This contribution should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

This study revisits the Quantity Theory of Money (QTM) by analyzing a comprehensive dataset spanning 150 years (1870-2020) across 18 industrial countries, compiled by Jordà et al. (2017). The empirical analysis reveals that the long-term link between (excess) money growth and inflation holds for extended periods. In recent decades, however, the relationship has weakened significantly due to structural change, particularly during the Great Moderation and given advancements in payment technologies, leading to the breakdown of the QTM’s traditional formulation. In addition, the study confirms the presence of long and variable lags in the transmission of monetary policy, as predicted by Milton Friedman, amid significant heterogeneity across time and countries.

Milton Friedman (1963) famously stated that inflation is “always and everywhere a monetary phenomenon”, a view that was related to his earlier discovery that monetary policy actions impact the economy only after “a lag that is both long and variable” (Friedman, 1961). This monetarist perspective, which posits a predictable long-term relationship between money growth and inflation, has been echoed in numerous economics textbooks (e.g., Barro, 2007) advocating it as a sound basis for forecasting inflation over longer horizons. In contrast, Keynesian and New Keynesian scholars, such as Woodford (2008), have cast doubt on the existence of a direct causal link between money growth and inflation, challenging its predictive power for inflation trends. To assess QTM, previous empirical research has employed a variety of methodologies, including cross-sectional studies comparing long-term average money growth with inflation rates across countries, time series analyses within individual economies, and panel analyses for different groups of countries over varying periods. The introduction of new empirical techniques, combined with extensive historical data, motivates the present empirical re-assessment of QTM.

This analysis examines the long-run link between money growth and inflation considering both narrow and broad measures of the money supply. It addresses the cross-sectional dependence that earlier tests of QTM frequently neglected. Employing the Common Correlated Effects Pooled Mean Group (CCEPMG) methodology developed by Pesaran (2006), the study calculates the long-term coefficient that quantifies the relationship between (excess) money growth and inflation. For QTM to hold, the long-run coefficient (θ) between money growth and inflation ought to be equal to one, reflecting a one-to-one link between the two. In addition, the significance of the error-correction term coefficient (φ) in the estimated error-correction model is essential to validate a stable long-run cointegration relationship. Its magnitude indicates the speed at which the system reverts to this equilibrium relationship after disturbances have occurred. For the full sample of 150 years and for a sample of 18 industrial countries, as shown in more detail by Jung (2024), the long-run coefficient θ is close to its theoretical value of one, while a significant error-correction term coefficient φ indicates the presence of a stable long-run cointegration relationship between (excess) money growth and inflation, in line with QTM.

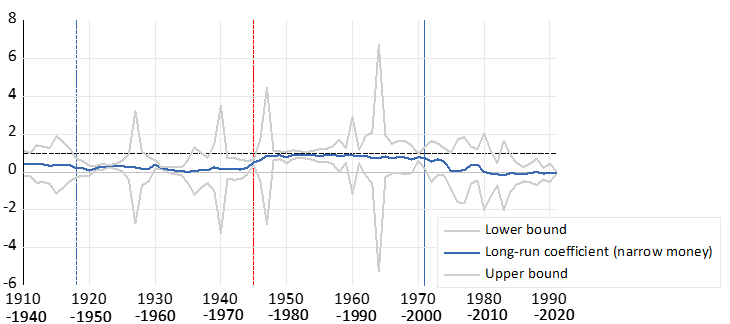

However, as exemplified by the rolling-window regression analysis depicted in Figure 1, the long-run link between money growth and inflation is not constant, but rather exhibits fluctuations over time undershooting the theoretical value of one. This analysis uncovers two significant discontinuities in the long-run money growth-inflation link. An initial shift is identified around the end of World War II in 1945, characterized by a marked reinforcement of the linkage between money growth and inflation, coinciding with the adoption of the Bretton Woods system that instituted an international fixed-exchange rate regime. A subsequent breakpoint is detected coinciding with the Great Moderation in 1985 and preceding the adoption of inflation targeting strategies by industrial countries that started during the 1990s. The results hold for both narrow and broad monetary aggregates and the extent of variation across countries is substantial, as further detailed in Jung (2024).

Figure 1. The long-run coefficient θ over time (narrow money)

Notes: Sample 1910 to 2020. The y-axis is in percent; the x-axis shows the years. Based on rolling window CCEPMG estimation for broad money using 30-year windows. Long-run impact of money growth on inflation is shown with two standard error bands around the coefficient θ. In the model, long-run coefficients are restricted to be the same across countries, while short-run coefficients and error variances are allowed to differ across cross-sectional units. The dashed horizontal line depicts a coefficient of one, as stipulated by the QTM, the blue dashed vertical line shows the end of World War I; the red dashed vertical line the end of World War II, the blue solid vertical line depicts the breakdown of the Bretton Woods system, and the red solid vertical line the first adoption of the IT strategy.

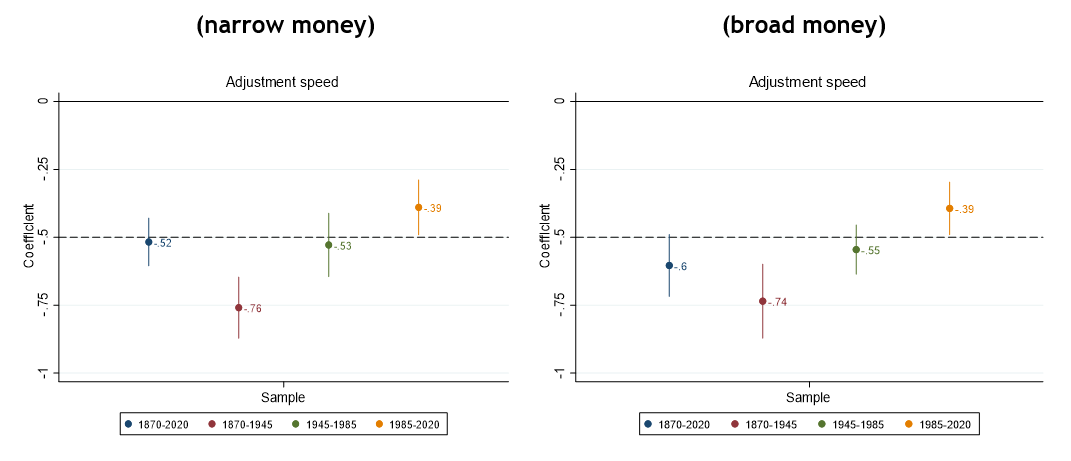

The panel cointegration regressions also confirm that monetary policy actions affect inflation with long and variable lags (see Figure 2), as predicted by Milton Friedman. The coefficient φ indicates that the adjustment speed to money supply shocks was fastest before 1945, with an average lag of less than 1½ years. The responsiveness gradually declined in the following period, post-1945, with the average lag increasing to approximately 2½ years after the Great Moderation. This deceleration in adjustment speed was mainly attributable to a reduction in the velocity of money, amid countervailing forces from technological progress and financial innovation. Notably, these findings are consistent across both narrow and broad measures of the money supply and mask substantial heterogeneity across countries, as shown by the vertical lines around the dots depicting φ.

The historical and empirical research presented indicates that the expansion of the money supply has been a fundamental factor influencing long-term inflation trends in industrial countries. However, the strength of the long-run relationship between money growth and inflation has varied over time, most notably weakening since the Great Moderation. Regarding inflation forecasting, this variability suggests that an increase in the money supply does not automatically translate into higher inflation in the medium to long term. The COVID-19 pandemic serves as a recent case study. Research conducted by Borio et al. (2023) suggests that a closer relationship between money growth and inflation has emerged during the pandemic. Notably, the Deutsche Bundesbank (2023), finds that the sharp rise in inflation during 2021 and 2022 was primarily attributable to the spike in energy prices and fiscal support measures in response to the pandemic, rather than a broad expansion in the money supply. This debate highlights the need for a flexible approach to monetary policy analysis that focuses on the changing interplay between the growth of the money supply and inflation trends, while also paying attention to money demand and special factors.

Figure 2. Variation in the adjustment speed across regimes

Notes: The y-axis shows the level of the coefficient (φ); the x-axis refers to the sample. Long-run and short-run coefficients and error variances are allowed to differ across cross-sectional units. The dashed horizontal line illustrates a coefficient of -0.5, implying an average speed of adjustment of two years. The observation for 1923 was excluded owing to hyperinflation in Germany.

The study highlights the critical link between the expansion of the money supply and inflation over the long term. In his 2006 address, Robert Lucas pointed out the pivotal role that the monetary pillar of central bank policy played in curbing excessive inflation. However, over recent decades substantial disruptions to the velocity of money in industrial countries have challenged the QTM’s premise of a stable money velocity, prompting central banks to adopt inflation targeting approaches and to downplay the role of money in policy decisions. The recent resurgence of inflation and the increasing difficulty of realigning it with policy objectives suggest that no essential indicator should be ignored when assessing risks to price stability. Central bankers must stay on guard, integrating historical insights and latest empirical evidence in their strategies to avoid costly policy errors and to effectively control inflation.

Barro, R. (2007): Macroeconomics: A Modern Approach. Thomson/South-Western Educational Publishing, 8th Edition.

Borio, C., Hofmann, B., Zakrajšek, E., 2023. Does money growth help explain the recent inflation surge?, BIS Bulletin No. 67, 26 January 2023.

Deutsche Bundesbank, 2023. From the monetary pillar to the monetary and financial analysis, Monthly Report, January

Friedman, M. (1961): The lag in effect of monetary policy. Journal of Political Economy, 69(5), 447-466.

Friedman, M. (1963): Inflation, Causes and Consequences, Asian Publishing House.

Jordà, O., Schularick, M., Taylor, A.M. (2017): Macrofinancial History and the New Business Cycle Facts. In: M. Eichenbaum and J. Parker (eds.), NBER Macroeconomics Annual 2016, Vol. 31, Chicago: University of Chicago Press.

Jung, A. (2024): The Quantity Theory of Money, 1870, 2020. ECB Working Paper No. 2940.

Lucas, R.E. (2006): Panel discussion: Central Banking: Is Science Replacing Art?. In: ECB (ed.), A journey from theory to practice – an ECB colloquium held in honour of Otmar Issing, 16 16-17 March 2006, 168-171.

Pesaran, M.H. (2006): Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica, 74(4), 967-1012.

Woodford, M. (2008): How important is money in the conduct of monetary policy? Journal of Money, Credit and Banking , 40 (8), 1561-1598.