regulations set by NPCI.

UPI also enables multi-application transactions. This means that users registered on any UPI platform can make safe and quick transactions to any other account registered with UPI. These could be accounts linked to third-party payment service providers (PSPs) or bank accounts. Users are not restricted to using a particular bank’s mobile app or payment platform but can use the UPI app or any UPI-enabled app to make transactions. This makes UPI a convenient single platform for transactions, eliminating the need for users to maintain multiple accounts or download multiple apps to make payments. Payment over UPI does not depend on full bank account numbers or other information of the recipients. Instead, they can use a mobile phone number or scan a quick response (QR) code by phone to initiate a transaction.8

The use of UPI data is strictly regulated. For this reason, big techs have not been allowed to extract rents from users’ transaction data.9 Users can access their own transaction data from their bank and there are separate data sharing initiatives,10 but payment initiators (TPAPs) cannot collect individual transaction data.

Finally, regulators in India have carefully calibrated the rules governing the system, supporting competition while being mindful of financial stability. While it is worth underscoring that the associated credit risk remains on the balance sheet of banks and other regulated lenders, the sheer volume of transactions by dominant players could raise competition and financial stability concerns. In 2021, the NPCI announced a restriction on the total volume of transactions processed by any one TPAP in the UPI system, capping it at 30%.11 TPAPs that surpass the three-month transaction volume limit have been advised to decrease their market share to avoid market disruption and encourage future use.12

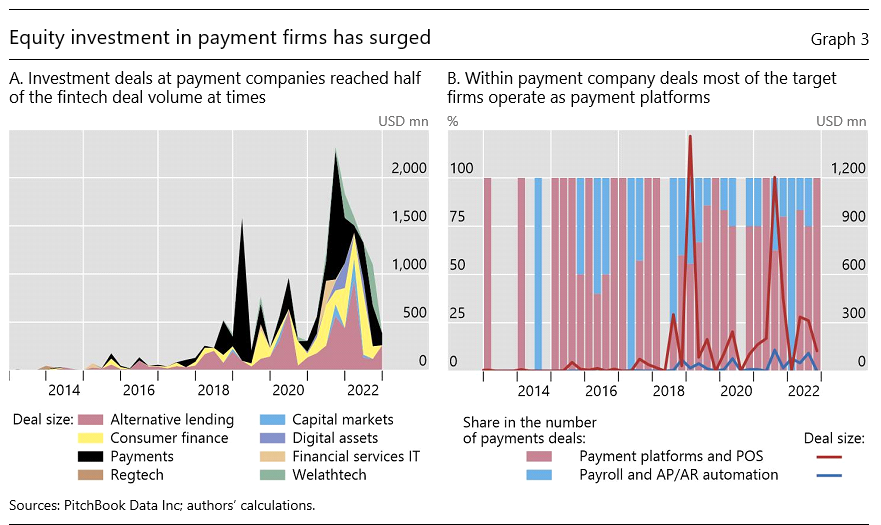

In addition to the structural attributes, robust private investment has been an important driver of the growth in India’s digital payment system, supporting greater opportunity for market entry and innovation. Investment in Indian fintech firms spiked in early 2019 and again in 2021 when payment firms took up nearly half the volume, marking a shift in investors’ interest (Graph 3, left-hand panel). The majority of investments was in companies whose core business was providing payment services and point-of-sales (PoS) devices (right-hand panel). The spike in the value of investment deals in 2019 related to the growing adoption of UPI and large deals by Paytm and PhonePe. In 2021, the surge in investment followed from an increased preference for using digital payment systems after the Covid-19 pandemic.

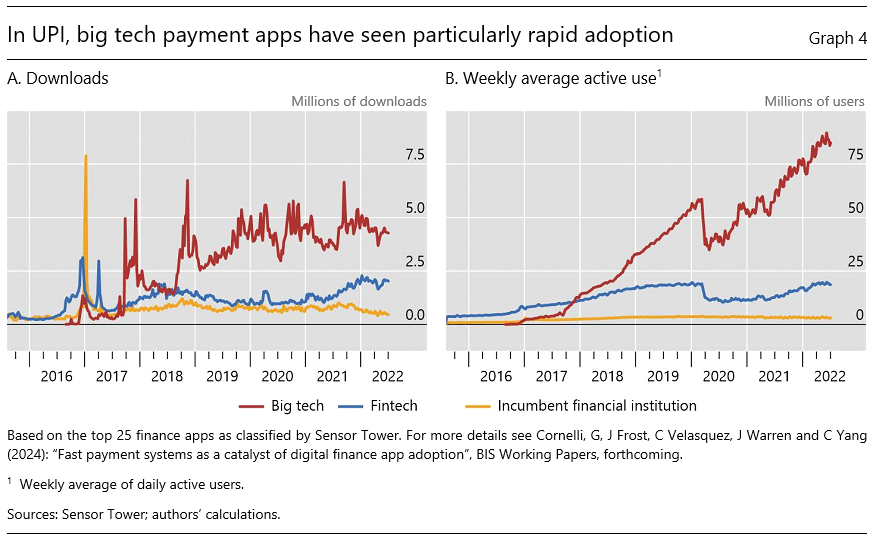

In terms of UPI use, big tech payment apps have become increasingly popular and widely used in the UPI system. This trend seems likely to continue in the future. This can also be seen in Graph 4, which shows the number of downloads and weekly average active use of big tech payment apps in the UPI system. The left-hand panel represents the number of downloads in millions, and the right-hand panel represents the weekly average active use in millions of users, taken from the provider Sensor Tower.

The number of downloads and weekly active usage shown in Graph 4 indicates rapid adoption of big tech payment apps in the UPI system. Use of big tech apps accelerated particularly with the Covid-19 pandemic – growing from about 60 million to almost 90 million daily active users. By contrast, fintech payment apps saw a decline during the pandemic, and only recovered to their pre-Covid levels of use after two years. Overall, the data suggest that especially big tech payment apps are popular and widely used for payment initiation – even as banks have continued to play an important role in back-end settlements.

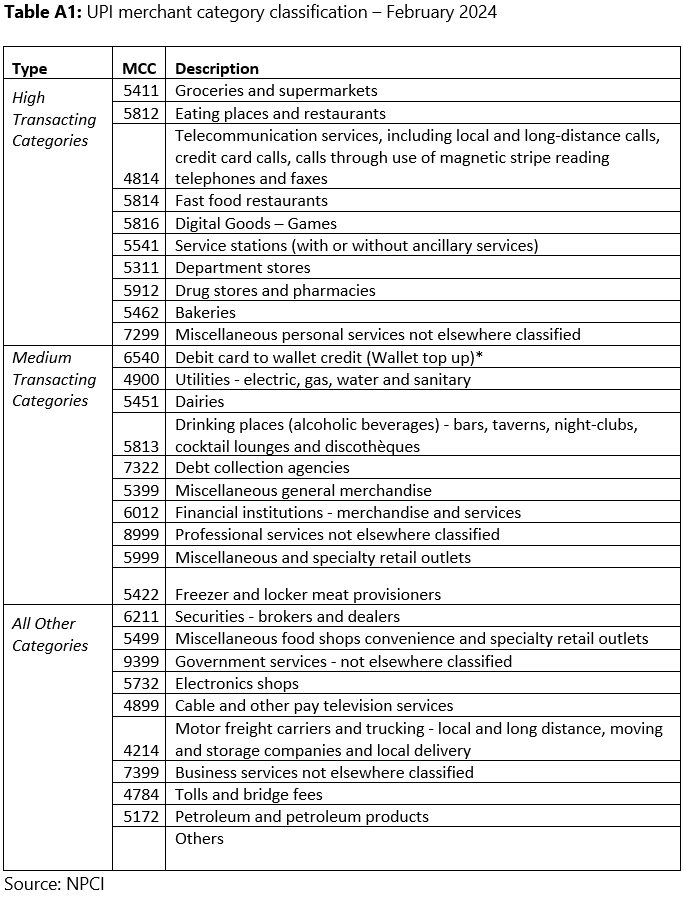

At the sectoral level, UPI-based transactions are mainly focused on retail payments, characterised by a large volume of small-ticket transactions in real time. Wholesale payments, ie transactions between businesses, make up a small share of overall payment volume but a larger share of their value. At the merchant level, these transactions are highest for categories like groceries and supermarkets, and restaurants. Merchant category-wise classification of UPI is provided in Table A1 in the Annex.

In 2020, in an effort to simplify offline payments and enhance user experience, all payment system operators were required to switch to at least one interoperable QR codes –UPI or Bharat QR. This, in turn, reduced the cost and complexity of digital transactions for end-users including small and medium-sized enterprises (SMEs). It has also set the stage for further innovation, including in tokenisation of credit cards,13 and cross-border payments.

In June 2022, RBI approved linking of credit cards to UPI, starting with RuPay credit cards, which is a domestic card payment network operated by the NPCI (RBI SDR, 2022). In September 2023, the scope of UPI expanded to include credit lines as a funding account, wherein individuals can give consent to making payments via the UPI using pre-sanctioned credit lines from a scheduled commercial bank.14 As of that date, services such as savings account, overdraft accounts, prepaid wallets, credit cards and pre-sanctioned credit lines can be linked to UPI.

In the last few years, the UPI has extended its capabilities across borders. In July 2021, BHIM UPI partnered with the Royal Monetary Authority (RMA) of Bhutan to implement QR-based payments in Bhutan, adding a new milestone of cross-border financial integration. In August 2022, the UPI and RuPay card schemes signed a memorandum of understanding (MoU)15 confirming a partnership with the payment solutions provider PayXpert to internationalise the acceptance of its payment solutions in the UK, starting with UPI-based QR-code payments. In the same year, UPI AUTOPAY also debuted in the mutual fund segment (and all recurring payments) to digitise its payment landscape by paying loan equal monthly instalments (EMIs) through UPI.

The growing scale of operations has improved outreach and transactions costs in domestic as well as cross-border initiatives. On 21 February 2023, a cross-border linkage between India and Singapore went live. The linkage operates through the countries’ respective fast payment systems, namely UPI and Singapore’s PayNow, with the aim of enabling cross-border fund transfers using their respective UPI-id, mobile number, or Virtual Payment Address (VPA). The collaboration between UPI and PayNow SG has brought significant advancements to cross-border remittances between India and Singapore. Leveraging PayNow SG’s peer-to-peer funds transfer service, users can now seamlessly transfer funds using mobile numbers or virtual payment addresses (VPAs) in real-time, without the need for bank account details.

UPI has also introduced a novel approach to offline payments, through UPI Lite X which enables transactions in environments with limited network connectivity. Both payer and payee can engage in transactions offline, using the existing UPI Lite wallet with an INR 500 (~USD 6) upper limit for each transaction. Leveraging NFC communication, UPI Lite X ensures secure transactions without internet access, catering to scenarios such as flights, parking lots, or remote locations. Users initiate transactions through a simple process within the UPI app, without the need for a UPI PIN. This product focuses on user security, offering real-time balance refunds in cases of app uninstallation, device changes or loss/theft. This feature-rich solution enhances accessibility and success rates for offline transactions, providing a convenient option for users, particularly in rural areas.

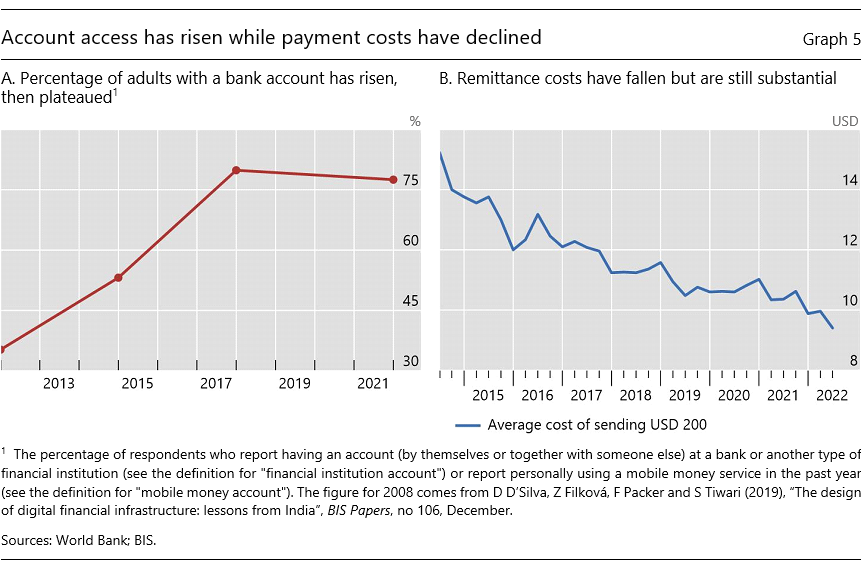

Progress in digital payments systems is one of India’s major tools to enhance financial inclusion. Robust implementation and adoption of digital payment infrastructure has been used to promote greater access to financial services, potentially enhancing consumer welfare (Croxson et al, 2022). Evidenced by the rapid adoption by end users, the digital payments system has become more diverse over time. In India, the payments infrastructure has combined with the opening a large number of bank account through the digital identity system Aadhaar, which has considerably improved access to finance.16 The share of adults with a bank account steadily increased until 2017 when it reached a peak at more than 75% (Graph 5, left-hand panel).

Further, the cost of remittances has fallen consistently since 2015 (Graph 5, right-hand panel) on account of increased market competitiveness and easy technology adoption.

The improvement in financial infrastructure has led to increased participation of poorer and rural segments of the population in the financial system. In addition, the reduction in remittance costs has improved outcomes, particularly for households in rural areas. The reduction of these costs has allowed for higher settlement of remittances, contributing to the financial well-being of these members of society.

Despite its success, the UPI is not without challenges. These have included technical glitches and outages leading to incomplete or failed transactions.17 Efforts to address these include continuous reconciliation processes, infrastructure improvements, and enhanced network connectivity. Additionally, UPI faces limitations due to uneven interoperability with other payment infrastructures, each of which have their own set of protocols, APIs and security standards. Steps are being taken to standardise across payment system products in a phased manner to upscale India’s digital expansion. Further, as UPI expands its international partnerships, scalability is a major challenge, which significant efforts in software and network development. Security, regulatory compliance and scalability for international partnerships remain key priorities, with ongoing efforts to enhance public infrastructure, improve grievance redressal mechanisms, and increase consumer awareness.

India’s digital payment ecosystem and experience of UPI holds important insights for the industrial organisation of payment markets across jurisdictions. Over time, the payments market has been developed with support from a range of public infrastructures and regulatory initiatives. While some large players are dominant providers of payment services, the UPI has allowed for a vibrant market with strong investments. There are at least five main factors driving the rapid adoption of UPI as a leading digital public infrastructure.

(i) Ease of development: First, UPI offers an open architecture which enables third-party developers to construct their own applications integrated with UPI. This facilitates tech companies and banks freely using UPI or develop their own apps using the UPI.

(ii) Ease of use: Second, UPI facilitates transactions across multiple applications. This allows users across various platforms to execute secure and swift transactions to any UPI-registered account, whether it is linked to applications of third-party payment service providers or banks. Users are not confined to a specific bank’s app but can use any UPI-enabled app for transactions, streamlining the process and eliminating the need for multiple accounts or apps.

(iii) Data protection: Third, UPI is governed by strict data regulations, instilling a sense of trust in the system. Technology companies, both big tech and fintechs, cannot collect individual data on transactions made through these platforms.

(iv) Partnering with private sector: Fourth, UPI has witnessed robust private investments even as zero transaction costs are levied on end-users. These trends have been an important part of overall digital infrastructure initiatives, alongside digital identity (Aadhaar) which has facilitated the rapid opening of bank accounts that can connect with the payment system.

(v) Adept regulation: The fifth crucial element is regulation. The authorities in India aim to promote innovation, enhance consumer and producer welfare and promote financial stability. To achieve these goals, regulators like the RBI and NPCI have introduced various policies and guidelines to facilitate innovation, ensure security and reduce the risks associated with digital payments. As a result, new innovations and products, such as tokenisation, offline payments and cross-border financial integration are being introduced in a phased manner while being mindful of financial stability.

UPI’s success in transforming digital transactions in India comes with challenges like technical glitches, outages, and interoperability issues. Continuous efforts are being made to address these through infrastructure improvements, standardisation initiatives and enhanced grievance redressal mechanisms. As UPI expands its international partnerships, scalability, security and regulatory compliance remain critical priorities. Ongoing measures aim to enhance public infrastructure, ensure seamless transactions, and increase consumer awareness.

Overall, UPI has significantly improved India’s digital public infrastructure by providing an efficient and credible payment system promoting financial inclusion while preserving consumer protection and financial stability. This has facilitated safe, real-time and cost-free digital transactions for users.

Annex

Aldasoro, I, S Doerr, L Gambacorta, R Garratt and P Koo Wilkens (2023), “The tokenisation continuum”, BIS bulletin, no 72, April.

Bank for International Settlements (BIS) (2019), “Big tech in finance: opportunities and risks”, Annual Economic Report, Chapter III, June.

Carstens, A and N Nilekani (2024), “Finternet: the financial system for the future”, BIS working paper, no 1178, April.

Chodorow-Reich, G, G Gopinath, P Mishra and A Narayanan (2020), “Cash and the economy: Evidence from India’s demonetisation”, The Quarterly Journal of Economics, vol 135, no 1, pp 57–103.

Croxson, K, J Frost, L Gambacorta and T Valletti (2022), “Platform-based business models and financial inclusion: policy trade-offs and approaches”, Journal of Competition Law & Economics, August.

Das, S (2022), “Fintech as a Force Multiplier”, address by Governor, Reserve Bank of India at the Global Fintech Festival, Mumbai, 20 September.

D’Silva, D, Z Filková, F Packer and S Tiwari (2019), “The design of digital financial infrastructure: lessons from India”, BIS paper, no 106, December.

Frost, J, P Koo Wilkens, A Kosse, V Shreeti and C Velasquez (2024), “Fast payments: design and adoption”, BIS Quarterly Review, March.

Jack, W and T Suri (2014), “Risk Sharing and Transactions Costs: Evidence from Kenya’s Mobile Money Revolution”, American Economic Review, vol 104, no 1, pp 183–223.

National Payments Corporation of India (NPCI) (2022), “RBI Governor Launches Three Key Digital Payment Initiatives at Global Fintech Fest 2022”, press release, 20 September.

— (2023), “UPI Ecosystem Statistics”, accessed 15 January.

Nayak, M (2021), “Around 40% Indians use digital formats like UPI for money transfer: Nandan Nilekani”, The Economic Times, 14 September.

Reserve Bank of India (RBI) (2021), “Booklet on Payment Systems in India, 2010–20”, January.

RBI (2022), “Statement on Developmental and Regulatory Policies”, February.

Sankar, T (2022), ‘Fintech and Regulation’, speech by Deputy Governor, Reserve Bank of India at the Business Standard Summit in Mumbai, 21 December.

The Economist (2023), “A digital payments revolution in India”, 15 May.

Tiwari, S, S Sharma, S Shetty and F Packer (2022), “The design of a data governance system”, BIS paper no 124, May.

Uña, G, N Griffin, A Verma and M Bazarbash (2023), “Fintech Payments in Public Financial Management: Benefits and Risks”, IMF Working Paper WP/23/20.

UPI Ecosystem Statistics, NPCI.

See, for example, this 2022 tweet from the Indian Ministry of Finance (link). The United Nations (UN) Secretary-General’s roadmap for digital cooperation defines digital public goods as “open-source software, open data, open artificial intelligence models, open standards and open content that adhere to privacy and other applicable international and domestic laws, standards and best practices and do no harm” (see link).

At an exchange rate of USD 1 = INR 83.4. A crore is equal to 10 million Indian Rupees.

RBI began reporting of Payment System Indicators from June 2021.

RBI guidelines on transaction charges (link)

Google Pay is run by Google. PhonePe is an Indian payment firm headquartered in Bengaluru. Until December 2022 it was a subsidiary of e-commerce platform Flipkart. It continues to have a majority ownership stake by Flipkart’s majority shareholder, US retailer Walmart.

Both FPS and other forms of digital payments may have benefits for the real economy. See Jack and Suri (2014) and Uña et al (2023).

See the NPCI website for list of UPI third party apps here.

A quick response (QR code) is a two-dimensional barcode that can be scanned by a smartphone or other device to initiate a payment.

In many private payment systems (walled gardens), firms can extract rents from users in the form of high fees or exclusive control over (valuable) personal data. In UPI, prices and the use of data are regulated, preventing these types of abuse by payment service providers.

For instance, regarding the India’s Data Empowerment Protection Architecture (DEPA) and open banking initiatives, see Tiwari et al (2022).

See NPCI Press Release (2020), https://www.npci.org.in/PDF/npci/press-releases/2020/UPI-balances-consumer-experience-with-growth-for-TPAPs.pdf

While the rule was originally scheduled to take effect on 1 January 2021, the NPCI later extended the deadline to 31 December2024, NPCI Press Release (2022), link here.

Tokenisation of credit cards refers to a security protocol that creates a randomly generated identifier rather than an individual’s card number and personal details. This should not be confused with tokenisation as the digital representation of assets on a programmable platform. For the latter, see Aldasoro et al (2023) and Carstens and Nilekani (2024).

RBI notification (2023), link here.

NPCI press release (2022), link here.

Aadhaar allows for electronic know-your-customer (e-KYC), which can drastically lower the cost of opening a bank account. It is estimated that banks that use e-KYC can lower their cost of compliance from $15 to $0.07. See D’Silva et al (2019).

The Economist (2023).