After more than a decade of struggling to bring inflation up to target, central banks now face the opposite problem. Inflation is back. The rise in inflation reflects the rapid and goods-intensive economic recovery from the Covid-19-induced recession – bolstered by highly accommodative fiscal and monetary policy – which supply has been unable to fully meet. We should not expect inflationary pressures to ease soon as many of the forces behind high inflation remain in place and new ones are emerging. There are already signs of increased price spillovers across sectors and between prices and wages, as is common in a high-inflation environment. Moreover, the structural factors keeping inflation low in recent decades may wane as globalisation retreats. The inflationary paradigm may be changing. Central banks need to adjust to this new environment, not least by raising policy rates to more appropriate levels. The world economy must learn to rely less on expansionary monetary policies.

After more than a decade of struggling to bring inflation up to target, central banks now face the opposite problem. The shift in the inflationary environment has been remarkable. If you had asked me a year ago to lay out the key challenges for the global economy, I could have given you a long list, but high inflation would not have made the cut.

I will describe the rise in inflation over the past year and discuss why this came as a surprise to many. I will argue that the pandemic and the extraordinary policy response laid the groundwork for a rapid and goods-intensive bounceback in demand which supply has been unable to fully meet. The war in Ukraine has further disrupted supply, particularly for commodities. I will also draw some broader lessons about the inflationary process – in particular, the need to look “under the hood” of aggregate data and models to understand how the behaviour of individual firms and workers drives inflation outcomes.

A key message is that we may be on the cusp of a new inflationary era. The forces behind high inflation could persist for some time. New pressures are emerging, not least from labour markets, as workers look to make up for inflation-induced reductions in real income. And the structural factors that have kept inflation low in recent decades may wane as globalisation retreats.

If my thesis is correct, central banks will need to adjust, as some are already doing. For many years now, having conquered inflation, they have had unprecedented leeway to focus on growth and employment. Indeed, with inflation stubbornly below target, stimulating activity hit two birds with one stone. But this is now no longer possible, since low and stable inflation must remain the priority. If circumstances have fundamentally changed, a change in paradigm may be called for. That change requires a broader recognition in policymaking that boosting resilient long-term growth cannot rely on repeated macroeconomic stimulus, be it monetary or fiscal. It can only be achieved through structural policies that strengthen the productive capacity of the economy.

Inflation has surprisingly flared up in the past year.

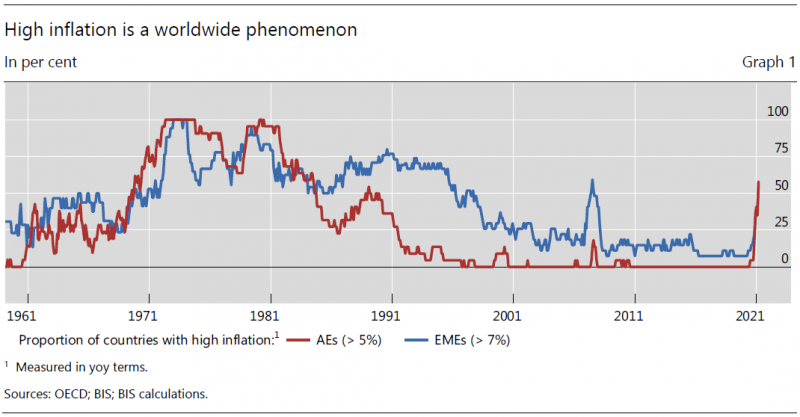

Developments in the United States, the euro area and other advanced economies (AEs) have attracted the most attention. And indeed, almost 60% of AEs currently have year-on-year inflation above 5% – more than 3 percentage points above typical inflation targets. This is the largest share since the late 1980s.

But the rise has not been limited to AEs. Inflation has risen in emerging market economies (EMEs) too. In more than half of EMEs inflation rates are above 7%. Aside from a short period around the Great Financial Crisis (GFC) reflecting very specific and short-lived factors, this is the largest share in over two decades.

Admittedly, the rise in inflation has not been uniform. In Asia, for example, inflation has generally risen less. But even in that region, most countries – with the exception of Japan and China – have seen a material pickup in recent months. And here in Switzerland, dubbed “the country that inflation forgot”, inflation is the highest since 2008.

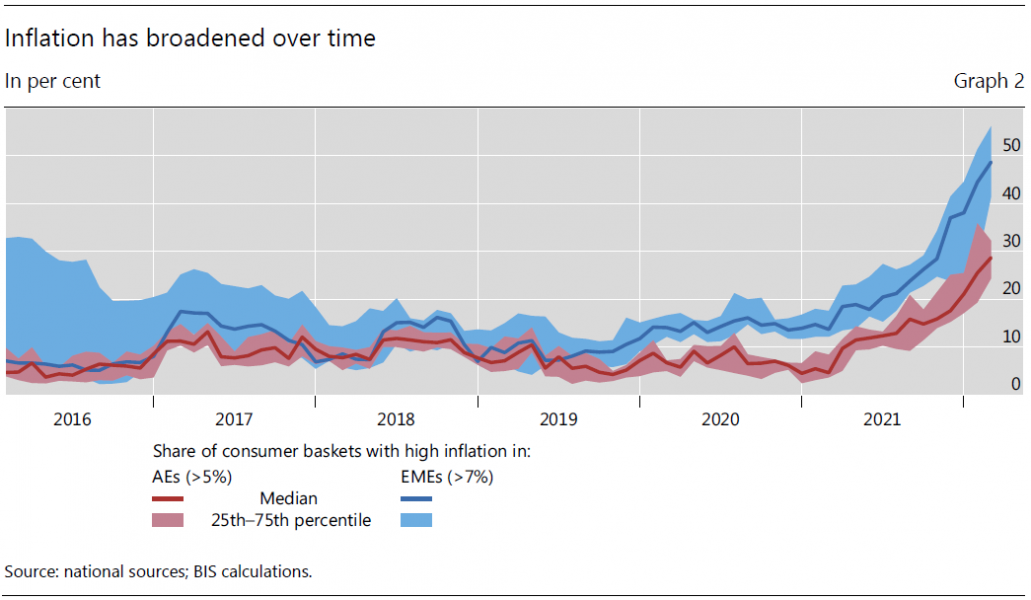

At first, in early 2021, price increases were confined to a small number of items. Energy, food and durable goods, such as cars, are the most familiar examples. We tend to think of these as relative price changes resulting from shifts in demand and supply, many pandemic-induced. The items where supply and demand imbalances were concentrated had relatively flexible prices, allowing quick adjustments. Indeed, for a while it was possible to attribute all of the increase in inflation to these items, making it look transitory.

But higher inflation has become increasingly broad based. Since the start of 2021, the share of items in the consumption basket that have seen very large price rises has increased steadily. In particular, growth in service prices has accelerated. Because growth in service prices tends to be more persistent than that in goods, inflation may be becoming more entrenched.

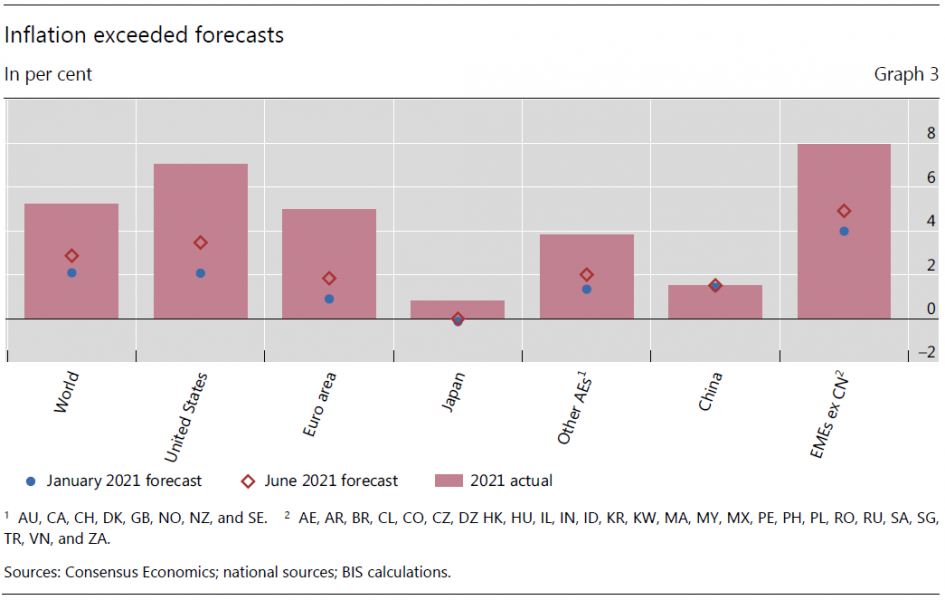

The rise in inflation came as a surprise to most observers. At the start of last year, most expected inflation to remain low. As it began to rise, forecasts were revised up. But, even mid-year, most observers projected only a modest and temporary overshoot of central bank targets. In the end, inflation far exceeded the forecasts.

Economic forecasts are often wrong. But the forecast misses in 2021 were unusually large. Indeed, in many countries they went beyond what many regarded as plausible. We were no exception. In our Annual Economic Report last year, we laid out a “high inflation” scenario, based on a standard Phillips curve framework. We found it hard to come up with large numbers.

So why did inflation rise?

I would say as a result of the confluence of three factors. First, a surprisingly strong global rebound in aggregate demand: the global economy is expanding much more quickly than in the post-recession recoveries of recent decades. Second, a surprisingly persistent rotation in demand towards goods and away from services, particularly customer-facing ones. And, finally, a surprisingly unresponsive aggregate supply, which has found it hard to keep up with surging demand.

These shifts did not appear out of nowhere. The world economy is in a very different place than three years ago because of the pandemic, the extraordinary fiscal, monetary and regulatory response to it, and the war in Ukraine.

Let me discuss in more detail how demand and supply behaved during the expansion – and the role of the pandemic and policy response in shaping them.

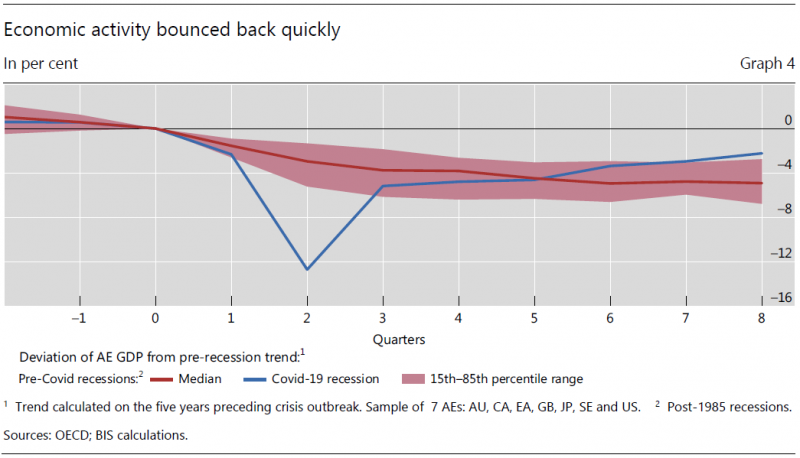

When the pandemic broke out, many feared that the hit to aggregate demand would prove persistent. Some observers drew parallels with previous finance-driven recessions. Given the size of the initial downturn, comparisons with the Great Depression didn’t seem entirely out of place. And there were widespread concerns about “scarring”: consumers and businesses would hold back expenditures – once bitten, twice shy – and a trail of bankruptcies would cripple production.

The remarkably fast recovery, particularly in AEs, has put those fears to rest. The 2020 recession was deep as activity was artificially repressed. But when Covid constraints lifted, output bounced back. The much-feared wave of bankruptcies did not materialise. In many AEs, GDP is on track to return to, if not exceed, its pre-pandemic trend. By some metrics, labour markets look even tighter than they did pre-Covid.

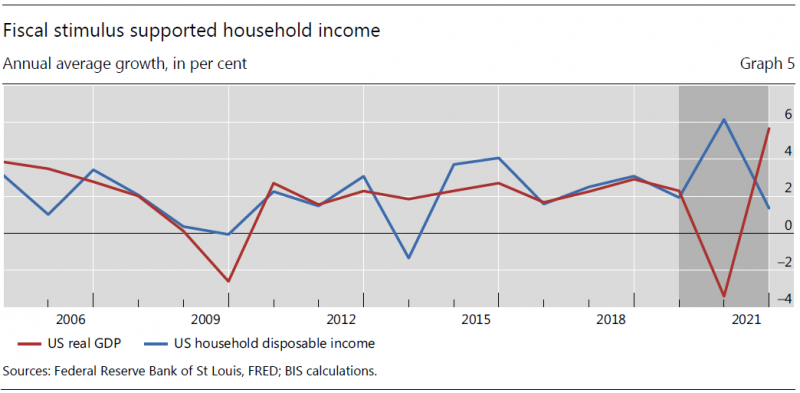

But the strength of the recovery was not entirely due to the unique nature of the recession. The exceptional policy response played a key role. Early in the crisis, it helped firms and households withstand an unprecedented loss of income and forestalled serious financial disruptions. This paved the way for a rapid recovery. Over the past year, macroeconomic policy continued to support aggregate demand. In some countries, this involved continued fiscal stimulus, long after the worst of the recession had passed. And, almost everywhere, monetary policy fostered highly accommodative financial conditions, even in the face of strong growth and rising inflation. The initial policy response to the pandemic was meant to provide a bridge to the recovery. With the benefit of hindsight, policy settings, at least over the past year, may have served as a springboard for the rapid expansion.

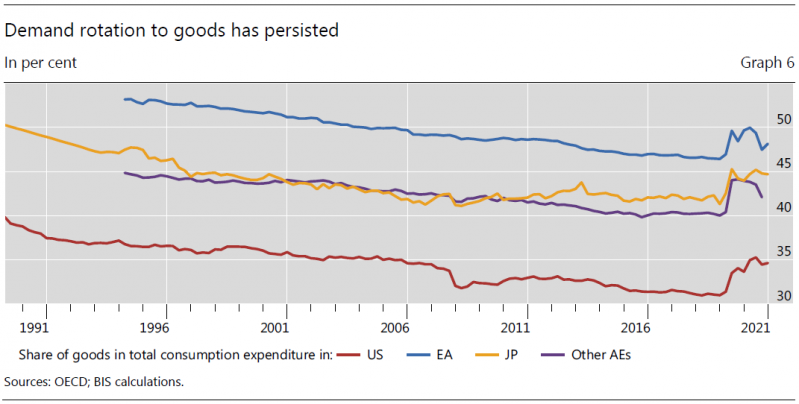

The initial early spending shift towards goods and away from services was to be expected. Lockdowns made it impossible to consume many services and boosted demand for goods, to make time spent at home more comfortable, to replace services that could no longer be bought or simply to allow people to work remotely.

But it is surprising how little demand rotated back to services later. Household spending on goods had been declining relative to services for several decades before the pandemic. Instead of households returning to their old patterns, the share of spending on goods generally remains well above pre-pandemic levels, although it dipped somewhat in the past year.

The goods-intensive nature of the expansion has added to inflation. It meant that some industries returned quickly to full capacity, leading to rapid price increases, even while economy-wide indicators pointed to continuing slack. Faster price growth in sectors where demand was strong was not offset by slower price growth in lagging sectors, not least as in service industries prices are relatively sticky. This may help explain why observers relying on aggregate measures of output or employment slack failed to foresee the rise in inflation.

Overall, supply has been surprisingly unresponsive to higher demand. This has showed up in bottlenecks, delivery delays, rising shipping costs and shortages of key production inputs. All of this stands in stark contrast to the aftermath of the GFC, when supply – particularly labour supply – seemed able to meet any increases in demand.

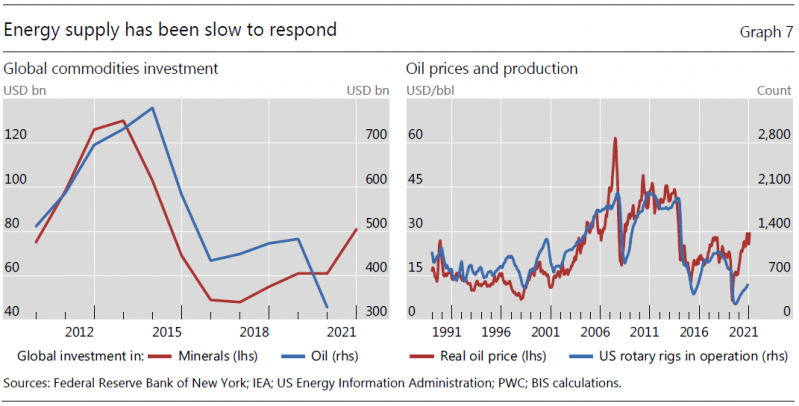

Once again, the pandemic contributed to these supply constraints. Staggered lockdowns disrupted global value chains and logistics networks, revealing the fragility of “just-in-time” manufacturing systems. Virus outbreaks and workers’ health concerns hit labour supply. Firms by and large did a good job of overcoming these constraints – in some bottleneck-affected industries like shipping and semiconductors, output is higher than it was before the pandemic. But changing demand patterns proved harder to deal with. Meanwhile, in commodity markets, a legacy of low investment pre-pandemic also hindered the supply response, along with a reluctance to boost production by marginal producers, scarred by the sharp price declines of the 2010s.

The experiences of the past 12 months provide several lessons for our understanding of inflation.

One is a reminder that the distinction between relative price changes and inflation is critical, but not always clear-cut. In hindsight, it was too tempting to dismiss the initial rises in energy, food and car prices as a one-off adjustment to changed demand. We have learned once more that sector-specific shocks can spill into other sectors and become more persistent and pervasive.

This can happen directly or indirectly, through rising input costs that percolate down the value chain. Indeed, recent bottlenecks have been so keenly felt partly because they occurred in items at the start of production chains, which are needed to produce other goods and services downstream.

This begs a broader question: under what conditions are relative price movements able to ignite broad-based inflation?

To answer this question, we need to look “under the hood” of the inflation process and examine the structural factors that have shaped inflation developments over recent decades.

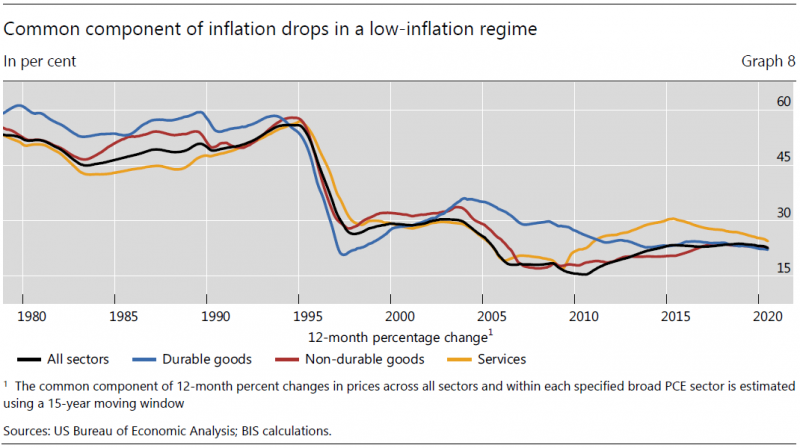

One key lesson is that high- and low-inflation environments are very different. When inflation is high, price changes tend to be more aligned. Their common component explains a large share of the total variability of individual price changes. By contrast, in an environment of low and stable inflation, as in the last two decades, price changes in individual items – even large ones – percolate less into the prices of other items and, therefore, aggregate price indices. Put differently, when inflation is persistently low, much of what we measure as inflation is, in fact, the result of idiosyncratic price changes.

A consequence of this is that low-inflation environments tend to be largely self-correcting. Large price rises in individual items can increase inflation for a while. But if other prices don’t respond, inflation will eventually come down.

When inflation is less persistent, its influence on wage- and price-setting loses traction. Most likely, this is because, once low inflation becomes entrenched, inflation naturally becomes less “salient”, or prominent, in the minds of consumers as they do not observe price hikes in daily life.

In addition, the general price level becomes less representative, since inflation comes to reflect mainly item-specific or relative price changes.

In fact, Paul Volcker, and later Alan Greenspan, famously defined price stability as “a situation in which expectations of generally rising (or falling) prices over a considerable period are not a pervasive influence on economic and financial behavior”. In academic jargon, this is an instance of rational inattention: the cost of neglecting low inflation is lower than the cost of including it in wage negotiations or pricing decisions. The central bank’s anti-inflation credentials and credibility can help to hardwire such behaviour.

But it is one thing to say that, when it settles at a low level, inflation has certain self-correcting properties, and quite another to say that those properties are shock-proof. If the system comes under stress, at some point those properties may give way. What is not salient, may become salient. And background economic conditions could allow that salience to be translated into higher wages and prices.

This brings me to the outlook for inflation. Where could inflation go from here?

We should not expect inflationary pressures to ease soon. In many countries, demand has not fully rotated back to services. Bottlenecks remain in shipping, semiconductors and in countries where the pandemic may keep part of the workforce away from production. Indeed, the full price impact of the disruptions of 2021 may still be working its way through the system.

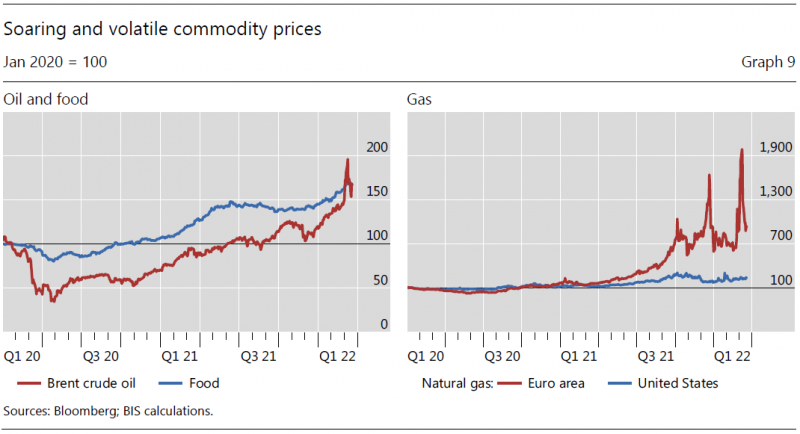

At the same time, new inflationary forces have emerged with a vengeance. Food, oil and many other commodity prices have soared since the start of the war in Ukraine as supplies have dried up. Some such increases will feed directly into higher consumer prices. Others, for example metals, will further stretch global value chains. And inflation has its own dynamics. We have already seen it broaden into services in many countries.

Looking beyond these immediate concerns, three developments lead me to think that the inflationary environment may have shifted in a more persistent way.

The first is that there are signs of inflation expectations becoming unmoored. This is clearest when we look at short-term expectation measures. Indicators of financial market participants’ views and professional forecasts point to inflation of over 4½% in the United States and much of Europe over the next two years, and above 3½% in many other AEs. Even in countries like Japan and Switzerland, near-term expectations have picked up, although they remain below 2%. In particular, the near-term expectations of households, which may provide a better indication of those that have a more direct influence on wage and price decisions, have risen sharply since mid-2021.

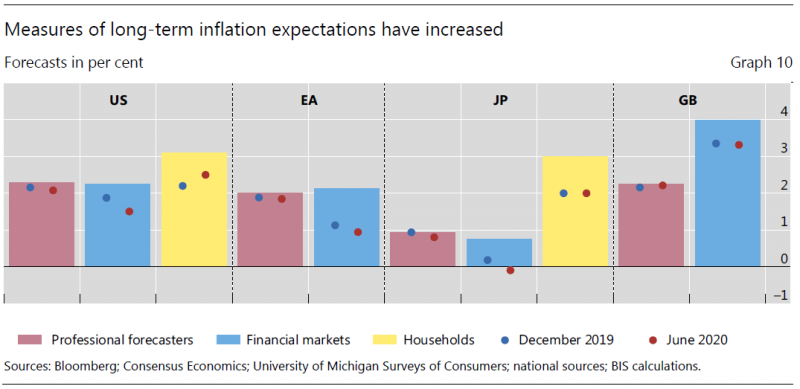

While the message is more mixed regarding longer-term expectations, it is not a source of much comfort. An overshoot in long-term expectations would be especially worrying to the extent that these have a more lasting influence on behaviour. Admittedly, professional forecasters’ expectations remain anchored. But – while these observers follow inflation developments closely and are attuned to evolving risks, they rarely stray too far from central banks’ own projections – their independent information content is limited. More worryingly, other measures look less benign. Long-term inflation expectations inferred from financial markets are higher than they were before the pandemic – and much higher than in mid-2020. And households’ expectations have also risen in some countries and are well above central banks’ projections.

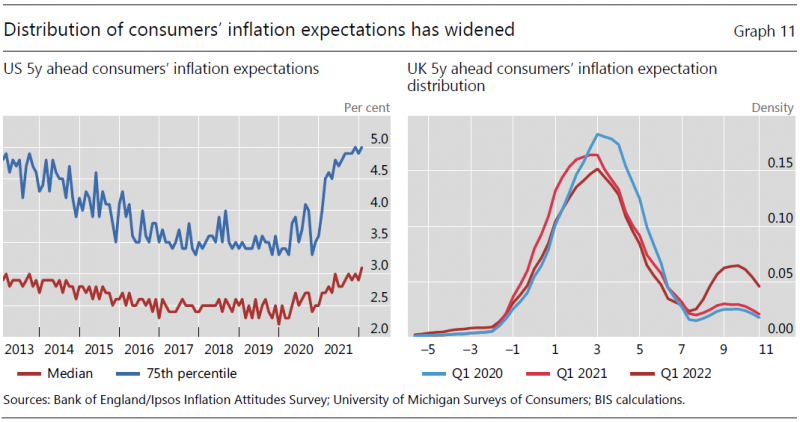

If we dig more deeply into the figures, further concerning signs emerge. One that I have found particularly striking is that, while median household inflation expectations have increased only slightly over the past year, the upper tails of the distributions have risen substantially. That is, most households’ inflation expectations haven’t shifted much, but some have risen a lot. If that tendency spreads, central banks could find it much harder to bring inflation down.

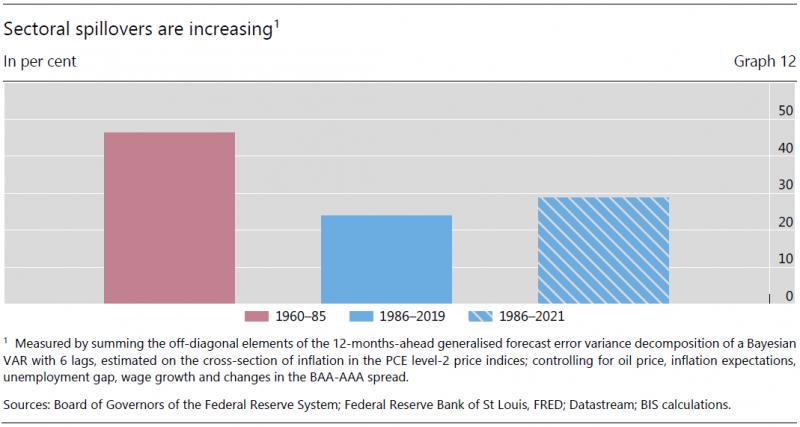

A second concern comes from signs that the muted link between relative price changes and inflation which characterised the low-inflation era may be shifting. One way of seeing this is by considering the behaviour of price spillovers across sectors. These tend to be comparatively low when inflation settles at a low level. In the United States, for example, in the pre-pandemic low-inflation era, less than a quarter of the variation in the prices in individual sectors was explained by unexpected changes in prices in other sectors, down from almost half in the high and runaway inflation environment of the 1970s. Now, there are already signs that the spillovers may be increasing. If we include data from the pandemic, the estimated degree of spillovers is rising quickly, approaching levels that characterised the high-inflation era.

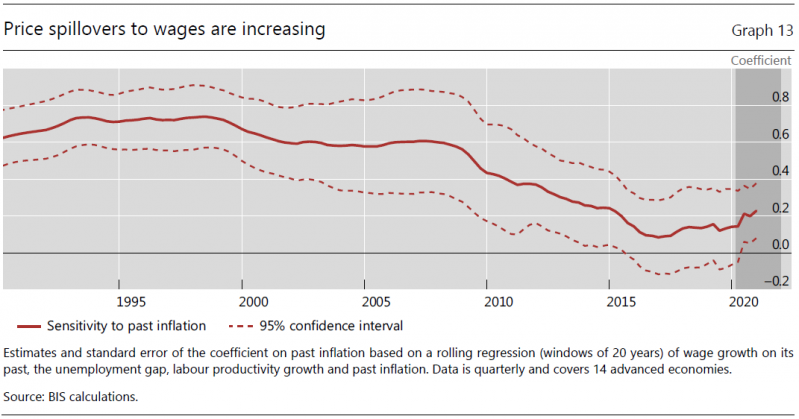

My third concern relates to the labour market. When inflation starts affecting the “cost of living” in a broad sense, it is more likely to take centre stage in price- and wage-setting decisions. This could trigger a dangerous wage-price spiral. Securing low inflation is a powerful antidote to such risk, as in this environment inflation exerts little direct influence on wage growth. The role of past inflation in determining wage growth steadily declined from the mid-1990s, as rolling estimates of a wage equation across several AEs show. In the years leading up to the pandemic, it was virtually zero. But there are some early signs that wage growth has become more sensitive to inflation – and even resumed its statistical significance – over the past year. Maybe what was no longer salient is becoming salient again.

So, we need to be open to the possibility that the inflationary environment is changing fundamentally. Mindsets may already be shifting. A generation of society, workers and business managers who had never seen meaningful inflation – at least in AEs – are learning that rapid price rises are not merely the stuff of history books. Research shows that people who live through high inflation hold materially higher expectations about its future level and persistence than those who have not. This may amount to a change in paradigm: the lens we used to interpret economic developments since the 1990s may no longer be adequate.

Looking even further ahead, some of the structural disinflationary winds that have blown so intensely in recent decades may also be waning. In particular, there are signs that globalisation may be retreating. The pandemic, as well as changes in the geopolitical landscape, have already started to make firms rethink the risks involved in sprawling global value chains. And, regardless, the boost to global aggregate supply from the entry of some 1.6 billion workers from the former Soviet bloc, China and other EMEs into the effective global labour force may not be repeated on such a significant scale for a long time to come. Should the retreat from globalisation gather pace, it could help restore some of the pricing power firms and workers lost over recent decades.

The past year has reminded us how quickly inflation can rise and catch everyone by surprise, not least policymakers. If I am right about the risk of the persistence of the inflationary environment, there are several implications for policy.

An immediate implication is that policymakers may need to shift their mindsets. For several decades now, high and rising inflation has rarely been a pressing concern for central banks, at least in AEs. Indeed, post-GFC the fundamental challenge for many central banks was to raise inflation to target. The low-inflation environment gave central banks great, if not unprecedented, leeway to place more weight on other objectives, be they growth, full employment or others further beyond their traditional remit. Moreover, post-GFC the tools at central banks’ disposal, and the room to use them, expanded in ways that would have been unthinkable in previous decades. Not all trade-offs disappeared. The long period of monetary accommodation clearly added to financial vulnerabilities. But inflation was not part of the trade-off. The current flare-up has highlighted the underlying constraints on policy and prompted central banks to act.

Central banks may also need to reassess how they respond to inflation resulting from supply side developments. These will typically spark relative price changes at first. The textbook prescription is to “look through” this type of inflation, because offsetting their impact on inflation would be costly. But that assumes inflation overshoots are temporary and not too large. Recent experience suggests it can be hard to make such clear-cut distinctions. What starts as temporary can become entrenched, as behaviour adapts if what starts that way goes far enough and lasts long enough. It’s hard to establish where that threshold lies, and we may find out only after it has been crossed.

The good news is that central banks are awake to the risks. No one wants to repeat the 1970s. It seems clear that policy rates need to rise to levels that are more appropriate for the higher-inflation environment. Most likely, this will require real interest rates to rise above neutral levels for a time in order to moderate demand.

The adjustment to higher interest rates will not be easy. In many countries, starting conditions complicate matters. Households, firms, financial markets and sovereigns have become too used to low interest rates and accommodative financial conditions, also reflected in historically high levels of private and public debt. It will be a challenge to engineer a transition to more normal levels and, in the process, set realistic expectations of what monetary policy can deliver.

Nor will the required shift in central bank behaviour be popular. But central banks have been here before. They are fully aware that the short-term costs in terms of activity and employment are the price to pay to avoid bigger costs down the road. And such costs represent an investment in central banks’ precious credibility, which yields even longer-term benefits.

The shifts do underscore that central banks cannot single-handedly ensure global growth by keeping an accommodative stance in all conditions. Amid low inflation, this perception became commonplace. It is one central banks must continue to fight against, even more so in an inflationary environment.

The key to higher sustainable growth cannot be expansionary monetary or fiscal policy. We must strengthen the productive capacity of the economy. Indeed, this is well overdue. Many of the economic challenges we face today stem from the neglect of supply side policies over the past decade or more. Over the medium term, higher potential growth would make it easier for indebted economies to withstand the higher nominal and real interest rates that are likely to prevail in the years ahead. Central banks have done more than their part over the past decade. Now is the time for other policies to take the baton.

Speech held by Agustín Carstens, General Manager, Bank for International Settlements, at the International Center for Monetary and Banking Studies, Geneva, 5 April 2022.