What explains the worldwide changes in central bank design over the past five decades? In Romelli (2022), I use a new dataset on central bank institutional design to investigate the timing, pace and magnitude of reforms in a sample of 154 countries over the period 1972-2017. I construct a new dynamic index of central bank independence and show that past levels of independence, as well as regional convergence, represent important drivers of changes in central bank design. An external pressure, such as obtaining an IMF loan, or political events, such as democratic reforms and the election of nationalistic governments, also impact the reform process. Reforms also follow periods of high inflation rates suggesting an endogeneous evolution of central bank independence. The results also reveal important heterogeneities in the reform process depending on the level of development, the size and direction of reforms, as well as the different dimensions along which central bank legislation can be amended.

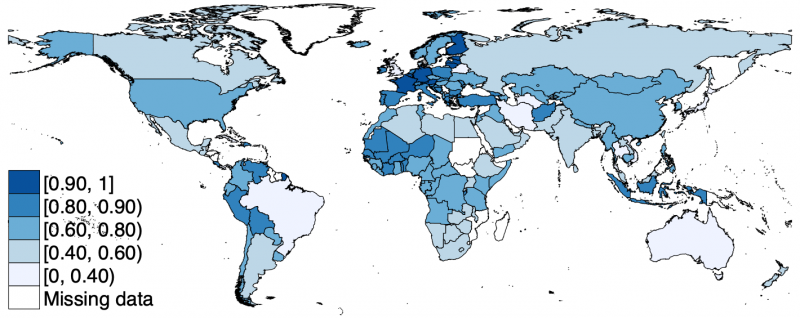

The past five decades have been characterized by significant changes in the institutional design of central banks around the world, generally towards assigning monetary authorities a higher degree of independence from the executive branch. Yet, despite the large consensus on the optimality of this institutional arrangement in stabilizing inflation rates, the degree of central bank independence (CBI) still varies considerably across countries (see Figure1). Moreover, the legacy of the 2008 global financial crisis brought several threats to CBI, first as a result of central banks’ involvement in financial supervision and second due to an increased risk of fiscal dominance as a result of extensive asset purchase programs. The autonomy of central banks has also come under political pressure in countries with populist political movements (The Economist, 2019).

Figure 1. Central Bank Independence around the world in 2017

Source: Romelli (2022).

A considerable body of work has investigated the consequences of assigning more independence to monetary policy authorities.2 However, the causes of reforms in central banking have received less attention. In Romelli (2022), I investigate why and how central bank reforms come about. To do so, I create a new index of central bank independence that allows for a more precise determination than previously possible of the timing and magnitude of reforms in central bank design for a set of 154 countries during the period 1972-2017.3

Employing this index, I show that past levels of independence, as well as regional convergence, represent important drivers of changes in central bank design. At the same time, an external pressure, such as obtaining an IMF loan, or political events, such as democratic reforms and the election of nationalistic governments, also impact the reform process. Reforms also follow periods of high inflation rates suggesting an endogeneous evolution of central bank independence. The results also reveal important heterogeneities in the reform process depending on the level of development, the size and direction of reforms, as well as the different dimensions along which central bank legislation can be amended.

The new dynamic index of central bank independence (CBI) builds on the two most common measures of de jure central bank independence in Grilli et al. (1991) and Cukierman et al. (1992). However, given that the role of central banks has evolved considerably since the early 1990s, the new measure of CBI proposed extends previous ones by capturing new characteristics that can affect the conduct of monetary policy, such as financial independence and reporting and disclosure.

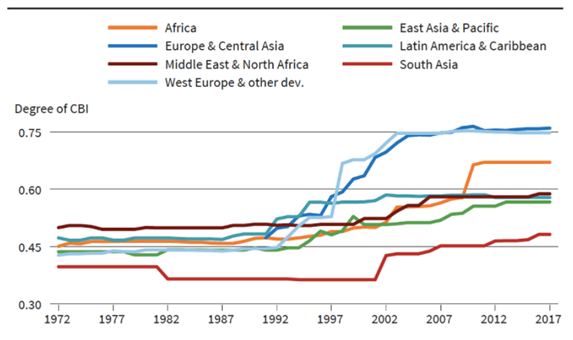

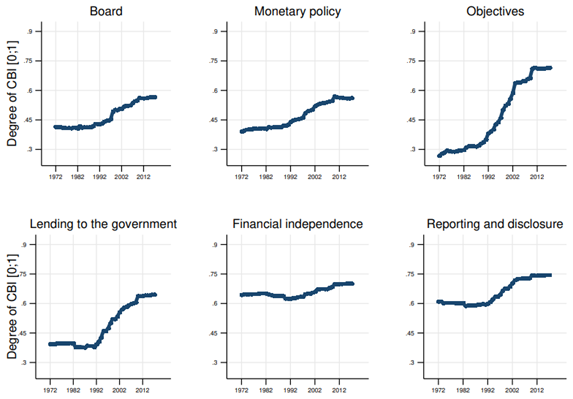

Employing this dynamic index, I provide a comprehensive overview of the evolution and timing of reforms in central bank design around the world. I find that, while central banks have become increasingly more independent over the last five decades, there is still a large variation across regions (See Figure 2). Moreover, significant improvements in independence relate to a few dimensions of the index, such as those referring to the primary objectives of the central bank or its lending to the government (See Figure 3).

Figure 2. Evolution of central bank independence (CBI) by regions

Note: The figure shows the evolution of the average index of CBIE by regional clusters.

Source: Romelli (2022).

Figure 3. Evolution of central bank independence (CBI) by dimensions (1972-2017)

Source: Romelli (2022).

In Romelli (2022), I investigate the potential drivers of the timing and pace of reforms in central bank design over the past half-century by employing a political economy framework to identify five sources of reforms: (i) status quo bias, (ii) external inducements, (iii) crises and shocks, (iv) ideology and political factors and (v) economic conditions.

The results show that the lagged level of central bank independence or status quo, as well as regional pressures are important in the reform process, as countries with lower levels of independence or those that are further from their regional average are more likely to adopt reforms that increase their level of independence. An external pressure to reform also comes from international institutions, as countries receiving an IMF loan or becoming a member of a currency union adopt reforms that increase the independence of their central banks.

Reforms that increase the level of central bank independence also follow periods of high inflation rates, suggesting central bank institutional design is endogenous to the inflation dynamics of a country. On the other hand, other types of crises such as systemic banking crises, currency or sovereign debt crises are not followed by reforms that increase the level of central bank independence. The data also shows important heterogeneities depending on the level of development. For instance, government fractionalization, cabinet changes or economic growth matter for the reform process among advanced economies, while external pressures and inflationary episodes are more important in developing economies.

The index constructed also allows for a more granular analysis of the magnitude and direction of reforms. This highlights important differences in the reform process. For instance, I find that financial crises are generally followed by reforms that decrease the level of central bank independence, while external inducements, regional convergence and status quo bias matter for reforms that increase the level of independence, but not those that decrease it. The robustness of these results is checked along several lines. First, I employ several estimation strategies, alternative definitions and proxies for the main determinants of reforms. Next, I control for the different dimensions along which central bank legislation can be amended, as well as the interaction between the lagged level of independence and external factors. I also perform various split sample analyses and control for other reform processes such as democratic reforms. For instance, I find that countries undertaking democratic reforms will experience improvements in central bank independence, while the election of nationalistic political parties are typically associated with reforms that decrease the degree of independence. The results are robust to all these alternative specifications and provide the first comprehensive picture of the determinants and timing of reforms in central bank design over the last five decades.

The empirical investigation proposed in my paper, while focused on central bank reforms, contributes to a broader political economy literature on the endogenous evolution of political institutions. The results obtained reinforce some widely held conclusions, such as the importance of external inducements in reforming central banks, but also shed light on some ambiguities in the literature such as the role of crises. The new index constructed not only sheds light on the endogenous evolution of central banks, but also provides a useful time-varying instrument of institutional design.

The endogenous evolution of central bank design is an ongoing process and the index and methods proposed in this paper can be useful in identifying how new challenges faced by central banks will affect their independence. For example, I show that an increase in nationalistic political parties is likely to be followed by reforms that decrease central bank independence. This increased political pressure faced by many central banks due to the rise of populist movements across the world could further threaten the hard-won independence of these policy institutions. A second challenge faced by central banks nowadays can arise from the extensive asset purchase programs undertaken to respond to the 2008 global financial crisis and, more recently, the Covid-19 global pandemic. The large amounts of government debt held by many central banks increase the risk of fiscal dominance, i.e. situations in which monetary policy could be undermined and interest rates pegged at low levels to reduce the costs of servicing sovereign debt. Finally, the highly debated impact of climate change on the institutional design of central banks might influence reforms in the years to come.

To incorporate such pressures, future work can extend the de jure index proposed in this paper with elements of de facto independence by analysing, for example, media coverage and governors’ speeches to capture the role of political pressures in central bank policies.

Arnone, M. and D. Romelli (2013). Dynamic central bank independence indices and inflation rate: a new empirical exploration. Journal of Financial Stability 9 (3), 385–398

Cukierman, A., S. B. Webb, and B. Neyapti (1992). Measuring the independence of central banks and its effect on policy outcomes. The World Bank Economic Review 6 (3), 353–398.

Grilli, V., D. Masciandaro, and G. Tabellini (1991). Political and monetary institutions and public financial policies in the industrial countries. Economic Policy 6 (13), 342–392.

Klomp, J. and J. de Haan (2010). Inflation and central bank independence: a meta-regression analysis. Journal of Economic Surveys 24 (4), 593–621.

Masciandaro, D. and D. Romelli (2015). Ups and downs. Central bank independence from the great inflation to the great recession: theory, Institutions and Empirics. Financial History Review 22 (3), 259–289.

Romelli, D. (2022). The Political Economy of Reforms in Central Bank Design: Evidence from a New Dataset. Economic Policy.

Siklos, P. L. (2008). No single definition of central bank independence is right for all countries. European Journal of Political Economy 24 (4), 802–816.

Contact: romellid@tcd.ie

See, among others, Grilli et al. (1991), Cukierman et al. (1992), Siklos (2008), Klomp and de Haan (2010), Arnone and Romelli (2013) and Masciandaro and Romelli (2015).

The replication code is available at https://dataverse.harvard.edu/dataverse/romellid. The index of central bank independence is available at https://davideromelli.com/cbidata/ and will be periodically updated.