Analysis based on Swiss survey data suggests that one of the key advantages of cash – its unique feature of combining a payment and monitoring instrument in a single device – has become less salient given recent technological progress. Alongside “pocket watchers”, i.e. consumers relying on checking the cash stock in their pocket to monitor their budget and expenses, “digital watchers” have emerged, i.e. consumers paying predominately noncash and using digital applications to monitor expenses. Both watcher types have distinct characteristics and reveal type-specific current and expected future payment behaviors. The rise of digital watchers and the cash-stickiness of pocket watchers have contrasting implications for cash demand. Moreover, the underlying determinants of watching behavior hint at core features a retail central bank digital currency (CBDC) would have to provide as a necessary precondition for its success.

For a long time, cash as a payment instrument has been unique in providing consumers with an integrated payment and monitoring device. As of yet, noncash payment instruments cannot provide both features in one device, which implies that cash generates utility, particularly for consumers with a budget control motive, i.e., to consumers with an interest in monitoring their past expenses and remaining budget. To reduce their watching costs, these consumers are likely to rely on “pocket watching”, i.e., they keep track of their expenses and their remaining budget by glancing into their pockets. As their watching cost decreases with an increasing cash-paying share, pocket watchers predominately pay in cash (von Kalckreuth et al., 2014 – henceforth vKSS).

Recent technological advances have reduced the monitoring disadvantage of noncash payment instruments. Mobile devices and applications enable consumers to access information on sight deposit balances and on past transactions in near real-time where and whenever they want. Often, mobile banking or credit card applications offer personalized add-on services next to providing aggregate information on consumers’ past expenses and remaining budget. Consequently, consumers with a budget control motive might easily rely on a strategy we denote as “digital watching”. In contrast to pocket watchers, digital watchers operationalize their watching strategy through the predominant use of debit and credit cards and monitor their budget through related mobile applications.

In a recent analysis,2 we make use of detailed data from the “Survey on Payment Methods 2017” commissioned by Swiss National Bank (SNB, 2018)3 and empirically assess the prevalence of these two distinct payment-instrument watching strategies in Switzerland and reveal their users’ distinct characteristics. Moreover, we analyze their payment behavior and discuss implications for cash demand and CBDC design.

Our empirical findings are threefold:

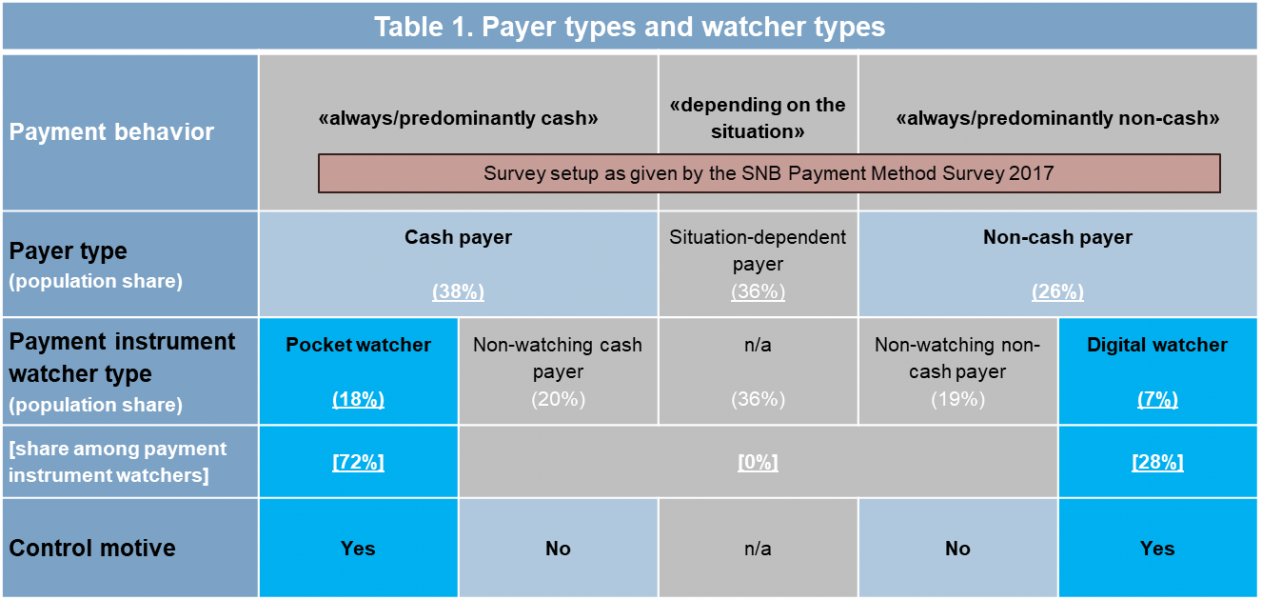

First, digital watchers have emerged as a new category of payment instrument watchers alongside pocket watchers (see Table 1). From a payment instrument design perspective, it is important to note that 25% of consumers in Switzerland characterize themselves as payment instrument watchers. While we find pocket watchers to remain more prevalent, 7% of consumers relied on a digital watching strategy in 2017, which corresponds to 28% of payment instrument watchers.

Pocket watchers and digital watchers reveal distinct characteristics. Among a large set of covariates, regression analysis indicates that income and the perceived pecuniary cost of paying with cash relative to the cost of paying with noncash payment instruments stand out as important determinants of pocket watching, whereas these factors do not have a bearing on the decision to rely on digital watching. Rather, digital watching is more likely for consumers who perceive the security of noncash payment instruments as being high and who live in an urban environment. These differences suggest, on the one hand, that for consumers with a heightened need to control expenses, pocket watching is (still) the more natural starting point to do so, as suggested by vKSS. On the other hand, the finding that only indirect cost considerations matter for digital watchers suggests that digital watching is, as of now, less sticky and less well entrenched than pocket watching.

Second, payment instrument watching contributes to explaining the observed heterogeneity in payment instrument usage beyond standard explanatory factors in our regressions.4 Specifically, being a pocket watcher implies a 3.2 (4.7) percentage point higher cash volume (value) share than for the average nonwatching cash payer.5 In contrast, the intensity of noncash instrument usage by digital watchers does not differ significantly from the intensity of nonwatching noncash payers. We relate these contrasting findings to two factors. For one, digital watching is still a relatively new phenomenon, and, thus, noncash payment instruments and digital means to watch past expenses and remaining budget are still evolving. The same holds for consumers’ use and point-of sale (POS) acceptance of new digital payment methods. Over time, experiences with new instruments and monitoring methods may foster a more strongly skewed payment behavior by noncash payers and – even more so – by digital watchers. In addition, for digital watchers, the search costs for POS locations that accept the preferred noncash payment instrument might be greater than the increase in monitoring costs of switching to cash. As digital watchers monitor the balance on their underlying account, their monitoring costs are likely to be similar whether their account balance changes because of a cash withdrawal or a noncash payment. Put differently, for consumers using both cash and noncash payment instruments, watching entails higher marginal costs for pocket watchers than for digital watchers.

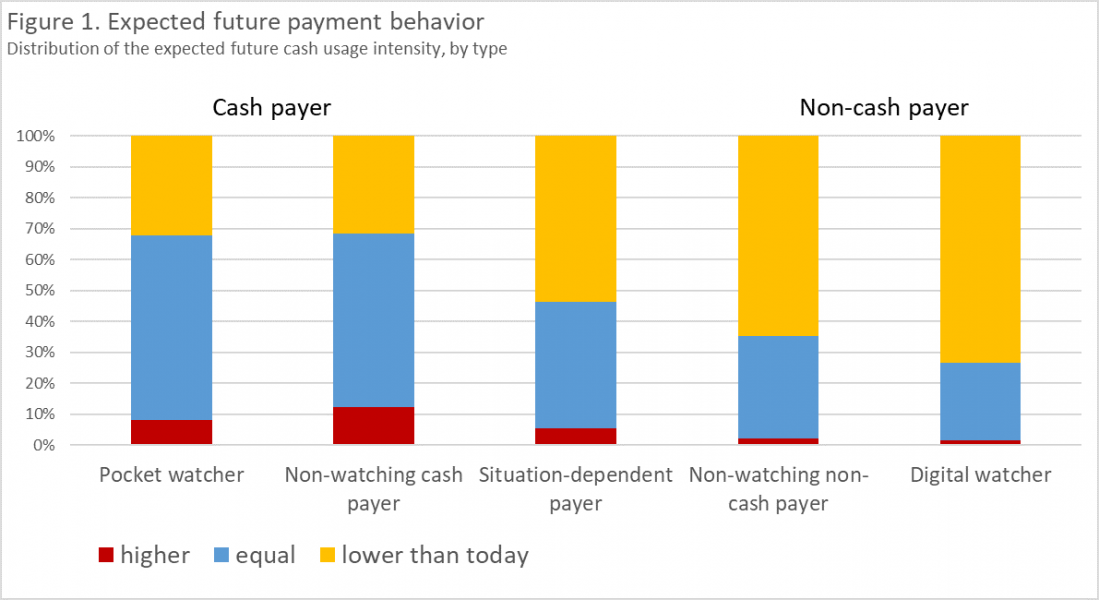

Third, payment instrument watching is an important explanatory factor for the observed heterogeneity in expected future payment instrument usage as well. Our regression results indicate that digital watchers expect to intensify the use of their preferred noncash watching instrument more strongly than nonwatching noncash payers (see Figure 1 for an indication based on descriptive statistics). In contrast, the expected future payment behavior of pocket watchers and nonwatching cash payers do not differ significantly. This finding is consistent with the fact that cash payers – pocket watchers in particular – had at the time of the survey, already exhausted their potential to increase cash usage further. From a cash demand perspective, it is interesting to note in this context that consumers of all payer types expect to use cash less intensively in the future. While also present for cash payers, this expectation is much stronger for situation-dependent payers, even stronger for nonwatching noncash payers and strongest for digital watchers.

In summary, we provide survey-based evidence that one of the key advantages of cash – its unique feature of combining a payment and monitoring instrument in a single device – has become less salient given recent technological progress.

As a result, this unique feature of cash will likely become less relevant for payment instrument choice and may bear corresponding implications for transaction related cash usage. At the same time, our analysis also provides evidence in favor of partially persistent cash usage: Consumers with a heightened need to watch are more likely to stick to cash. The pending results from the most recent survey on payment methods in Switzerland, conducted in autumn 2020, will shed new light on the overall trends in cash and noncash usage as well as on the relative importance of various motives underlying the payment choice and the prevalence and implications of payment-instrument watching strategies in particular.

Our analysis elucidates ongoing investigations by several central banks and the Bank for International Settlements on the foundational principles and core features of retail CBDCs (BIS, 2020). In terms of foundational principles, should a CBDC be introduced, central banks endorse the coexistence of CBDC and cash for as long as there is sufficient public demand for cash. In terms of core features of a potential CBDC, central banks seek a convenience level similar to cash and a high degree of interoperability with private payment service providers. Our findings indicate that satisfying a budget control motive is a key convenience provided by cash, at least for some consumers. Hence, only if adequate interoperability arrangements ensure the provision of this convenience feature to a sufficient degree in cooperation with private payment service providers would a retail CBDC speak to those consumers.

Arango, C. A., D. Hogg and A. Lee (2014). Why is cash (still) so entrenched? Insights from Canadian Shopping Diaries. Contemporary Economic Policy 33, pp. 141-158.

BIS (2020). Central bank digital currency: foundational principles and core features. Joint report by The Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve and Bank for International Settlements. Bank for International Settlements, www.bis.org/publ/othp33.htm.

Ebner, T., T. Nellen and J. Tenhofen (2020). Budget control and payment behavior: evidence from Switzerland. International Cash Conference 2019 – Cash in the age of payment diversity. Deutsche Bundesbank.

Ebner, T., T. Nellen and J. Tenhofen (2021). The rise of digital watchers. Swiss National Bank Working Paper, No 2021-01.

Hernandez, L., N. Jonker and A. Kosse (2017). Cash versus debit card: The role of budget control, Journal of Consumer Affairs 51, pp. 91–112.

Swiss National Bank (2018): Survey on Payment Methods 2017, Swiss National Bank.

von Kalckreuth, U., T. Schmidt and H. Stix (2014). Using Cash to Monitor Expenditures: Implications for Payments, Currency Demand and Withdrawal Behaviour, Journal of Money, Credit, and Banking 46 (8), pp. 1753–1786.

von Kalckreuth, U., T. Schmidt and H. Stix (2013). Choosing and using payment instruments: evidence from German microdata, Empirical Economics 46 (3), pp. 1019–1055.

The views, opinions, findings, and conclusions or recommendations expressed in this SUERF Policy Brief are strictly those of the authors. They do not necessarily reflect the views of the Swiss National Bank (SNB). The SNB does not take responsibility for any errors or omissions in, or for the correctness of, the information contained in this paper.

Ebner et al. (2021).

In face-to-face interviews, respondents were asked about a broad range of aspects regarding their current and expected future payment behaviors and underlying motives. Furthermore, respondents filled out a payment diary, recording information on all (nonrecurring) payments over a period of seven consecutive days.

These factors include sociodemographic, transaction-related and payment instrument-related characteristics; see for example, Arango et al. (2014) and von Kalckreuth et al. (2013).

For similar findings, see Hernandez et al. (2017), and vKSS. Ebner et al. (2020) provide additional evidence on the effect of watching on a broader set of payment-related variables.