The views expressed here are those of the authors and do not necessarily reflect those of the European Central Bank or Bank of Finland.

Abstract

With rising prominence of China in the global economy, interest in internationalization of its currency, renminbi (RMB), has increased. We study one aspect of the internationalization, the RMB’s role as an anchor currency. By developing previously used methods to estimate the weights, we estimate anchor weight for 63 advanced and emerging economy countries for the period 2010−2018. Unlike earlier studies, we find that the RMB’s anchor weight remains low irrespective of China’s global role. Overall, the RMB weight averaged 6 %, compared to an average share of 58 % for the US dollar (USD) and 35 % for the euro. We also find that the USD, euro and yen anchor choices are strongly interlinked. A change in the anchor weight of any of these three currencies results in a strong opposite change in the weights of other two. On the other hand, heightened geopolitical uncertainty increases the weights of the major currencies, USD and euro.

The RMB’s international role, albeit still low, has increased in the recent decade. A significant milestone in the currency’s internationalization was when it was included in the IMF basket of Special Drawing Rights (SDR) currencies. The RMB’s share in the global reserves is 3 %, but increasing (COFER, 2023). In 2022 it accounted 7 % of the global foreign exchange rate market turnover (BIS, 2022). Rising geopolitical tensions, especially since Russia’s invasion of Ukraine and enhanced sanctions, could lead to a bipolar financial landscape; one centered around the United States with the dollar as the main currency and the other around China and the RMB. That can enhance the RMB’s international role.

In estimating the weights, we primarily rely on the specifications of Haldane and Hall (1991), Frankel and Wei (1994), and Ahmed (2021), but we develop them further. Among other factors, we take into account Exchange Rate Market Pressures (EMP) and central bank interventions, as well as other non-policy-related factors affecting exchange rate movements, such as commodity prices and investor risk appetite.

We estimate our model for 63 countries for the period 2010-2018. The sample ends in 2018 due to missing data for one of our control variables.

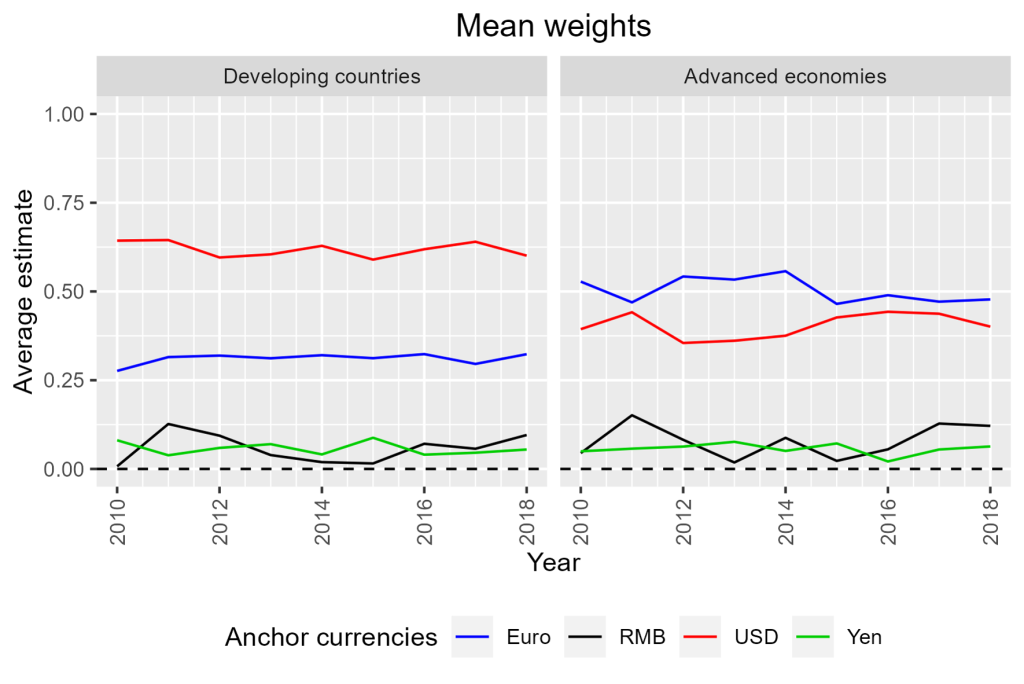

We treat the RMB, USD, euro and the yen as potential anchor currencies in our model. Figure 1 shows average anchor weights across developing and developed countries. Among developing countries, the USD is the most important anchor currency with the average weigh of 62 %. The euro is the second largest anchor currency with average weight of 31 %. It is notable that the RMB weight is low, 6 % on average, and there is no sign of the share increasing over time. When we concentrate on advanced economies, the euro has the highest average anchor weight of one half. The high share of the euro relates to our sample in which the advanced economies are heavily weighted by European countries. Our sample includes the euro area countries prior to joining the area, but not after that. Average USD weight is 40 %, and as in developing countries, the average RMB weight is low at 8 % also among advanced countries.

Figure 1. Average anchor weights for developing and developed countries

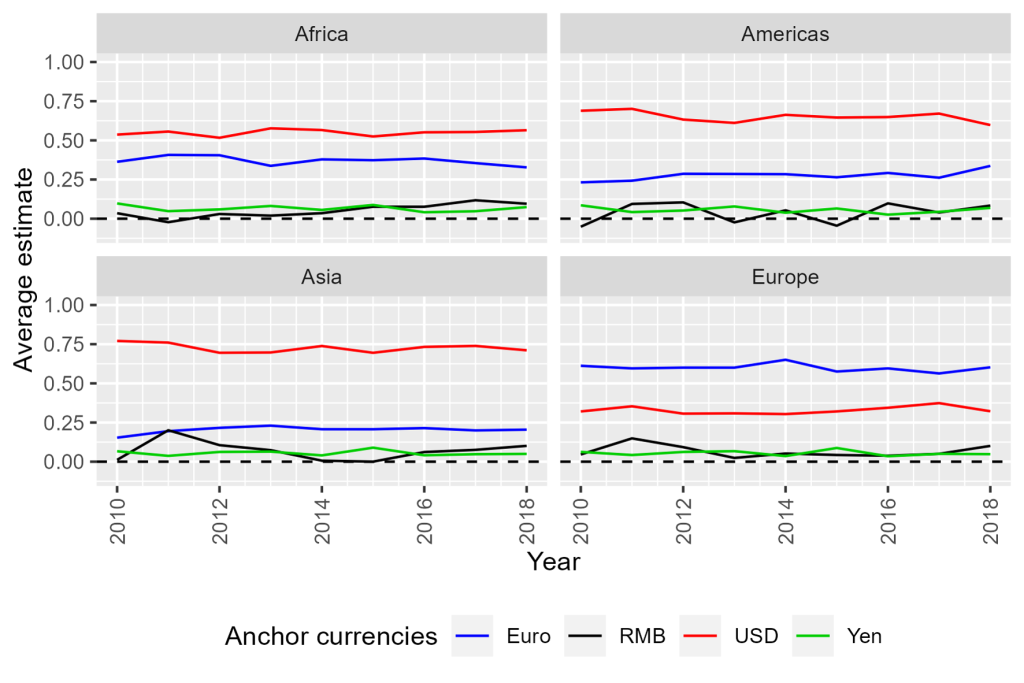

When we further disaggregate the analysis by geographical regions, we find that the average RMB weight is low even among Asian and African countries, as shown in Figure 2. In both regions average RMB weight is 7 %. This is slightly unexpected given strong trade, financial and foreign policy ties between China and Asian countries, and to a lesser degree between China and African nations. Among individual countries, the highest average RMB anchor weight is mostly reported for developing countries (Serbia 22 %, South Africa 18 %, Turkey 18 %, Nepal 16 % and Philippines 15 %). Notably some advanced economies also report significant RMB weights, including Hungary (17 %) and Australia (15 %).

Figure 2. Aggregate weights across geographical areas

Of other currencies, the USD is the most common anchor currencies in all continents except Europe. Overall, these findings align with other measures of currency internationalization. For example, the USD accounts 59 % of global currency reserves (IMF COFER, 2022), 88 % of all FX market trade (BIS, 2022) and 40 % of export invoicing during 1999–2014 (Gopinath, 2015) while the RMB’s role in these metrics remains relatively low. Additionally, based on our findings, there is no indication that the USD will diminish in its role as the leading anchor currency. The significance of the euro has also been stable.

Our results on the RMB weights are in stark contrast to recent studies. These, for example McCauley and Shu (2018) and Keddad (2019) report high RMB weights, often exceeding 50 % or even approaching 100 %. We conducted several robustness checks to identify potential drawbacks in our empirical model, but the results remained essentially the same. We believe the difference in results between our study and others stems from our modelling choice, as we aim to control for factors affecting exchange rate movements outside policy scope as exhaustively as possible.

We also explore potential drivers of the anchor choices by estimating standard panel country fixed effects regression for anchor weight. Especially, we are interested whether trade links with an anchor country, financial markets uncertainty (measured by the VIX index), geopolitical uncertainty (Caldara et al., 2022), or the anchor country economic uncertainty (Baker et al., 2015) affects the policy choice. In addition to that we control home country macroeconomic fundamentals, anchor currency exchange rate behavior (such as anchor currency exchange rate strength), and interlinkages between the anchor currency choices.

We find strong interlinkages in anchor choices among the USD, euro and yen. A change in the anchor weight of any of these three currencies results in a significant opposite change in the weights of other two.

However, changes in RMB anchoring do not materially impact weights of the USD, euro, and yen weights. Perhaps unexpectedly, we do not find that increased trade (per home country GDP) with an anchor country leads to an increase its anchor weight. We observe that as geopolitical uncertainty in the world increases, countries tend to peg tighter to the USD and euro. Additionally, when financial markets volatility rises, developing countries tighten their pegs to the major currencies of developed countries: the USD, euro and yen. It appears that as uncertainty increases, countries tend to tighten their peg to the traditional major currencies.

Our results indicate limited progress in the international use of the RMB as a pegging currency. This may be attributed to the dominant role of the USD, and to a lesser extent the euro, in the global economy as a denomination currency for trade, assets and safe haven. Furthermore, the non-convertibility of the RMB likely contributes to this situation. During periods of heightened geopolitical uncertainty, countries appear to prefer pegging to these two leading currencies, suggesting a limited willingness to adopt the RMB as the peg amidst potential fragmentation in the global economy.

Ahmed, R. (2021). Monetary policy spillovers under intermediate exchange rate regimes. Journal of International Money and Finance, 112, 1024-1042.

Bank of International Settlements (2022). Triennial Central Bank Survey. OTC foreign exchange turnover in April 2022.

Baker, S.R., Bloom, N. & Davis, S.J. (2016) Measuring Economic Policy Uncertainty. Quarterly Journal of Economics, 131(4), 1593-1636.

Caldara, D. & Iacoviello, M. (2022). Measuring Geopolitical Risk. American Economic Review, 112(4), 1194-1225.

Frankel, J.A. & Wei, S.-J. (1994). Yen block or dollar block: Exchange rate policies of the East Asian Economies. In T. Ito and A. Kruger (eds.) Macroeconomic Linkages: Savings, Exchange Rates and Capital Flows.

Gopinath, G. (2015). The International Price System. NBER Working Papers 21646.

IMF COFER (2023). Currency Composition of Official Foreign Exchange Reserves (COFER) 2023. IMF Database. Available in https://data.imf.org/?sk=E6A5F467-C14B-4AA8-9F6D-5A09EC4E62A4.

Keddad, B. (2019). How do the Renminbi and other East Asian currencies co-move? Journal of International Money and Finance, 91(C), 49-70.

Haldane, A.G. & Hall, S.G. (1991). Sterling’s relationship with the dollar and the Deutschmark: 1976-1989. Economic Journal, Royal Economic Society, 101(406), 436-443.

McCauley, R.N. & Shu, C. (2018) Recent RMB policy and currency co-movements. BIS Working Paper No. 727.